10 Cities that WON'T have a Housing Crash in 2023

By Nick Gerli | Posted on January 14, 2023These 10 cities in America WON'T have Housing Crash in 2023.

If you're a homebuyer or real estate investor intent on buying right now, and can't wait any longer, these 10 Cities would be the ones to do it. That's because the underlying fundamentals supporting these Housing Markets, like income and rent, suggest solid footing to withstand the crash.

For each metro discussed you will see a % Downside / % Upside estimate. This estimate tells you how much prices could go down or up during the Crash. The estimate comes from the Reventure Consulting Home Pricing Model, which compares long-run home price data from Zillow to income data from the US Census Bureau.

The 10 Metros on this list all have fairly low levels of downside. Some even still have upside. As a result, they are better places to buy during the 2023 Housing Crash.

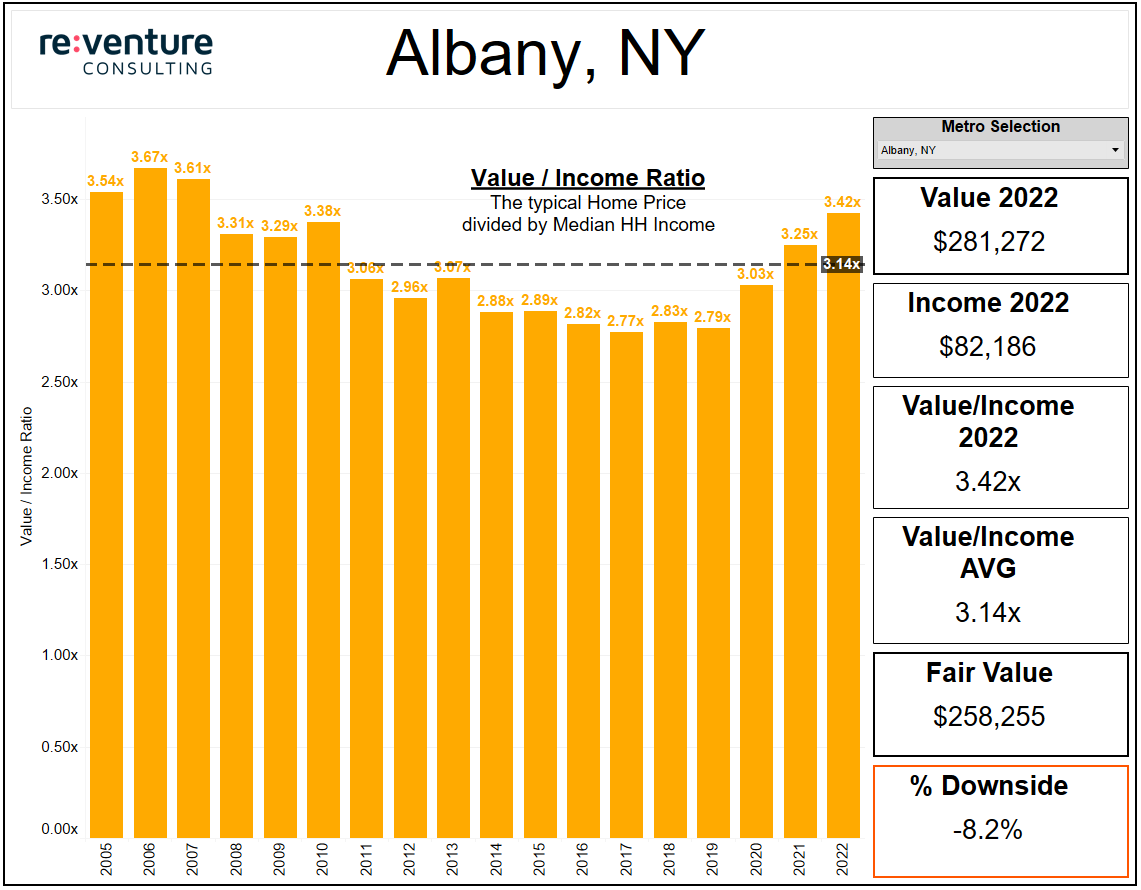

10. Albany, NY (-8.2% Downside)

We're starting things off with my hometown. I was born in Albany, NY in 1989 and called the Hudson Valley home for much of my life. So this is a Housing Market I'm personally familiar with.

And ultimately the thing to realize about Albany is that it's affordable. According to Zillow, the typical Home Value across the 5-county metro is only $288k. That affordability is keeping the local Housing Market afloat in early 2023, with inventory levels still far below pre-pandemic levels.

But the other thing to know about Albany is that it's higher income. The median household earns $82k per year, which is 12% above the national average. The resulting 3.4x Home Value/Income Ratio is only slightly above the long-term average of 3.1x. Indicating that Albany only has -8% downside in the oncoming Housing crash (for comparison, a metro like Austin, TX is at -31%).

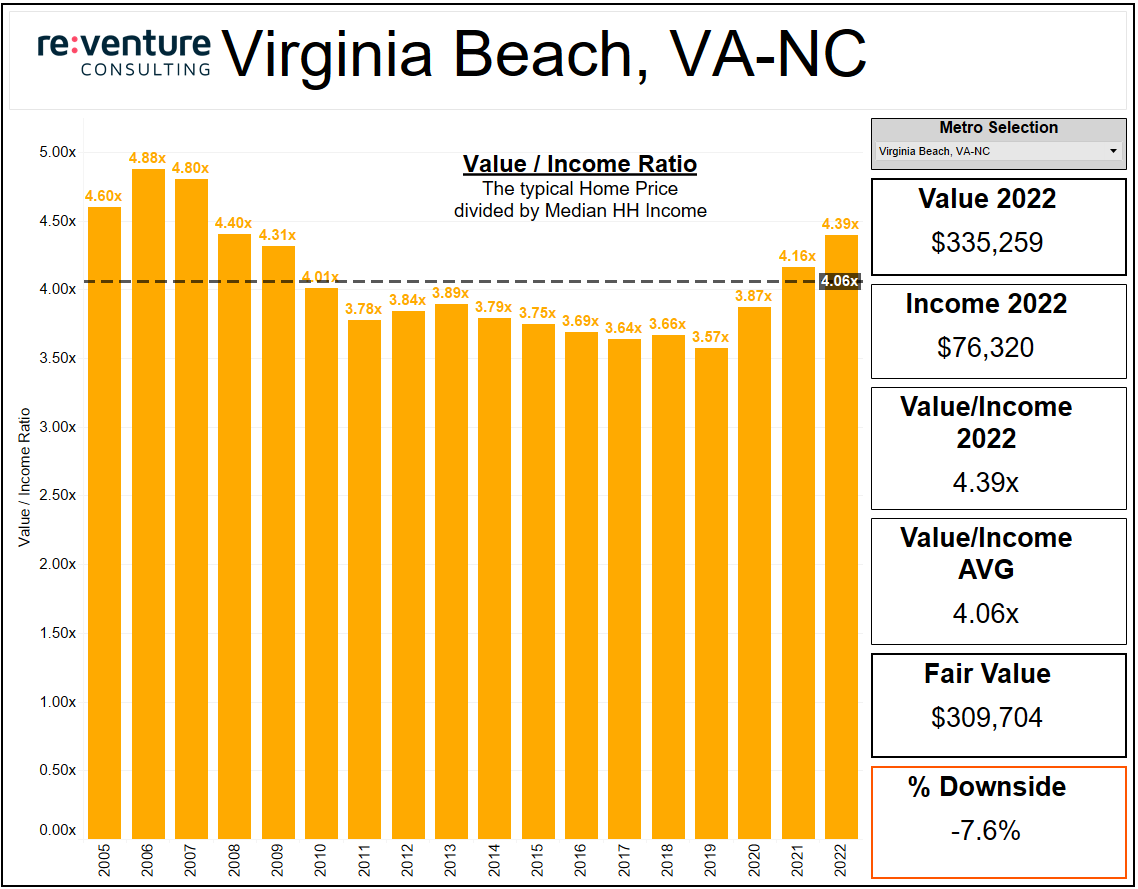

9. Virginia Beach, VA (-7.6% Downside)

Virginia Beach is a Housing Market that runs off the military. According to Redfin, 40% of all purchase mortgages in 2022 were made using a VA Loan.

That reliance on military, and by extension government demand, makes Virginia Beach (as well as nearby Norfolk & Newport News) a more stable Housing Market. There are fewer booms, and there are also fewer busts.

Today's Value/Income Ratio of 4.4x is fairly close to the long-term average of 4.1x. And also below the previous peak of 4.9x that occurred in 2006 during the last Housing Bubble. As a result, the Reventure Home Price Model is only predicting -7.6% price downside across the Virginia Beach metro.

Sidenote: Virginia Beach is 1 of 2 warm-weather metros that made the list.

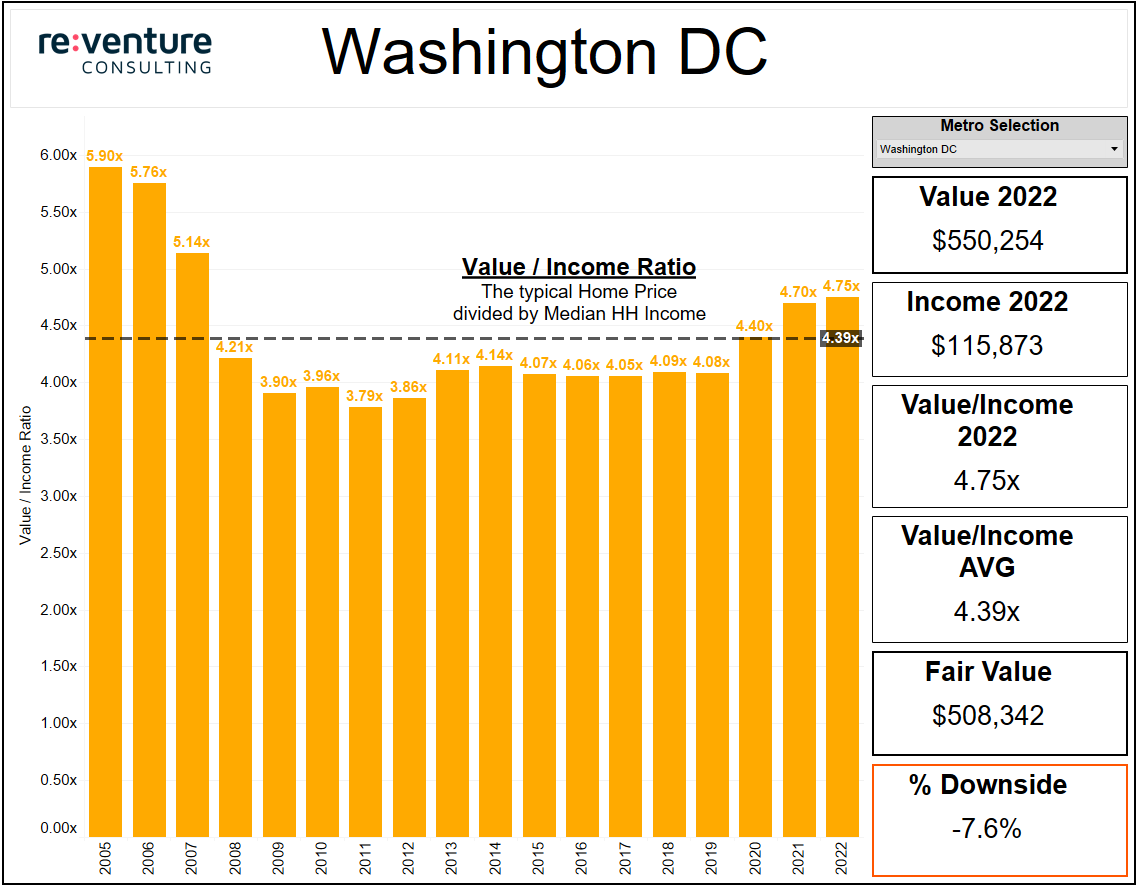

8. Washington DC (-7.6% Downside)

The Washington DC Metro, which includes parts of Northern Virginia and Southern Maryland, is a good example of a Housing Market that was in a Bubble in the mid-2000s, but isn't today.

The Value/Income ratio in DC hit 5.9x in 2005 at the peak of the last Bubble. And prices crashed a lot in the ensuing downturn as a result. But today that ratio is much more manageable at 4.8x, meaning there won't be as big a decline in prices.

You also might be sensing a trend at this point. The first 3 entrants on this list are all capital cities or heavily government influenced. These areas to tend to do better during recessions. But don't do as well during expansions. Thus their relative affordability entering the Housing Crash.

Another thing to pay attention to in Washington DC is that people have money. Lots of it. The Median Income is $116k, which is the 3rd highest in America.

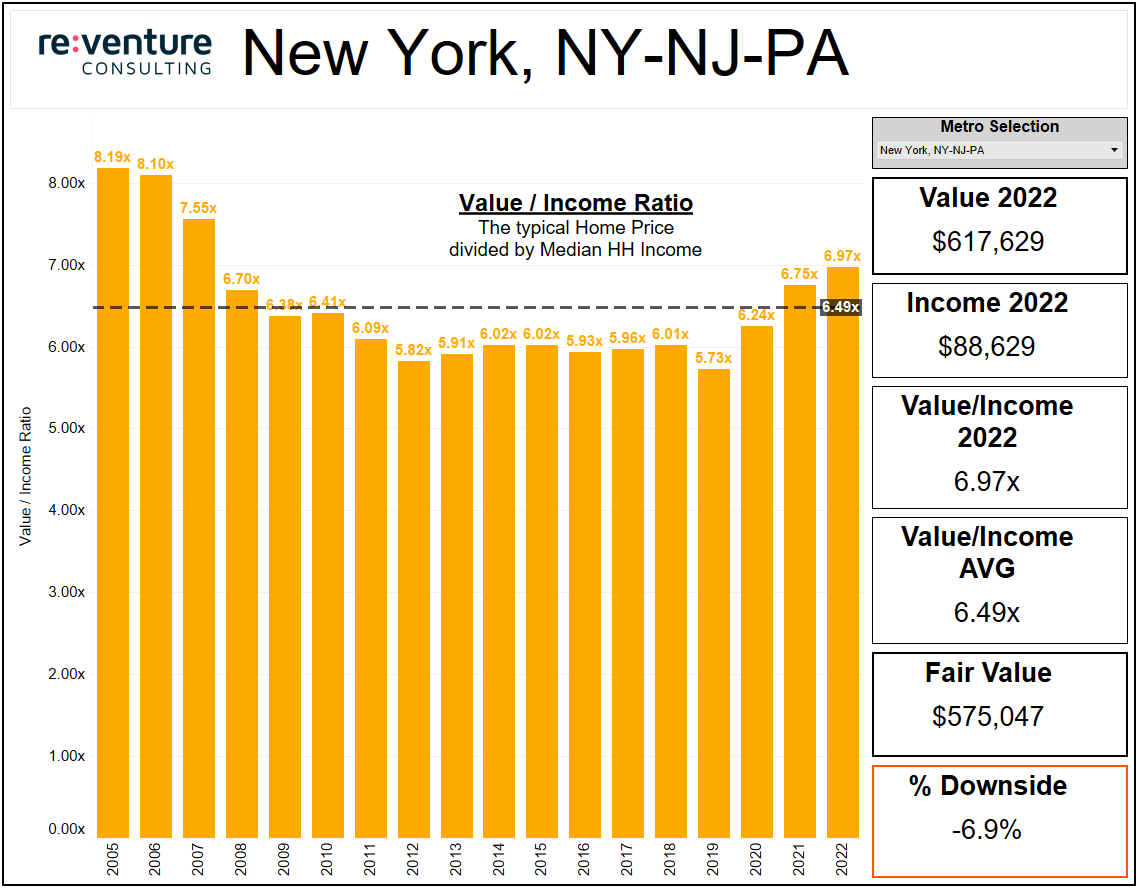

7. New York, NY (-6.9% Downside)

New York follows a similar model to Washington DC. There clearly was a bubble in 2005. And a sizable downturn during the ensuing crash.

But things aren't nearly as bubbly today. One reason why is that home prices did not grow by much in the 2010s, while incomes grew by a lot, restoring some relative affordability to the New York Metro (which includes NYC, Long Island, Westchester, and Northern Jersey).

With that said - prices in nominal terms are still expensive at a $617k typical value. The area is also dealing with some major headwinds related to outbound migration. As a result, I wouldn't be surprised if New York ends up declining by more than Reventure's -6.9% downside projection. But even if it does, a full scale crash is unlikely.

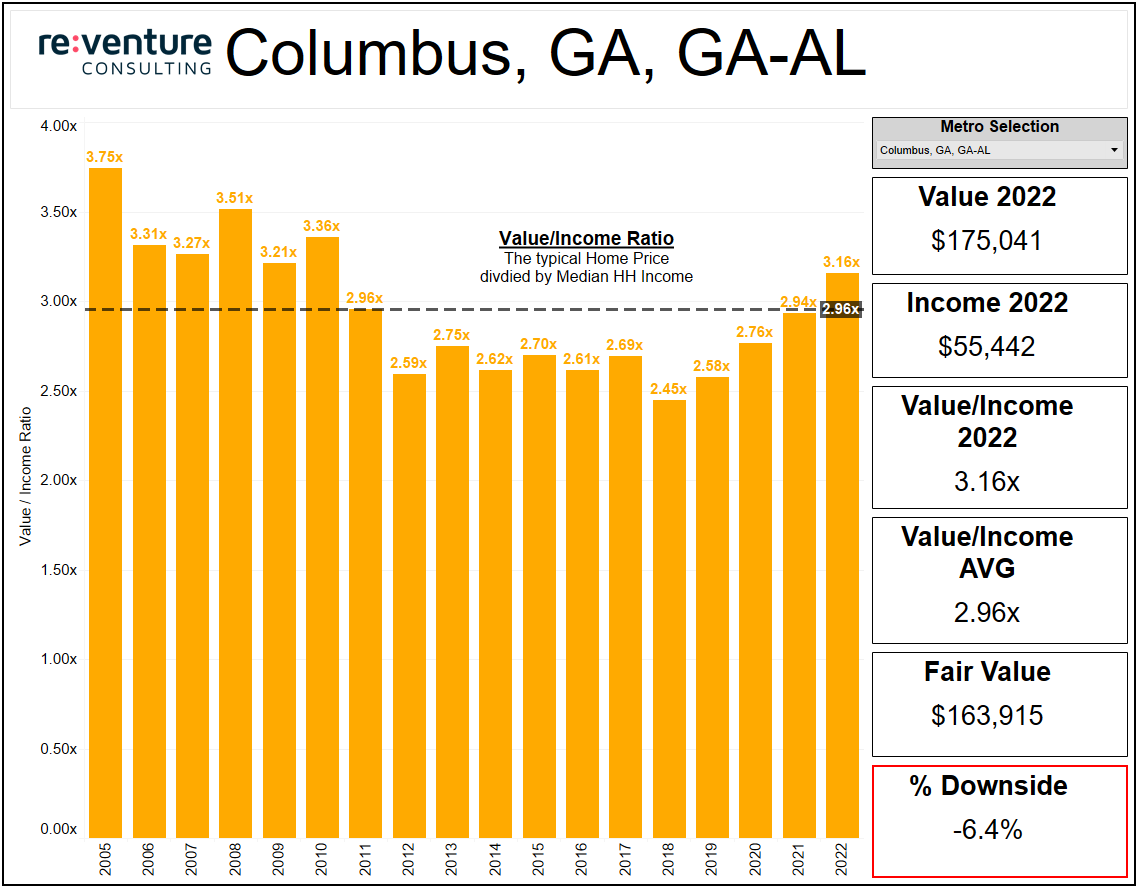

6. Columbus, GA (-6.4% Downside)

Show of hands...how many of you knew there was a Columbus in Georgia?

I sure didn't. Until I created this Home Valuation Model and realized it was one of the most fairly valued in America.

The hallmark of Columbus, GA is affordability. The typical home value of $175k is very cheap: about 50% below the US Average. And only 3.2x above the local Median Income of $55k.

That type of affordability means it will be very difficult for the market to crash. I'm penciling it in for a -6.4% decline in value (which is less than the -18% decline in the 2007-12 crash).

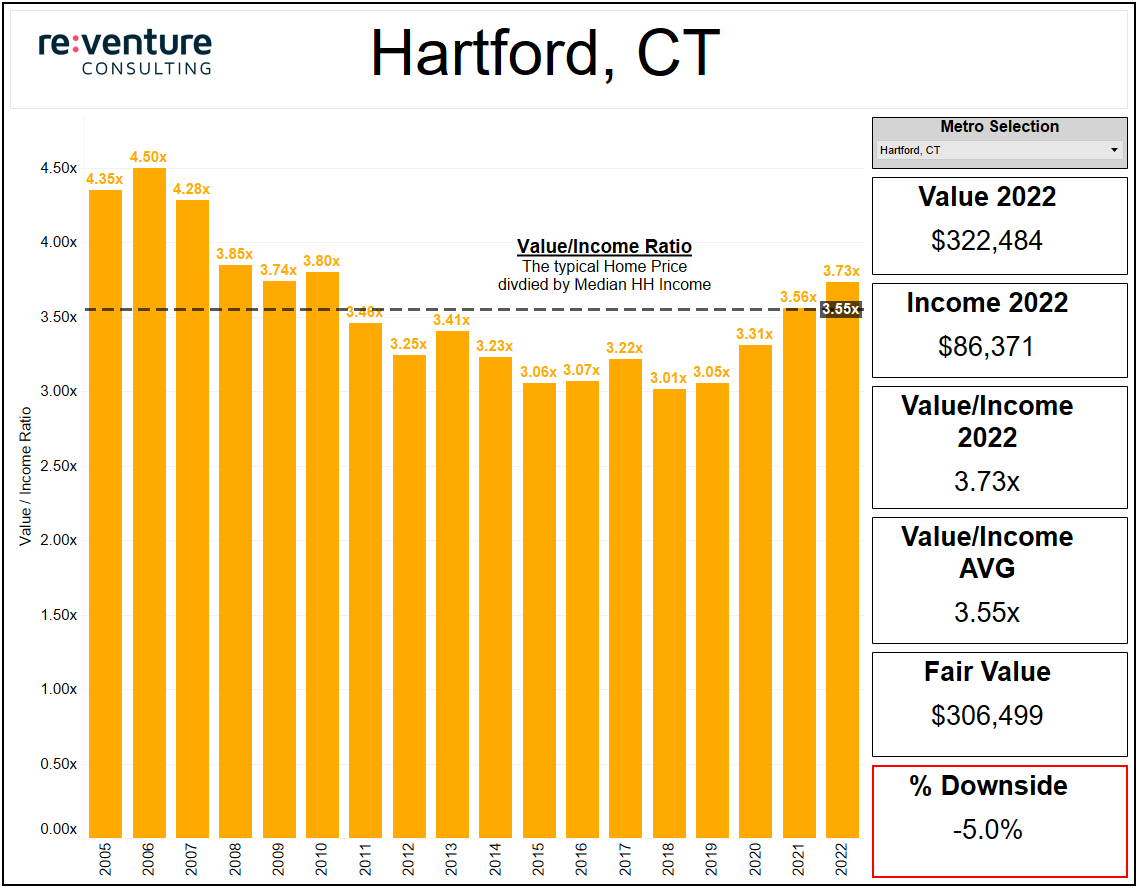

5. Hartford, CT (-5.0% Downside)

Did you know: Hartford, CT is the most inventory-constrained Housing Market in America? Current active listings are an astounding -65% lower than their long-term norms. As a result, home prices are still going up in Hartford.

But eventually prices will come down. And when they do, I'm not expecting a big decline. Potentially -5%. That's because there's still decent affordability in Hartford's Housing Market with a Value/Income Ratio of 3.7x.

In case you're confused why a Rust Belt Metro like Hartford is on this list, make sure to take note of the income. $86k Median. That's pretty good. It means locals have a decent amount of money, and have been able to absorb the higher prices and mortgage rates.

With that said - Hartford loses people in most years. It's been losing industry/business for a while. So don't expect much long-run appreciation.

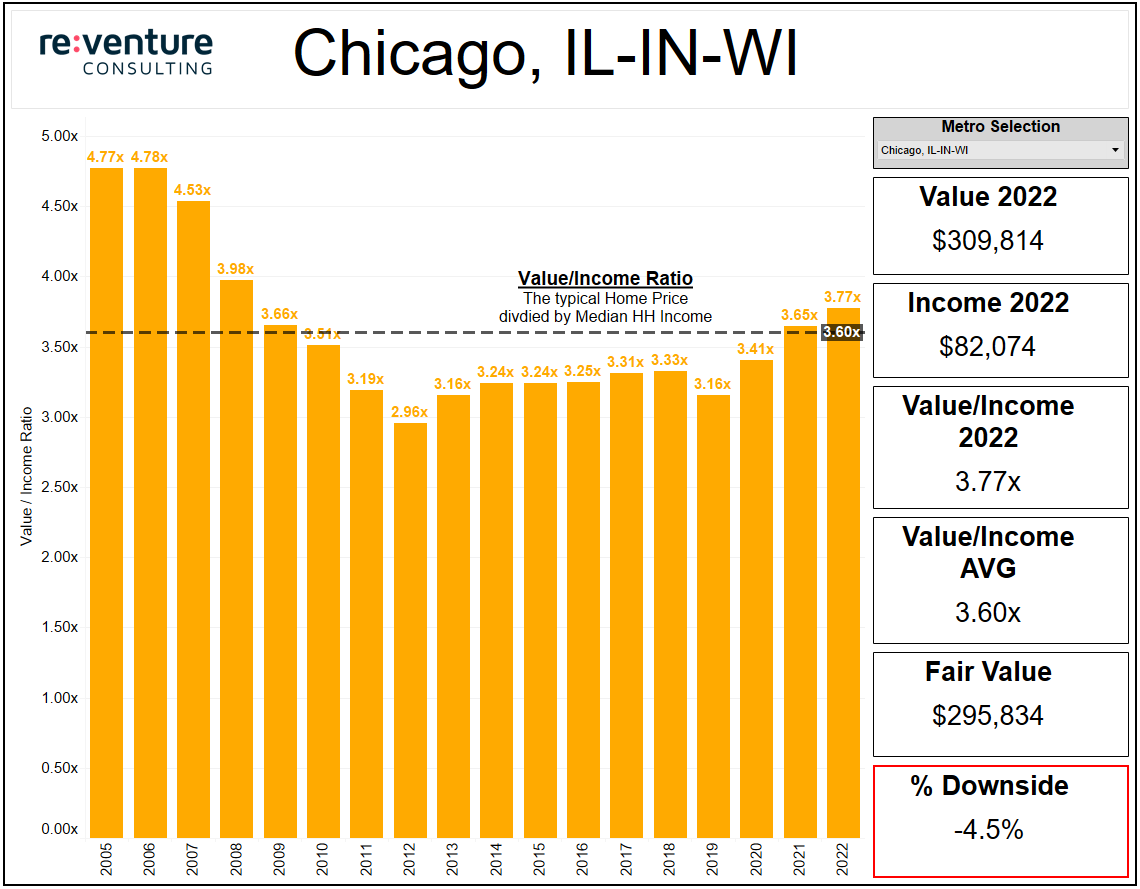

4. Chicago, IL (-4.5% Downside)

I'm preparing to have tomatoes thrown at me for this one.

Let's start with the obvious: Chicago is not the best. It is crime-ridden. Has high taxes. It's cold. And the local leadership leaves much to be desired. That's why the Chicago-Naperville-Elgin Metro has experienced outward migration every year since 2002.

And ultimately why home prices are fairly cheap. A $310k typical price in an international business hub like Chicago is compelling value. Especially compared to the $82k local median income.

Chicago is another market that was in a bubble in 2006-07 evidenced by the 4.8x Value/Income Ratio back then. The result was a stiff -35% decline in prices during the previous crash. But I don't think the same thing will happen this time around. I'm projecting -4.5%.

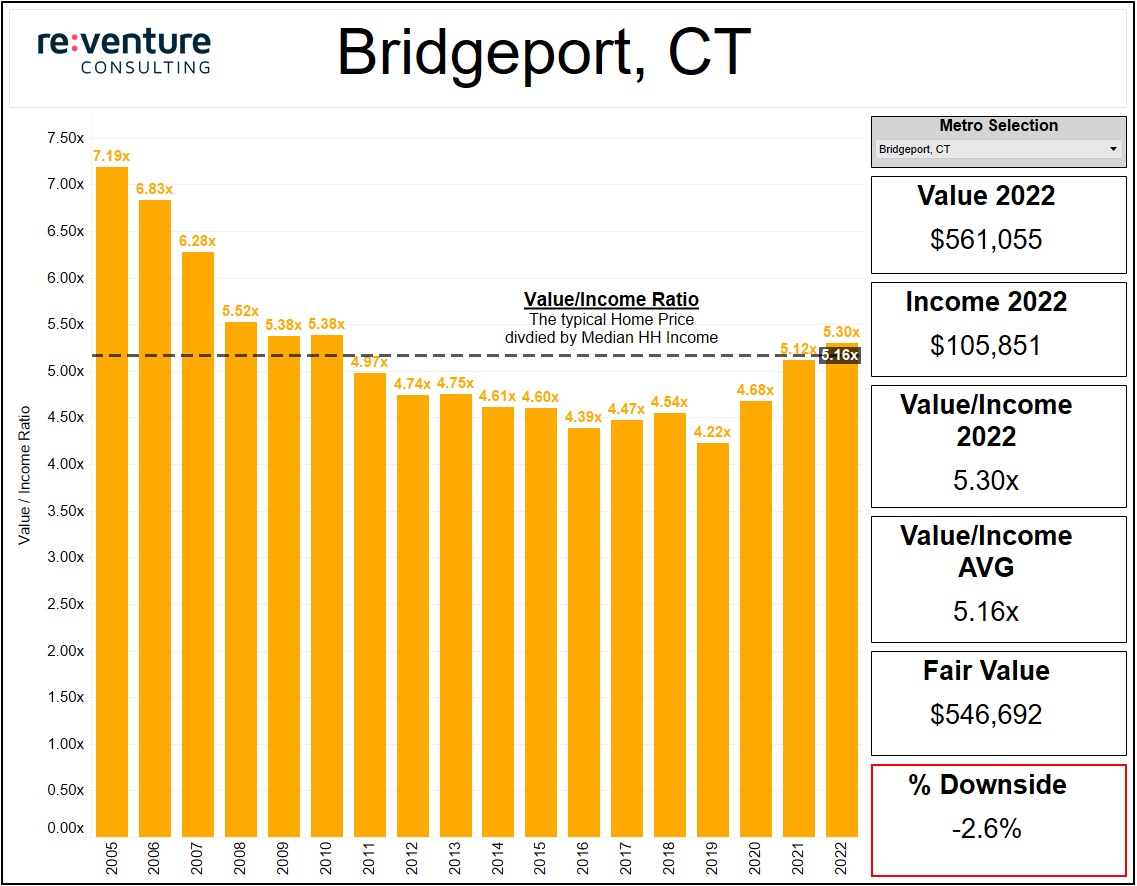

3. Bridgeport, CT (-2.6% Downside)

To be clear - this metro covers the Bridgeport-Stamford-Norwalk area. So basically all of southwestern Connecticut.

The thing that sticks out about Bridgeport is the income. $106k Median is very high. A reality driven by the high share of locals who commute to high-paying jobs in New York City.

These NYC commuters see the typical $561k value in Bridgeport and can usually afford it because they're used to seeing $1 Million prices in and around New York.

The result is that the Reventure Valuation Model is only projecting a -2.6% decline in Bridgeport-Stamford-Norwalk to get back to baseline.

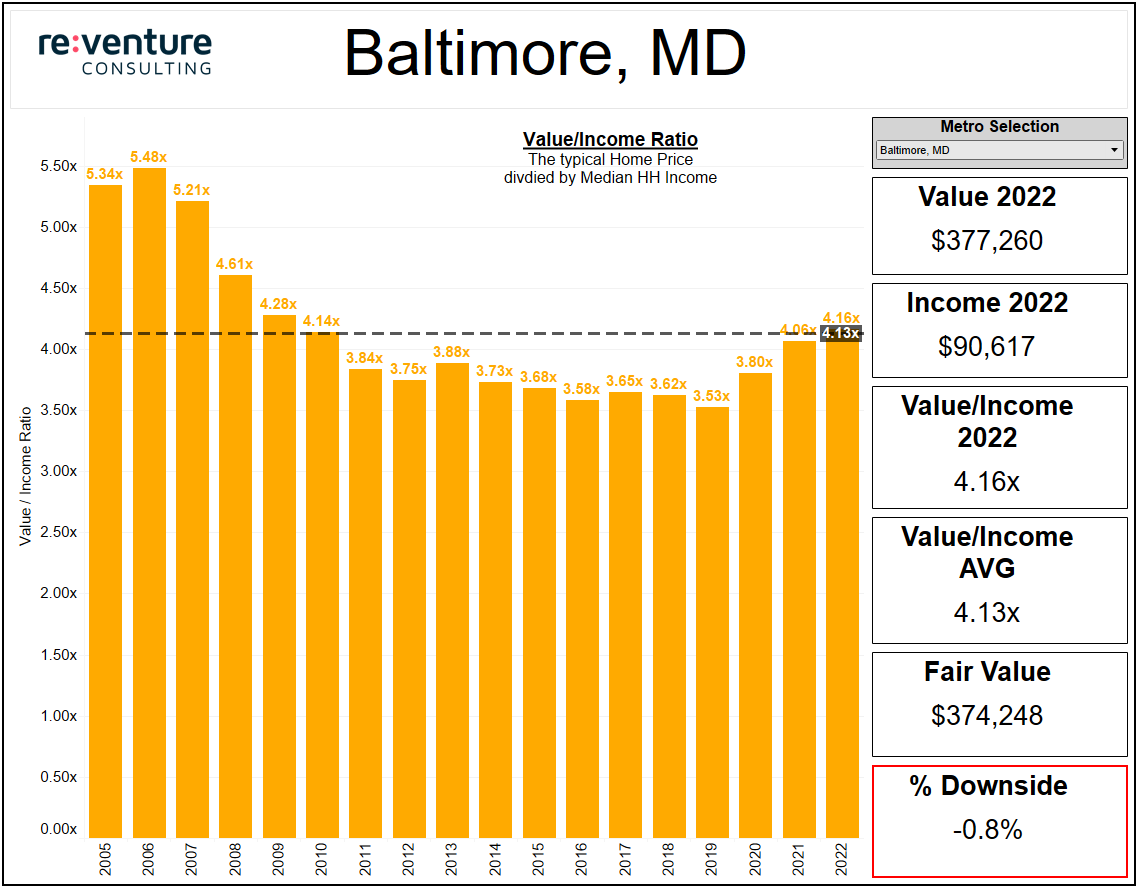

2. Baltimore, MD (-0.8% Downside)

Woah. Baltimore? Seriously? The place with one of the highest murder rates in America?

Remember that this list covers entire Metro Areas. The part of Baltimore you see on The Wire covers about 1/5 of the metro population. The remaining 4/5 is filled with a fairly affluent demographic that brings the metro Median Income all the way up to $91k

(Higher than Raleigh, Portland, Los Angeles, and Salt Lake City).

Baltimore was in a bubble in 2007. The Value/Income Ratio back then peaked at 5.5x. And values crashed pretty hard as a result. But I don't see another crash coming. Because today's 4.2x Value/Income Ratio is relatively in line with the historical average.

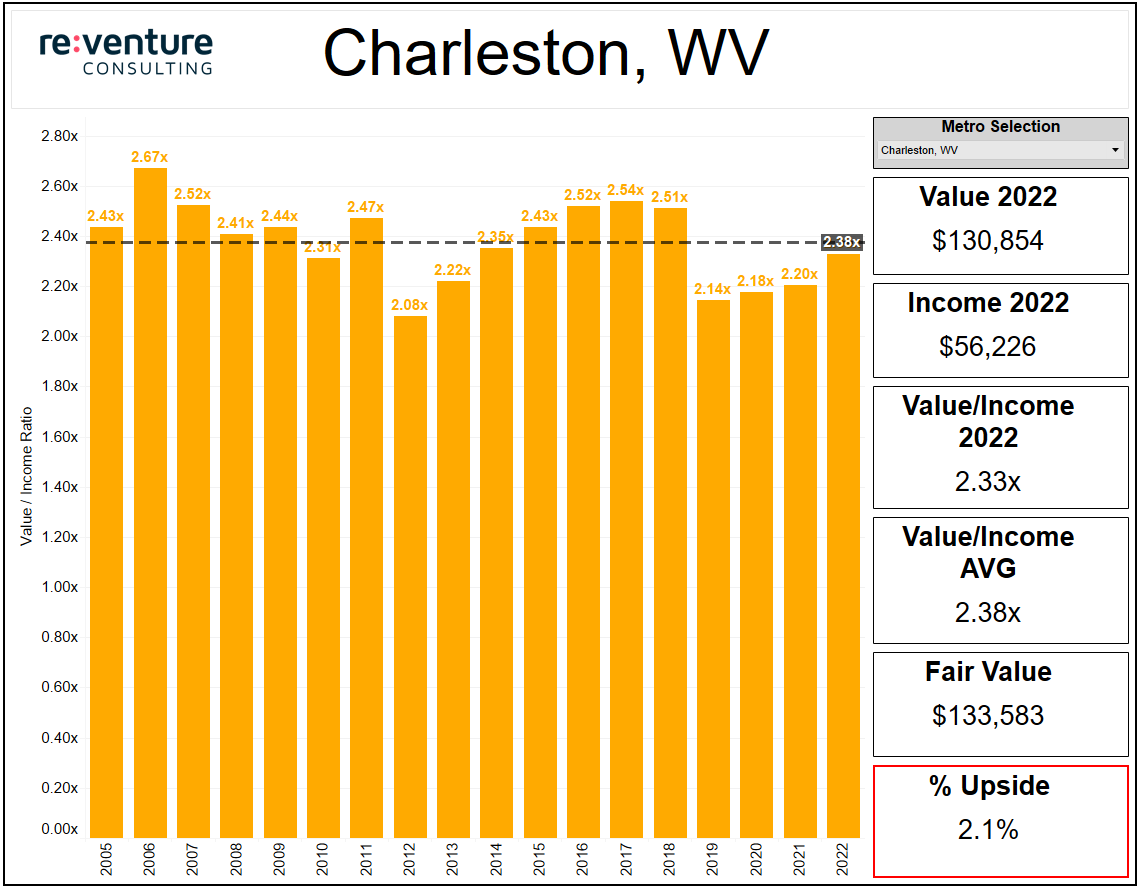

1. Charleston, WV (+2.1% Upside)

Let's finish things off with the only metro in America where prices are currently undervalued. Wait, undervalued? That's right folks. There's +2.1% Upside in Charleston, WV.

Before you get too excited, let's do a quick reality check. Charleston, WV is a tough place both economically and demographically. It has lost people to outward migration 27 of the last 30 Years. Its economy revolves around coal power generation.

Which is why home prices are ridiculously cheap. The typical value of $131k is 64% cheaper than the US Average. And a miniscule 2.3x higher than the area median income. Think about that: it only takes 2 years and 3 months of income for a local to buy a house in cash.

Please also marvel at the stability of the Value/Income graph over the last 18 years. Charleston, WV is never in a bubble. And it is never in a bust. It's simply appreciating at the rate of income growth.

For investors - the local Cap Rate average is above 7.0%. Which is pretty good in today's environment.

Before signing off, I want to address some caveats and questions about this list that I'm sure some of you will have.

First - the elephant in the room is that most of the cities on this list are not desirable. Few people want move there. Many people leave every year. This outbound migration ultimately keeps the prices more affordable and fundamentally linked with incomes. And thereby less likely to crash.

Second - the thesis surrounding these cities performing better during the crash is already being validated. For instance, inventory levels today in Charleston, Hartford, Bridgeport, Albany, and Virginia Beach are still -50% below long-term levels. Whereas so-called "desirable" metros like Austin, Phoenix, and Nashville now have inventory levels above historical norms to go along with declining prices.

Third - the lesson here is that affordability rules the day during a Housing Crash and Economic Downturn. Whereas Migration/Job Growth does not. That's a hard lesson for many to internalize. Because the mainstream narrative heavily pushes boomtown markets. But historically these boomtowns are almost always the ones that crash, while the boring markets are the ones that hold value.

Fourth - if you're a real estate investor, you should make a determination whether you a) want to to wait for the boomtown metros to crash, which could take 3-4 years, or b) want to buy now in the markets like the ones on this list, that aren't as sexy but are more stable.

Ultimately there's no "right" answer to the fourth question. It really depends on your capital situation and desire to explore different markets. Perhaps an enterprising investor deploys both strategies.

Fifth - big economic shocks can cause Home Prices to go down by more than expected. For example, if the US Government were to cut its budget by 20% and do a mass layoffs of federal workers, metros like Washington DC and Baltimore would likely experience bigger home price declines than the Reventure Model anticipates. The biggest drawback with these value projections is that they do not account for economic shocks. So please take note of that.

-Nick