Will New York's Housing Market Crash?

By Nick Gerli | Posted on August 1, 2023Will New York's Housing Market ever crash?

Despite huge levels of outbound migration, a weak economy, and high property taxes, New York's Housing Market has defied the odds thus far in 2023 and remained resilient. With home prices increasing and inventory hitting the lowest levels on record.

These unfortunate realities are now causing many New York Homebuyers - whether in Manhattan, Long Island, Westchester, Albany, or Buffalo - to wonder if home prices will ever decline.

In this post, I will answer that question and:

- Explore why New York has remained as one of the strongest real estate markets in America in 2023,

- provide predictions for when the market will hit a downturn, and

- estimate how much home prices could decline.

Let's get into it.

Point #1: New York is losing People & Housing Inventory at the same time

In order to understand where home prices will head into the future in New York, you have to understand the massive contradiction developing between the state's demographic growth and its housing market.

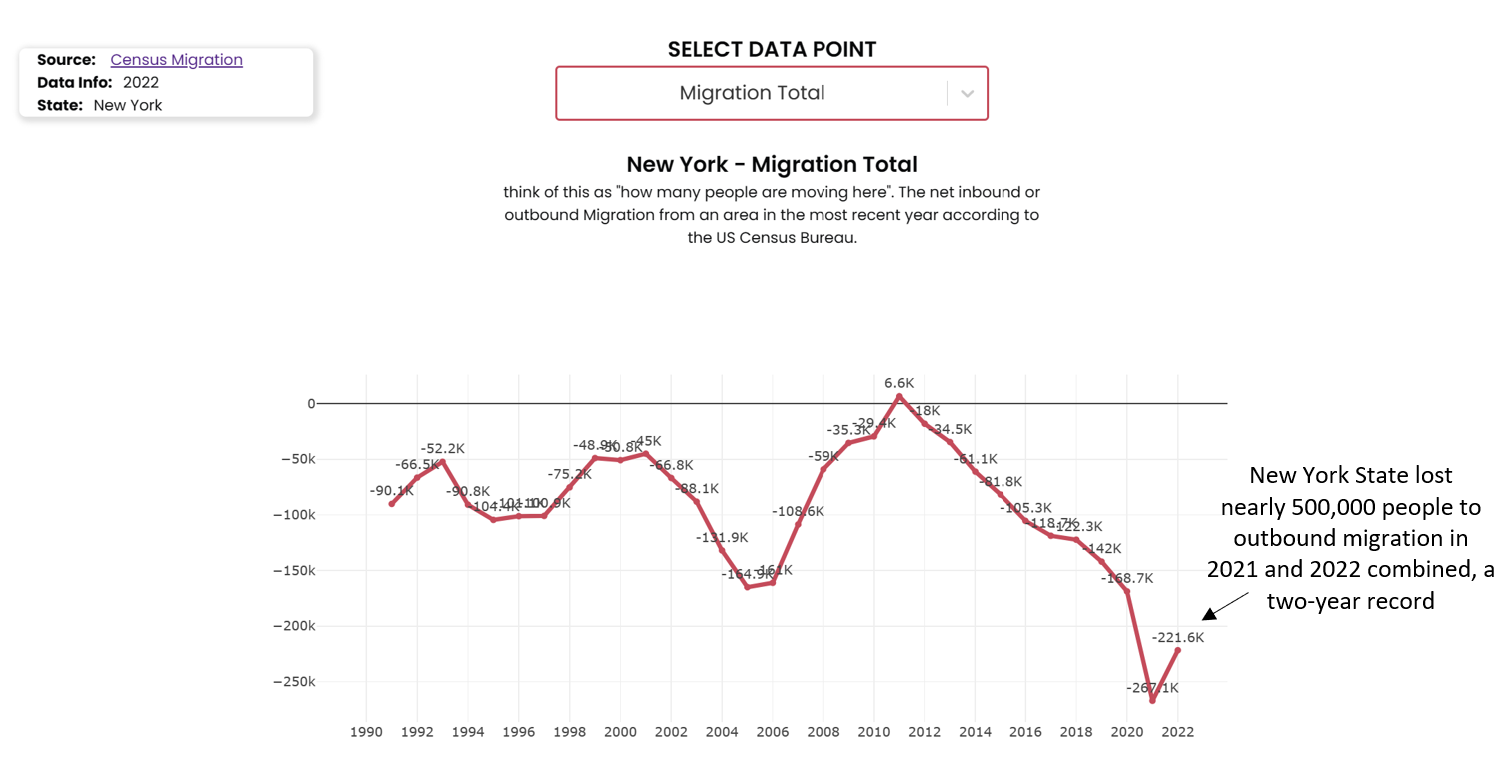

In terms of demographic growth, things are abysmal. People are moving out of New York State in droves like they never have before. With migration data from the US Census Bureau showing that New York State lost 222k people in 2022 and 267k in 2021, a record 489k combined loss over the last two years.

What's more - people leave New York pretty much every year, with the state registering only one positive migration year going all the way back to 1990.

But here's what's confusing...

Looking at the migration graph above, which you can access for every State and Metro in America on Reventure App, would leave most people thinking that New York's Housing Market should be in a crash. Because if so many people are leaving that should mean lots of sellers, skyrocketing inventory, and lower prices...right?

Wrong.

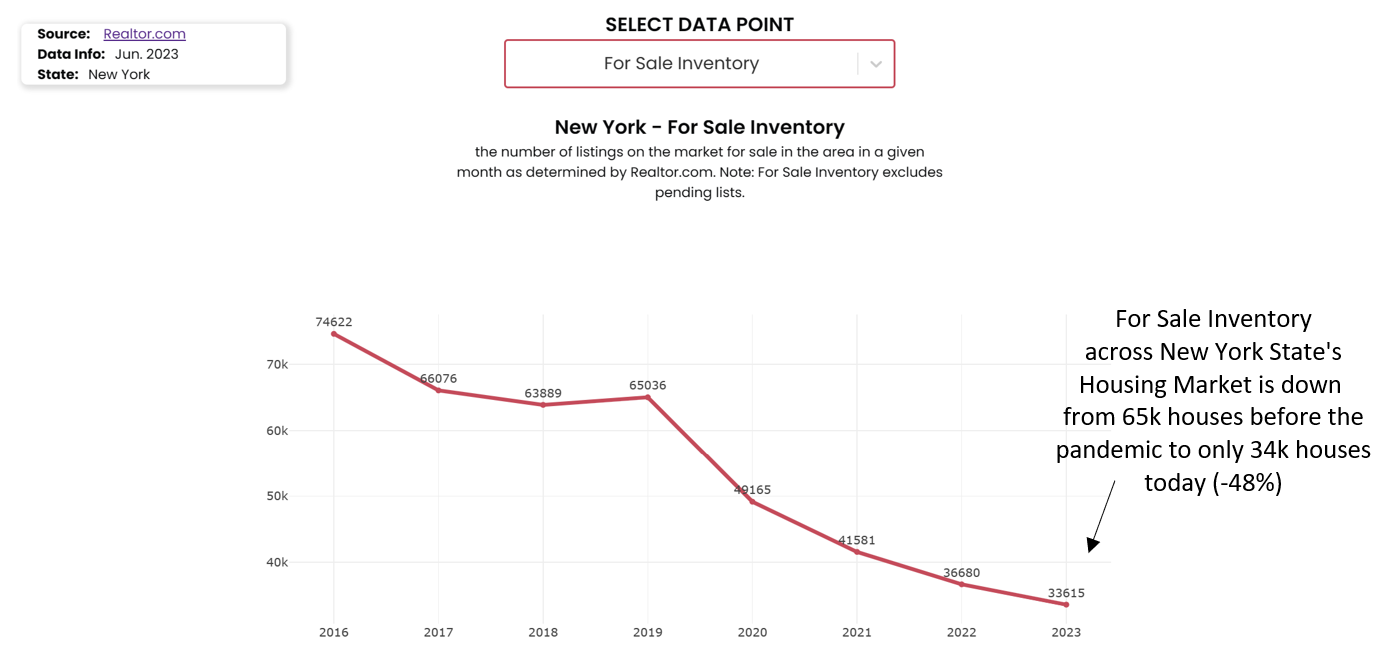

At the same time that New York has experienced a record loss of people, it has also experienced a record loss of housing inventory. With the number of homes for sale across the state plummeting from 65,000 prior to the pandemic to only 34,000 in 2023 (-48% decline).

This collapse in inventory is making life very difficult for homebuyers across New York and keeping it in a seller's market, with home prices across the state up 2.8% over the last year.

Point #2: Home Prices are increasing most in Upstate New York

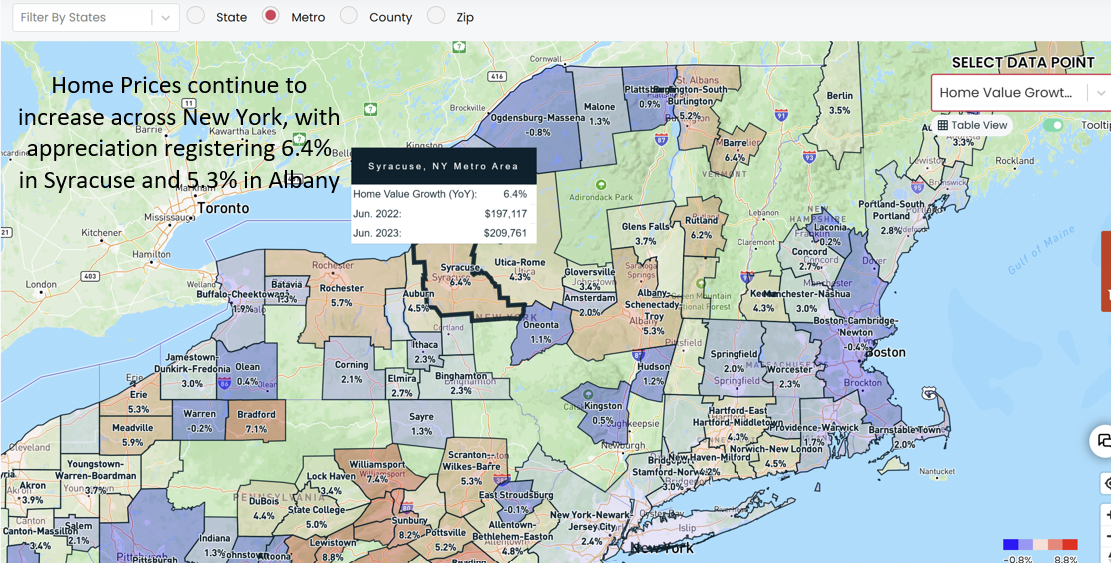

Prices are still going up across the state more broadly, with every metro area in New York registering positive appreciation from June 2022 to June 2023 according to data from Zillow.

The strongest levels of appreciation are being seen in Upstate New York, headlined by Syracuse (+6.4%), Rochester (+5.7%), and Albany (+5.3%).

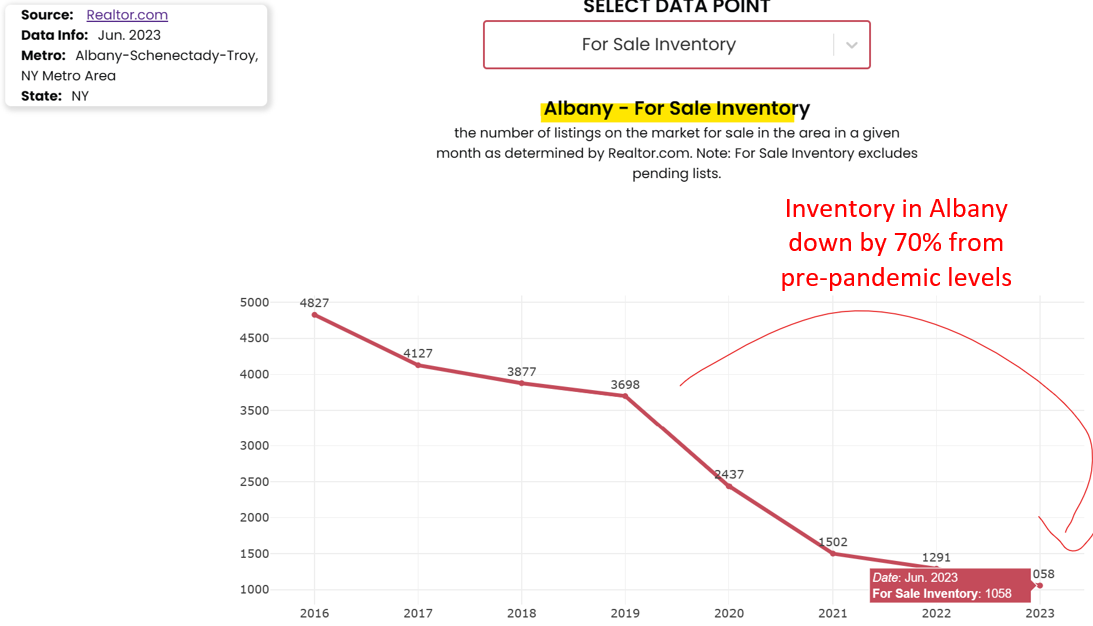

The reason prices are going up the most Upstate is because this is where inventory is lowest. I mean - check out the Inventory graph for Albany. Where homes for sale have plummeted by 70% from their pre-pandemic levels.

That's an absurd decline in inventory. This situation is creating bidding wars this summer in Albany and other parts of New York State.

Point #3: Home prices are still going down in Manhattan.

However, prices aren't going up everywhere across New York State. In some pockets, such as Manhattan, prices are down anywhere from 5 to 15% over the last year. Particularly on the Upper West and Upper East Sides, where quite a few ZIP Codes are registering double-digit price declines.

With the issue in Manhattan being inventory.

Because while homes for sale are down pretty much everywhere else in New York State, they're still up in Manhattan, with the 7,100 condos, co-ops, and townhouses available for sale in June 2023 tracking as the highest on record going all the way back to 2016.

So long as these inventory levels in Manhattan remain historically elevated, it is unlikely we will see a recovery in the local housing market. Especially with mortgage rates still hovering around 7%, making the cost to buy a condo in Manhattan completely unaffordable for even the wealthy segment of people that live there.

For instance, on this "reasonably priced" midtown condo below, the ongoing payment for a buyer with a mortgage is nearly $11,000/month.

However, Manhattan is more the exception than the rule in New York. While its Housing Market is struggling, nearby areas like Westchester and Suffolk County are still buoyant, with almost every other county across the state tight on inventory.

Which begs an interesting question: when can buyers across New York expect to see some relief in the form of lower prices?

Point #4: The bull run in New York real estate won't last. Eventually, the market will "die". And stay depressed for a long time.

New York State's low inventory, driven by a lack of home building and low mortgage defaults, is creating the perception of a buoyant Housing Market that will last long into the future.

However, I suspect we are on the cusp of a major shift in New York's market. In particular, I believe the market will "die" at some point over the next year, with a large decline in homebuyer demand. This drop in demand will be the result of continued outbound migration as well as economic decline due to a worsening recession.

With the result being higher inventory and stagnating prices for a long-time.

New York experienced similar episodes in 2006 and 1988 that marked a transition from a bull run in the state's housing market to a period of long-term malaise. For instance, after a big surge in prices in the mid-1980s, New York's Housing Market faltered from 1988 to 1998, a period where home prices didn't grow for over a decade.

A similar situation occurred starting in 2006, the peak of the last bubble. Prices proceeded to dip by about 15% over the next six years and then gradually rose so that home values in 2017 were basically the same as in 2006. Another "lost decade" for New York's Housing Market.

I suspect something similar is about to happen in the 2020s. Where home prices don't really "crash", but simply stop growing for a long-time and maybe correct by 5 to 10% on average. This correction, coupled with income growth, should slowly return affordability to New York's housing market over the next five to seven years.

Point #5: Should you buy now or wait in New York?

This analysis creates an interesting question: if you're a homebuyer in New York, should you buy now or wait?

And ultimately the right answer to that question really depends on your personal family and financial situation.

However, if it were me, I would wait.

Because I simply don't see the historically low inventory levels across New York as something that is sustainable. Eventually the state's huge outbound migration, weak economy, and high property taxes will catch up to it, and the Housing Market will decline.

Just like it did in the late 1980s and mid-2000s.

With that said - I don't expect a massive crash in New York. Data from Reventure App shows home prices in the state are about 19% overvalued. With big differences depending on what metro you are located in.

Albany is 8% overvalued. While Buffalo is 23% overvalued. Manhattan and Brooklyn are somewhere in between, around 15% overvalued.

Ultimately these overvaluation figures point more to a correction than a crash. A correction where I can see values declining by 10% over multiple years, with incomes growing in the background by 3-4% per year. Such a result would bring home prices to a more fundamentally supported level by 2025 or 2026.

And then after that - don't expect much growth until the next bubble.

Access the Data on Reventure App for Free

This post did a deep dive on New York's Housing Market by looking at trends in inventory, home prices, and overvaluation in various metros, counties, and ZIP codes across the state.

If you want to perform a similar analysis for your area, or do a deeper dive on New York, you can. Just go to Reventure App and search the data for yourself.

Currently the website is completely free. However, that will change in coming months with the release of Reventure App 2.0, which will introduce a host of new features. As well as a paywall for certain features and data points.

I'm still in the process of determining price points and figuring out which features will remain free v. premium, so stay tuned for more information on Reventure App 2.0 in coming weeks.

-Nick