Will Mortgage Rates hit 8%? Powell signals "Higher for Longer"

By Nick Gerli | Posted on August 25, 2023The big story in the Housing Market over the last month has been surging Mortgage Rates, with the 30-year fixed now trading near 7.4%. A figure that is nuking affordability and causing a calamitous collapse in homebuyer demand in America. Many are now concerned that these mortgage rates could increase further in the coming months and approach 8% as the Fed continues to signal a hawkish tone for monetary policy.

Are 7-8% Mortgage Rates the "New Normal"? Jerome Powell seems to think so

The latest data from Mortgage News Daily shows the 30-year mortgage rate at 7.37%. This rate is more than double the lows experienced during the pandemic period of monetary easing and is well above the 5-year average mortgage rate of 4.5%.

Many believe, including myself, that this period of sharply higher mortgage rates was a temporary situation. Something that would last for 6-12 months and then dissipate when the economy collapsed and the Fed pivoted to cut rates. But so far that hasn't happened.

Rather - Jerome Powell and the Fed have remained steadfast in keeping interest rates elevated. And potentially increasing them further. At his latest speech in Jackson Hole, Wyoming on August 25th, Powell reiterated that the fight against inflation is far from over, and to expect elevated rates to hang around for a while:

Turning to the outlook, although further unwinding of pandemic-related distortions should continue to put some downward pressure on inflation, restrictive monetary policy will likely play an increasingly important role. Getting inflation sustainably back down to 2 percent is expected to require a period of below-trend economic growth as well as some softening in labor market conditions.

Powell's emphasis that "restrictive monetary policy will likely play an increasingly important role" in bringing inflation down to 2% is a signal that rates will stay higher for longer. And that rates could potentially increase further:

At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data. Restoring price stability is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all.

Powell makes clear that at upcoming meetings the decision will be between either 1) hiking rates more or 2) keeping rates the same. Meanwhile, rate cuts are nowhere on the horizon. This hawkish stance resulted in betting markets increasing the odds of another interest rate hike by the end of 2023.

The result is that 7-8% Mortgage Rates will likely be the "new normal" until a more noticeable decline in economic activity takes shape.

Homebuyer Demand Crashes to 28-Year Low as Affordability Worsens

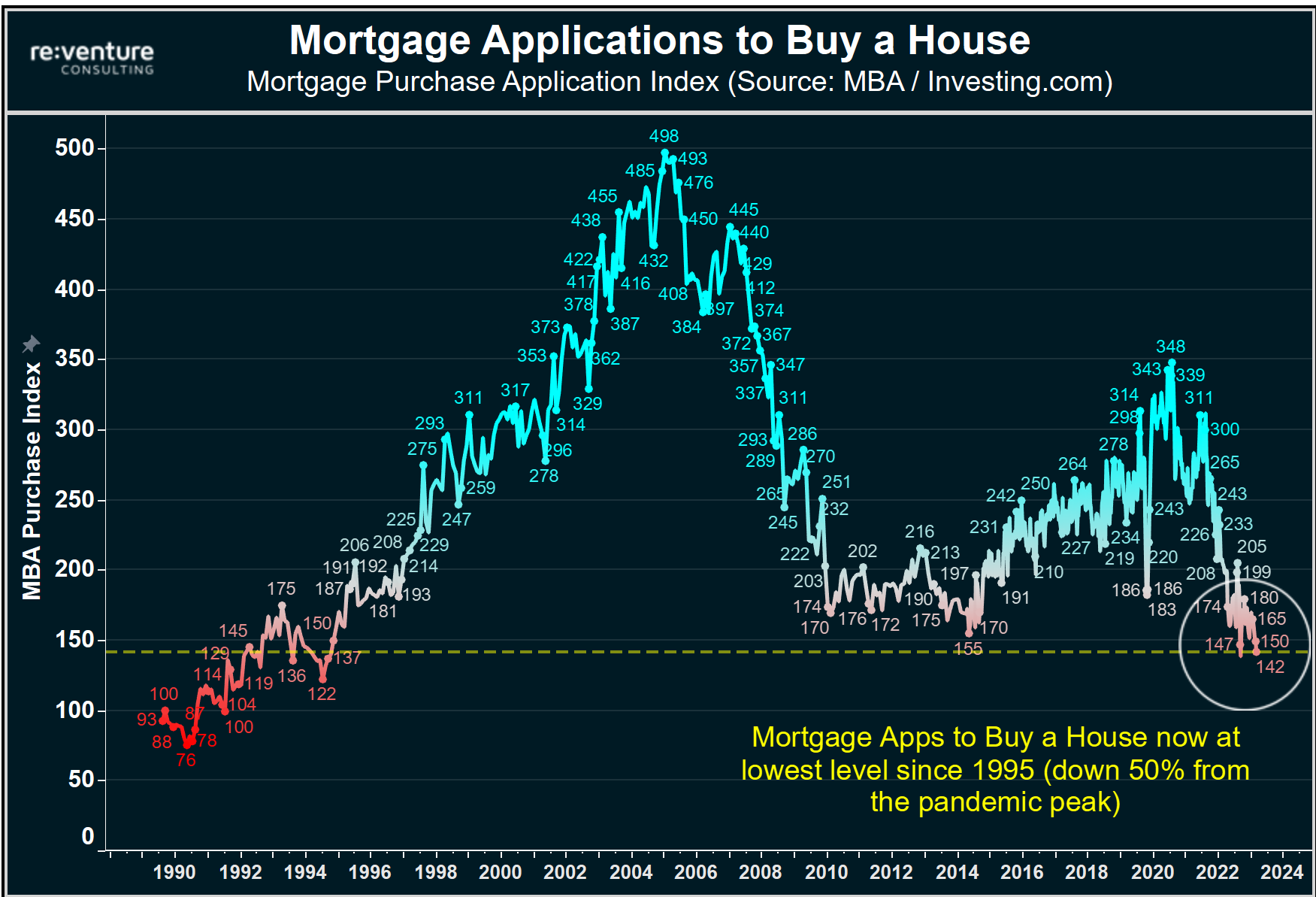

The result of these stubbornly high Mortgage Rates has been a nosedive in homebuyer demand, with Mortgage Applications to Buy a House now crashing to the lowest level since 1995.

That's a sobering graph and shows just how dire the situation in the Housing Market is right now. Due to a combination of still very high prices and 7-8% mortgage rates, most homebuyers literally can't qualify for mortgages. And if they can, they're just barely squeezing in and having to purchase at elevated Debt-to-Income Ratios near 40%.

And unfortunately, until this affordability conundrum is solved, we're not going to see an improvement in homebuyer demand. Because right now it just isn't realistic for most homebuyers to purchase a house, nor does it make financial sense.

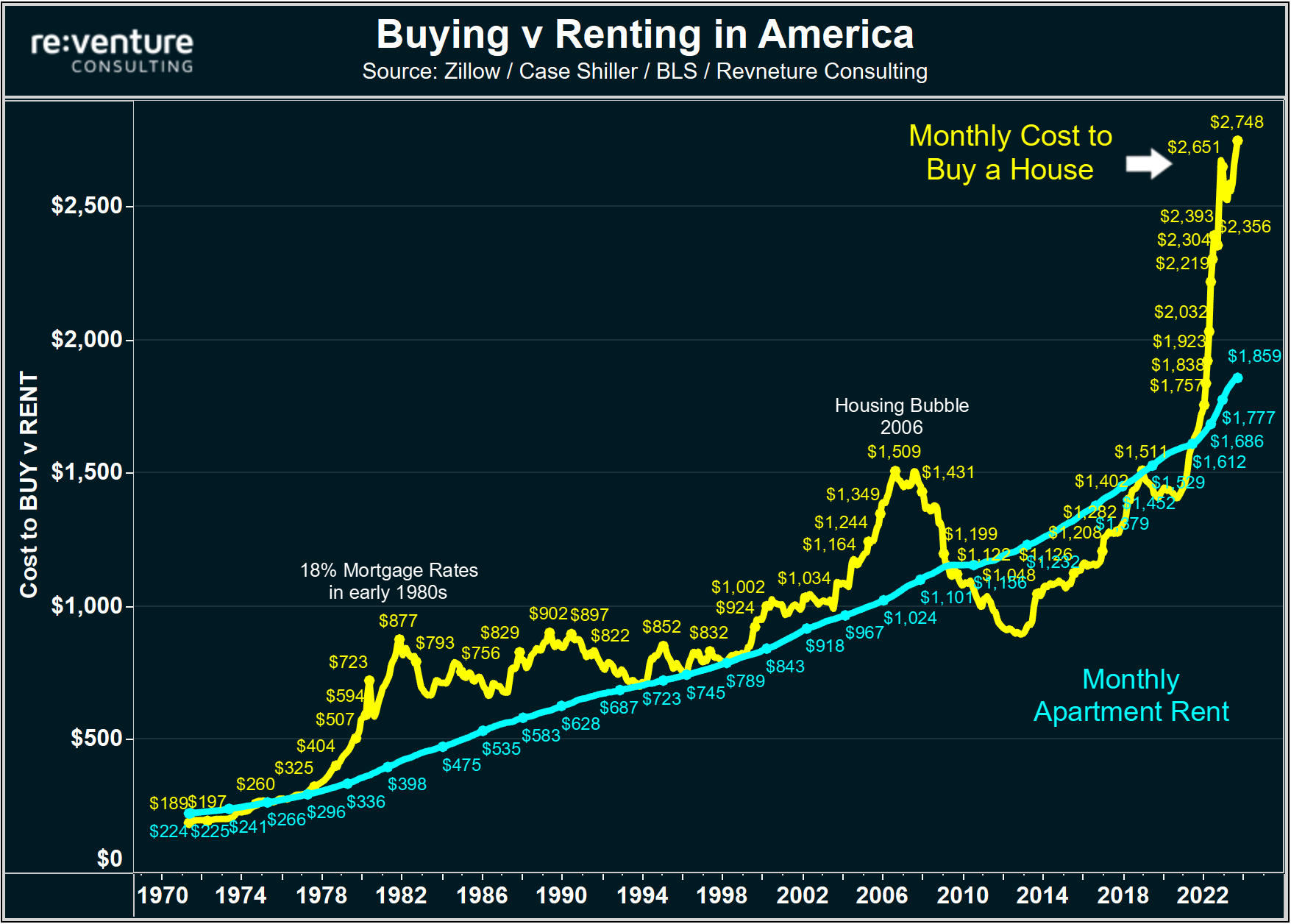

The way to really understand this is by comparing the Monthly Cost of Buying a House to the Monthly Apartment Rent in America. Currently, the typical American household would need to spend over $2,700/month on their mortgage payment, taxes, and insurance if they were to buy in today's market.

Meanwhile, the cost of renting a standard apartment in America is $1,859/month. Indicating that it is 50% more expensive to buy a house, a financial reality that is going to keep many first-time homebuyers on the sidelines.

There are only two ways this can go: 1) Home Prices Down or 2) Inflation Up

Ultimately the current situation in the Housing Market is not sustainable. We won't continue to see record-low homebuyer demand mixed with the worst affordability levels on record. Quite simply: something has to break.

Over the next several years, we will see either:

1) Home prices and mortgage rates go down significantly, making the cost of buying nominally cheaper, or

2) Rent and income levels go up significantly (aka inflation), increasing the incentive for households to buy even at higher prices and payments

These are the only paths forward, folks. There is no other "out" for the Housing Market. The cavernous gulf between the cost of owning and renting will not last. The sky-high DTI Ratios will not last. Eventually, they will be solved by falling prices or increasing rents/income.

And perhaps we see some combination of those things over the next several years, where home prices go down incrementally due to rock-bottom buyer demand, At the same time, inventory will increase as the economic downturn worsens and more owners are forced to sell. Perhaps home prices decline by 15-20% over three years while incomes grow by 10% in the same span. Such a combination would help restore affordability to the market and increase buyer demand.

What do prospective buyers do until then?

This begs an interesting question: what do prospective homebuyers do until the market resets (either through lower prices or higher incomes)?

Well, one option is to wait for home prices in your city to fall. This is likely the option that many people will choose.

However, there is another option: investigate housing markets that have more affordability. Believe it or not, there are still areas in America where it is still relatively affordable to buy a house in 2023.

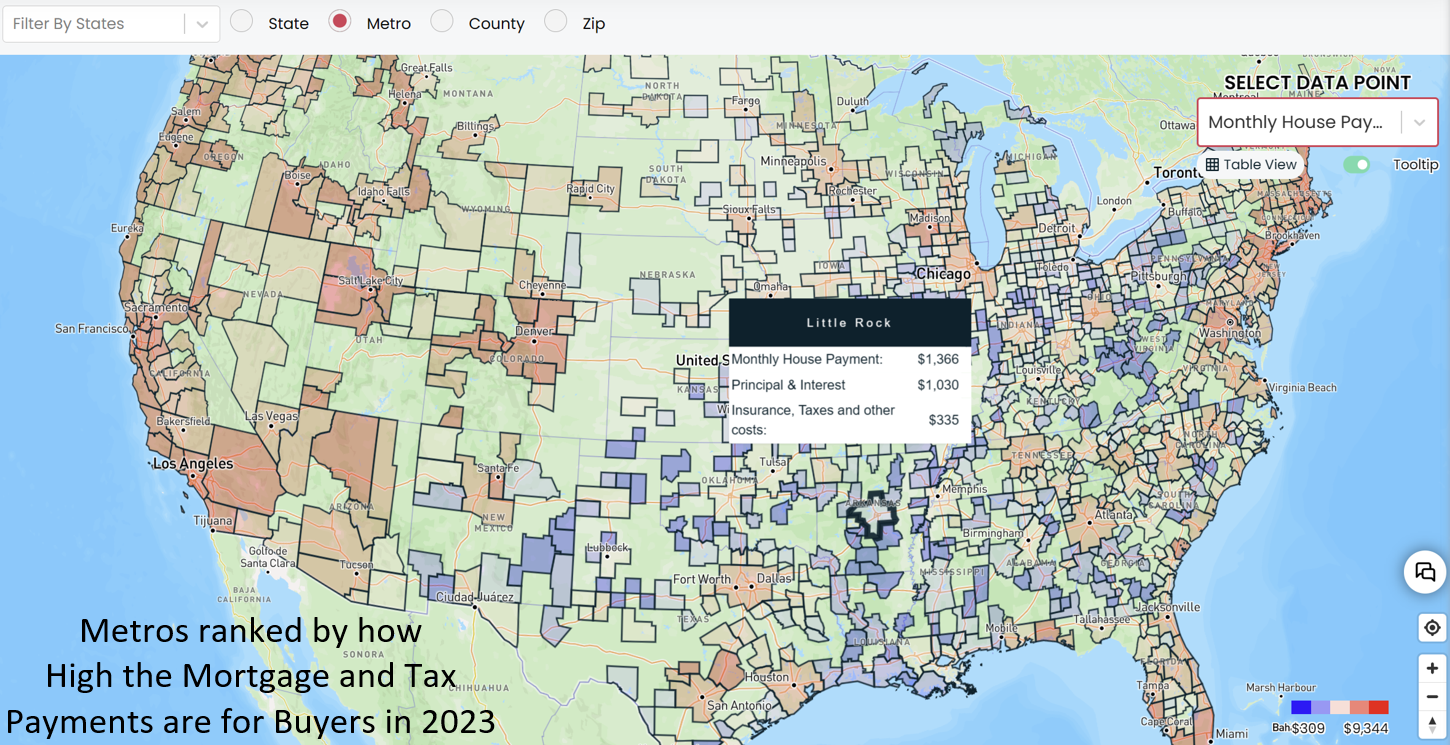

Data from the Reventure App shows the Monthly House Payment in every Metro across America, with the areas in Blue still offering buyers superior affordability.

States such as Arkansas, Alabama, Kentucky, Ohio, West Virginia, and Pennsylvania still have areas that are affordable, where Mortgage Payments are below $1,500/month even in a 7% Mortgage Rate environment.

Now that doesn't necessarily mean these areas are good places to live or invest in. However, for frustrated homebuyers and investors who are looking for value in 2023, it's probably worthwhile to know that such places do exist. You can use Reventure App to explore them and see if they fit the criteria of the type of place you would consider buying or moving to.

How long are you willing to wait?

But I'm curious to know - if you're set on buying in your local city, which I'm sure most of you are, I'd like to know how long you're willing to wait for affordability to improve.

Let us know in the comment section below and be sure to mention the state/metro you're looking to buy.

-Nick