Top 10 Housing Market Predictions for 2023

By Nick Gerli | Posted on January 6, 2023It's that time of year, folks. We've crossed the calendar into 2023 and that means it's time for some Predictions. Specifically - Reventure Consulting's Top 10 Housing Market Predictions for the year.

This year is going to be a wild ride. The "appetizer course" of the Housing Crash we received in 2022 will turn into the main course for 2023. A combination of huge levels of homebuilding, elevated mortgage rates, a recession, backlogged foreclosures, and pitiful affordability will drag the entire US Housing Market down.

If you're a homebuyer or real estate investor: now is the time to get prepared. Big discounts are coming. Figure out the markets and ZIP codes you want to buy in now. And importantly, how much prices need to go down to entice you to buy in those areas. With this playbook in hand you will be able to capitalize on the Housing Crash.

I hope that these 2023 Predictions help provide guidance and affirmation to you about where the Housing Market is heading. Also make sure to stay tuned to the end of the post where I review how my 2022 Predictions performed.

Prediction #1: Home Prices decline by -10% across America in 2023, and by -20% in some cities

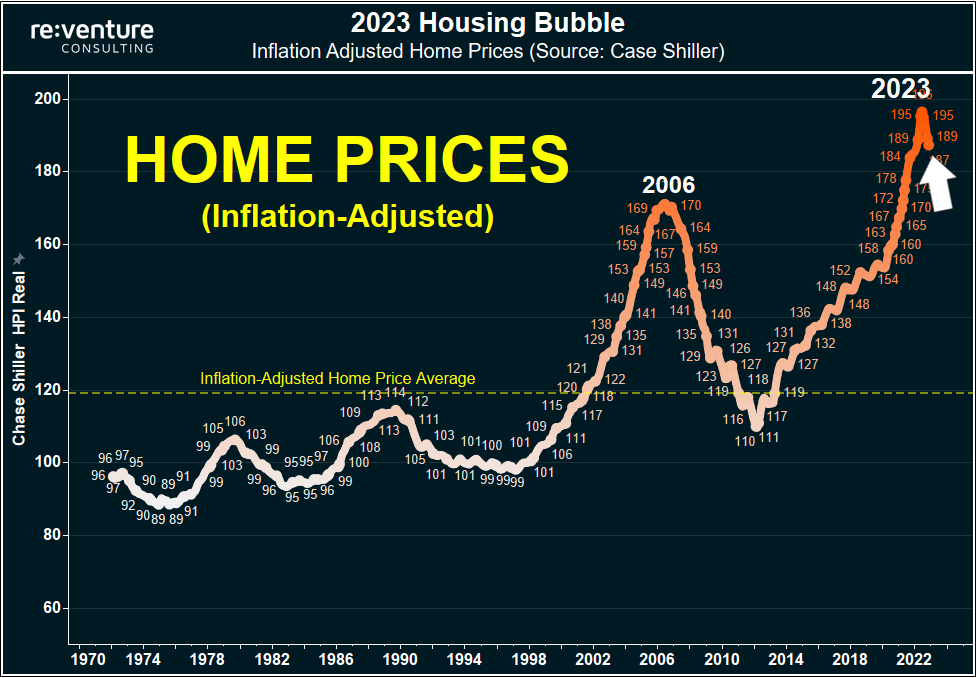

Remember this: America is still in the largest Housing Bubble ever. After accounting for the declines of the last six months, inflation-adjusted home prices in late 2022 are still higher than their previous peak in 2006.

That means there is still significant pain to come in the US Housing Market. And 2023 will be the year that the pain really starts to be felt. I'm predicting nominal price declines of -10% across America by year end, with some markets registering closer to -20%.

Which markets will get hit the hardest? Well, you'll have to read the rest of these predictions to see. But to give you a hint: pandemic boomtowns with lots of homebuilding are most in the crosshairs.

Prediction #2: California and Florida will be the worst performing Housing Markets in 2023.

Home Prices will fall the most in California and Florida. Inventory will spike throughout 2023. Few will be able to comprehend how these markets turned so quickly.

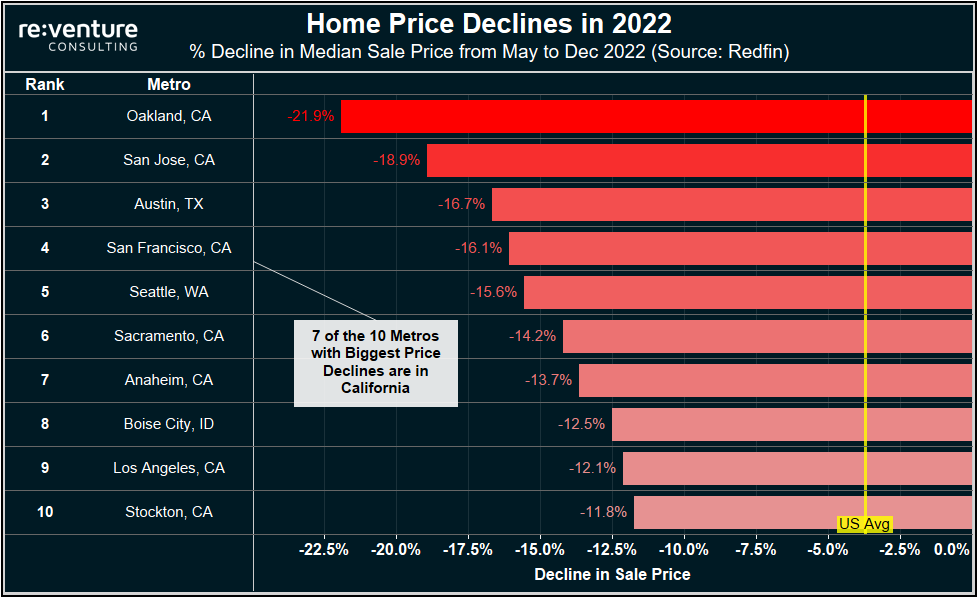

Technically - California is already crashing. The Median Sale Price in Oakland is down -22% from peak. -16% in San Francisco. -12% in Los Angeles. But this is just the start of a multi-year Housing Crash in California that will truly kick into high gear in 2023.

Interestingly, Florida hasn't crashed yet. Prices are flat or down only marginally in recent months. However, inventory is spiking. And the rental market is trending down. Both prices and rents are going to start dropping fast in Florida in early 2023.

But the straw that is really going to "break the camel's back" in both these states is the Recession worsening in 2023. In California expect many more tech layoffs and bankruptcies, crushing local housing demand. In Florida expect a huge slowdown in tourism and leisure spending, causing Airbnb/STR owners to sell.

One more thing: because of looser lending standards in these two states, both California and Florida are heavily exposed to mortgage defaults and foreclosures. More on that later in the predictions.

Prediction #3: Deflation is coming. CPI will go negative in 2023.

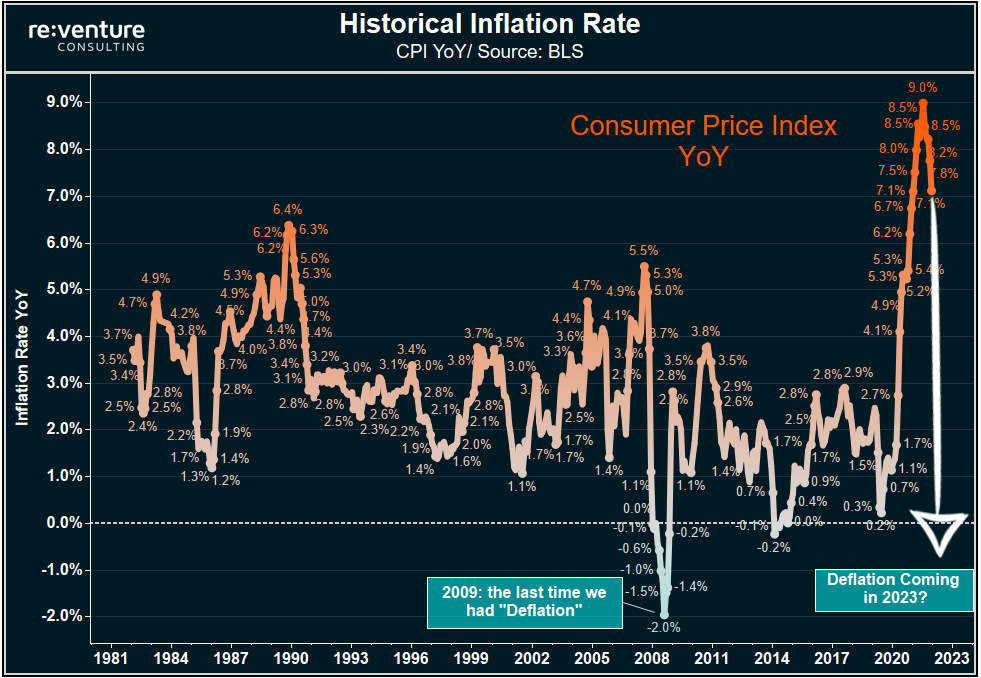

Home Prices are going down. Rents are going down. Commodities like lumber, aluminum, and oil have crashed hard from their highs. These are signals that deflationary forces are hitting the US Economy. And I predict that 2023 will be the first year since 2009 where Consumer Prices (measured by CPI) officially go negative and deflation occurs.

This prediction is of course a huge reversal from what occurred in 2021 and 2022, when Inflation measured +7% per year. But the thing to understand about high inflation is this: if it happens too fast, faster than underlying wage growth in the economy, the destined outcome is a deflationary episode.

That's because eventually Americans will run out of money and stop spending. One of the most obvious signs that this trend has started is the decline in Personal Savings Rate. It's at a pitiful 2.4% right now. Near the lowest level on record.

This record bottom savings rate suggests that Americans will run out of money in 2023. Just as the Federal Reserve contracts the Money Supply via rate hikes and quantitative tightening. The end result will be a decline in the price of goods, services, and housing (aka, Deflation).

Prediction #4: Jerome Powell will pivot "early" and cut rates by April 2023.

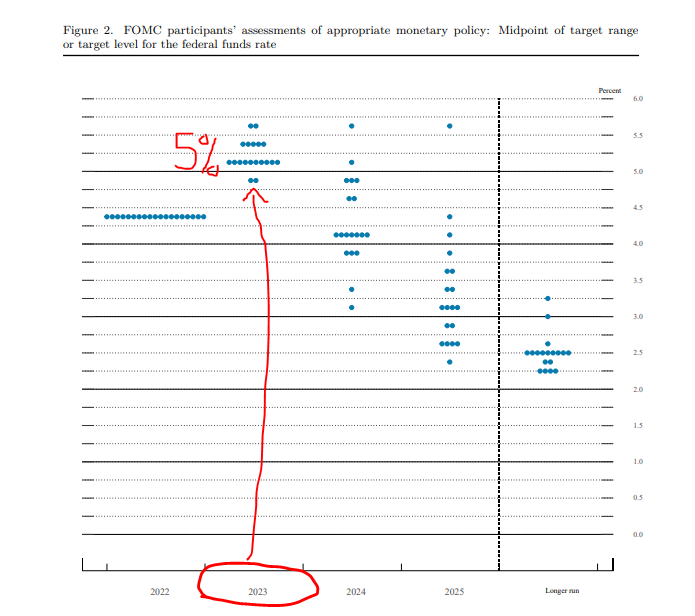

As a result of these escalating deflationary pressures, Jerome Powell will be forced to pivot early and cut rates. I'm predicting that this pivot will occur by April 2023.

Interestingly, Powell and the rest of the Fed remain steadfast that there won't be a cut. They have stated they expect further interest rates hikes, and for the Fed Funds Rate to remain elevated (above 5%) throughout 2023.

But deflationary forces in the economy, to go along with the the biggest yield curve inversion of all-time, suggest the Fed's hand will be forced. Major trouble is coming for the economy in 2023. And that trouble will likely come sooner than the Fed anticipates. Meaning we could see Powell cut rates in the first half of 2023, perhaps by April.

This rate cut will cause long-term bond yields, along with mortgage rates, to go down. Which will be good for homebuyers. But historically the Fed cutting rates in a Recession is a signal that things will get much worse in the economy, which will mean continued issues for the Housing Market.

Prediction #5: The US Rental Market will crash. Rents down by -10% in 2023.

One reason I feel confident in predicting deflation, and a Fed Pivot, are the problems the US Rental Market is having right now.

According to RealPage, 2022 was the worst year for apartment leasing in America since 2009. These rock bottom leasing figures have started to show up in rent declines over the last several months, a trend that will likely continue through early 2023.

Markets such as Las Vegas, Phoenix, and Sacramento are experiencing the biggest rental market downturn to date, with collapsing occupancy rates and rents down -5% over the last six months. However, despite these declines, rents in these markets and America more generally are still way above their pre-pandemic levels.

Meaning that rents still have far to fall, especially considering the double whammy that is coming in 2023 of 1) Worsening Recession and 2) Record-Breaking Apartment Construction. There are currently 917k apartment units actively under construction, and markets like Phoenix and Austin will experience a double-digit percentage increase in rental inventory.

All of these factors add up to a declining (crashing?) US Rental Market in 2023 that could result asking rents declining by -10% by year end.

Prediction #6: Investors will wise-up and sell in 2023. Especially in the South.

These declining rents will be a big problem for Investors, particularly those big Wall Street Investors. You know - the ones that dominated the Housing Market during the pandemic?

Well, their run of dominance is coming to an end. In the third quarter of 2022 they stopped buying. But 2023 will be the year where they start selling. That's because many of these investors are now losing money on their rental properties and will be forced to sell.

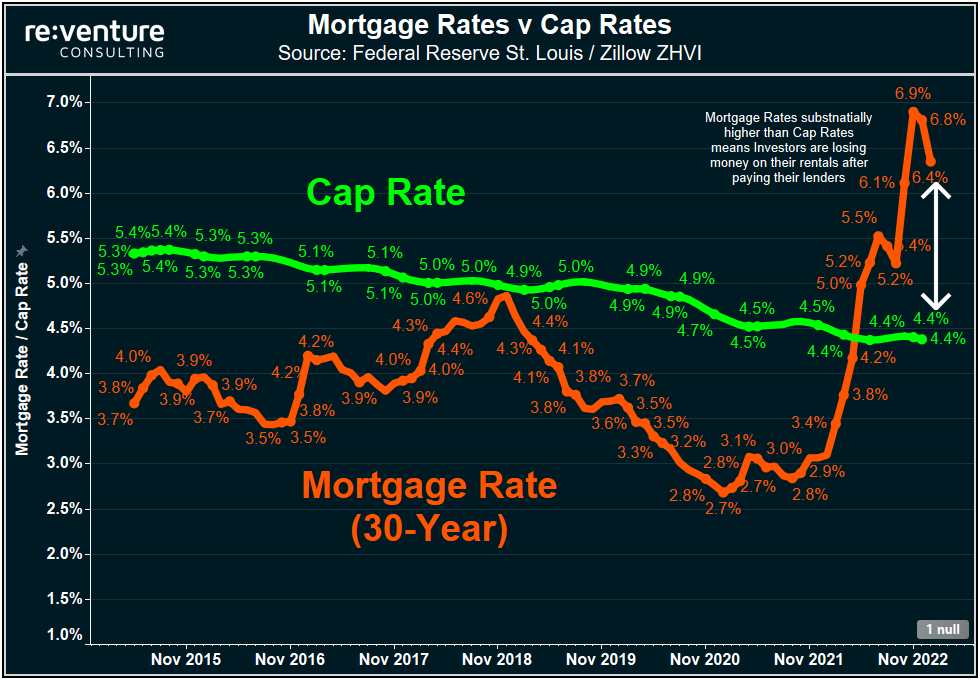

The way we know this is by comparing Cap Rates (aka, Investor Profit) to Mortgage Rates (the Interest Rate paid to the Investor's Lender). Normally, Cap Rates are above Mortgage Rates, allowing the Investor to earn a profit after paying their lender.

But in today's environment Mortgage Rates (6.4%) are way above Cap Rates (4.4%). Meaning that owning a real estate rental is a money-losing venture for many investors, especially those who bought recently.

Eventually these investors will run out of capital to sustain the losses, or be margin called and forced to sell by their lenders. And when that happens, likely slowly at first in 2023 and then reaching a fever pitch by year end, it will create calamity in the Housing Market.

Particularly in Sun Belt Metros like Charlotte, Atlanta, Jacksonville, and Phoenix, where investors own 50% of the homes in certain ZIP Codes. The inundation of inventory and sudden decline in prices in these areas when investors sell will be jarring and shock many Housing Market pundits.

And it will result in substantial price declines. Think 20-25% in a year. And 40% by the bottom in investor-dominated ZIP Codes.

Prediction #7: Stubborn sellers capitulate. Massive inventory surge in Spring 2023.

One of the most interesting storylines in the 2022 Housing Downturn has been that many sellers are remaining "stubborn". Some are refusing to cut the price. Others are flat out refusing to list their property during a down market.

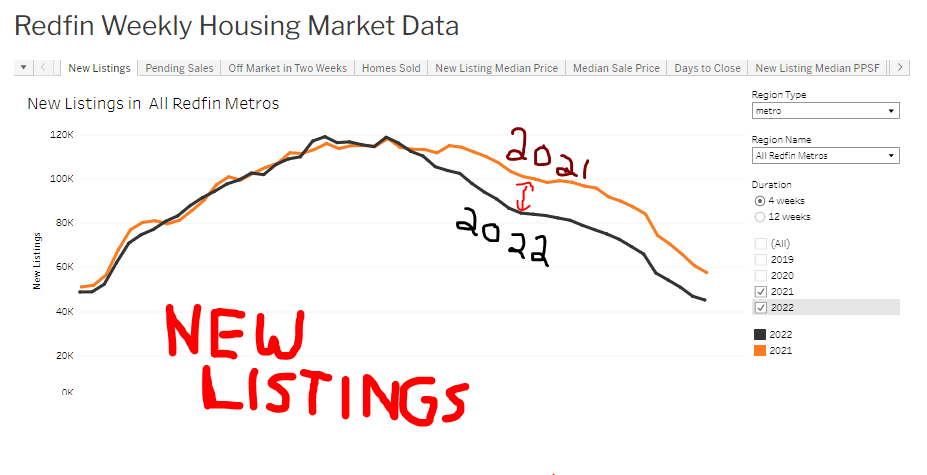

This stubborn seller trend started in July 2022. When you can clearly see a plunge in New Listings on the graph below. Sellers starting saying to themselves, "It doesn't make sense to list now. It's a bad market to sell. Let's wait until 2023". The result was a -14% decline in new listings in the 2nd half of 2022 from the previous year (a shortfall of about 350k in total).

Well folks: 2023 is now here. And those 350k stubborn sellers are going to rush to the market simultaneously in the Spring to list their houses on the hope that buyer demand rebounds. This will likely cause the Inventory spike that began in 2022 to continue in 2023.

By the end of the year don't be surprised if Inventory sitting on the market is at its highest levels since the last Housing Crash in the mid-2000s. No longer will people be saying there is "low inventory".

Prediction #8: Mortgage Defaults will surge. Foreclosure Wave by end of 2023.

Remember that "Foreclosure Wave" that was supposed to happen after the Federal Pandemic Moratorium was lifted in August 2021? Well, that never came to be in 2022. While Foreclosure starts were up +98% on the year, they were still below pre-pandemic levels.

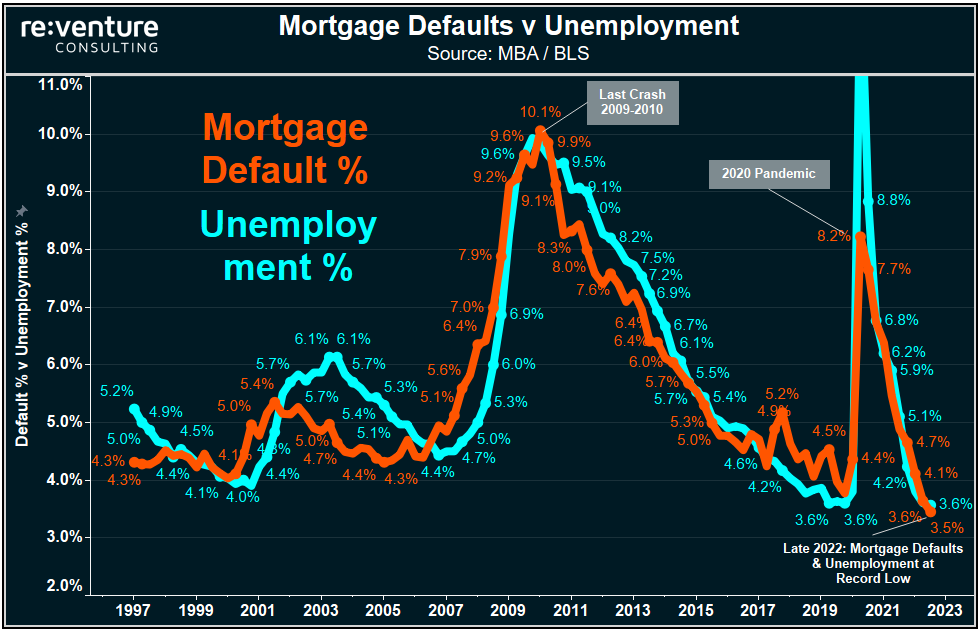

Which is curious. Because the Default Rate during the pandemic hit 8.2% (of all mortgages), which nearly matched the record high set in 2009-10 during the last crash. But the foreclosures never came. Where did these lost Foreclosures go?

Well, it all has to do with Unemployment Rate. The surge in Unemployment during the pandemic caused mass defaults. But $5 Trillion in fiscal stimulus and heavy interest rate suppression caused the Unemployment Rate to drop as quickly as it rose. As a result, both Mortgage Defaults and Unemployment were at record lows in late 2022.

But economically fragile mortgage borrowers won't be so lucky in 2023. A worsening Recession will cause another surge in Unemployment Rate, which will increase the Mortgage Default % in the first half of the year. But this time there will be no moratorium, no $5 Trillion in stimulus. And Foreclosures will follow in the second half of 2023.

By the way - California and Florida are very exposed to an increase in foreclosures. Because prices in California are so expensive, it has a high share of subprime mortgages (which are called "non-QM" mortgages these days). Meanwhile, Florida's prevalence of Airbnb's means that there's lots of "DSCR Loans" in the state that were underwritten to the cash flow potential of the Airbnb, not the credit score and income of the owner.

Prediction #9: Boise, Sacramento, Salt Lake, Las Vegas, Phoenix, Nashville & Tampa have biggest Price Declines. Maybe -20%.

The cities that will crash hardest in 2023 will meet 3 criteria:

1) Being a pandemic boomtown

2) Having home prices that locals can't afford

3) Lots of Home Building

Boise, Sacramento, Salt Lake City, Las Vegas, Nashville, and Tampa meet each of these criteria to varying degrees. And I believe they will be the markets that experience the biggest decline in prices in 2023. In some of these cities I think values could be down by -20% by year end.

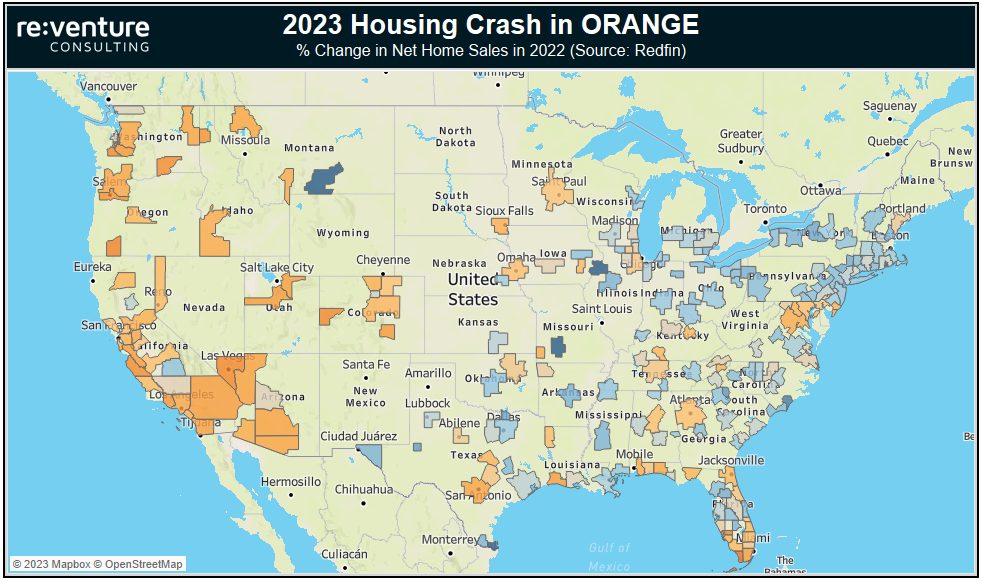

From a zoomed out geographic perspective - expect the declines to once again be heaviest on the West Coast of America (in orange on the graph below). But the big story in 2023 will be that the crash will spread into the Southeast and bring down states that had previously remained resilient like Tennessee, Georgia, and Florida.

PS - I left Austin off the list because prices there have already dropped a lot (over -15% according to Redfin). And while prices will continue to drop in Austin in 2023, I don't think it will be in the Top 5 for price declines again.

Prediction #10: Midwest & Northeast Housing Markets will correct when the Unemployment Rate spikes in 2023.

Another interesting storyline about the Housing Crash thus far is that the Midwest & Northeast have been relatively immune to it. Prices are still up and inventory levels are pitifully low.

Just how low is Inventory in the Midwest/Northeast? Very low.

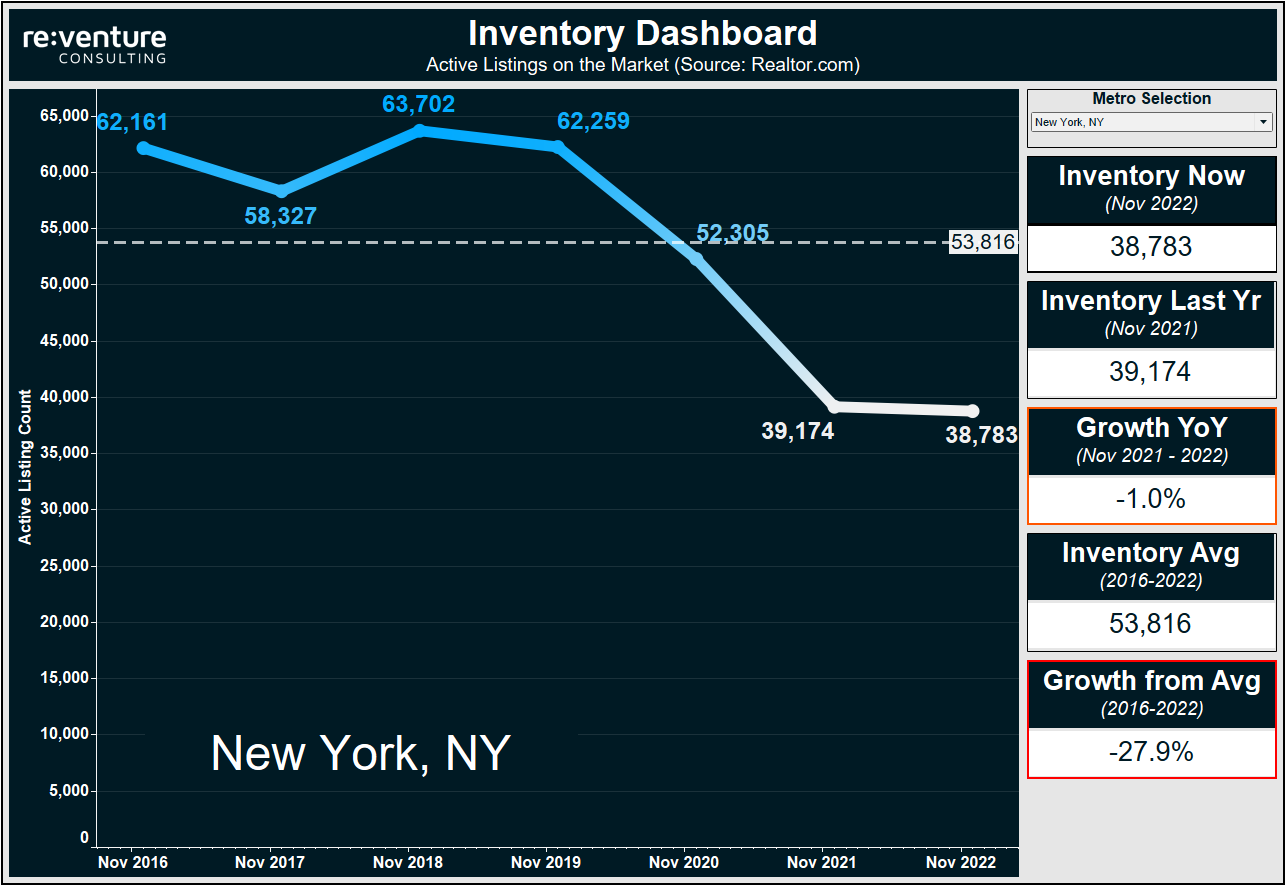

Check out the inventory graph below for the New York MSA. Which shows that Inventory levels in November 2022 were still down -1% YoY, and a large -28% from the average levels from 2016-2022.

Other metros like Buffalo, Hartford, Cincinnati, and Pittsburgh all also have very low inventory levels. The reason is twofold: 1) there is very little home building in the Midwest / Northeast and 2) most of these areas still have home prices that are relatively affordable (when compared to local incomes). These tailwinds have kept home prices growing, and inventory levels low.

But let's remember: the Midwest & Northeast are still losing LOTS of people. The outbound migration was huge in 2021-22. And many of these local economies have failed to regain the jobs lost during the pandemic. At some point in 2023 these economic and demographic headwinds will cause Midwest & Northeast Rust Belt Housing Markets to correct.

But we'll likely need to see a visible increase in the unemployment rate, and an associated increase in forced selling, before that happens.

Review of 2022 Housing Market Predictions

Now, as promised: let's end this post with a quick review of my predictions from last year. After all, what good are my 2023 predictions if you can't verify how my 2022 predictions performed?

These came from a video posted to YouTube on January 3rd, 2022.

10. HOME BUILDING SURGE: expect 1.5 million housing units completed in 2022 based on the huge surge in Housing Starts that occurred in 2021. This will bring much needed inventory to the market. Came close on this. Builders caused big price declines in many markets. At the end of November there were 1.38 Million completions on a T-12 basis.

09. FORECLOSURE WAVE: data from Black Knight suggests there could be as many as 1 Million backlogged foreclosures heading into 2022. Now that the Consumer Financial Protection Bureau's Foreclosure Ban has expired, it will be open season for banks to foreclosure on delinquent borrowers. Wrong on this one. While foreclosures doubled in 2022, they are still below pre-pandemic levels.

08. FLORIDA IS NUMEBR ONE: Florida will be America's strongest Housing Market in 2022, registering potentially 10% price growth over the next 12 months. Florida's super low inventory levels and strong migration will keep it afloat for another year. But WATCH OUT in 2023. Prices could be heading down. Nailed this one. Florida had best price growth in America in 2022 according to Zillow.

07. MIGRATION SHIFT: Growth hubs like Austin, Salt Lake City, Denver, and Boise dominated over the last five years. However, their reign is now over. Heading into 2022 these markets are too expensive and will begin losing people, pushing home prices down. Nailed this one as well. Austin, SLC, Denver, and Boise are the cities crashing first. And a big reversal in migration is one of the reasons.

06. MORTGAGE RATES UP: Interest and Mortgage Rates will go up significantly in 2022, constraining affordability and pushing home prices down in certain markets. Expect the 30-Year Fixed Mortgage Rate to hit 4.0% by Year End. This will push mortgage payments up by over 10% at today's prices. The spirit of this prediction was right. But I was way off on the year-end Mortgage Rate. Right now we're at 6.4% due to the Fed aggressively hiking the Fed Funds rate to over 4%.

05. INFLATION RUNS HOT: Inflation will moderate slightly, but continue running hot in 2022 at 5%. This higher level of inflation will actually hurt the housing market, as more home buyers delay or cancel their plans to buy due to inflation. Once again, correct on the spirit of the prediction, as Inflation continued running hot. But off on the amount. Inflation is currently at 7.1% YoY in November 2022. I suspect it will settle in the high 6.0% range when the December figures come in.

04. WEST COAST CRASH: Higher mortgage rates and inflation will be most damaging to West Coast Housing Markets where affordability is already significant constrained. Think San Francisco, Seattle, Denver, Salt Lake City, and Austin. Higher rates and lower inflation-adjusted incomes will crash prices in these cities first. Probably my best prediction. When I made it SF, Seattle, Denver, SLC, and Austin were all approaching record high prices, with super low inventory. Not anymore. These markets are fully in crash mode.

03. TECH BUST 2.0: Higher rates will also hasten a collapse in America's tech industry, similar to the DotCom Bubble that burst in the early 2000s. Expect Tech Hubs like San Francisco, Boston, and Austin to lose a significant amount of jobs and their local housing markets to be negatively impacted as a result. Probably my 2nd best prediction. When I made it the NASDAQ was trading near an all-time high around $15,000. Now it's 30% lower at $10,500. Meanwhile there's been lots of tech layoffs, and housing markets like SF and Austin have been some of the worst performing.

02. IDAHO IS THE WORST: The worst-performing Housing Market in 2022 will be in Idaho, where inventory is already up a massive 62% YoY. Prices in Idaho could decline by as much as 15% through the year, especially in Boise. I was correct on Idaho being the worst-performing market. But I missed on the magnitude. Prices in Boise are down by about -5% YoY. -15% is coming in 2023.

01. HOME PRICES FLAT ON AVERAGE: Home prices in America will register no growth on average, but will decline heavily in certain cities while still appreciating in others. Expect the Southeast US, including Florida, Georgia, and South Carolina, to continue performing well. Feel pretty good about this one. Data from Redfin shows Median Sale Price is up +1% YoY in late December, so basically flat. Meanwhile, the Southeast did perform better in 2022.

All together I feel very good about my 2022 predictions looking back. I captured the regional trends that were about the occur very well. I also saw some big macro trends like the tech bust and migration shift coming. But I was a bit too optimistic about how quickly prices would fall. I was off on foreclosures. And I was way on how much mortgage rates would increase (as was pretty much everyone else).

So for this year I tried to stick with my strengths: regional outcomes and macro trends. Looking forward to doing the review in one year's time!

-Nick

(PS - if you liked this post, please share it! On Twitter, Instagram, via e-mail, via text. I want to get these predictions out to as many people as possible).