Home Builder Stock Crash Coming in 2023?

By Nick Gerli | Posted on November 16, 2022The US Housing Market is crashing. Yet Home Builder Stock Prices are SURGING. Suggesting that Home Builder Stocks could be in a massive Bubble that is set to explode in 2023. For instance...

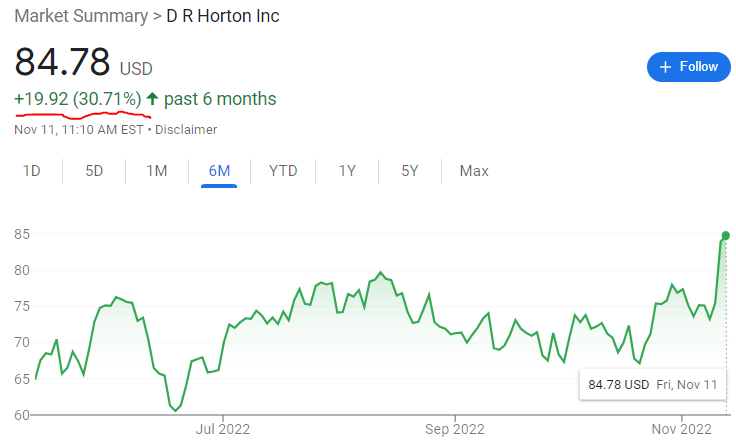

DR Horton, the largest builder by volume, is up a massive +31%.

Lennar is up +24%. Taylor Morrison by +10%. PulteGroup by +9%. During the same period the S&P 500 is flat. Meaning that Builder Stocks have been some of the best performing assets in the stock market over the last 6 Months.

Which doesn't make much sense. Because the last 6 Months has been the era of the US Housing Crash. Homebuyer Demand is at 10-Year lows. Home Prices are declining. Builder Sales have plummeted. And the mainstream consensus suggests that this trend will last well into 2023.

Clearly - something has to give. Either:

1) Home Builder Stocks are in a Massive Bubble, or

2) Builder Stock Performance suggests that the US Housing Market will Rebound in a big way in 2023.

Builder Stock Prices v Home Sales

One of the most basic ways to understand Home Builder Performance, and the health of the overall Housing Market, is by analyzing Home Sales.

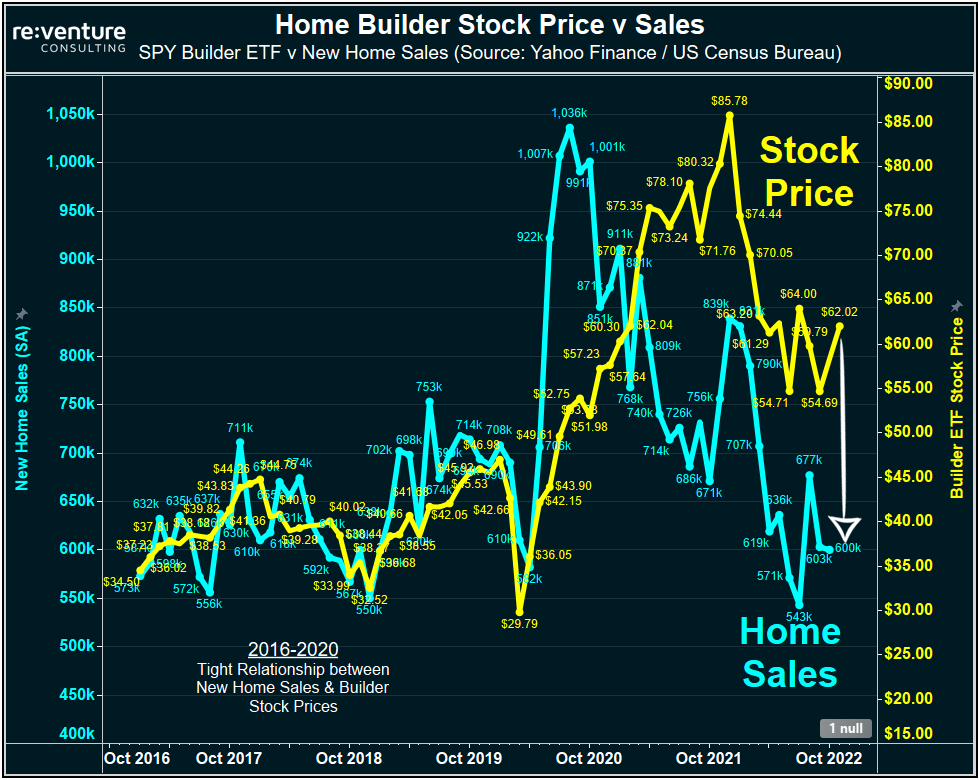

The Blue Line on the graph below charts New Home Sales (annualized, seasonally adjusted) as reported by the US Census Bureau and compares it to the Stock Price of the S&P Builder ETF (Yellow Line).

What's immediately evident is the tight historical relationship. Prior to the pandemic Home Sales were consistently in a range of 550k-700k, while the SPY Builder ETF traded from $3o to $45.

Once the pandemic hit, Home Sales soared. And in the following months, Builder Stocks soared as well. But fast forward to late 2022 and New Home Sales have collapsed back down to their 2017-2018 levels. And will likely fall further in future months.

However, Builder Stock Prices have not fallen to their 2017-18 levels. After an initial correction in early 2022, the SPY Builder ETF has rebounded to $62/Share. Trading roughly 35% above its pre-pandemic levels. Far above the levels suggested by how many Homes these builders are actually selling.

The Lag Effect on Builder Earnings

One reason that Stock Traders might be still favoring Home Builder Stocks in late 2022 is because their Revenue is still very strong. For instance, DR Horton just reported $9.1 Billion in Revenue in Q3 2022 compared to $5.0 Million in Q3 2019. A massive 80% increase over 3 Years. So maybe these Builder Stocks are fairly valued?

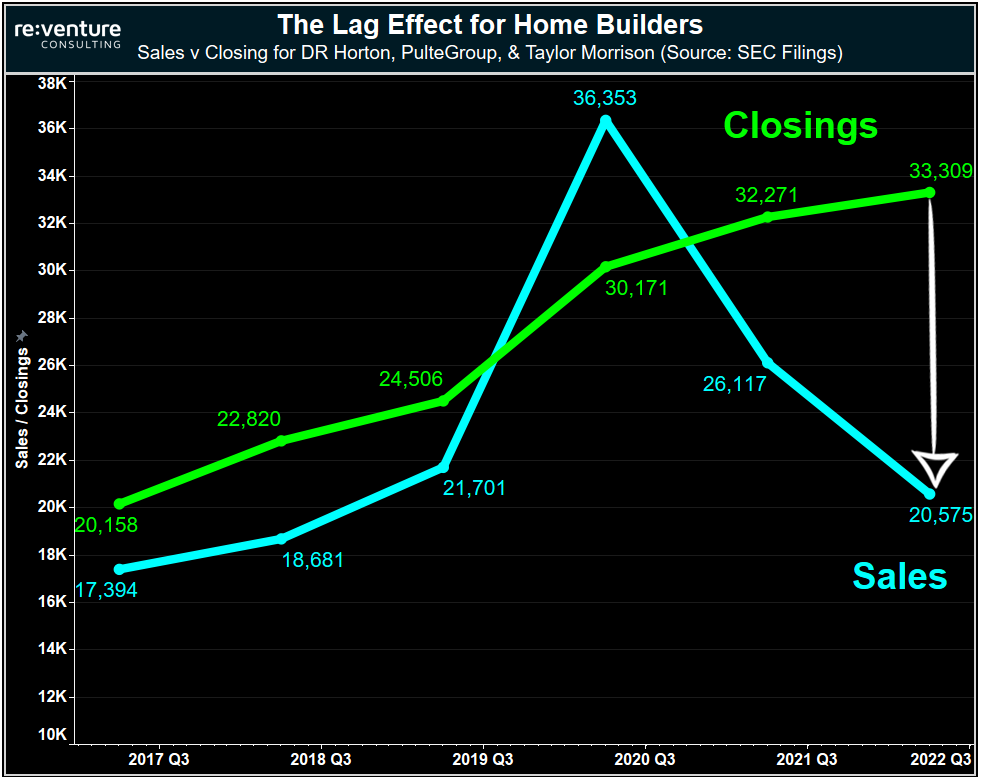

Not so fast. The problem with relying on existing Revenue and Earnings figures from Builders is that they are backward-looking. To see what I mean, take a look at the graph below which compares CLOSINGS v SALES for DR Horton, PulteGroup, and Taylor Morrison (3 of the biggest Builders in America).

Note: a Closing occurs when the Homebuyer takes ownership of the House (which is also when the builder books the Revenue). A Sale occurs when a Buyer goes under contract to purchase the house.

Closings in Q3 2022 for these 3 Builders measured 33,309, an all-time record, which explains why Builder Revenue is still so high. There are still lots of people moving into their brand new built homes that they purchased 6-18 Months ago.

However, New Sales for the quarter were 38% lower at 20,575, similar to their levels in 2018-2019. Indicating that future Closings throughout 2023 are going to crash hard. And that Builder Revenue will also crash by extension.

I suspect that Wall Street Investors are not properly forecasting the inevitable decline in Closings and Revenue. And thus leading some to buy into Home Builder Stocks based on past performance, thereby inflating their Stock Price.

Predicting a Fed Pivot

But the real Elephant in the room regrading Home Builders and the Housing Market is the impending Fed Pivot and its impact on Mortgage Rates. For instance, a softer than expected Inflation Report in October 2022 fueled a massive one-day rally in Builder Stocks on November 10th. To quote Bloomberg:

The S&P Supercomposite Homebuilding Index surged 12%, the most since April 2020, after a smaller-than-expected rise in consumer prices last month ramped up hopes that the central bank’s aggressive monetary policy tightening is reining in inflation. That sent Treasury yields tumbling, promising to pull mortgage rates back from the steep jump that’s weighed on the real estate industry.

The line of thinking here is as follows:

Lower Inflation = Dovish Fed = Lower Treasury Yields = Lower Mortgage Rates = More Homebuyers = More Closings = More Revenue for Builders

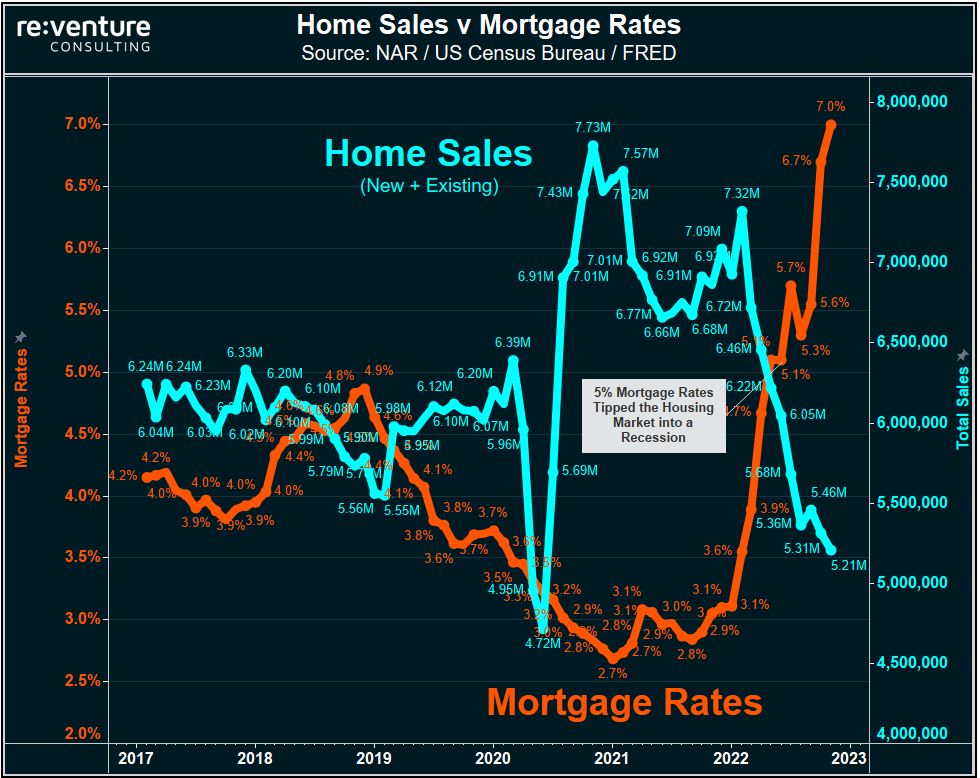

And this is a tempting narrative to believe at first. After all, comparing the 5-Year History of Mortgage Rates and Home Sales does show that the US Housing Market in very Mortgage Rate Sensitive. The market was in balance from 2017-2020 when Rates were around 4% and Total Sales (New + Existing) were around 6 Million.

Then the pandemic hit. And Mortgage Rates plummeted to 3.0% and Sales exploded to over 7 Million.

Now Sales are hovering around the 5 Million Level - the lowest totals in nearly a decade. And as you can see on the graph above, it was Mortgage Rates eclipsing the 5.0% threshold that really drove sales down. For instance, in August 2022 the Mortgage Rate was 5.3% and Sales had already collapsed to 5.4 Million.

So if lower Inflation and a Fed Pivot can induce Mortgage Rates to fall below 5.0%, I could logically understand the boom in Homebuilder Stocks. The problem is that we're still very, very far from that level of Mortgage Rates.

Mortgage News Daily shows the current 30-Year Fixed at 6.6%. An improvement from the 7%+ levels of previous weeks, but far off from delivering the type of affordability relief needed to bring buyers back into the market.

Because Let's Not Forget: Prices are Still Way Too High

All the discussion of Mortgage Rates in recent months has obscured the fact that Home Prices, the other key variable in the affordability equation, are still way too high.

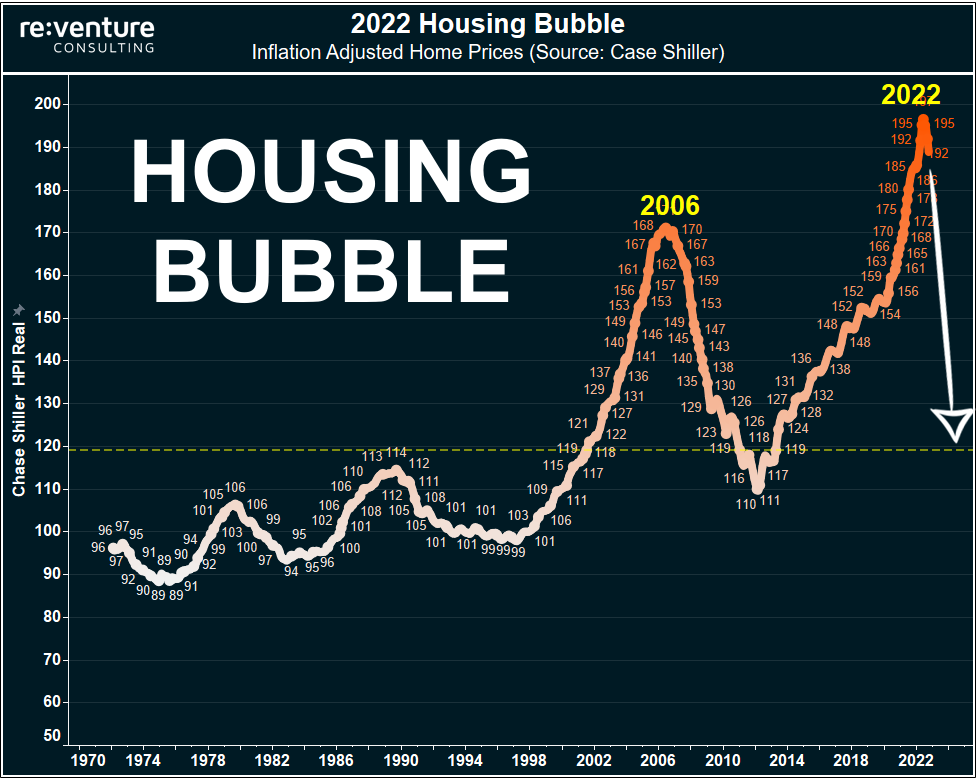

Even with the recent decline in Prices, the Inflation-Adjusted Case Shiller Home Price Index is still at its highest level EVER. Even higher than the peak of the 2006 Housing Bubble.

Real Home Prices across America need to decline by roughly 40% to get back to their long-term, 50-Year Trend of Affordability. And we're still likely a ways off from that happening.

Conclusion

It's important for Home Buyers and Real Estate Investors to keep tabs on what's happening in the Stock Market. Because movements in Stock Prices can be a useful leading indicator of what's going to happen in the future Housing Market & Economy.

However, in this case, Home Builder Stocks seem much more likely to be in a Bubble than to be delivering a reliable signal that the 2023 Housing Market will rebound. The simple reality for Builders and the Broader Housing Market is that:

1) Buyer Demand is terrible.

2) Mortgage Rates are too high.

3) Prices are too high.

A significant decline in both Rates AND Prices will be necessary to bring Buyers back into the market.