It was a bad week for the US Economy. What will Home Prices do in Response?

By Nick Gerli | Posted on September 1, 2023This was a bad week for the labor market in the US Economy, with a host of economic indicators showing a major slowing in activity among employers. Most notably: 1) job openings plummeted, 2) the unemployment rate increased, and 3) wage growth slowed. Signals that the US Housing Market could face increased headwinds in the second half of 2023 as would-be homebuyers begin to struggle with diminished job prospects.

Moreover, one has to wonder if this recent slowing in the jobs data is a signal that the most predicted Recession of all time might finally be at our doorstep. If so, there's a good chance inventory will increase and Home Prices will drop.

Let's dive into the data that came out this week so you as a homebuyer or investor can have a better perspective on what the Housing Market impacts will be.

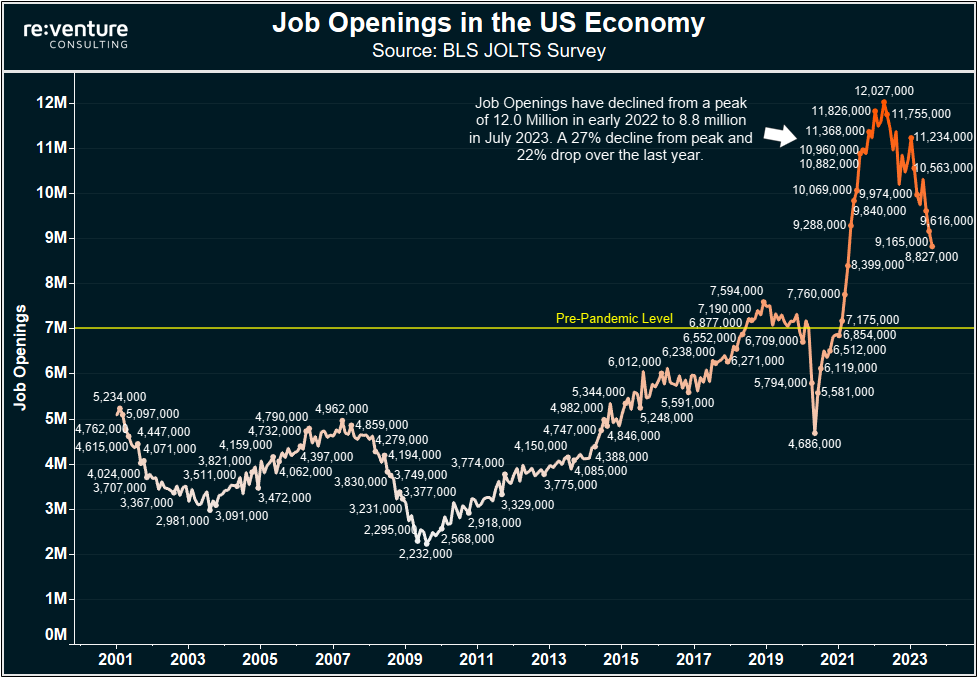

Job Openings collapsed 27% from peak. But are still above pre-pandemic levels.

Each month the Bureau of Labor Statistics tracks how many Job Openings there are in the US Economy through their JOLTS Survey. This figure tends to rise in times of economic expansion and fall during recession.

The current data is consistent with a Recession, as job openings fell 27% from their peak last year to 8.8 million in July 2023. This figure suggests that employers are becoming much less confident about the future of the economy.

Of course, the number of Job Openings today is still above pre-pandemic levels when the figure was closer to 7 million. So there is still some economic deleveraging that needs to take place before we see employers embark on the type of major layoffs that will cause the unemployment rate to spike and trigger widespread selling in the US Housing Market.

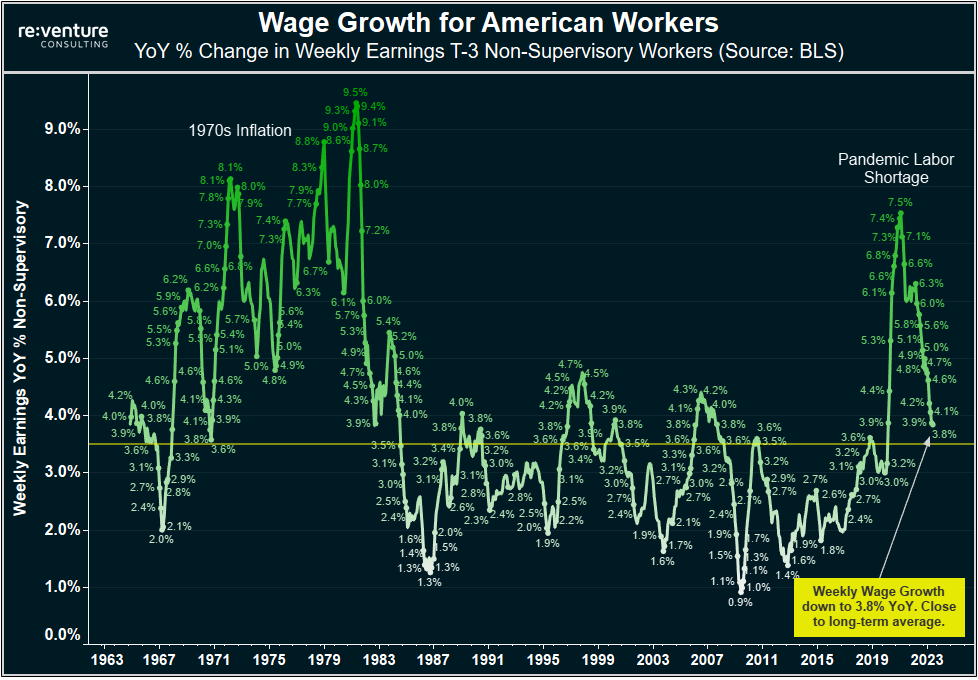

Wage Growth slows to 3.8% YoY. Not nearly high enough to return affordability to the Housing Market.

At the same that employers are reducing the number of open jobs, they are also reducing wages for those jobs, with a new report from Zip Recruiter showing that 48% of employers reduced pay for open positions.

This report was confirmed by the Bureau of Labor Statistics, which showed that weekly wage growth for non-supervisory employees slowed to 3.8% YoY in August.

This slowing wage growth is a big problem for the US Housing Market because it suggests that affordability will remain severely constrained until both home prices and mortgage rates decline to more reasonable levels.

Moreover, this slowing wage growth also suggests that a repeat of the 1970s inflation is not in the cards (for now). Back in the 1970s inflation ran rampant for a decade, which caused both wages and home prices to skyrocket. Some investors in the Housing Market believe that we are on the precipice of a similar period of raging inflation, which is why they still have a bullish outlook on real estate and thus aren't selling.

But so long as wage growth remains muted in the 4% range, a repeat of the 1970s looks unlikely. Making lower home prices the path of least resistance for a renewed equilibrium in the US Housing Market.

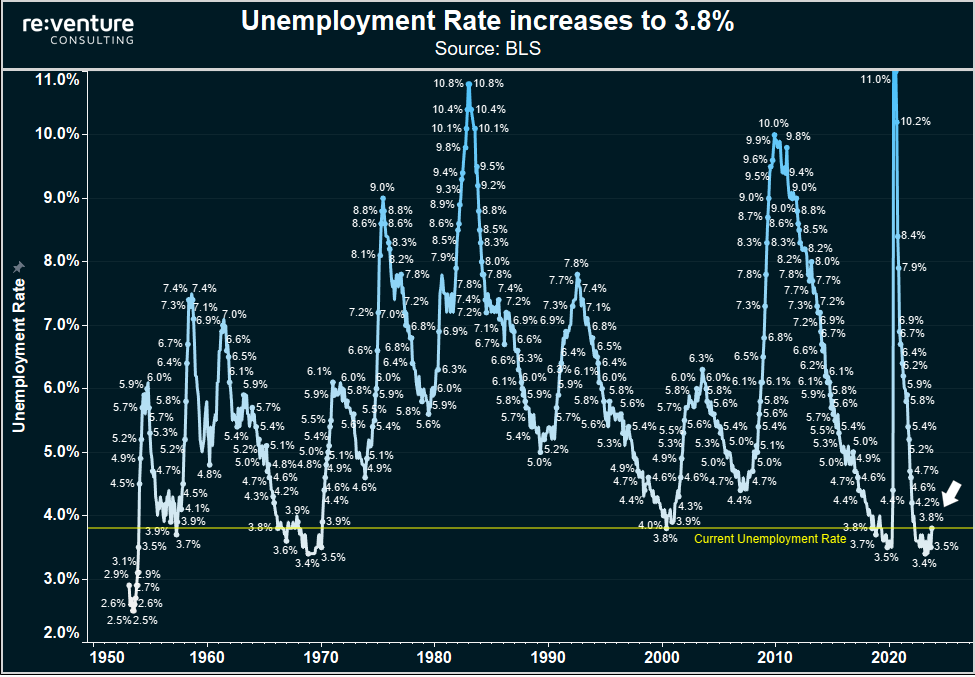

Unemployment Rate ticks up to 3.8%. Still very low. But potentially a sign of things to come.

The other news that just came out today was a surprising increase in the unemployment rate. At least - it was surprising to mainstream news outlets such as CNBC.

The unemployment rate increased from a near-record low of 3.5% to also a near-record low of 3.8%. So by historical accounts, the US Labor Market is still very tight. However, something to take note of is that when a Recession hits, the Unemployment Rate tends to spike very fast.

You can get a sense of this on the chart below, which looks at Unemployment Rate data going back over 70 years. You can see that it confirmed a small increase in August, up to 3.8%, and that this level is still near an all-time low.

But pay attention to how the Unemployment Rate line tends to shoot up vertically when a Recession hits. Historically, the level of joblessness in the economy is capable of doubling in 12-18 months.

So if you're a homebuyer or real estate investor trying to gauge the health of the economy in guiding your buying decision - note that the the momentum and direction of the unemployment rate matter more than the current level.

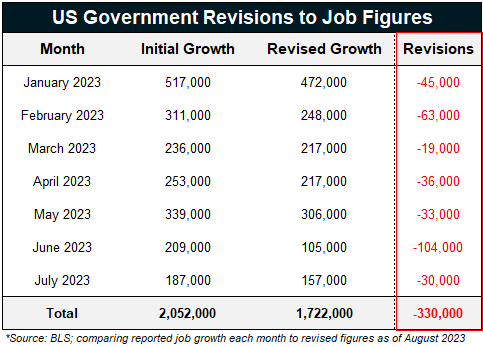

More downward revisions to previous Months' Employment Data.

Another aspect of the August 2023 jobs report from the BLS worth paying attention to is the downward revisions that occurred for previous months' data.

In particular, July 2023's non-farm payroll growth was revised down from 187,000 to 157,000 (-30,000). While June's growth was cut in half from 209,000 to 105,000 (-104,000).

That brings total downward revisions for the first seven months of 2023 to -330,000. Meaning that job growth has been 16% lower than initially reported. The consistent nature of these downward revisions makes me suspect that there will be further cuts to 2023's job growth data in future months.

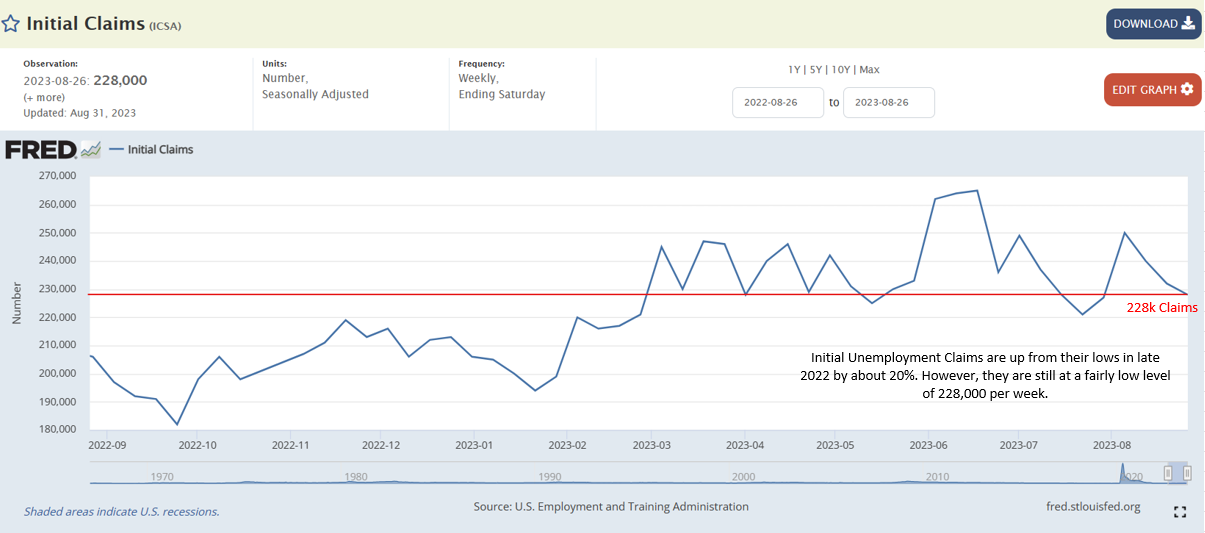

Weekly Unemployment Claims remain consistently low.

The one piece of labor market data that didn't worsen this week was Unemployment Claims Data. This weekly data tracked by the US Department of Labor surveys each state to see how many people applied for unemployment benefits that week.

And for the most recent week (ending August 26th), there were 228,000 initial claims for unemployment benefits. That's up from the very low levels that occurred in late 2022 and has tracked fairly consistently over the last several months.

However, this level of unemployment claims is still fairly low. So we will need to see this figure go up before declaring that widespread layoffs have occurred.

What's the Housing Market Impact? Watch New Listings

So what's the impact on the US Housing Market and home prices from this obvious slowing in the US Jobs Market?

Well, I suspect it will serve as a headwind to homebuyer demand for the rest of the year, as would-be buyers will be less inclined to purchase a house at record prices if they feel shakier about their job prospects.

But demand has already been very low for a while. What's more interesting to think about is the impact on Housing Supply and Inventory. Because theoretically, if more people lose their jobs, or feel insecure about their employment, it could push some people to sell.

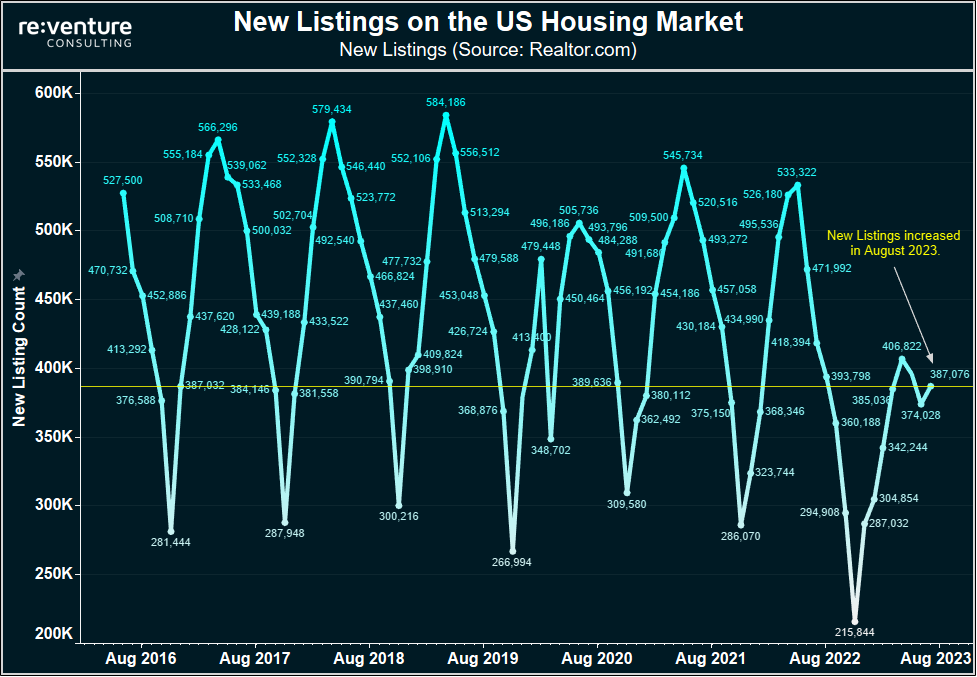

This means that the metric to watch in the coming months will be New Listings of homes in the US Housing market.

If the labor market in America is really declining, and people are feeling economic stress, we should see New Listings begin to increase. As more homeowners are forced to convert their home equity into cash.

And sure enough - New Listings in the US Housing Market did increase in August according to new data from Realtor.com, jumping to 387k on the month. Note that this is the first August going back to 2016 where New Listings increased month-over-month.

Of course - this New Listing figure was still down about 7% from what it was the previous year, reflecting a continued seller boycott of the US Housing Market. Moreover, New Listings could start declining again in September and October for seasonal reasons.

However, if New Listings were to continue to go up incrementally in the coming months, or were to stabilize at current levels through the Fall, it could be a sign of increased seller distress and associated declines in home prices.

This New Listing data is a metric I will be tracking in future months so stay tuned.

-Nick