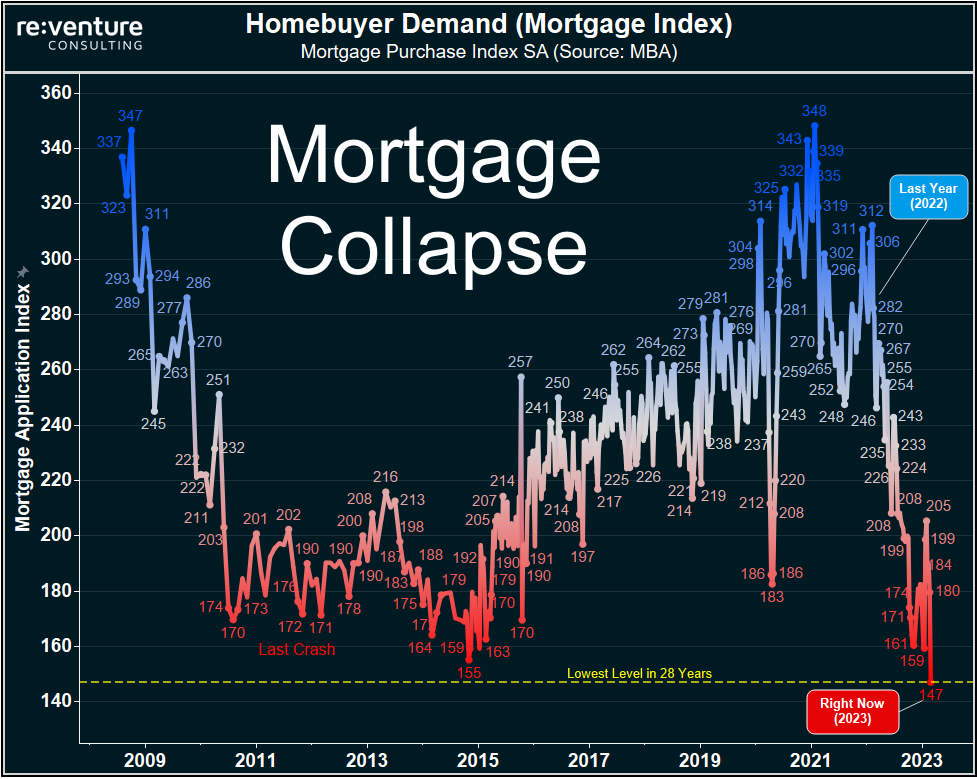

Mortgage Collapse gets Worse. Lowest Buyer Demand in 28 Years.

By Nick Gerli | Posted on February 22, 2023Shocking. Unprecedented. The first time in 3 Decades. All those descriptors apply to today's mortgage application report from the Mortgage Bankers Association.

This mortgage report is very important because it provides a real-time view into into the health of the US Housing Market. It's a leading indicator. Meaning it gives you insight into how many homebuyers will be in the market over the next several months.

And boy - based on this week's report, the Spring 2023 Housing Market is going to be in a lot of trouble. Because we have an outright Mortgage Collapse occuring right now.

The seasonally adjusted mortgage purchase application index crashed down to 147 for the week ending on February 19th. That's the lowest weekly level in 28 Years. It's lower than anything experienced during the late 2000s crash. It's down an astronomical 41% from last year.

This data has numerous implications that you need to understand as a homebuyer or real estate investor. Let's run through them one-by-one.

1) No Buyers in Spring 2023 Housing Market

This pitifully low level of mortgage demand is an indication that the Spring 2023 Housing Market will be a ghost town.

There will be very few buyers. Homes will be sitting on the market for a long time. Many open houses will be empty. And sellers will be blindsided by this. Because the narrative they're hearing from realtors right now is that there's a "recovery" occurring in the Housing Market.

But no - there can't be a recovery in the Housing Market when mortgage demand is at the lowest level since 1995. Especially when over 70% of home sales still require a mortgage to complete the purchase.

Expect many sellers to be in for a rude awakening come March and April.

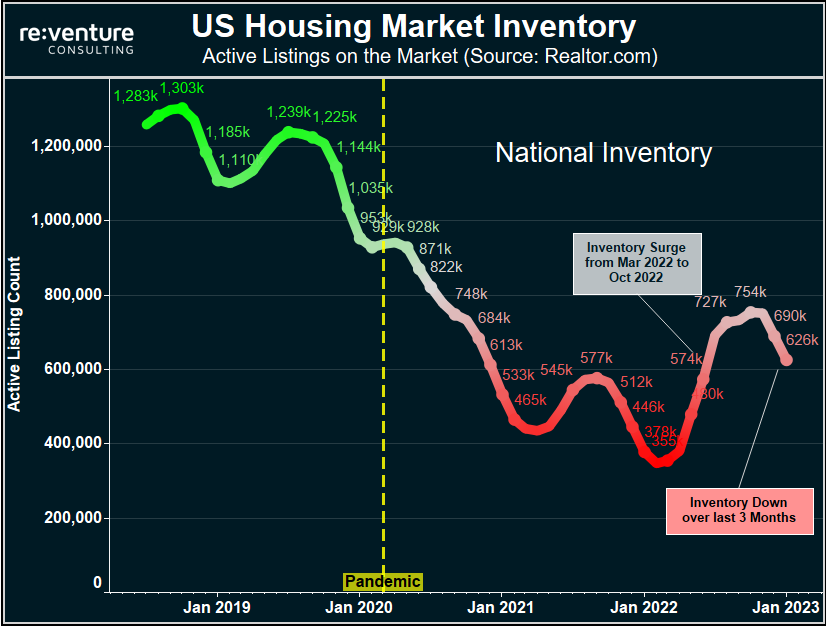

2) Inventory will begin piling up again soon.

Inventory on the Housing Market surged starting in March 2022 and that surge lasted until October.

But over the last 3 months inventory has fallen due to normal seasonal variations to go along with a moderate uptick in buyer demand that occurred in January (Source: Realtor.com listings database).

But I expect that inventory will begin piling up again soon. Because over the next month we're about to see the intersection of plummeting buyer demand with sellers listing their houses for the Spring. Don't be surprised if in 4-6 Months time, Inventory on the US Housing Market is back to pre-pandemic levels nationally. And if in many markets it's way above pre-pandemic levels.

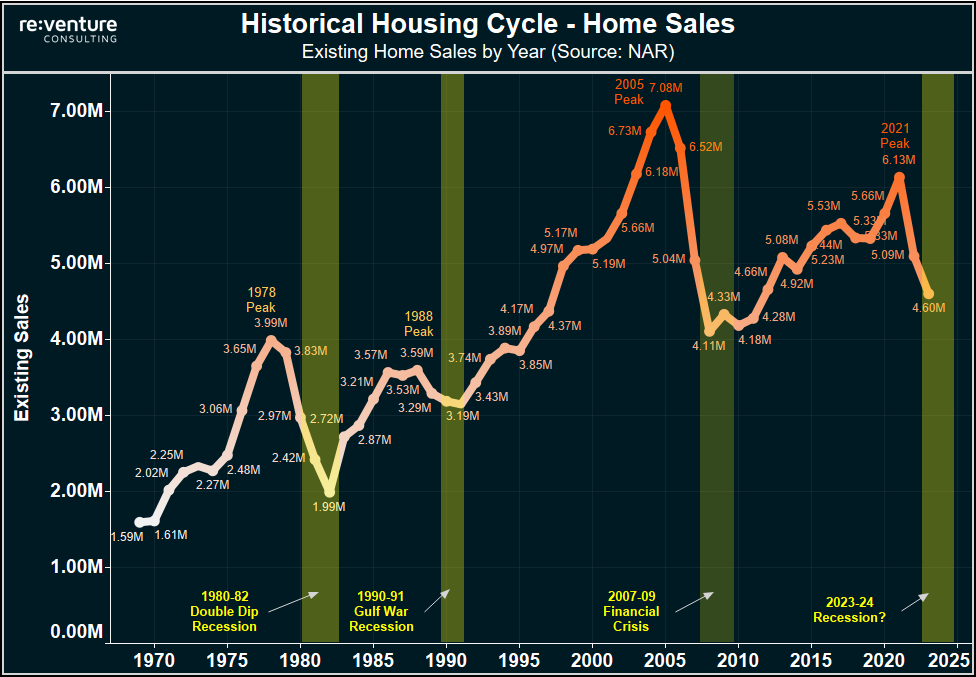

3) Don't forget: Recession is still in the cards.

Many people have "forgotten" about the Recession. Some say it's over. Some say it will never happen. But make no mistake - the leading indicators still point to it.

Particularly the US Housing Market. Throughout history, when mortgage applications and home sales plummet from their peak, it'a signal that Recession is around the corner.

For instance - there have been four distinct "peaks" in Home Sales in America over the last five decades. Occuring in 1978, 1988, 2005, and 2021 (Source: the National Association of Realtors). These peaks tend to occur right before a Recession.

- The sales peak in 1978 gave way to a brutal double-dip Recession from 1980 to 1982 where the unemployment rate surged to 10%. The Housing Market was frozen for a good three years as the Fed at the time aggressively hiked rates. Interestingly, nominal prices continued going up because of a decade of raging inflation that preceded the downturn.

- The sales peak in 1988 occurred two years prior to the Gulf War Recession from 1990-91. The unemployment rate maxed out at 7.8%. While this was considered a mild recession and housing downturn overall, it was brutal for certain parts of the country like California and New England.

- And now the one most of you are familiar with. The 2005 peak in sales occurred two years prior to the 2007-09 Great Financial Crisis. The unemployment rate once again hit 10%. And the US Housing Market declined by 25% with certain cities losing half their value.

In each of these downturns - home sales peaked two years prior to the start of the Recession. And 3-4 years before the bottom. Suggesting that a Recession could start in mid-2023 and last through late late-2024 based on the current trajectory of sales.

4) The Government will feel pressure to step in and save the Housing Market.

Today's mortgage application report was very jarring. I'm sure lobby groups in the real estate, mortgage, and building industry are calling the Biden administration and saying that they need to do something.

And Biden is already doing some things. Today the administration announced a reduction in mortgage insurance premiums that will save new FHA homebuyers $800/year on payments (not a whole lot in the grand scheme of things).

This comes two weeks after they announced that mortgage servicers will need to offer defaulted FHA borrowers forbearance options through November 2024 (this could further kick the can down the road on some foreclosures until the next presidential election).

I wouldn't be surprised if we see several more programs like these announced in coming months. And I also wouldn't be surprised if lending standards start to get loosened for FHA and Fannie Mae loans.

The Million Dollar Question is: will these moves actually prevent a Housing Crash?

No, I don't think so. Ultimately if the government wants to "save" the Housing Market, it would require a massive level of stimulus. Think $15k downpayment assistance for every homebuyer. To go along with government-sponsored mortgage rate buydowns for 2-3 years. That could conceivably reinject demand into the market.

Trouble is - the power to do that rests with a Republican-led Congress. In a time when they're refusing to raise the debt ceiling unless the government cuts spending.

That doesn't like an arena favorable for passing housing stimulus.

5) What will Sellers do?

The last, and potentially most important thing to consider about all this, is what sellers do.

So far sellers have been fairly stubborn. Many don't want to list their houses in a down market. For instance, new seller listings ended in 2022 down over 20% from the year prior. And so far in 2023 new listings are down 10-15% YoY. This has prevented inventory from increasing as much as it should given how low buyer demand is.

And there's some talk out there that sellers won't list their homes so long as mortgage rates stay high since many are enjoying their 3-4% Mortgage Rates from 2019-21. And have no interest in swapping that rate out for 6%+.

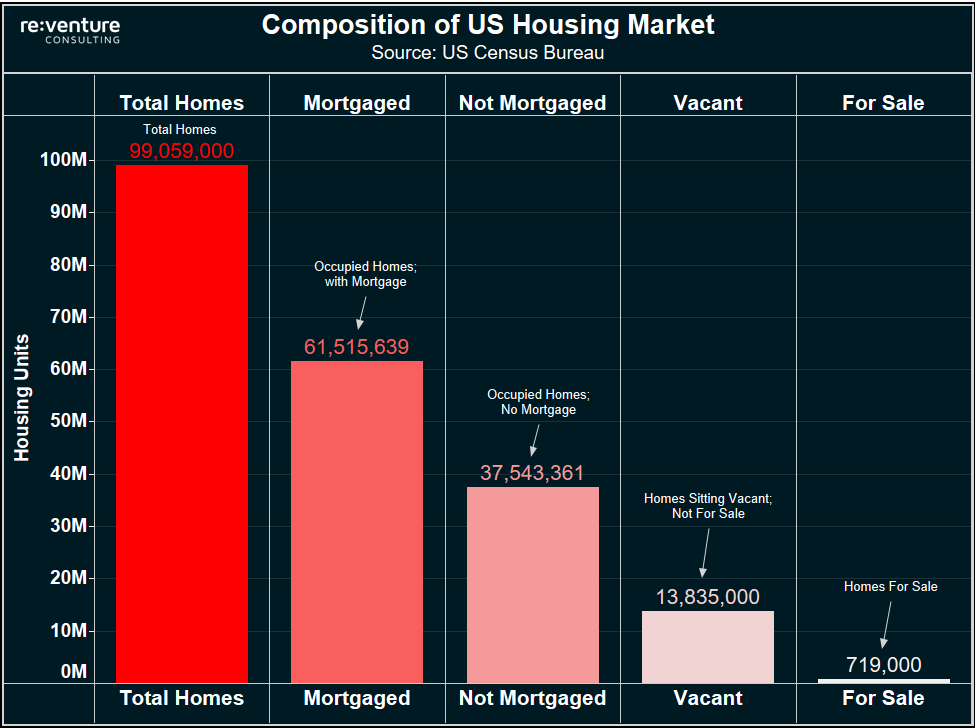

But there's a problem with this thinking. Because it ignores the Composition of the US Housing Market. Specifically, just how many homes on the US Housing Market are 1) Sitting Vacant and 2) Don't have a Mortgage.

There are nearly 100 Million homes on the US Housing Market. 62 Million have a Mortgage, likely at a much lower mortgage rate than today's prevailing rates. Housing Market bulls focus squarely on these owners and think "inventory will never go up because these people will never sell because they have a low mortgage rate".

But these bullish housing pundits conveniently leave out the fact that there's 37.5 Million homes with no mortgage. Many of these homes are occupied by older people on fixed incomes who have seen their savings crushed by inflation. What if just 2% of these owners entered a financial bind and were forced to sell? That would instantly double inventory on the Housing Market.

Or what about the 13.8 Million houses that are sitting vacant and not listed for sale? These vacant homes are owned by investors. Others serve as seasonal second and third homes for wealthy people. What if 5% of these owners decided they wanted to cash out near the top of the market and sell their vacant inventory? Once again, inventory would double.

This data makes one thing very clear: there is plenty of inventory in the US Housing Market. It's just hiding in the background. Likely because dovish Fed policy over the last decade has convinced many owners of vacant property that home prices will keep going up. And thus they think that even in the beginning stages of a Housing Crash, "things will recover soon" and thus "I'll wait it out". And that's how new listings go down.

My suspicion is that mentality changes as 2023 progresses. And more people wake up to the fact that this is not some 12-month housing dip. But likely the start of a long, protracted downturn that will likely coincide with an economic recession where people lose their jobs. If that mentality shift takes hold, I expect new listings to increase, and inventory to go up by even more.

One caveat before signing off: while today's mortgage application report was very bad, and signals issues for the Housing Market and Economy, it is still only on week's worth of data.

We'll need to track this data in real-time in future weeks to see if buyer demand continues to plummet. Which I will be doing both here and on my YouTube Channel.

Make sure you have your notifications turned on. And make sure to leave some comments below letting me know what you're seeing and hearing in your local housing market.

-Nick