Texas Housing Market downturn worsens. Vacant Inventory up 100%.

By Nick Gerli | Posted on June 30, 2023New inventory data for the US Housing Market is showing that problems are brewing in Texas (as well as Florida). Across both states, landlords are beginning to have major issues renting out their properties, resulting in a 100%+ surge in vacant inventory over the last year.

Many of these landlords, both of the Wall Street and mom-and-pop variety, bought homes in Texas and Florida during the pandemic as investments. The idea was to capitalize on the influx of people moving to these states, rent the homes out, and make a solid profit.

However, that is not materializing right now. Instead, many of these homes are sitting empty and the landlords have started to cut the rent, leading to lower revenues at a time when the costs of operating a rental (taxes, insurance, mortgage interest) have skyrocketed.

Don't be surprised if some of these landlords feel distress later in 2023 and opt to sell their property instead of taking losses on it sitting vacant. The more the vacant inventory builds, and the more they have to cut the rent, the greater the likelihood they are forced to sell.

Austin, TX is a hotbed for this surge in vacant rentals

One particular market where landlords are struggling right now is Austin, TX, where rents are now starting to go down alongside home prices. The primary issue for these landlords in Austin is lower demand and higher supply, which is leading to a crush of inventory hitting the market.

With the number of vacant house rentals in Travis County increasing from 863 last year all the way up to 2,167 in June 2023, a +151% growth rate year-over-year.

(This rental inventory data comes from my manual calculations of how many houses and townhouses are on the market for rent on Zillow at the end of each month, and could be subject to some error.)

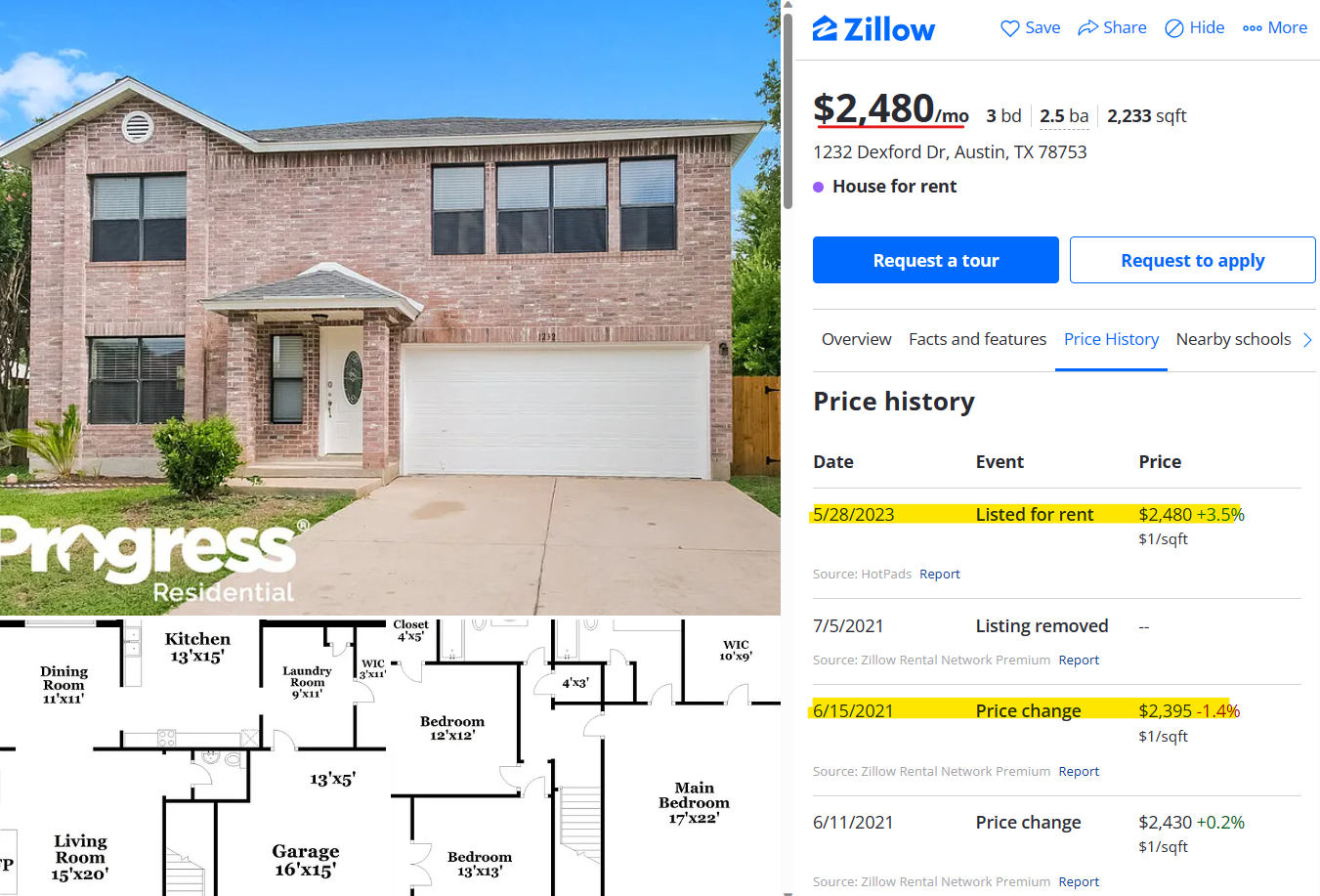

To get a sense of the issues this higher rental inventory is causing, check out the below rental listing in Austin from Progress Residential, one of the biggest corporate Wall Street landlords. It's a 3 bed, 2 bath house that was listed one month ago for $2,480 in rent.

And so far, 33 days later, it remains vacant.

Pay special attention to the change in rents over the last two years. Currently, the property is listed at $2,480/month rent, only a 3.5% increase from what it rented for two years ago in June 2021. An indication that nearly all the rent growth the Austin landlords experienced in the 2021-2022 boom has now been erased, with the potential for further rent declines into the future.

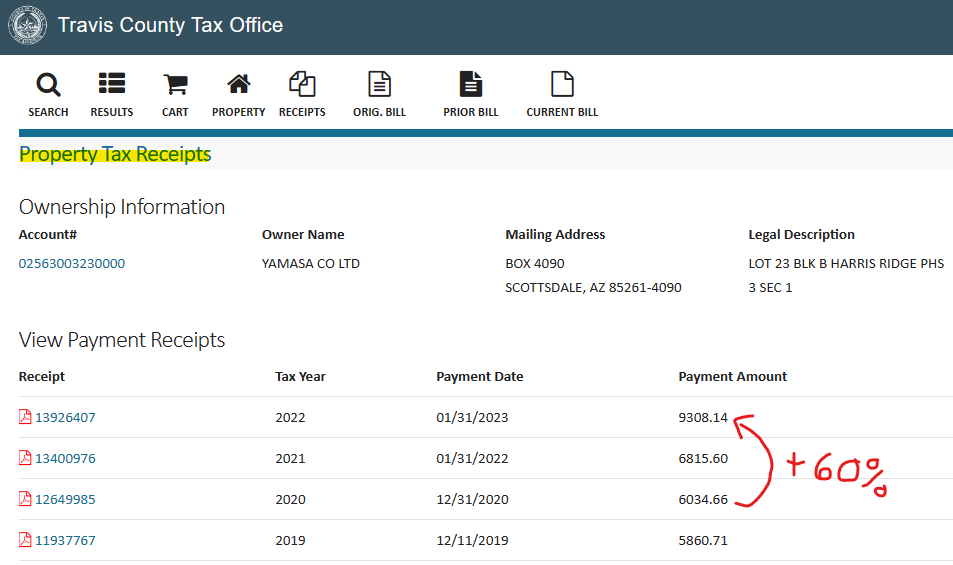

At the same time, the expenses for landlords like Progress Residential have surged. Particularly property taxes on the above rental, which have increased by over 60% in the last two years from $6,000/year up to $9,300 according to the Travis County Tax Assessor website.

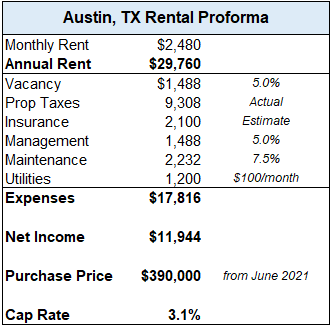

Declining rents, increasing vacancies, and surging property taxes is a nasty combination, one that is severely compressing returns for landlords in cities like Austin. With the below proforma indicating that Progress Residential is likely only earning ~$12,000 per year in net income on this property, a mere 3.1% of what they paid for it April 2021 ($390k sale from Zillow).

A 3.1% cap rate that could go lower in coming months if the house sits vacant for longer, or if Progress Residential has to cut the rent. Meanwhile, the two-year US treasury now yields 4.9%.

At what point does Progress and other landlords cut their losses on a property like this in a declining market?

Florida is even worse. Check out all the vacant rentals in West Palm Beach.

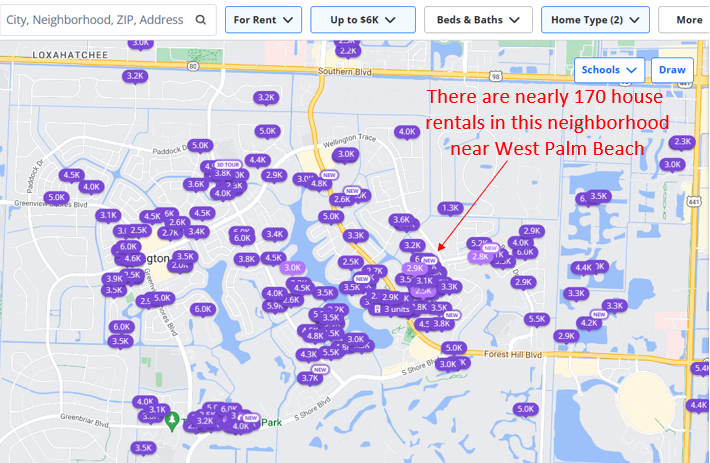

But Austin isn't the only area experiencing this crush of vacant rentals and associated issues for landlords. The same exact thing is happening in Florida, particularly in West Palm Beach.

Where the number of vacant rentals on the market increased from 1,137 last year to 2,949 in June 2023, a 159% growth rate over the last year. The inventory is up so much that in some neighborhoods there are hundreds of properties currently listed for rent on Zillow.

Many of these rentals are still very overpriced, listed between $4,000 to $5,000/month, a figure the locals in West Palm Beach cannot afford given the area's $72,000 median annual income. These landlords are clearly hoping to find a wealthy New Yorker who just moved down to West Palm and is waiting to buy a house. Trouble is - there are fewer of them coming now that the pandemic is over.

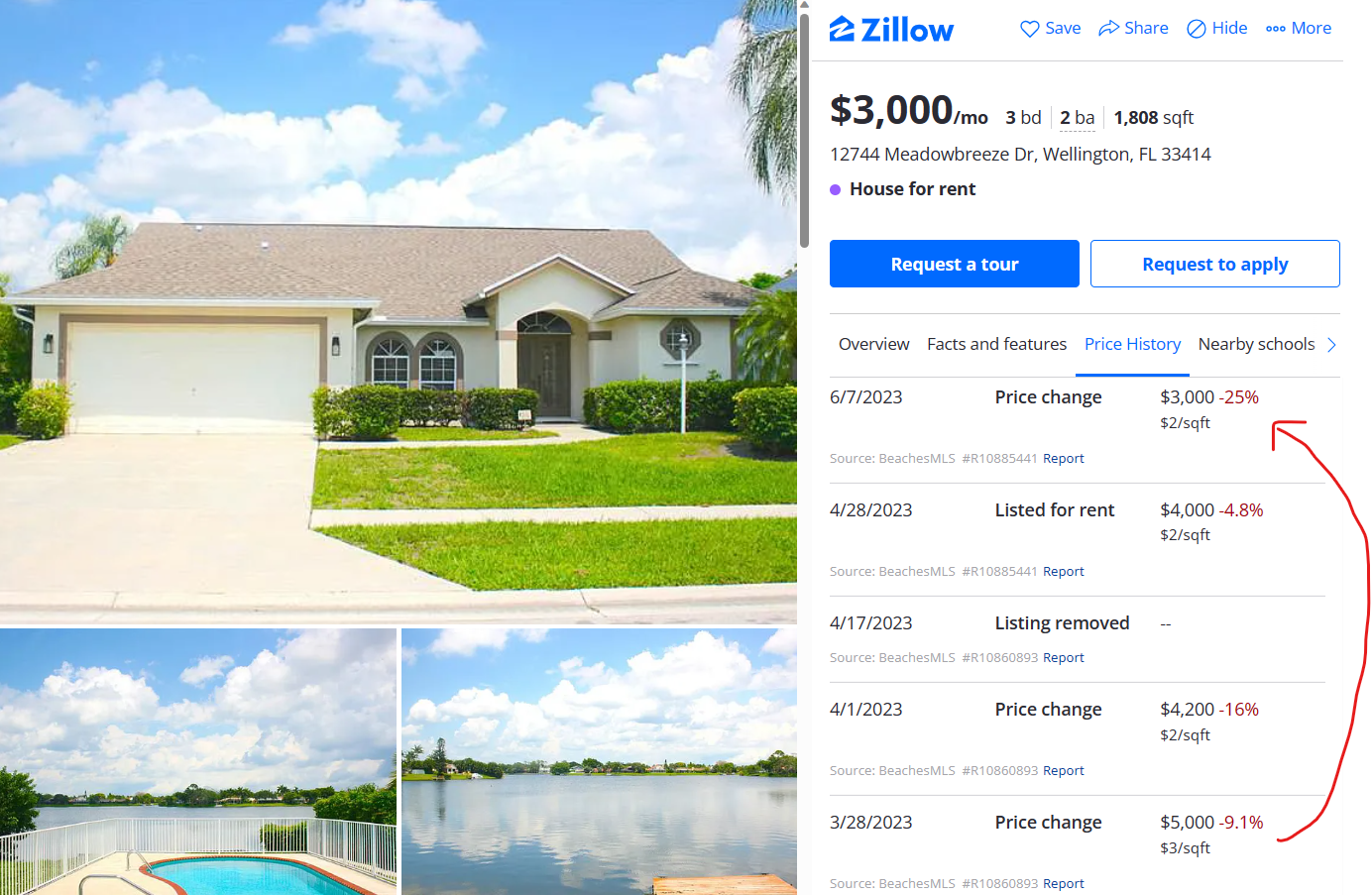

A trend which is inevitably going to cause rents to fall. Like on this listing in the neighborhood, where the rent has been reduced by over 40% down to $3,000/month. It's now listed for significantly lower than it was back in early 2022.

The description of this listing says it is fully furnished, suggesting to me that this listing was previously used as an Airbnb. Don't be surprised if you see more and more former Airbnbs begin to pop up on the long-term rental market due to Airbnb Bust.

What will be the impact on Home Prices?

But I know most of you reading this post are prospective homebuyers, not prospective renters. Increased rental inventory and declining rents might sound nice to you, but ultimately, what you really care about is the ultimate impact on home prices.

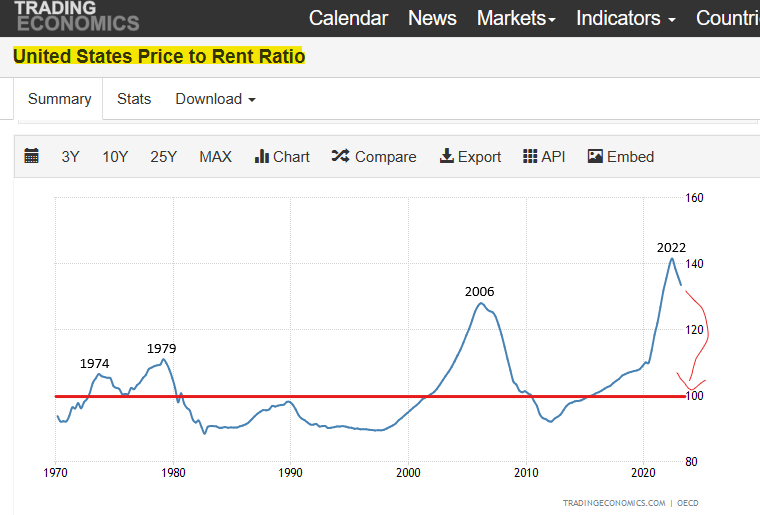

And I have some good news for you - if rents decline throughout the second half of 2023, home prices are likely to follow suit at some point. That's because over 50 years of US Housing Market history show that the growth in rents and home prices is linked together.

However, that link has been broken over the last several years, with home prices growing about 20% faster than rents over the last three years. The result is that the Home Price to Rent Ratio in America is at the highest level of all-time in 2023.

What this means is that Home Prices are overvalued relative to rents, and in order to correct this overvaluation either 1) home prices need to come down, 2) rents need to go up, or 3) some combination thereof.

The trouble is - rents don't appear likely go up much over the next couple years given the huge glut in vacant inventory that is hitting the market to go along with a massive 1 million-unit construction pipeline for apartments. This leaves home prices going down to meet the level of rents the most likely outcome in my estimation.

Note that the only other time in US History when the Home Price to Rent Ratio was near this high was 2006. Which was of course followed by a massive collapse in prices.

The other "mini-bubbles" came in 1974 and 1979, during the great inflation. What corrected those peaks was a big increase in rents up to the home price levels.

Are you seeing more vacant rentals in your market?

I'm curious - are you seeing more vacant rentals in your housing market this Summer?

Cities like Houston, Austin, Dallas, Miami, and Atlanta are the ones where my data is showing the biggest YoY increase. California is also up there, perhaps as a result of homeowners with low mortgage rates opting to rent their house instead of sell it.

However, at some point, some of this rental inventory is likely to make it back into the for-sale market, especially if vacancies continue climbing.

Leave a comment and let me know what you're seeing in your market.

-Nick