More Bank Failures are Coming. Here's how to Prepare.

By Nick Gerli | Posted on March 16, 2023The problem with a Bank Crisis is that eventually it become a self-fulfilling prophecy. One large bank goes under. Then other banks start failing. Then liquidity in the market gets even more constrained. And more bank runs happen.

I believe the failures of Silicon Valley Bank and Signature Bank are likely the first of several (many?) bank failures that are about to occur in 2023-24. In this post I will explain why I believe that to be the case. And most importantly - what you can do prepare for them.

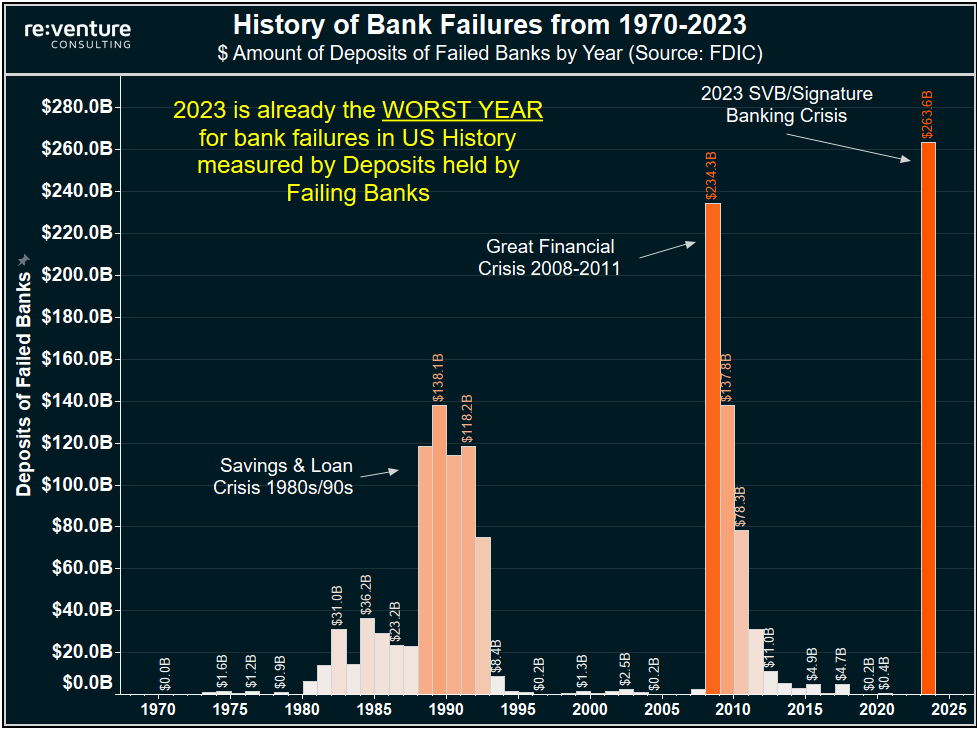

2023 already worst year on record for Bank Failures

One of the first things we need is context. Just how bad were the bank failures of Silicon Valley Bank and Signature Bank? The answer: very bad.

Their combined deposits held were $263 billion. Which makes 2023 the worst year of bank failures on record based on deposits held by failing banks. Even worse than 2008.

That's after just two bank failures. Less than 3 months into the year. If other regional banks such as First Republic go under, the situation will start to look far worse. Note that most of the bank failures that occurred in 2008 happened in the second half of the year.

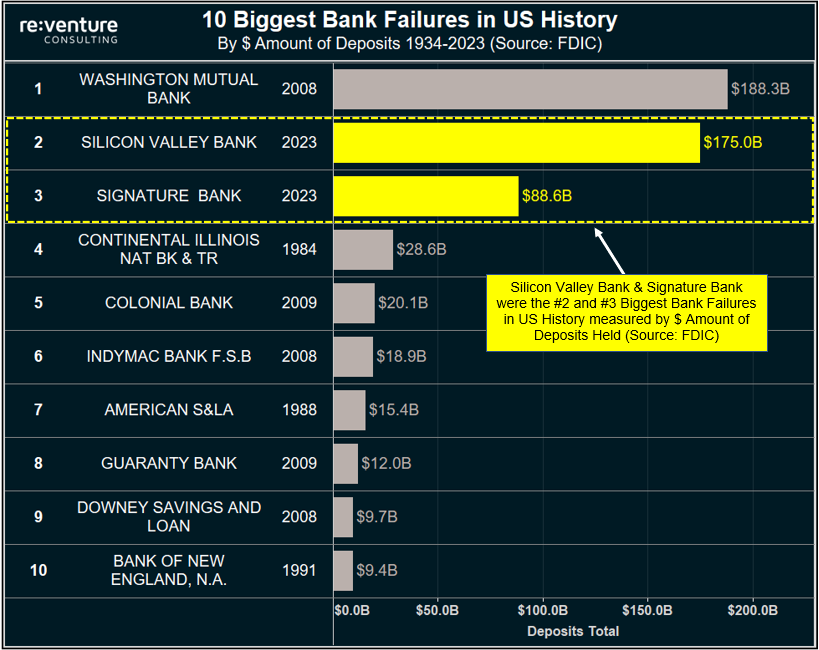

Why does 2023 look so bad already? Because Silicon Valley Bank and Signature Bank were the 2nd and 3rd largest bank failures of all-time based on deposits held. 4th place and on weren't even in the same stratosphere. Unprecedented is the correct word to use about their failures.

Of course - the government guaranteed the deposits of Silicon Valley Bank and Signature Bank. So their $263 Billion in combined deposits was not "lost". In the short-term the Fed will print money to backstop withdrawals. In the long-term the FDIC will liquidate the assets of the failed banks to pay back the Fed and make sure there's money for depositors.

Some might think that this government rescue plan will "save the day" and avert future bank runs. However, I am skeptical. Because even if the crisis is averted for now, the fact that such large institutions failed so quickly will likely send shockwaves throughout the financial system for the rest of 2023.

Get Ready for a Credit Crunch and massive Deleveraging

Imagine you're the CEO of another commercial bank in America. One that hasn't failed yet. Say JP Morgan, which has over $3 Trillion in assets, or maybe a smaller bank like Capital One, which has $450 Million in assets.

What is going to be your immediate reaction in the wake of the SVB and Signature Bank failures?

To be extra careful, of course. Silicon Valley Bank's shareholders were wiped out and the management team was fired. No one wants that to happen to their bank. So I suspect commercial bank CEOs across America (and the world) all want to make sure they're not the next victim of a bank run.

How do they accomplish that? By de-risking their balance sheet. Cutting their exposure to loans that are illiquid. Increasing their cash position. And tightening their underwriting standards on loans that they do make. The net effect of these actions will likely be a credit crunch, massive bank deleveraging, and worsening Recession. Similar to what happened in 2008.

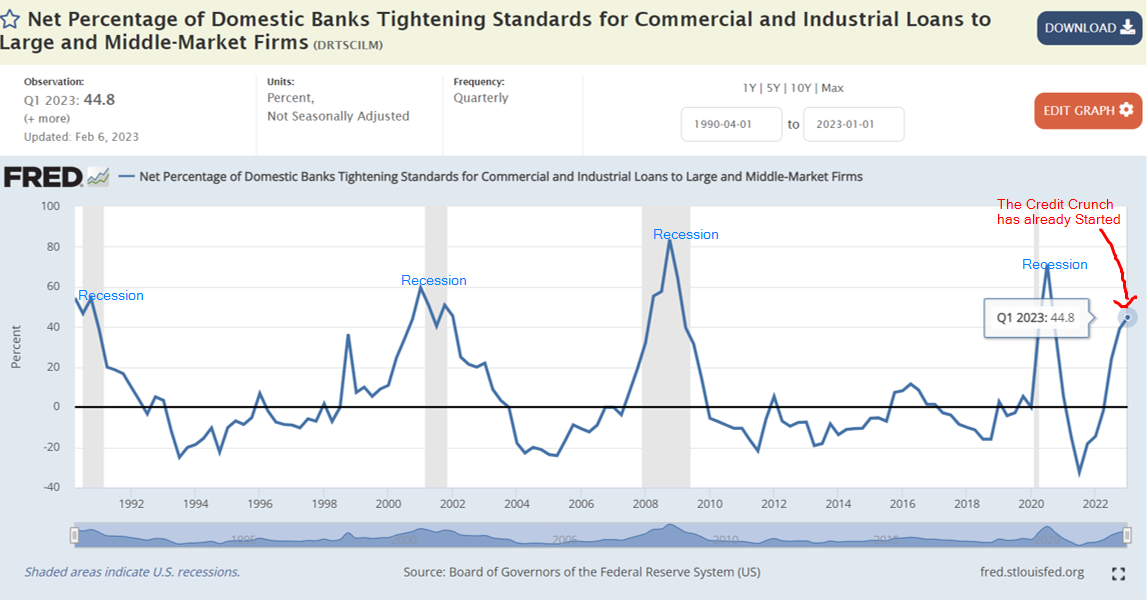

To prove this point: data from the Federal Reserve Board of Governors shows that a credit crunch, evidenced by tightening lending standards, is historically correlated with recessions. See the results below from their Senior Loan Officer Survey going back to 1990.

When Loan Officers tighten lending standards, they create a credit crunch, and a Recession occurs shortly thereafter as businesses can't get new loans and borrowers default. What's concerning is that the results of the Q1 2023 survey, which track the last 3 months of 2022, show that banks were already prepping for a credit crunch before SVB's failure.

So...what is this Loan Officer Survey and the resulting credit crunch going to look like in a post-SVB world?

We'll have to track the data in future months. But I'm guessing the result will be a big reduction in loan volumes, which means less money going into the financial system.

Money Supply was already contracting. It could contract by more.

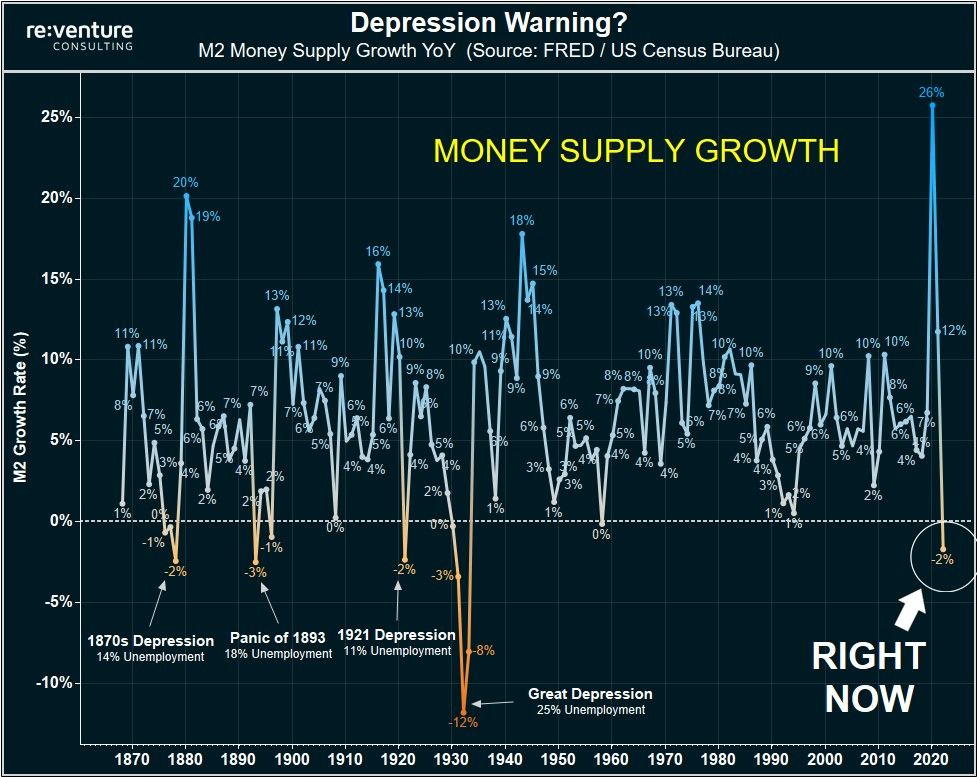

You might be getting me sick of showing this graph at this point. But I'm going to show it again. The M2 Money Supply is officially in contraction territory at the beginning of 2023, down -2% from its levels last year.

I suspect this contraction in money supply is what ultimately prompted the runs on SVB and Signature Banks. And what could prompt more banks runs throughout 2023 if it continues.

Every other time in US History that the money supply contracted on a YoY basis there was a banking crisis and depression. It's 4/4 in predicting that type of thing.

The reason even a small money supply contraction (just -2 to -3%) is a problem is because people and businesses don't like seeing less money in their account. Even if the account grew by a lot beforehand. Once the dollars start going down, people become more cautious, and want more cash on hand. Some individuals and firms start feeling distress. And that's how bank runs occur.

Which makes the prospect of credit crunch more alarming. Because if banks truly do pull back the reins on lending in 2023, then it's possible the money supply contracts further. Because fewer loans will mean business failures and layoffs. Which would likely cause a further tightening of lending standards.

Shades of 2008. Remember Bear Stearns?

Something very similar to the current situation happened in 2008.

That was when Bear Stearns, the big investment bank, went bust. Specifically, on March 14th, 2008, almost 15 years to the day of the SVB Collapse, Bear Stearns went insolvent. A couple days later they were purchased by JP Morgan for $2/share in what amounted to a forced bailout by the US Government.

It's surreal how similar the situation back then sounds to the one today. Check out the first three paragraphs of this ABC News article from March 17th, 2008.

March 17, 2008 -- With the collapse and then fire sale of Bear Stearns within the span of a few days, many on Wall Street are now looking around and asking, "Who might be next?"

Bear Stearns fell victim to what was essentially a bank run. Investors who feared that the 85-year-old firm was too deeply invested in bad mortgages cut off funding, crippling the firm.

Just a month ago, Bear's stock was trading at $80 a share. As news spread about the run on Friday, the bank's stock plunged, closing at $30 a share. And then — in what appears to be the final nail in the coffin — J. P. Morgan Chase announced plans over the weekend to buy the firm for a shockingly low $2 a share.

I mean - replace, "2008" with "2023", "Bear Stearns" with "Silicon Valley Bank", and "bad mortgages" to "bad tech companies", and this article could have been written this week.

The similarities don't end there. Bear Stearns' collapse took everyone by surprise, just as SVB did. According to a brokerage analyst back in 2008:

"Bear was actually in a pretty good position," he said. "It was really no worse than other institutions that are standing today (2008)."

And sure enough, the Fed also road to the rescue back then, too. Injecting liquidity into the banking sector through a variety of credit facilities. Causing other banking CEOs, like the head of Lehman Brothers, to mistakenly believe the crisis was "contained".

Lehman Brothers chairman and CEO Richard S. Fuld, Jr. said in a statement that moves over the weekend by the Federal Reserve to make more money available to the investment banks "from my perspective, takes the liquidity issue for the entire industry off the table."

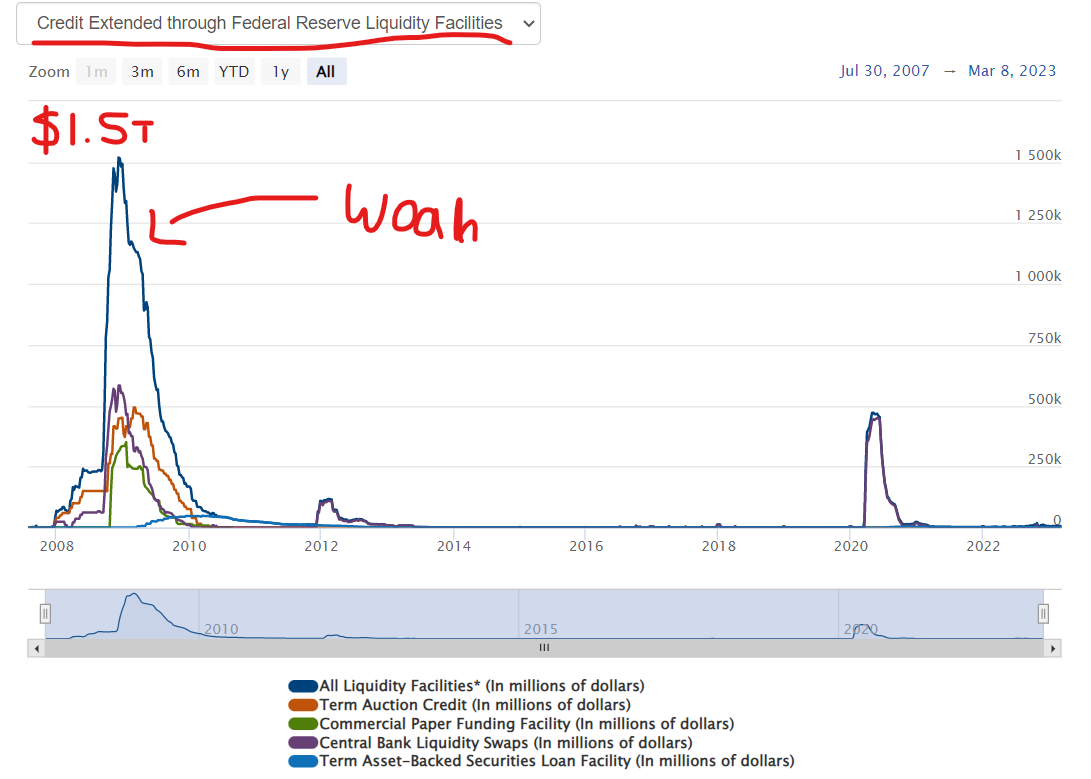

At the peak of hysteria in December 2008, the Fed was providing commercial banks with over $1.5 Trillion in rescue funding through programs like Term Auction Credit, Commercial Paper Funding Facility, Central Bank Liquidity Swaps, and Term Asset-Backed Securities.

Note that this "rescue capital" did little to stop the 2008 crisis from happening or worsening. Indicating that the Fed's recently created "Bank Term Funding Program", meant to help stop more bank runs from occurring in 2023, might just be another form of window-dressing.

It took 6 Months for S*** to hit the fan after Bear Stearns. Same in 2023?

Another interesting aspect of the Bear Stearns saga is timing. They went bust in March 2008. At that point the unemployment rate was still low, the stock market was only down 15% from peak, while the Housing Market was only down 9%.

(Basically a mirror image of right now. Unemployment is near a cycle low, 2023 stock market is down 15% from peak, while Housing Market is down 5%.)

To many at the time - it appeared like Bear Stearns was a blip on the radar. And that the US economy would enter recession but get out of things fairly unscathed. The stock market even surged on March 20th, 2008 on the news of the Fed providing bailout money for banks.

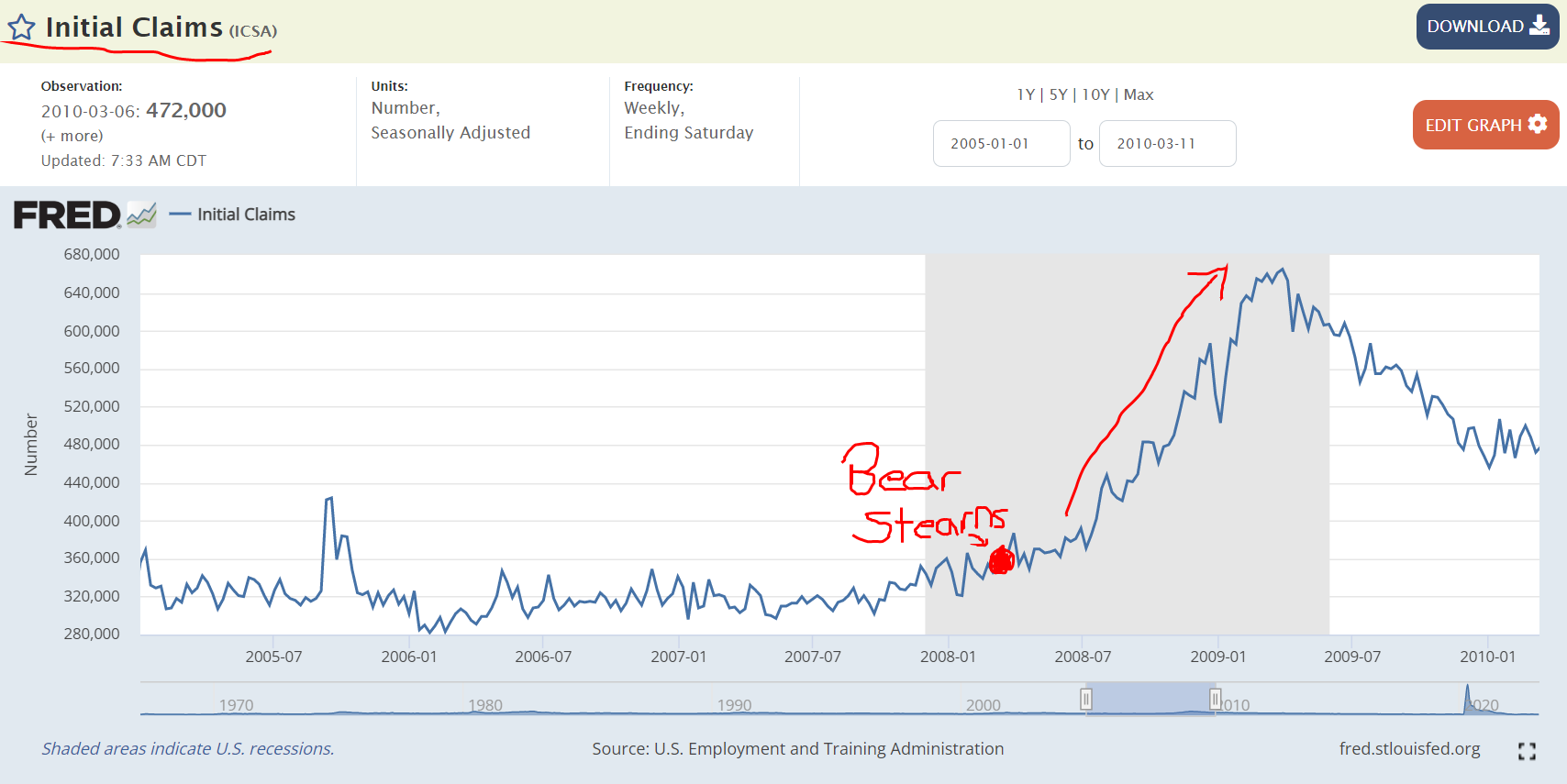

True reality did not set in for months. Initial Jobless Claims when Bear Stearns went bust were 369,000 for the week. Still fairly close the cycle lows experienced in 2006 and 2007. The labor market was still "strong" based on the conventional government metrics.

But by August 2008 the picture started changing. Jobless claims spiked. And then they kept spiking throughout the rest of 2008 and into 2009 as the subprime crisis spread and more banks failed.

All this is to say: is took about 6 months after the Bear Stearns collapse for s*** to really hit the fan. Could we be in for a similar timeline in 2023?

Potentially. Because right now the US Labor Market still looks very strong despite the headlines of big layoffs from tech companies. The unemployment rate is currently a near record-low 3.6% with initial jobless claims registering around 200k per week.

For any type of "crisis" to occur - those figures will need to lurch up significantly. And they likely will if my prediction of a bank credit crunch manifests. It just might take some time to get there.

Watch Jerome Powell. If the Fed Pivots, it could change things.

My prediction for a credit crunch and further contraction of the money supply will be heavily influenced by what the Fed does in future months. Particularly in regards to their fight against inflation.

If the Fed continues hiking interest rates, and doing quantative tightening, then I feel fairly steadfast in the analysis in this article thus far. However, if the Fed pivots prematurely, particularly on quantitative tightening, then things could change.

Specifically - if the Fed were to go back to "printing money" and expanding their balance sheet then that could give banks a kick in the pants to lend. And it could prevent a credit crunch.

While everyone's obsessed over interest rates, I'd encourage you to track the Fed's Balance Sheet instead. This is where the rubber will meet the road on inflation. If the Fed continues with quantitative tightening, like they have been the last 9 months, then their balance sheet will continue contracting. Which would constrict the money supply further. And greatly increase the odds of more bank runs and a deflationary depression.

However, if the Fed starts to print money again, and their balance sheet goes back up, then that's a signal that more inflationary times are ahead. And that banks might take on more risk and make more loans.

Deflationary Depression v Inflationary Recession: what's worse?

I see two main outcomes. Either a Deflationary Depression with more bank runs overtakes the US economy in 2023-24 OR we hit an extended Inflationary Recession.

Deflationary Depression: would be marked by worsening credit crunch and contracting money supply. This type of downturn would be brutal and happen fairly fast once it gets going. It would lay waste to the Housing Market. Prices and rents would go down. The unemployment rate might spike past 10%. Wages could also go down.

The way to prepare for this type of downturn would be to stack cash. Have some of it (say, $2,500) in a safe place that's easily accessible. You might want to buy some physical gold that's also kept in a safe place. You'd also want to make sure that your life essentials such as your car and house (if you own one) are in good working condition and don't need any major repairs.

You'd want to avoid taking out debt in this type of downturn. Since deflation (declining prices/rents) would increase the relative burden of your debt load.

I think this type of downturn, if it does happen, would resolve itself fairly quickly. Maybe after 18 months of severe pain there would be a road to recovery since the price levels in the economy reset to a fairer level.

Inflationary Recession: would be marked by more Fed money printing and a worsening of inflation. Banks would feel more confident in lending in such an environment and would make the inflation worse. Think a repeat of the late 1970s.

The best way to prepare for this type of downturn would be to not hold much cash. Since that cash will be worth less and less each day. Instead, taking out debt and buying a house now would be a good idea since the value of the debt would decline and the price of the house would go up with inflation.

(To be clear - I'm not suggesting someone buy a house right now. I'm merely pointing out that if we have another 5 years of money printing and rampant inflation then house prices will likely go up, similar to what occurred in the 1970s.)

The inflationary recession would take longer to hit in this situation. But once it goes, it will likely be a slog. With progressively increasing interest rates that choke the economy. The unemployment rate could eventually get to 10%, but it will likely take years to get there. And once it arrives it will stay. With a very slow recovery thereafter.

The main obstacle to the inflationary recession occurring is wage growth. Wages simply have not gone up enough to keep pace with inflation. And if inflation were to worsen, I think the US consumer would eventually "break" and spending would collapse. Increasing the likelihood of a deflationary depression.

Of course - the government would then feel pressure to step-in and "stimulate" the economy again through money printing. But right now I have a difficult time seeing that happening with a Republican-led congress with Biden in the White House.

Soft Landing: I guess there's a third possible outcome. The so-called "Soft Landing". Where inflation goes back down to normal levels without a deflationary crash taking place. The banking crisis is contained. And asset prices for stocks and real estate go down a bit, but don't collapse.

I mean - anything is possible. But in my study of the historical record I haven't found a single instance of a soft landing occurring. The closest example would be the recession that occurred after World War II in 1948-49. However, debt levels across the economy were much lower then, as were asset prices, providing more room for the economy to rebound.

My personal opinion, and what I'm preparing for, is the Deflationary Depression. I think that has the highest probability given the already contracting money supply, bank runs, and parallels with 2008. But the Inflationary Recession is also possible. And the difference between these two vastly difference outcomes rests on what the Fed, and the US Government, does in terms of money supply management and spending. I will be keeping a close eye on the Fed and the money supply, as well as credit metrics, in future months.

Ultimately I believe it's important to be open-minded about the future right now. The events that are occurring bear uncomfortable comparisons to years like 2008 and 1929. But the US Government is also aware of that and might step in to prevent those things from happening. Only to ignite inflation further and kick the can down the road and make the situation worse in the long-run.

To be clear: I'm not a financial advisor. This is not financial advice. These are just my thoughts/opinions based on the data at hand. You should consult with a registered financial advisor before making any big changes to your financial situation.

-Nick