10 Cities where Home Prices will Decline in 2023

By Nick Gerli | Posted on December 28, 2022Last week I wrote about the 10 Cities where home prices are already crashing. In metros like Austin, Phoenix, and Boise values are down 10% in just six months. And could go down another 30-40% before the bottom hits.

But here's the thing. The Housing Crash is spreading. Buyer demand has plummeted everywhere. Price Cuts have skyrocketed. And I predict by the end of 2023 there will be a long list of cities experiencing heavy value declines.

This post explores 10 Cities that are I believe are next in line for the Housing Crash. Tread very carefully if you're a homebuyer or investor in these areas. Values haven't gone down by much yet. But data on seller behavior in these markets from Realtor.com suggests prices are about to crash.

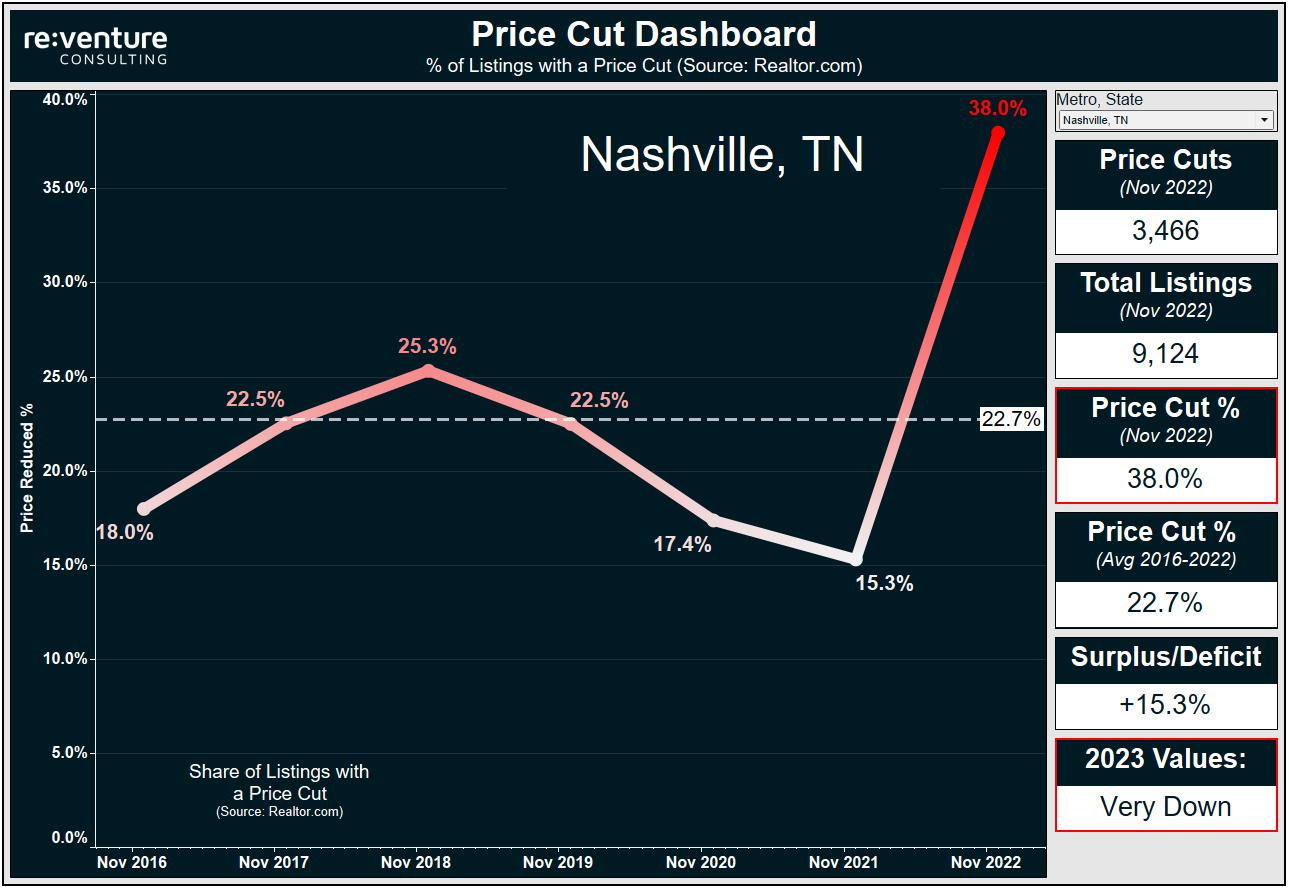

10. Nashville, TN

Nashville has done a good job "dodging" the initial stages of the Housing Crash in 2022. Even in the face of rapidly increasing inventory, home prices have remained flat over the last six months.

But that will change in 2023. A combination of ridiculous levels of home building combined with a decline in inbound migration is going to send prices in Nashville way, way down.

Consider this: currently, 38.0% of sellers in Nashville have cut the price on their listing (3.466 Cuts / 9,124 Listings). While in the typical month of November from 2016-2022, only 22.7% of sellers cut the price on their listings.

This +15.3% price cut "surplus" in Nashville is one of the highest in America. And indicates local sellers are bailing on the Housing Market. They want to sell now before values decline significantly in the future.

Expect value declines in Nashville to arrive very soon, with them hitting another gear in Spring 2023.

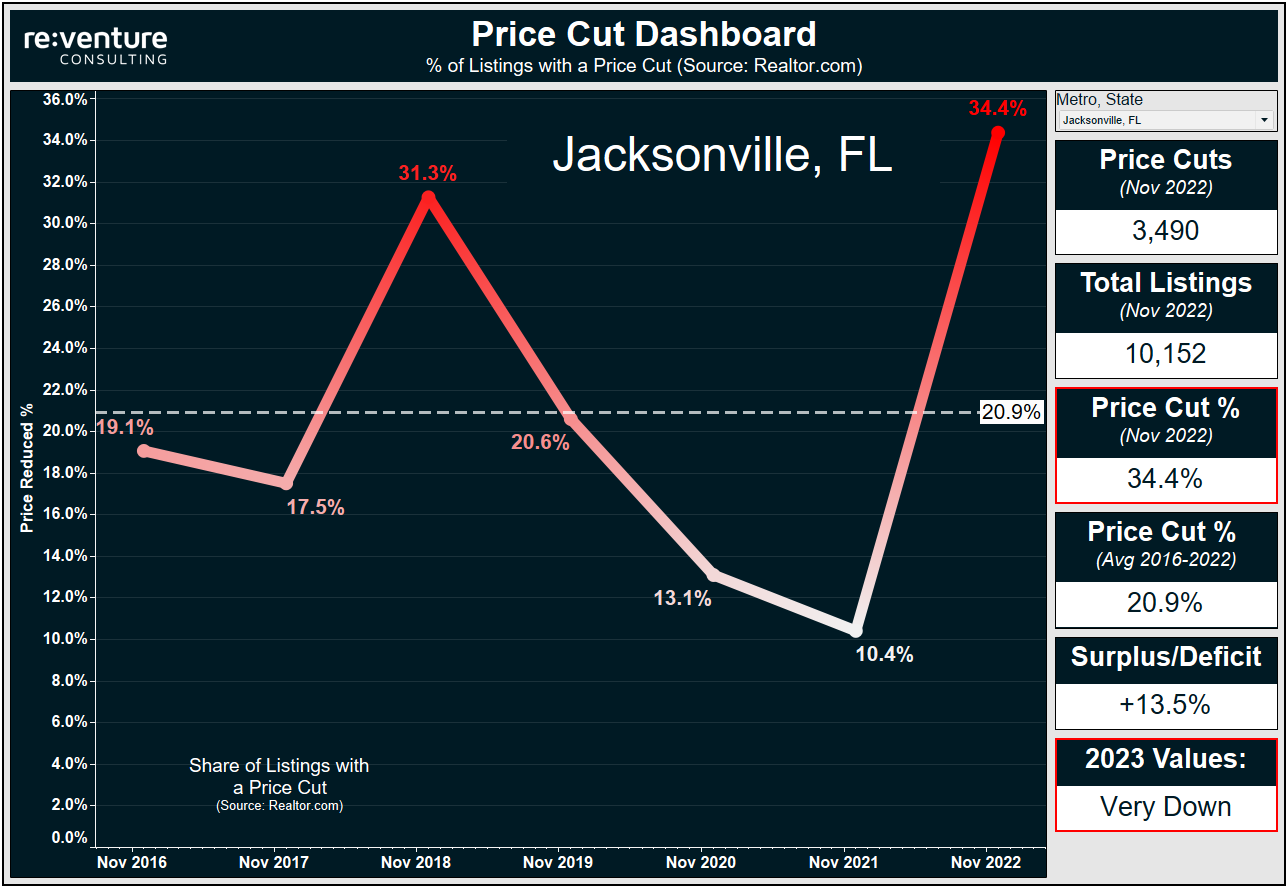

9. Jacksonville, FL

Jacksonville is the oft forgotten Florida Market. Everyone likes to talk about Miami, Tampa, and Orlando. But what about Jacksonville? Well I predict that by the end of 2023 Jacksonville will gain notoriety for its home price declines.

And the wheels are already in motion on these declines. According to Realtor.com, 34.4% of sellers in Jacksonville have cut the price on their listing (3,490 Price Cuts / 10,152 Total Listings). That's a record high level of price cuts in Jacksonville for the month of November (going back to 2016) and well above the typical price cut share of 20.9%.

As more and more sellers cut the price, the price cuts themselves will get larger and larger. And those larger price cuts will drive down home prices across Jacksonville in 2023.

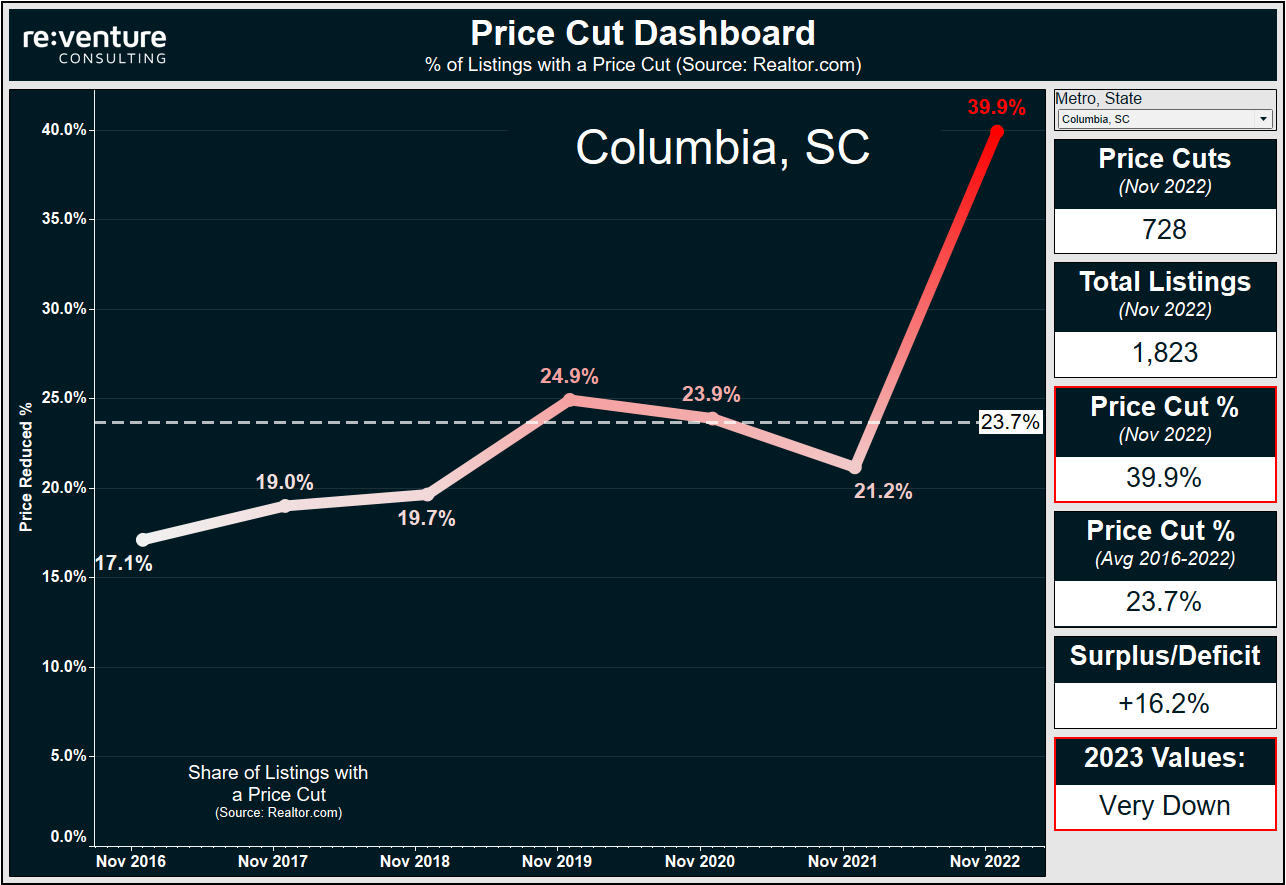

8. Columbia, SC

POP QUIZ: what's the capital of South Carolina? "Charleston", you say? EHHH, WRONG. The correct answer is Columbia, SC, a metro of 836k people situated directly in the heart of the state.

Columbia is an interesting Housing Market. Because it is still relatively affordable. The typical home value of $242k is 43% cheaper than the aforementioned Charleston. But despite this affordability Columbia is having issues.

Sellers have now cut the price on 39.9% of all listings in November 2022. Last year in the same month the figure was only 21.2%. So clearly the leverage in the market has shifted. And buyers in Columbia can now expect declining prices in 2023.

With that said - I don't think Columbia will "crash" as hard as some of the other cities on this list. Perhaps a 15% correction is in order.

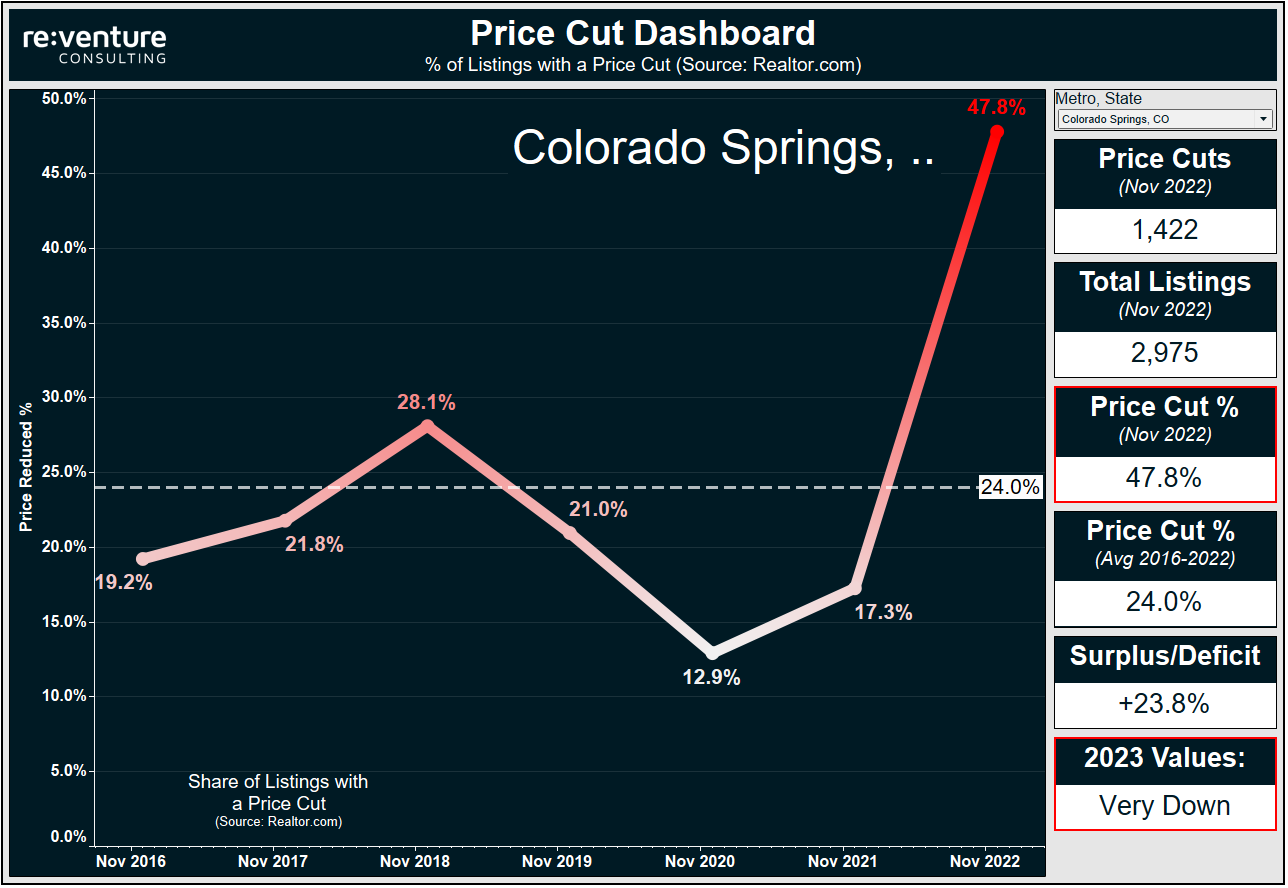

7. Colorado Springs, CO

This one is cheating a bit. Because Colorado Springs is a Housing Market that is already crashing, with values down -5% over the last six months.

However, it's a market we need to discuss. Because the level of price cuts is absolutely insane. 47.8% of listings had a price cut in November 2022, roughly DOUBLE the long-term average over the last six years (a wild +23.8% surplus).

Compare that to only one year ago when the share of price cuts was a measly 17.3%. Yikes. Sellers are panicking and trying to get out of the market before the crash gets worse.

And worse it will get. I have Colorado Springs pegged for another 25% decline in values before the bottom comes. Buckle up.

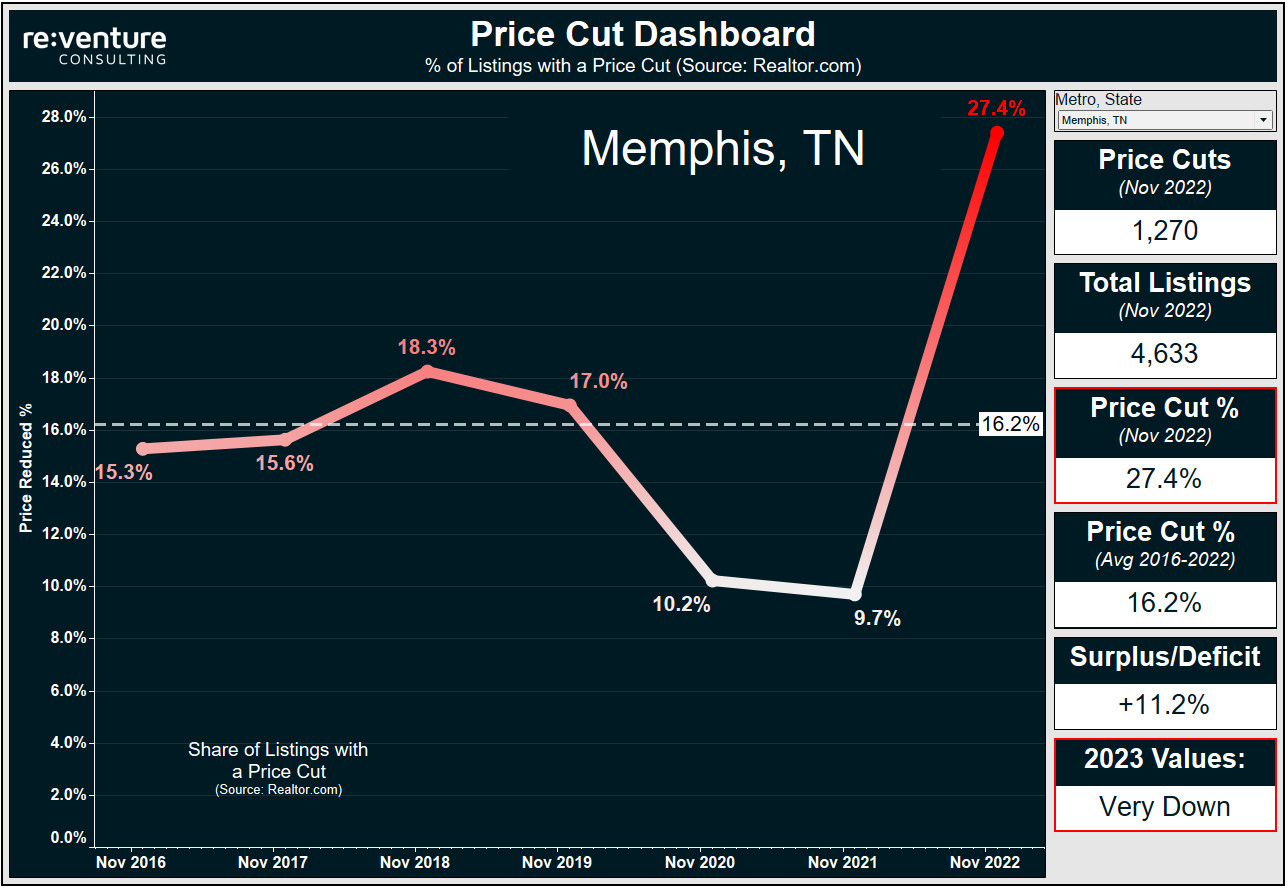

6. Memphis, TN

Let's head back to Tennessee for an under the radar market that has slowed significantly in recent months.

Memphis was a "hidden gem" for investors in 2020-21 because they knew they could buy at cheaper prices and get fairly high rental yields in return. But no longer is the market being so kind to these investors.

Inventory has doubled over the last year while the share of price cuts has tripled from 9.7% to 27.4%. Now, a 27.4% price cut share is lower than most of the other cities on this list. So maybe that eases some concern for local owners in Memphis.

But it shouldn't. Memphis is a low price cut market overall. When the market declines here, sellers will usually lower their initial list price rather than going through the song and dance of cutting the price.

But even now they are starting to do that. Watch out for big declines in 2023.

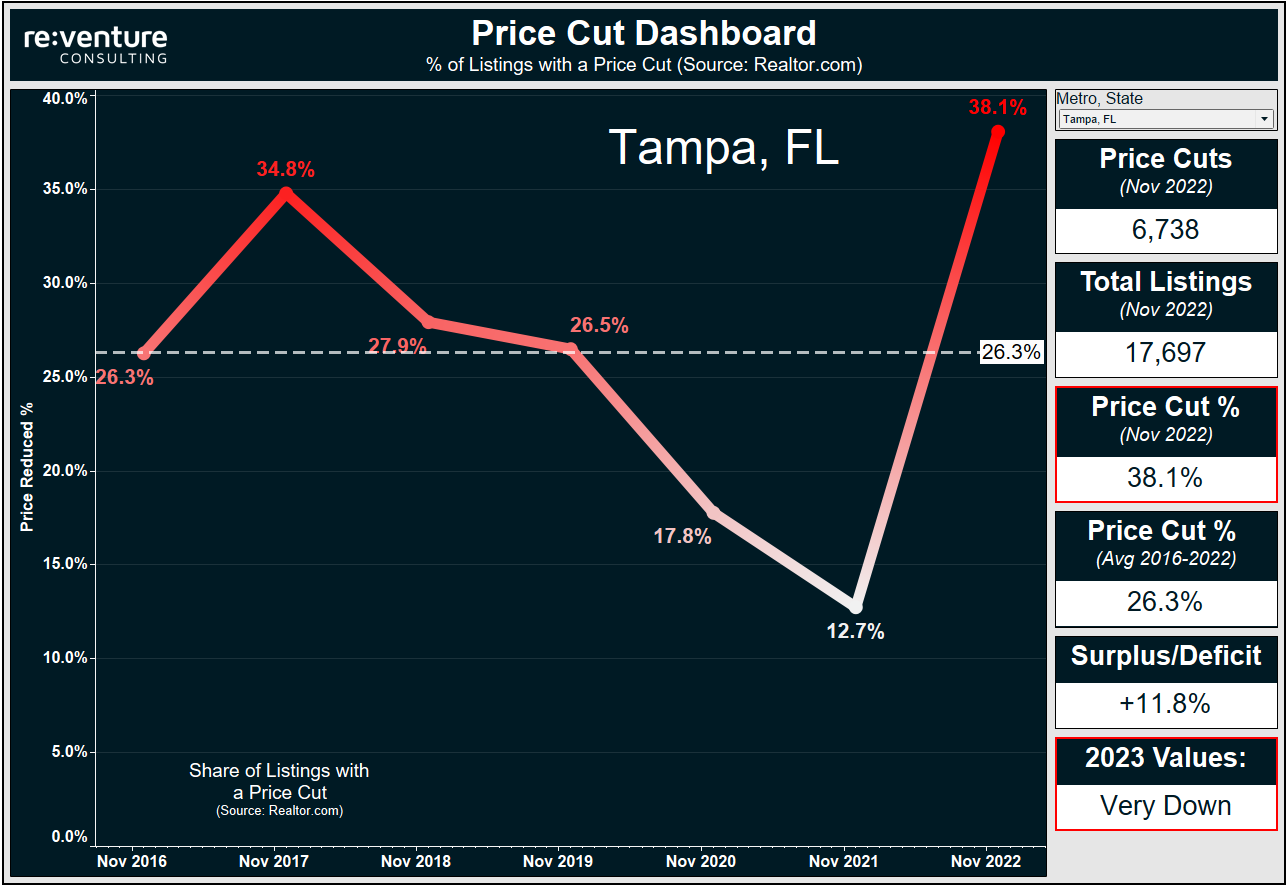

5. Tampa, FL

Tampa is a stubborn Housing Market. Inventory has skyrocketed. Price Cuts are way up. Rents are going down. But overall price levels have managed to remain stable over the last six months.

But that ends in 2023. A combination of declining investor demand to go along with big levels of home building are sinking the fundamentals of this Housing Market. And oh yeah - how about the complete lack of affordability? The local household in Tampa earns $66k/year and now needs to pay $30k/year to afford a mortgage.

Not sustainable. Which is why the share of price cuts in Tampa has tripled over the last year, all the way up to 38.1%. Which is at a +11.8% surplus to the long-run levels.

This downturn in Tampa is going to get messy. And it will kick into high gear in Spring 2023.

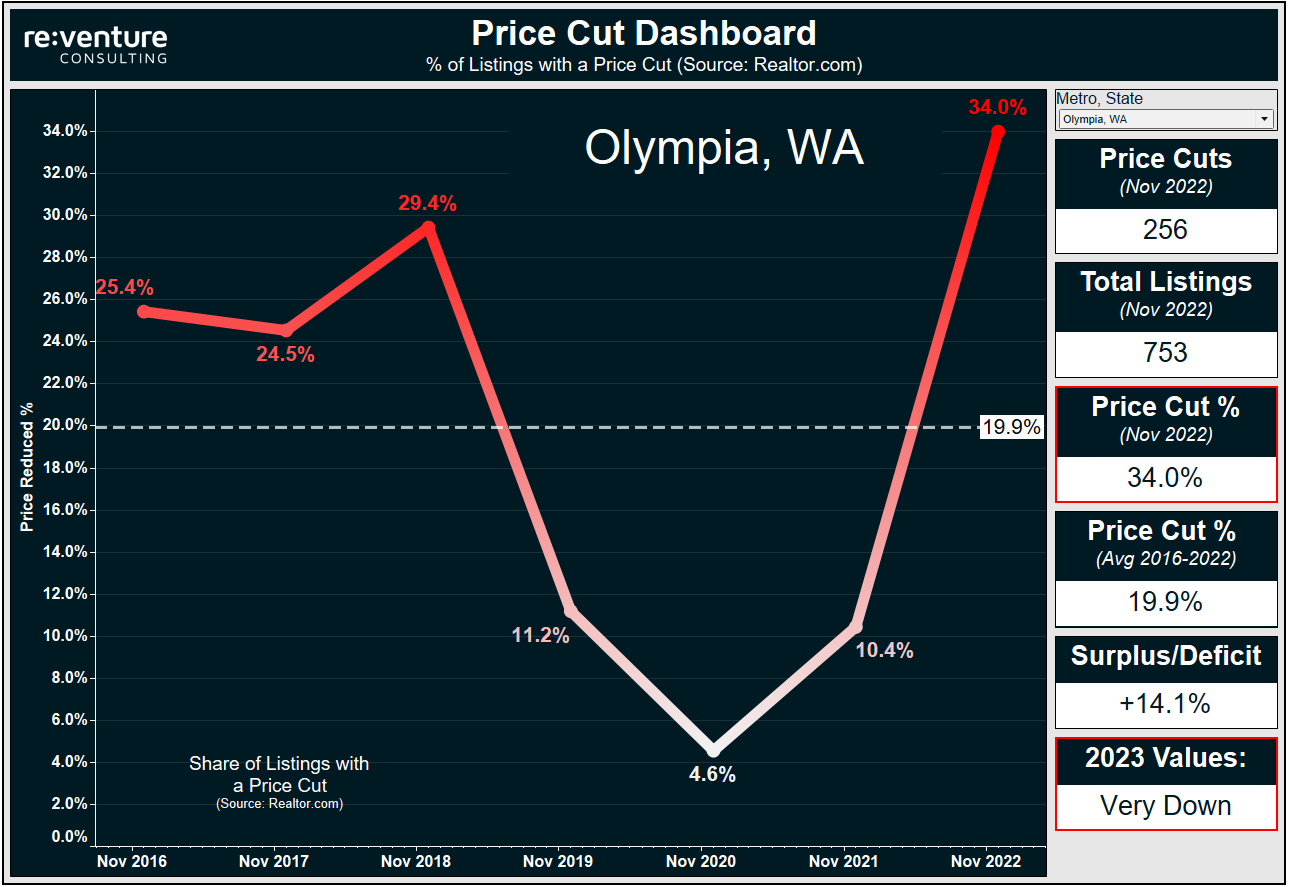

4. Olympia, WA

I had to check and see exactly where Olympia was located on a map. Turns out it's the capital of Washington and is situated a quick 1-hour drive southwest of Seattle and 30-minutes from Tacoma.

For Olympia I want you to pay special attention to the price cut graph. Notice how the housing boom in Olympia started back in November 2019, before the pandemic, when the price cut share dropped to a measly 11.2%. Then it fell lower to 4.6% in 2020. Before improving slightly to 10.4% in 2021.

For all homebuyers out there - in Olympia or otherwise - you need to understand that today's sky-high prices are the function of 2-3 years of misalignments where sellers had all the leverage.

But now that's over. Sellers have cut the price on 34% of listings in Olympia. A signal that values could drop precipitously in 2023 as the Housing Crash worsens. Don't be surprised if there's a 25% decline in values before the bottom hits.

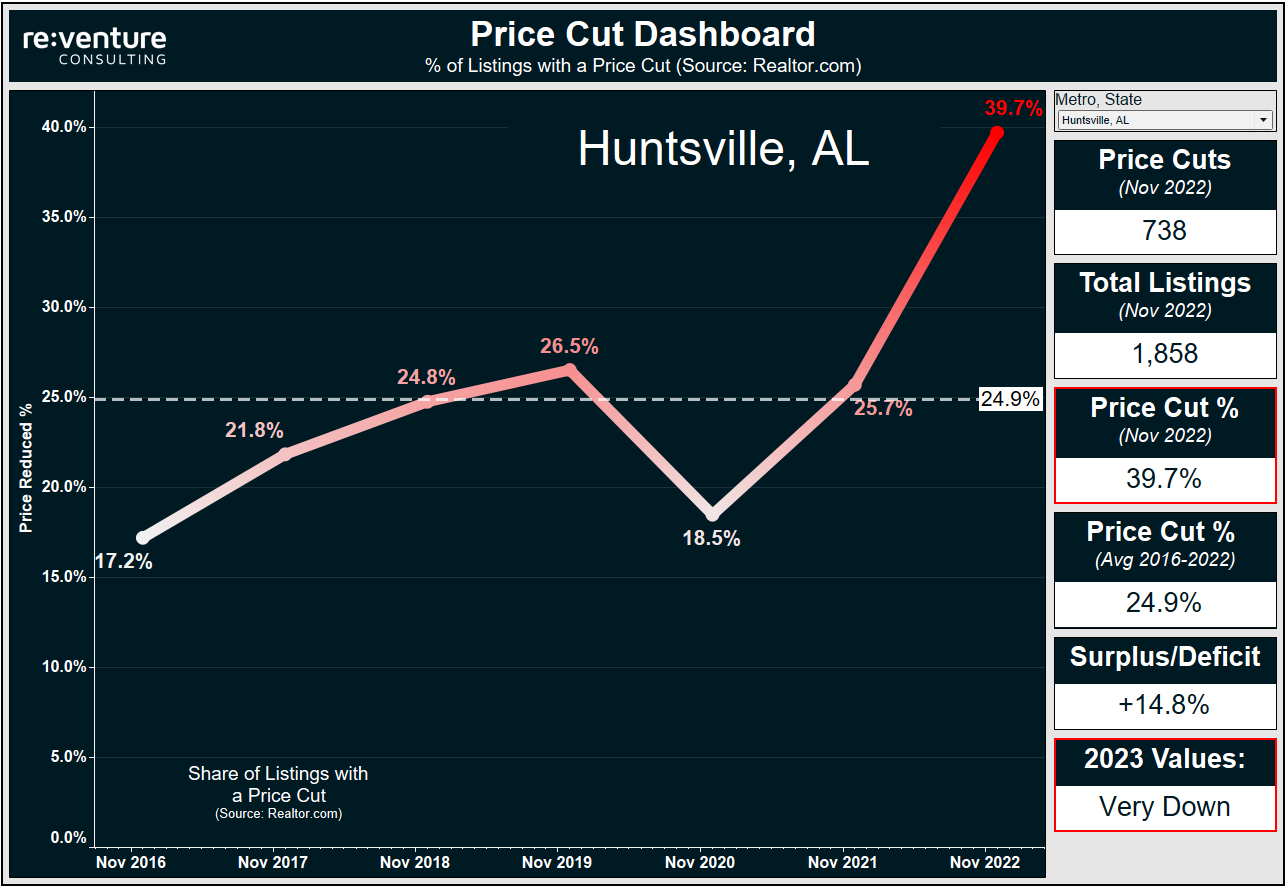

3. Huntsville, AL

It pains me to put Huntsville on this list. It's a personal favorite Housing Market of mine that I truly believe in over the long-run. However, things have taken a turn for the worse in the Alabama Space metro.

Sellers are now cutting the price on nearly 40% of all listings. A massive +14.8% surplus to the long-run average for November according to Realtor.com's data. This signals that the price action in Huntsville is going trend "Very Down" in 2023.

Which will actually be welcome news for Huntsville homebuyers. Because values have kept going up over the last six months. There's been some definite resiliency to this market, likely driven by its high local incomes and still somewhat affordable home prices.

But a correction is coming. And it starts very soon.

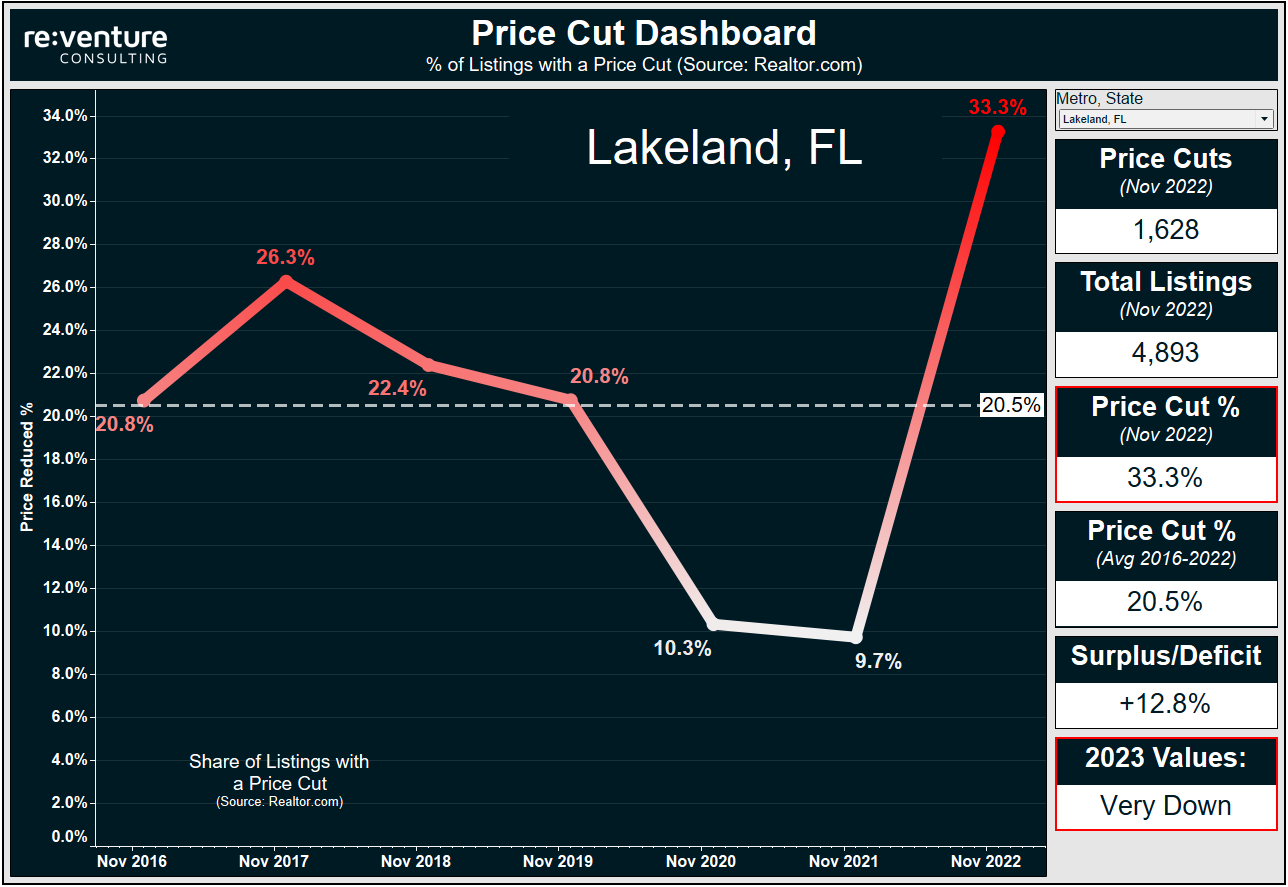

2. Lakeland, FL

If you don't live in Florida, chances are you don't know where Lakeland is. It's a metro that doesn't have much industry on its own. It mainly serves as a "stop along the way" between Orlando and Tampa.

This "stop long" metro absolutely boomed during the pandemic. Lots of inbound migration. Crazy home price appreciation on the order of +65% in 3 years. Price cuts dropped all the way down to a record low of 9.7% in November 2021. Indicating just how tight this Housing Market was.

But now everything has changed. Over 33% of sellers are now cutting the price, the highest November on record according to Realtor.com. A combination of reduced migration, huge levels of home building, and an utter lack of affordability for locals has caused the leverage in to shift from seller to buyer.

Expect prices in Lakeland to go down in earnest throughout 2023.

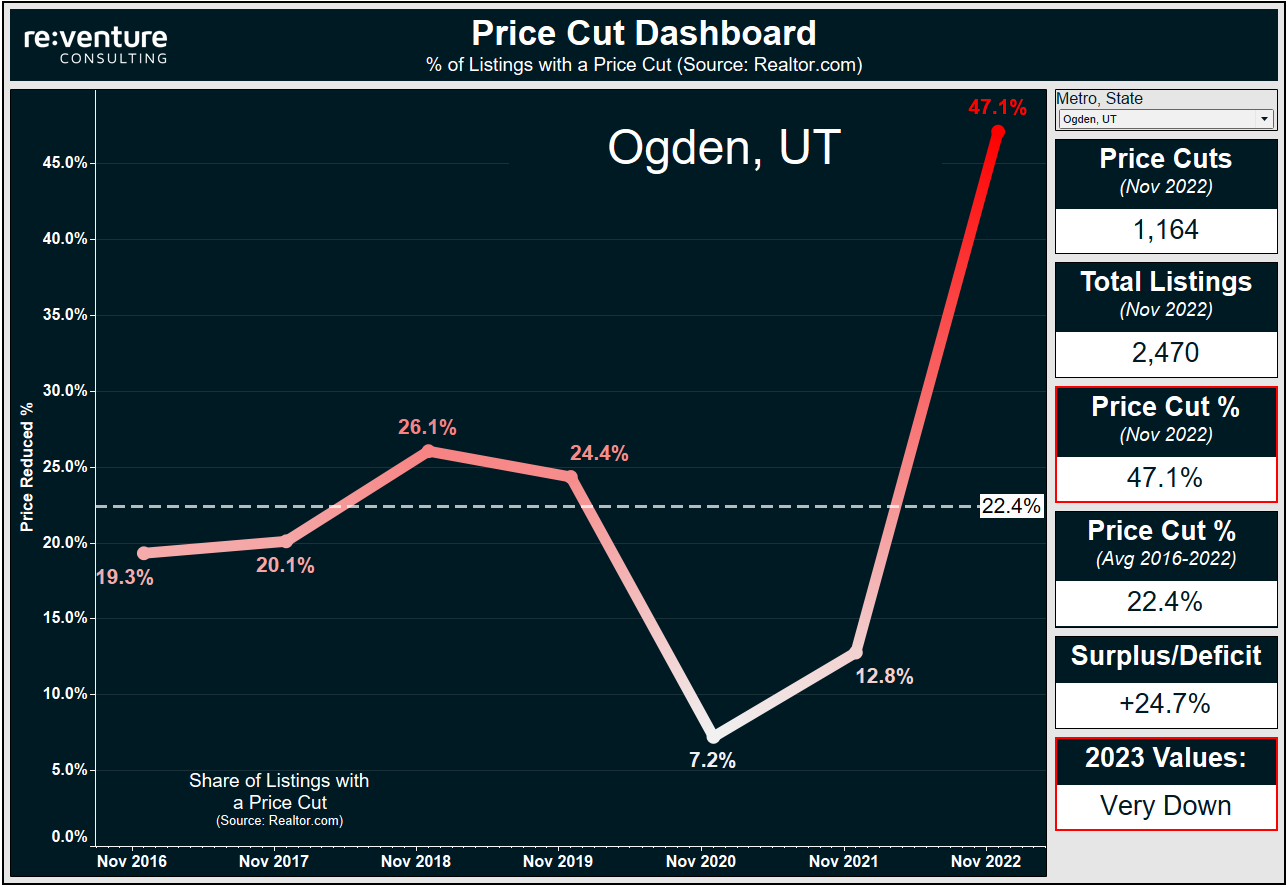

1. Ogden, UT

I must confess. I am cheating with the #1 choice. Because Ogden, UT, situated just north of Salt Lake City, is a market that is already crashing. Values are down 5-10% over the last six months depending on the source.

However, the epic surge in price cuts that's happening here is something I needed to show you all. An amazing 47.1% of all listings in Ogden currently have a price cut. Just how high is that?

Well, it's more than double the long-term average of 22.4% price cuts. It's nearly 4x higher than the 12.8% price cut share in November 2021.

It signifies a market that is going to continue crashing in 2023 as values need to fall by 30% to restore affordability for local homebuyers.

I hope you all enjoyed this post. Let me know your thoughts in the comments. Also make sure to leave requests for other markets to cover in future posts.

Before signing off - I wanted to clarify something about this Price Cut Data. Regarding what it does and what is does not do.

What It Does: helps inform you on the direction that prices are going in the next 12 Months. If 40% of sellers are cutting the price today, compared to 20% normally, that's a strong indication that sellers themselves expect prices to go down. And want out before it happens. Conversely, if the price cut share goes down to 10%, just like what happened in 2020-21, it shows that sellers expect prices to go up in the future.

What It Does NOT do: the Price Cut % does NOT tell you how fundamentally overvalued the market is. For instance, there were cities on this list (Ogden, Colorado Springs) that could have another 30% to crash. But there are also cities like Columbia, SC where a 15% correction is more likely. Metrics like P/E Ratio and P/R (Price to Rent) Ratio do a better job explaining how much values could drop and where the bottom will be.

An astute homebuyer/real estate investors would use this Price Cut data in conjunction with metrics like P/E Ratio to get a better sense of where their Housing Market is heading.

To YouTube Channel Members: we will be doing a livestream using this Price Cut Data next week. Stay tuned for updates on the YouTube Members Board.

-Nick