10 Cities where Home Prices are DROPPING FAST

By Nick Gerli | Posted on December 20, 2022I warned you all: the Housing Crash was coming. And now it's here.

Home Prices have already dropped by A LOT in these 10 Cities. Many homeowners in these "Crash Markets" have already lost their equity. And many more will be underwater on their mortgage in 2023.

If you're a homebuyer or real estate investor in one of the cities: be careful. While the price cuts and discounts might start to look appealing, it can be risky to try and catch a falling knife.

WARNING: the price drops in these cities have likely just begun. The list you see below represent the 10 Metros with the biggest % decline in values since May 2022 according to Zillow and Realtor.com.

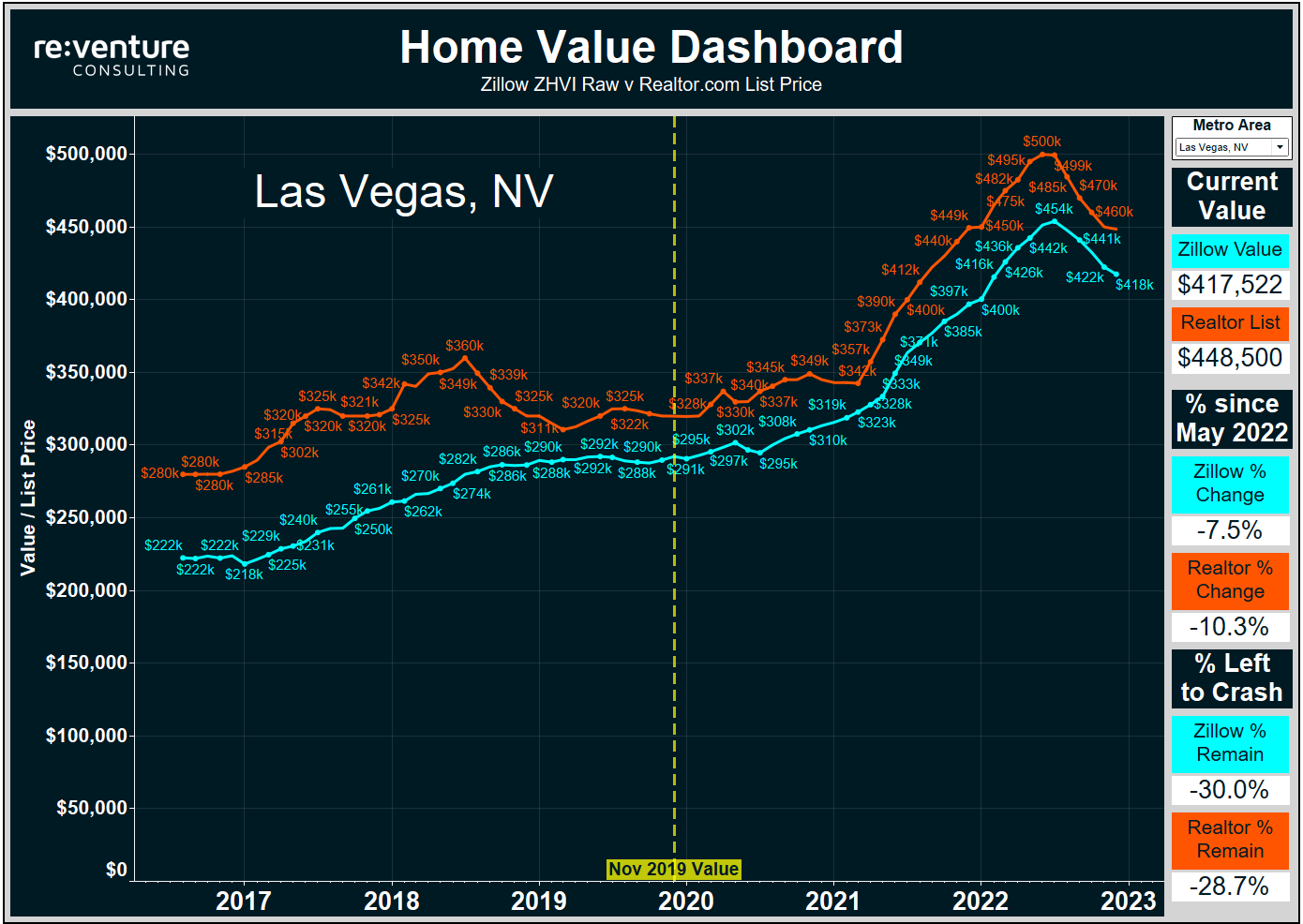

10. Las Vegas (-8.9%)

Do you remember how bad the last Housing Crash was in Las Vegas? Let me refresh your memory: home prices in Vegas dropped by an astounding 63% from 2007 to 2012 in the worst localized housing downturn in US History.

I don't think this Housing Crash will hit Vegas as bad. But it will still be ugly. Zillow is reporting that the typical Home Value is already down by -7.5% while Realtor.com is showing a -10.3% decline in list price. That averages to a -8.9% blended decline since values peaked in May 2022.

Why are values crashing in Las Vegas? Well, a complete collapse in investor demand certainly has something to do with it. As does a slowdown in inbound migration from Southern California. I suspect values in Vegas could have a another 20-30% left to crash. Don't be surprised if prices eventually hit their 2019 levels before the pandemic struck.

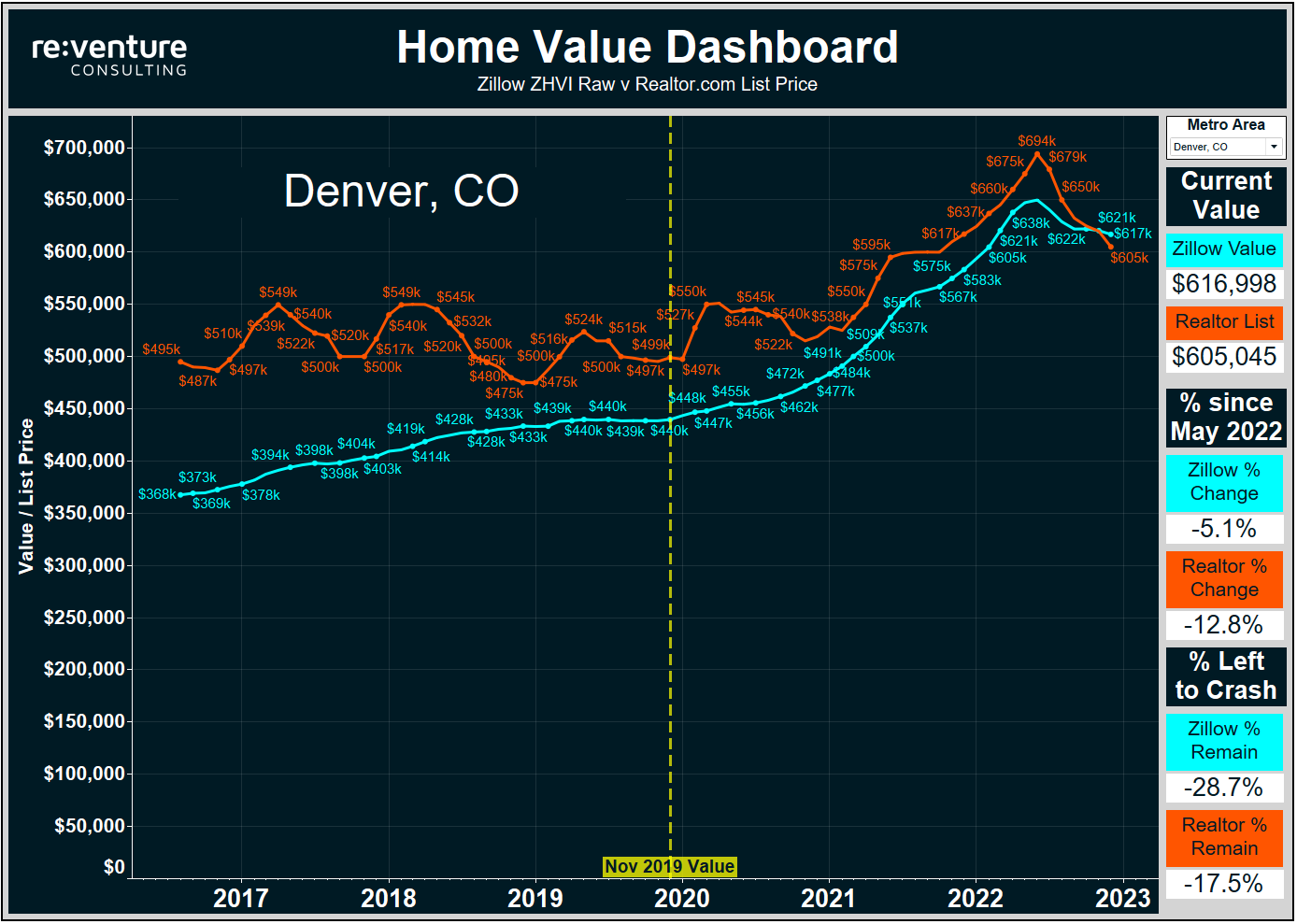

9. Denver, CO (-8.9%)

Home Prices in the Mile High city hit peak altitude back in Spring 2022 when the Median List Price according to Realtor.com registered $694k. However, since then, sellers have become much realistic. The Median List Price has dropped by -12.8% all the way down to $605k.

Meanwhile - Zillow is representing a more conservative -5.1% decline in values. Averaging the Zillow and Realtor.com estimates gives Denver a -8.9% blended crash since May.

And make no mistake - that's a BIG drop in home prices for only a six-month period. Yet prices in Denver are still way too high and local homebuyers remain on the sidelines. I believe we'll need to see another 15 to 25% drop in prices before the long-term affordability of the market is restored.

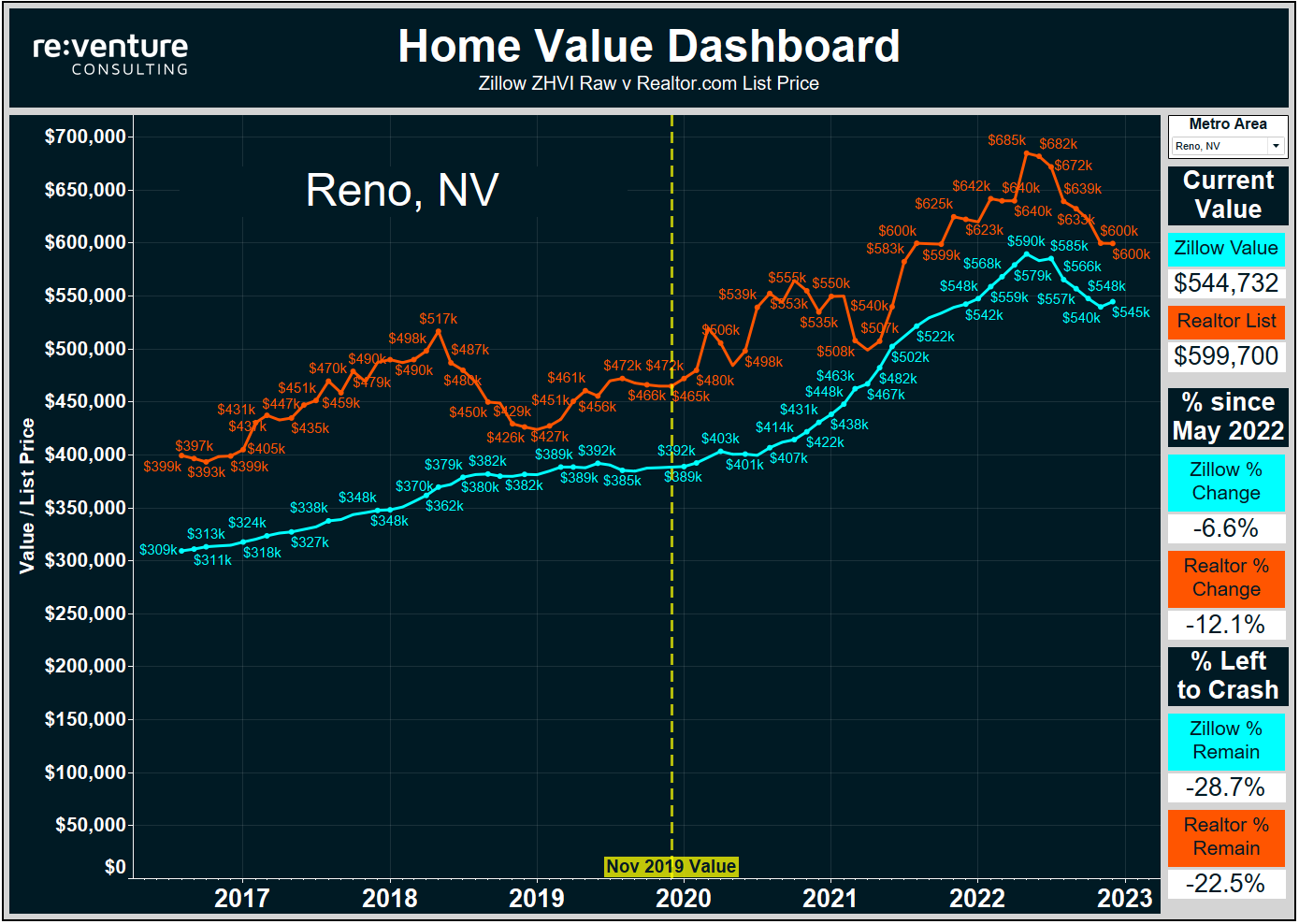

8. Reno, NV (-9.4%)

When I hear the word "Reno" I think of three things: 1) gambling, 2) the hilarious Comedy Central show Reno 911, and 3) Housing Crashes. Reno is one of the most volatile Housing Markets in US History, with prices declining by over 50% during the last downturn from 2007-12.

And while another 50% decline is unlikely, don't be surprised if prices in Reno decline for a long time. The typical Zillow Home Value of $545k is down -6.6% from peak, but is still over 10x higher than the average annual wage of $51k per year. Which means locals are still very priced out of the market.

Realtor.com is reporting that values have declined by over 12%. And could have another 20%+ to go. If you're a homebuyer or investor in Reno, strap in, because the bumpy ride has just begun.

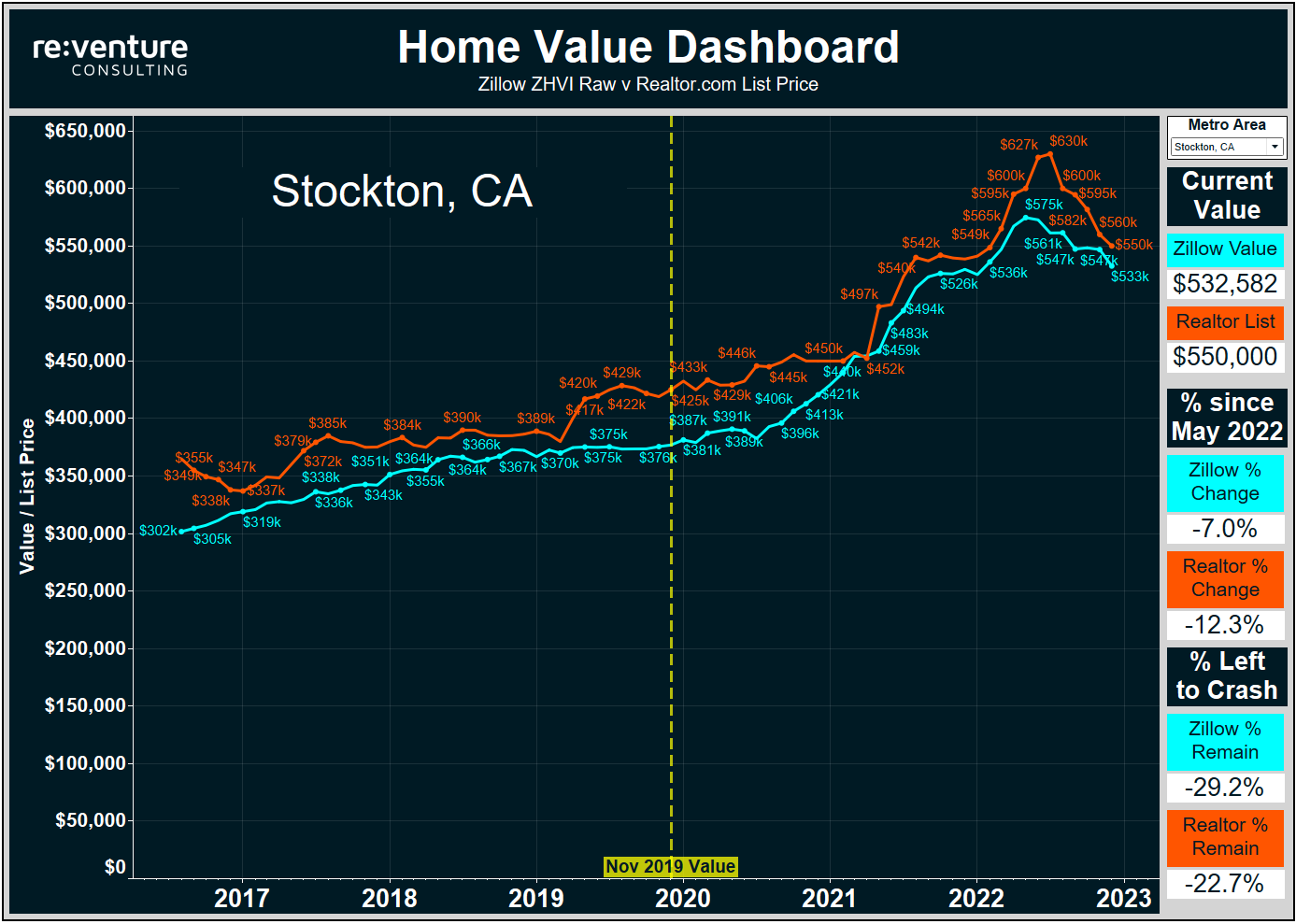

7. Stockton, CA (-9.6%)

Stockton was 2nd to Las Vegas in terms of having the biggest price decline during the 2008 Crash. And it will likely be near the top of the price crash charts this time around when all is said and down.

The issue for Stockton, as well as nearby Sacramento (which came in at #16 on this list), is that so much of the local housing demand is driven by inbound migration from the Bay Area.

That was a distinct positive for Stockton Homebuyer Demand during the pandemic, when there was a huge exodus out of the Bay Area. But now that workers are getting called back into the office, and tech companies are laying off works, there has been an abrupt collapse in buyer demand in Stockton.

The result? Zillow shows a -7.0% decline in values while Realtor.com has a -12.3% decline in list price.

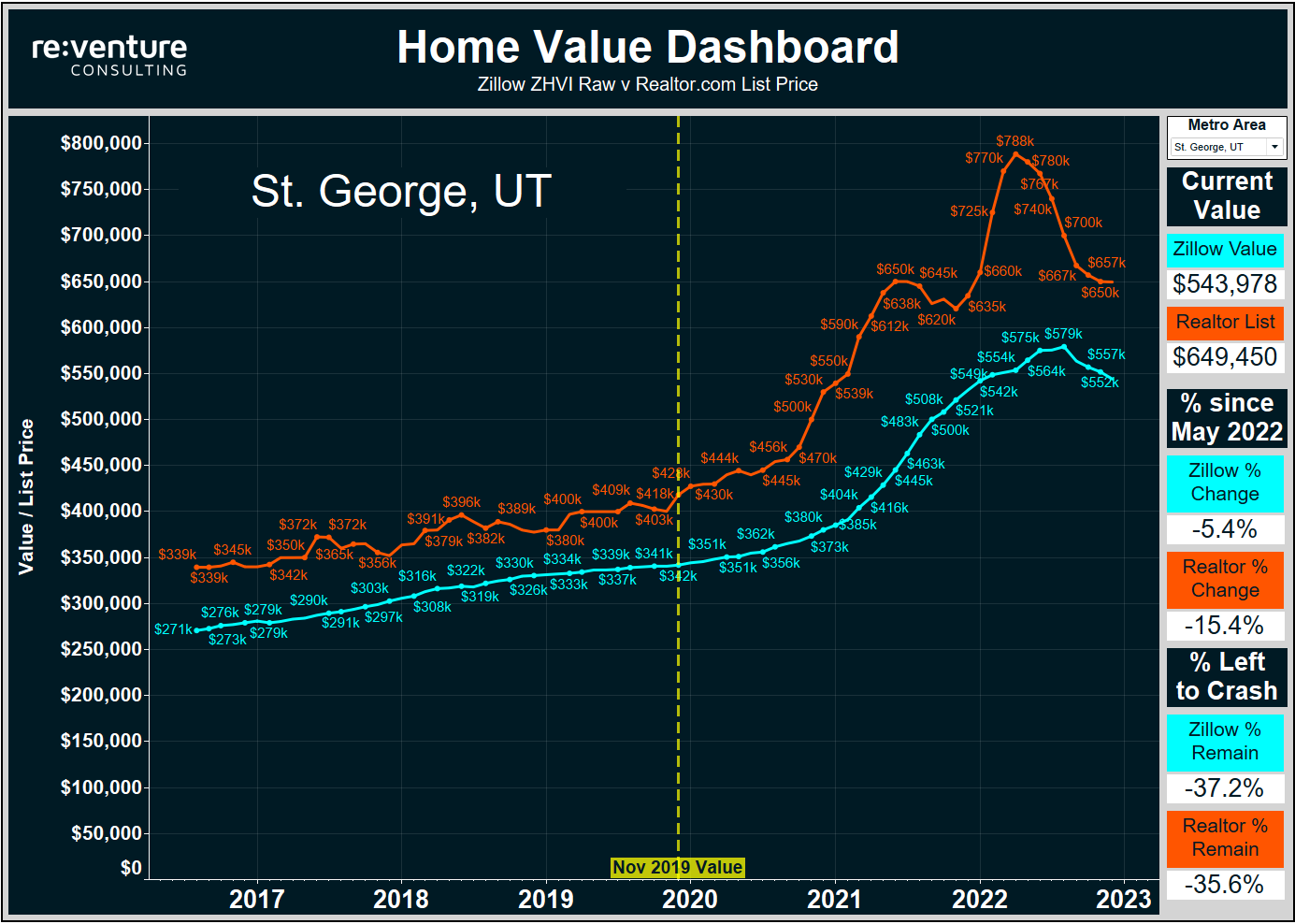

6. St. George, UT (-10.4%)

St. George, UT is a metro of 180k people in Southwest Utah. It is a big retirement and second home destination for vacationers. That could be one reason why it boomed so much during the pandemic, with the Zillow Value increasing from $342k in 2019 to a peak of $579k in the summer of 2022.

But now values are heading south. And heading south fast. Zillow shows St. George with a -5.4% decline in value while Realtor.com shows a whopping -15.4% crash in Median List Price.

What's scary is that St. George could have a lot further to fall. Values would need to decline by another 35% to get back to pre-pandemic levels. And given the huge drop in 2nd home-demand that's occurred across America, St. George's Housing Market could be in the doldrums for years.

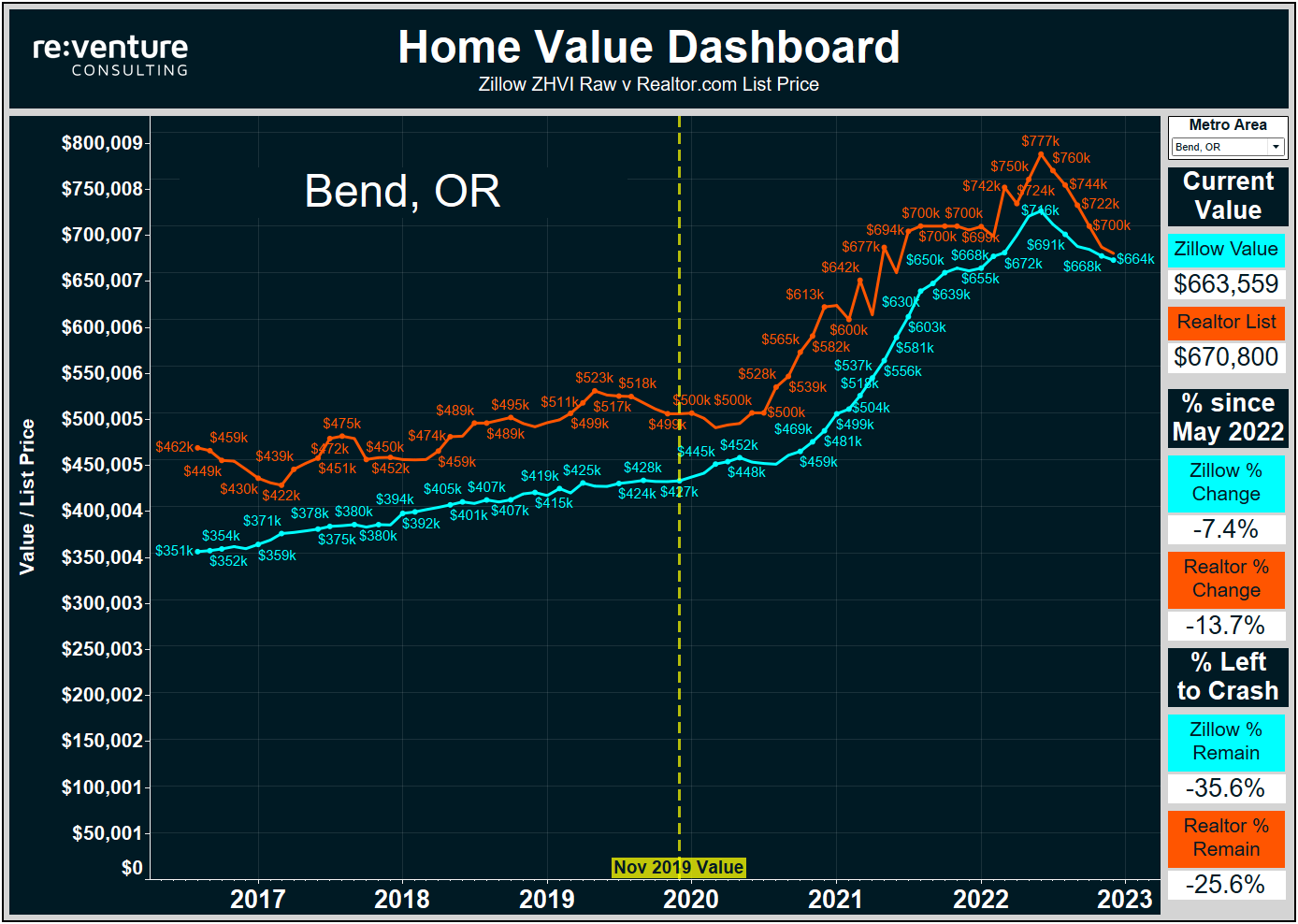

5. Bend, OR (-10.5%)

Bend is another vacation destination that boomed during the pandemic. Many tech-workers from the Bay Area and Seattle bought 2nd homes in Bend when they were allowed to work remote. But now that those workers are getting called back into the office and laid office, the Bend Housing Market has begun to crash.

Realtor.com reports a -13.7% drop in List Price, while Zillow shows a -7.4% decline in values. The blended average is -10.5%, a massive decline for only a six-month period.

And rest assured - there's more price declines coming. Today's typical home value in Bend of $664k is absurdly high. An insane 13x higher than the average local annual wage of $52k. Another 25-35% drop in values could be in the cards.

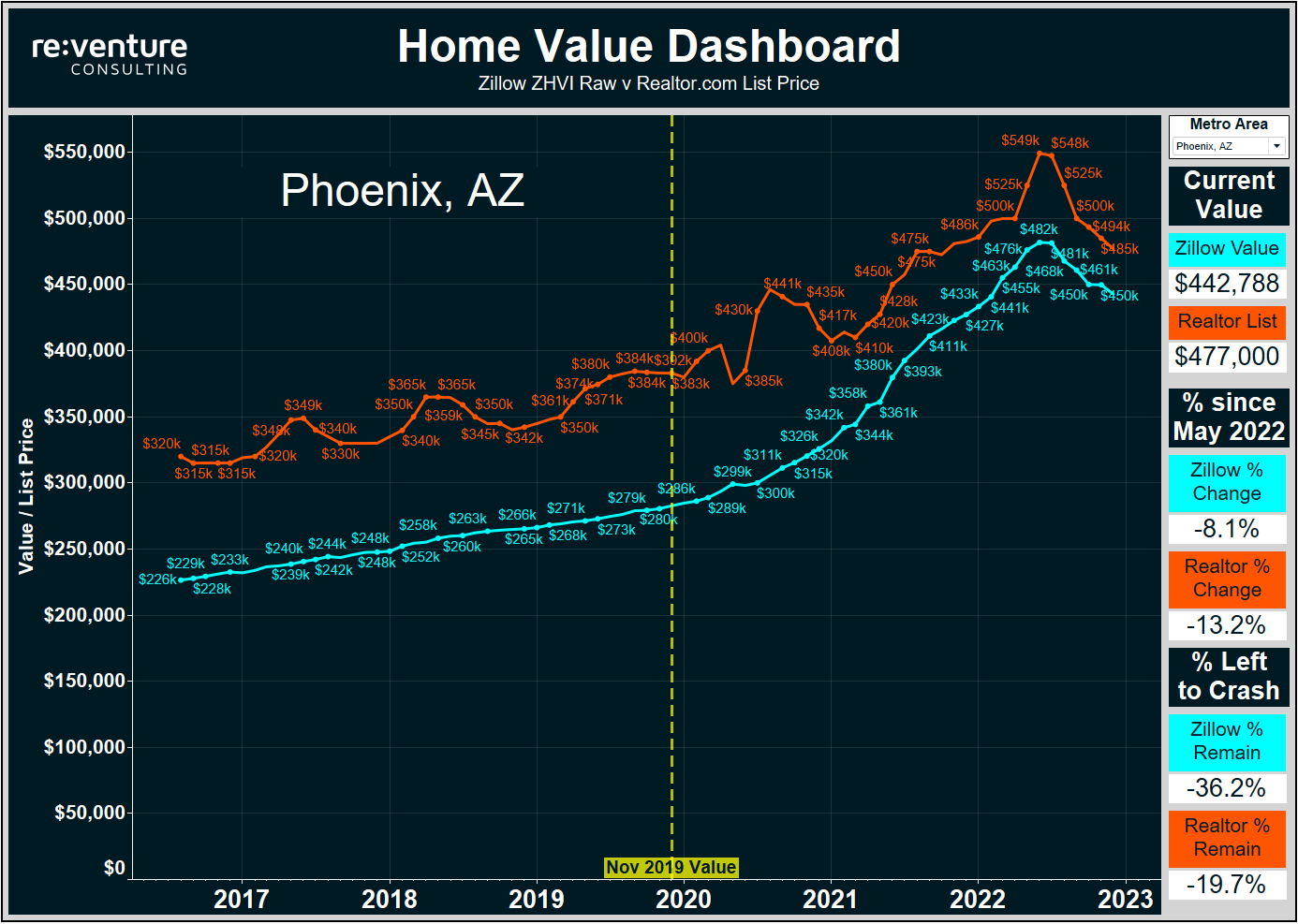

4. Phoenix, AZ (-10.6%)

Oh Phoenix. How do you manage to fool real estate investors and speculative homebuyers every time?

You would have thought that after the 52% Price Crash in Phoenix from 2007-2012 that people would have learned their lesson. But no - Phoenix went through an even bigger boom in prices from 2019 to 2022. And now that boom has turned into another crash.

Zillow is reporting a -8.1% decline in values since May. Realtor.com has a -13.2% drop in list price. The blended average is over 10%, and there could be another 25% to go given how frothy this market has become.

Take note: investor purchases are down 49% YoY in Phoenix. Wall Street has bailed. Just as the home builders are gearing up to deliver a record surge in inventory in 2023.

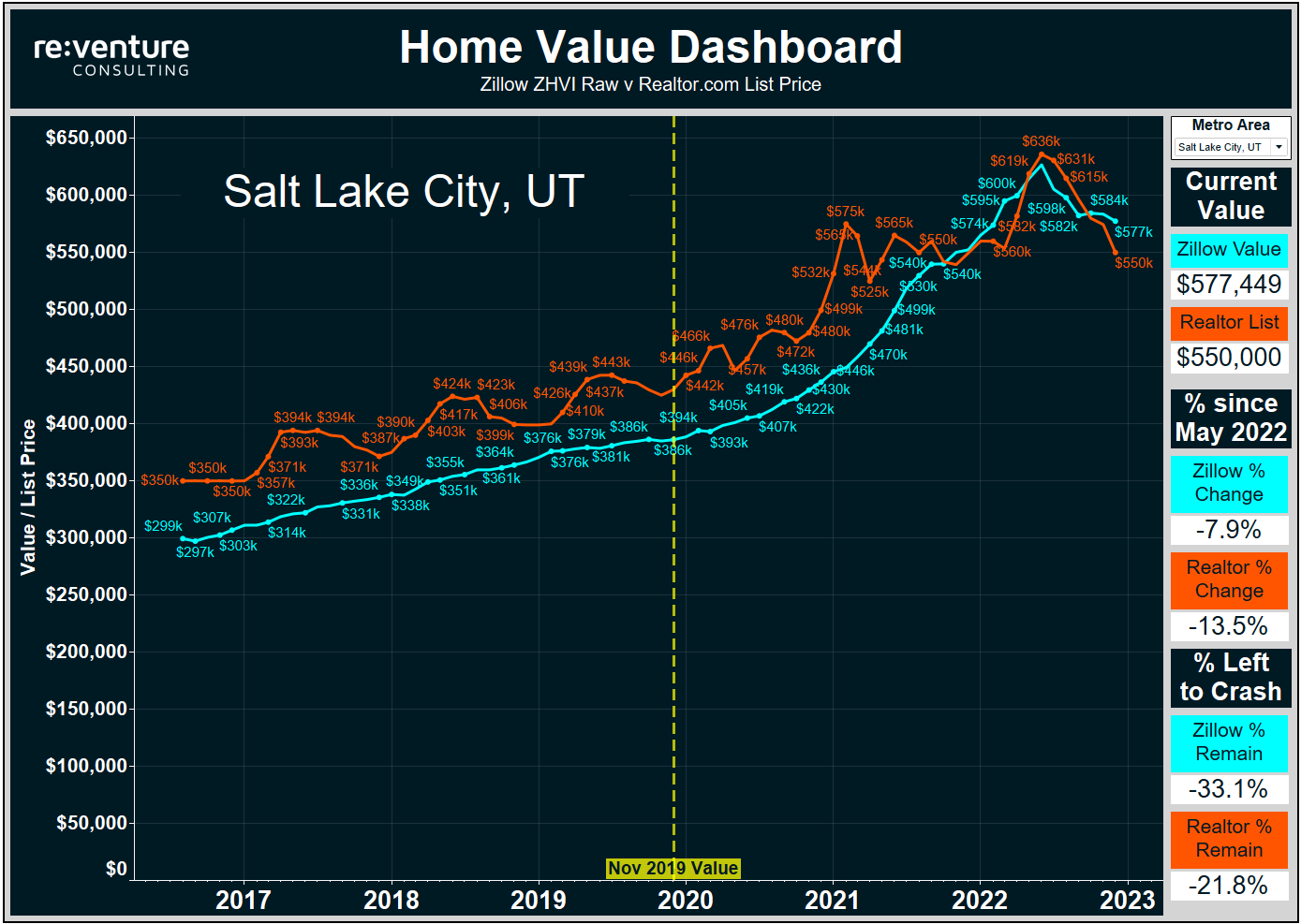

3. Salt Lake City, UT (-10.7%)

Salt Lake City is an attractive Housing Market in many respects. It's population is very young. There's lots of birth and job growths. There will eventually be limits to home building based on the region's geography.

However, in the short-run (and by short-run I mean 2-3 Years), there's going to be a lot of pain in the Salt Lake City Housing Market. Home Prices simply grew way too high, with the Zillow Typical Value peaking at $627k in May.

Now that value is already down by -7.9%. While the Median List Price has crashed by -13.5%. Put simply - it's a bloodbath across Salt Lake City real estate and in Utah more broadly.

If you're a homeowner in Salt Lake - don't expect a reprieve any time soon. Values still have much further to fall before affordability is restored.

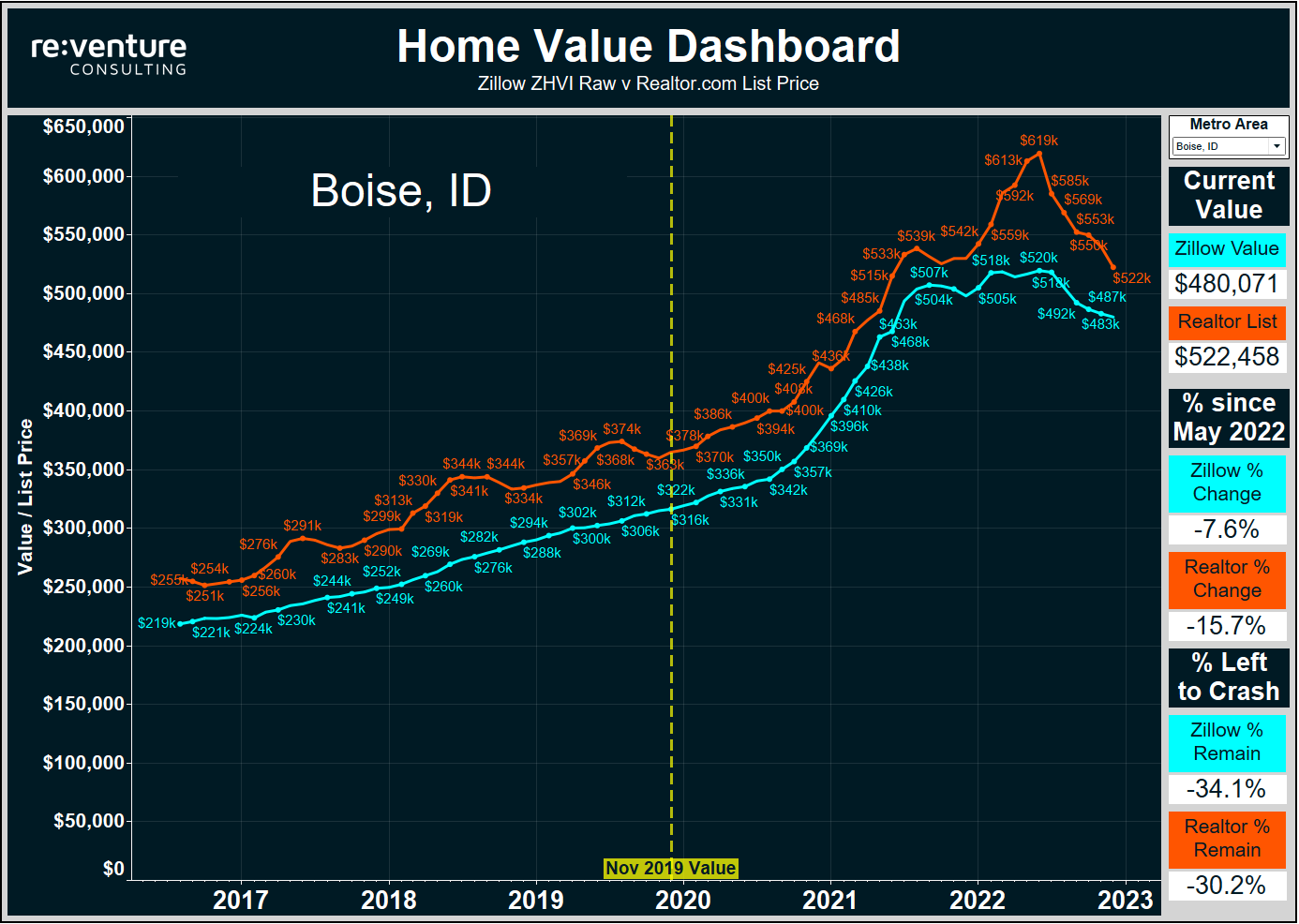

2. Boise, ID (-11.6%)

Boise, ID. You were the first metro to start crashing all the way back in the Fall of 2021. And now that crash is coming full circle. Not only are values down in Boise over the last 6 months, they're also down over the last 12 months. If I had set the start date for the % decline on this list as January 2022 instead of May, Boise would be #1 on this list.

Values are down -7.6% according to Zillow. List prices are down a massive -15.7%. This blends to a decline of -11.6%. And these declines are just the start. Values in Boise could go down by another 30% due to a combination of exposure to tech/remote work, high levels of home building, and reduced migration.

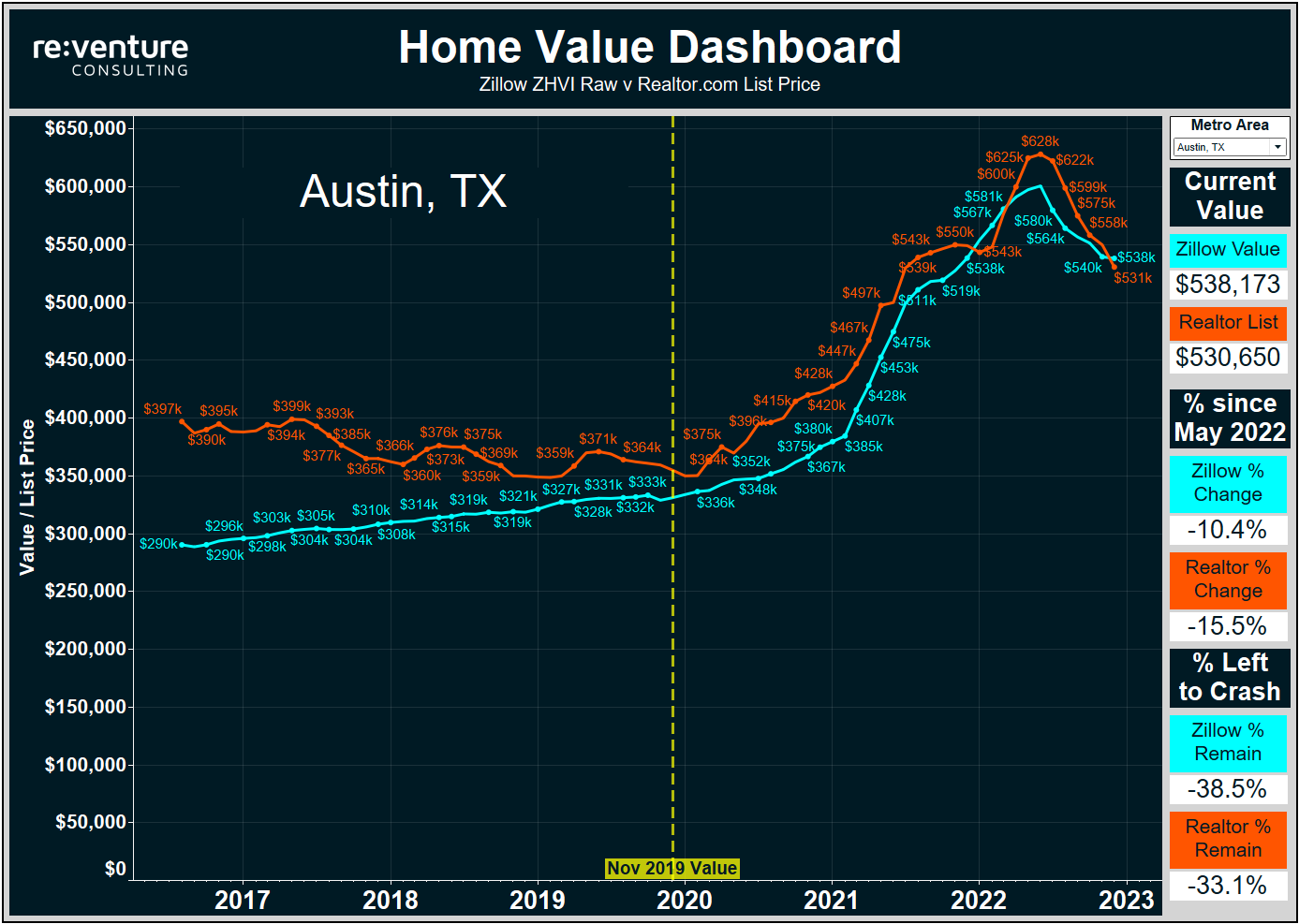

1. Austin, TX (-13.0%)

Welcome to America's #1 Housing Crash Market: Austin, TX. Home Values in Austin are in absolute freefall right now.

Austin is the only market that Zillow is reporting a double-digit drop at -10.4% in the last six months. Meanwhile, Realtor.com is showing an even bigger decline at -15.5%. The blended crash of -13.0% is by far the most for any large metro in America.

Despite these declines in price, buyers are still jumping ship on Austin with a massive 40% YoY decline in sales. Buyers will likely continue to drop out of the Austin market given how much exposure there is tech layoffs. Additionally, home builders and apartment developers are set to deliver a record number of units to Austin in 2023.

The result will be even bigger price declines next year.

One last thing. On June 2nd, 2022, at the peak of Home Prices before the Bubble Burst, I released a video predicting the 10 Housing Markets that would have the biggest home price declines. You can watch it below.

My top 3 predictions for biggest price declines back in June were:

3) Salt Lake City, UT

2) Boise, ID

1) Austin, TX

Which turns out the be the exact order of the cities with the biggest price declines since. Good validation for the foundation I have built at Reventure Consulting in terms of understanding Housing Markets and predicting changes in home prices.

In the end it all comes down to Home Prices v Incomes/Rental Rates. More on that in a future post.

-Nick