Home Prices drop again in October. 4th Month in a Row.

By Nick Gerli | Posted on November 3, 2023Realtor.com just released their October 2023 housing market data and it confirms what's become increasingly obvious over the last several months: home prices are dropping.

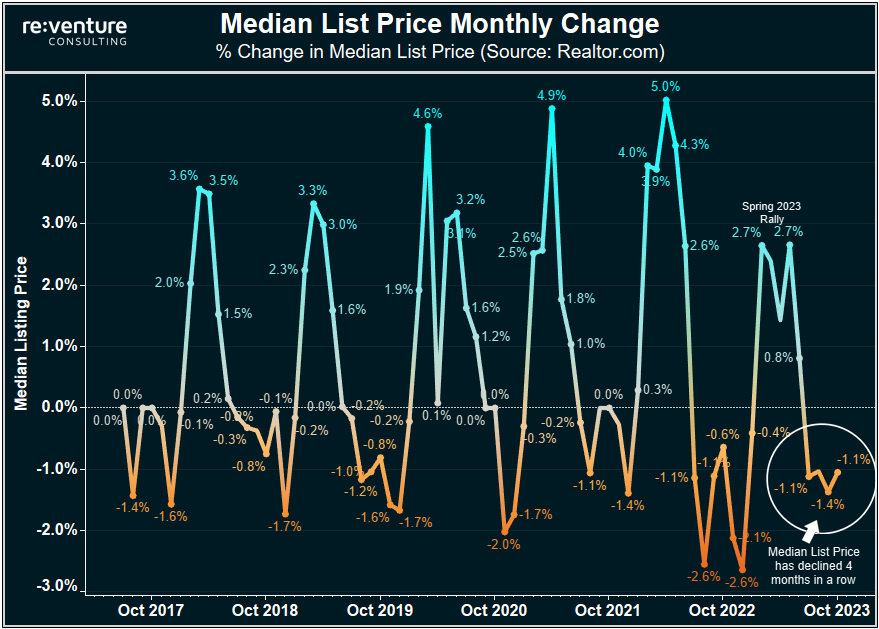

With the Median List Price for houses across America slipping by -1.1% in the month of October. This marked the fourth consecutive month of list price declines dating back to July.

This data shows that sellers are slowly waking up to the realities of plummeting homebuyer demand and near-8% mortgage rates, learning that they'll need to lower their expectations on sale price in order to find a buyer.

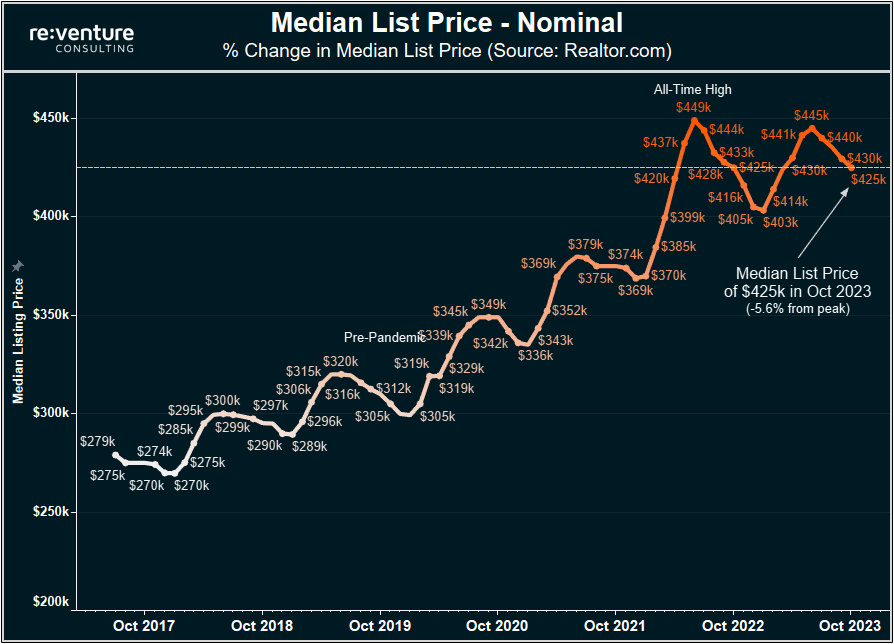

However, even with these declines, homes are still being listed at a very high price compared to historical norms. With October 2023's Median List Price of $425,000 matching its level of one year ago and sitting 33% above its pre-pandemic norms.

On a positive note, current list prices are now down about -5.6% from the peak that occurred in June 2022 and will likely fall further in the coming months as sellers look to liquidate their homes before the winter hits.

Impressive gains in the number of Homes For Sale

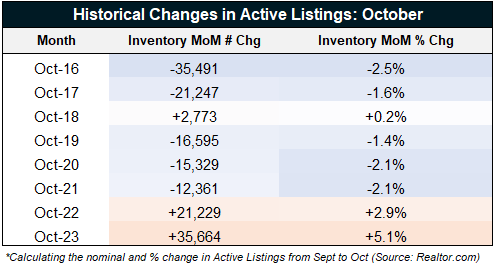

But what has me most excited about Realtor.com's recent housing market data are the inventory figures. With October 2023 active listings growing by nearly +36,000 from their levels in September, good for a +5.1% month-over-month growth rate. This was the highest reported inventory growth for the month of October in Realtor.com's dataset heading all the way back to 2016.

As you can see - it's normal for the Housing Market to lose inventory in October. But not this year, with a combination of rapidly declining buyer demand and stable new listings resulting in a fast pile-up of homes for sale.

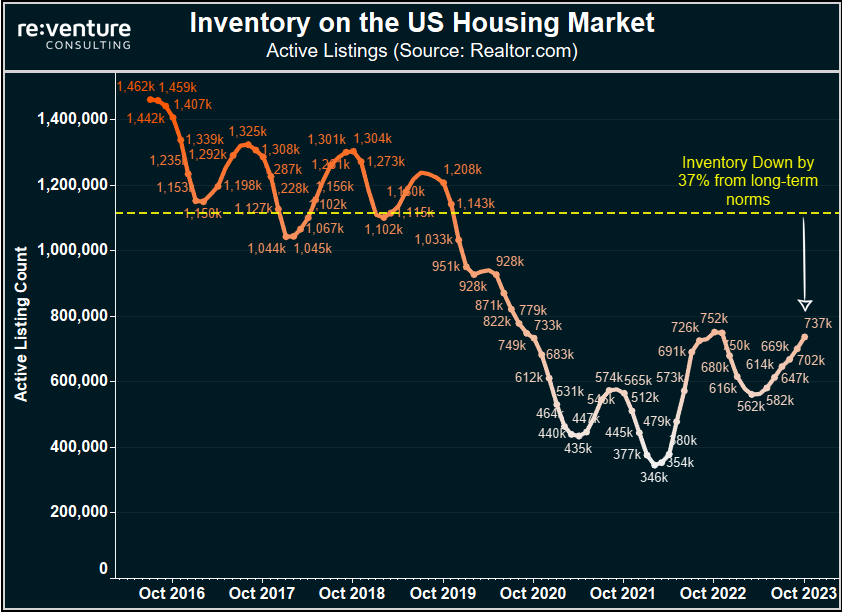

Which is a good sign for homebuyers heading into the winter. This unseasonable increase in inventory is a signal that home prices will likely face further downward pressure over the next several months.

These recent increases in homes for sale have caused total active listings on the US Housing Market to rise up to 737,000, which is still 37% below long-term norms. Suggesting that we will need to see further improvements in inventory before home prices will make the significant drop required to entice buyers back into the market.

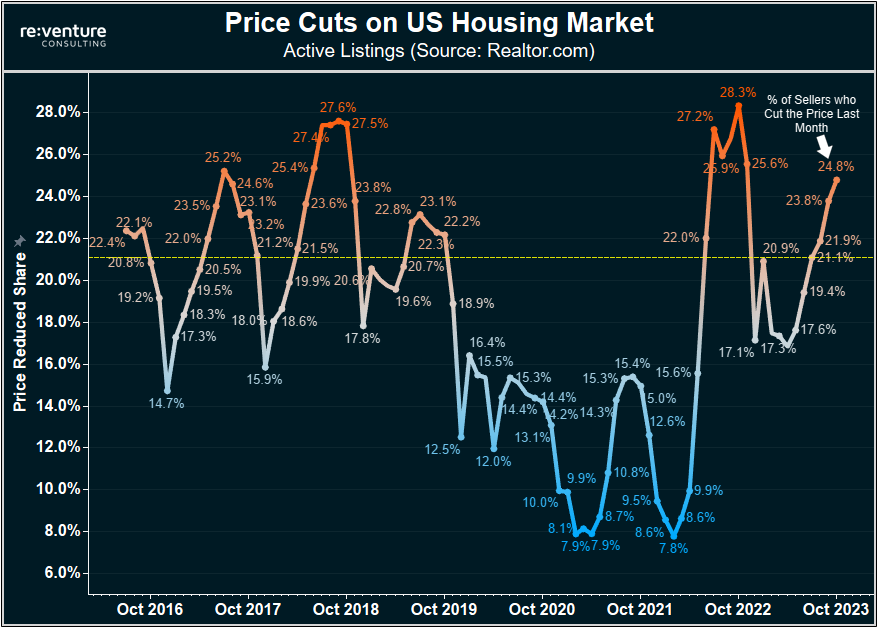

Seller Price Cuts are also Ramping Back Up

There are two ways home prices can decline: the first is when sellers list their homes at lower prices to begin with.

But there's also a second way home prices can decline, and that's through sellers cutting the price on homes already listed on the market for sale. And sure enough, high mortgage rates and suppressed buyer demand have finally put some urgency into the minds of sellers who already listed their homes.

With 24.8% of sellers reducing the price of their house in October 2023. That price cut % is up significantly from the lows experienced during the pandemic and is back in a more normal range of price cuts for the fall.

Mind you - this Price Cut data from Realtor.com, which is also available on Reventure App, only tells you if a seller reduced the price. It does not say how much the price was reduced. Even so, a higher share of sellers reducing the price is a sign that more pressure is entering the minds of existing owners as we head towards the winter.

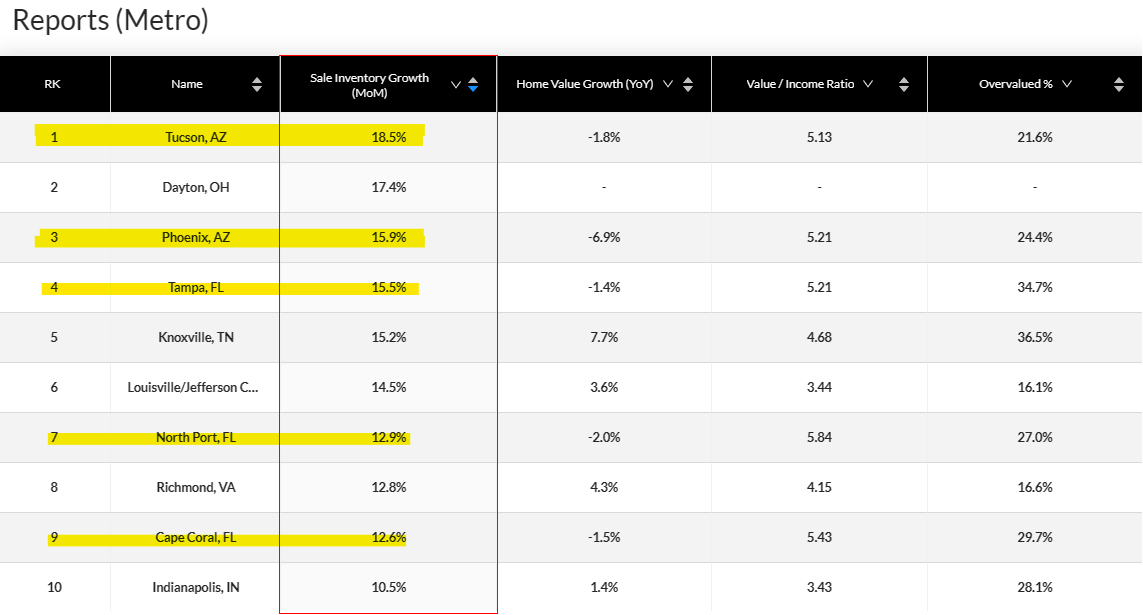

Pay attention to Arizona and Florida, where Inventory is exploding.

Make sure to analyze the inventory and price cut data for your state and metro on Reventure App, where the data has been updated through October.

Particularly if you live in Arizona or Florida, where there has been an explosion of inventory and price cuts over the last months. Metros like Tucson, Phoenix, Tampa, North Port, and Cape Coral all cracked the top 10 for metros with the biggest monthly inventory gains (tracked by the data point "Sale Inventory Growth MoM").

Each of these Arizona/Florida markets has already started to see price declines (represented by the negative values in 'Home Value Growth YoY'). And all of them are heavily overvalued (Overvalued rate north of 20%). So be very careful if you're a buyer in these locations right now because if the inventory deluge continues then some very substantial price declines could be triggered.

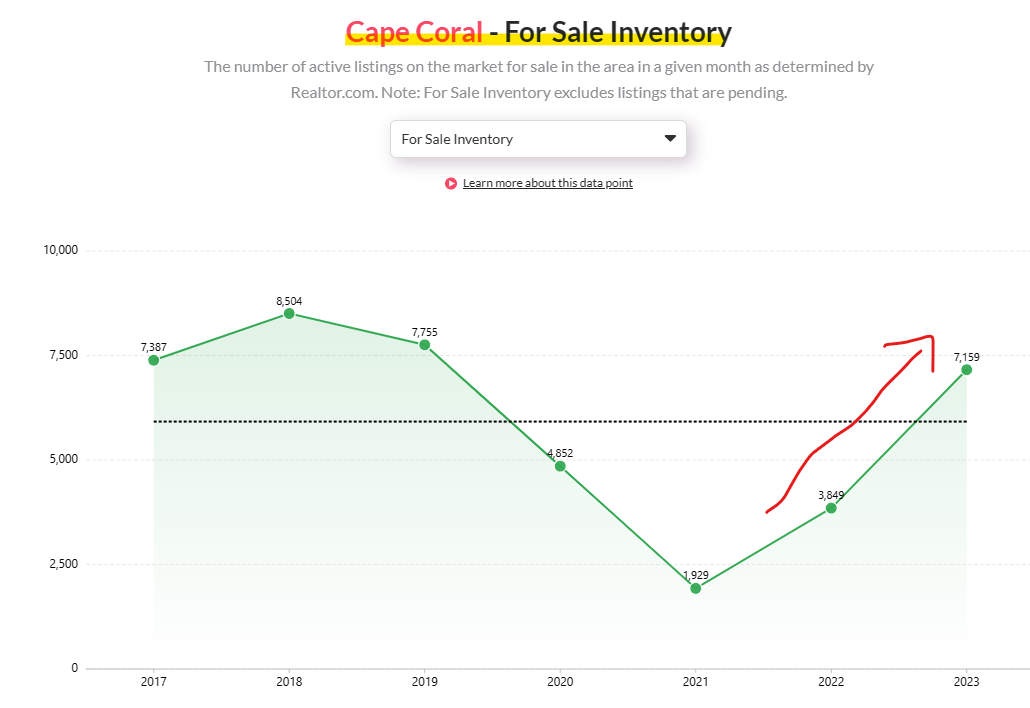

One metro, in particular, that I'm watching is Cape Coral/Fort Myers, where the inventory for sale has just exploded over the last two years, surging up past 7,000 active listings.

Likewise - the number of sellers cutting the price in Cape Coral has also spiked.

A clear signal that a Housing Downturn has started to impact this area, as well as Southwest Florida more broadly.

Reventure App allows you to access this Inventory and Price Cut data for nearly every ZIP Code in America. So make sure to check out the updated data for October now (Inventory is a free data point; Price Cuts are premium).

What will happen in November?

So it's pretty clear October was a "win" for would-be homebuyers in the Housing Market. Inventory spiked. Price Cuts increased. List Prices dropped.

But will we see those trends continue in November and December?

That's the million-dollar question. And based on the current data in the market, I think we will continue to see more price reductions and stronger inventory growth than normal. Especially given the lowly state of homebuyer demand in the US Housing Market, with:

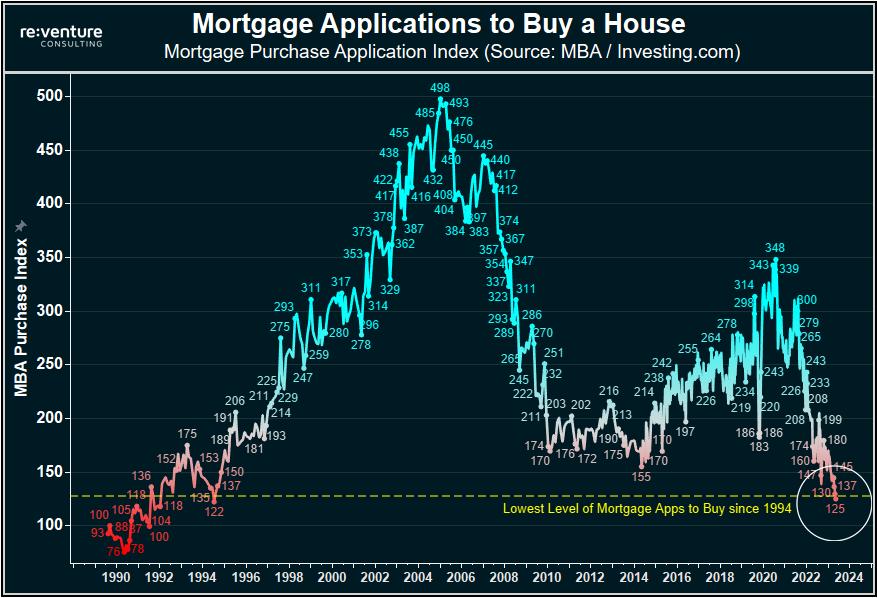

- Mortgage applications to buy a house down at their lowest level since 1994.

- Redfin's homebuyer demand index at its lowest rate in 3 years.

- Google searches for homes for sale down over 10% from pre-pandemic norms.

As a result, don't be surprised if inventory rises slightly in November, which would be a very rare occurrence as inventory almost always drops historically in November. Moreover, don't be surprised if price cuts also increase again, with an associated hefty drop in list price.

But those are just some high-level projections. We will need to track the data as it comes out to confirm it.

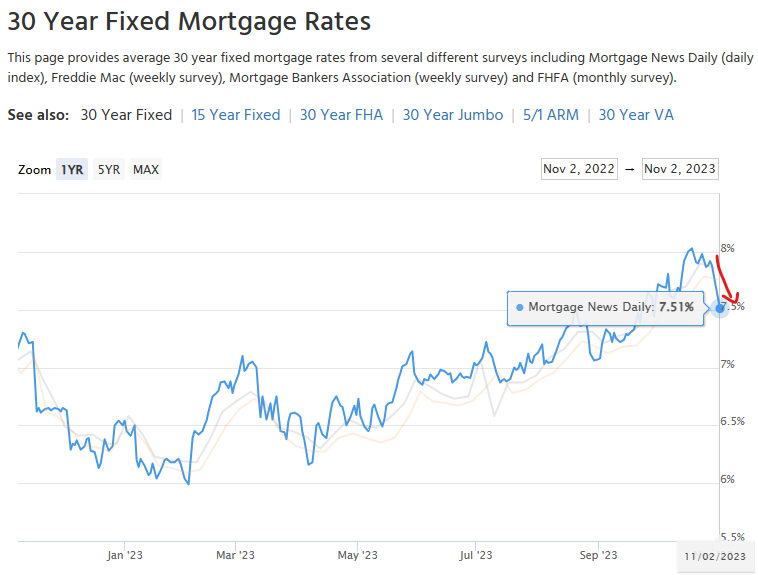

What about Mortgage Rates? Will they keep dropping?

Another interesting storyline to watch in the coming weeks will be Mortgage Rates, particularly if the current drop in rates continues.

Over the last week, the 30-year fixed mortgage rate has collapsed from 8.0% down to 7.5%. Which is a fairly rapid decline for just one week.

And given the current downswing of long-term bond yields, mortgage rates could drop a bit further in the coming days, potentially down to the 7.3-7.4% range.

One has to wonder if this drop in mortgage rates could send more homebuyers back into the market, and potentially cause a mini-spike in demand/mortgage applications over the next couple weeks. I personally wouldn't be surprised if that happened, as some people who canceled contracts or were closely watching the market decide to get back in at a reduced mortgage rate.

However, I'm skeptical that this reduction in mortgage rates will have much of a tangible impact on the market over the intermediate term as homebuyer demand is still already ridiculously low. With mortgage applications to buy a house currently down 50% from pre-pandemic levels and at their lowest level since 1994.

Thus - a moderate "rally" in demand wouldn't be surprising given the huge drop that's occurred in recent months. So perhaps we see a short-term spike in mortgage applications, by maybe 10-15% over the next two weeks. With that spike then quickly subsiding or stabilizing.

I will be tracking all of this data here on the Reventure App blog, as well as on YouTube, so stay tuned. Also make sure to check out data for your housing market in the meantime on Reventure App, particularly the updated Inventory and Price Cut figures for October 2023.

-Nick