How the Fed destroyed the US Housing Market

By Nick Gerli | Posted on April 24, 2023The 2023 Housing Market is frozen. Buyer demand is way down. But so are new listings. After a 9-month correction, prices are going back up this spring. And are still near all-time highs.

So I thought it would be good to ask: how did we even get to this point in the Housing Market?

And in particular - what was the Fed's role in creating this monstrosity of a Housing Bubble?

And most importantly - what will be their role in bringing about the inevitable crash?

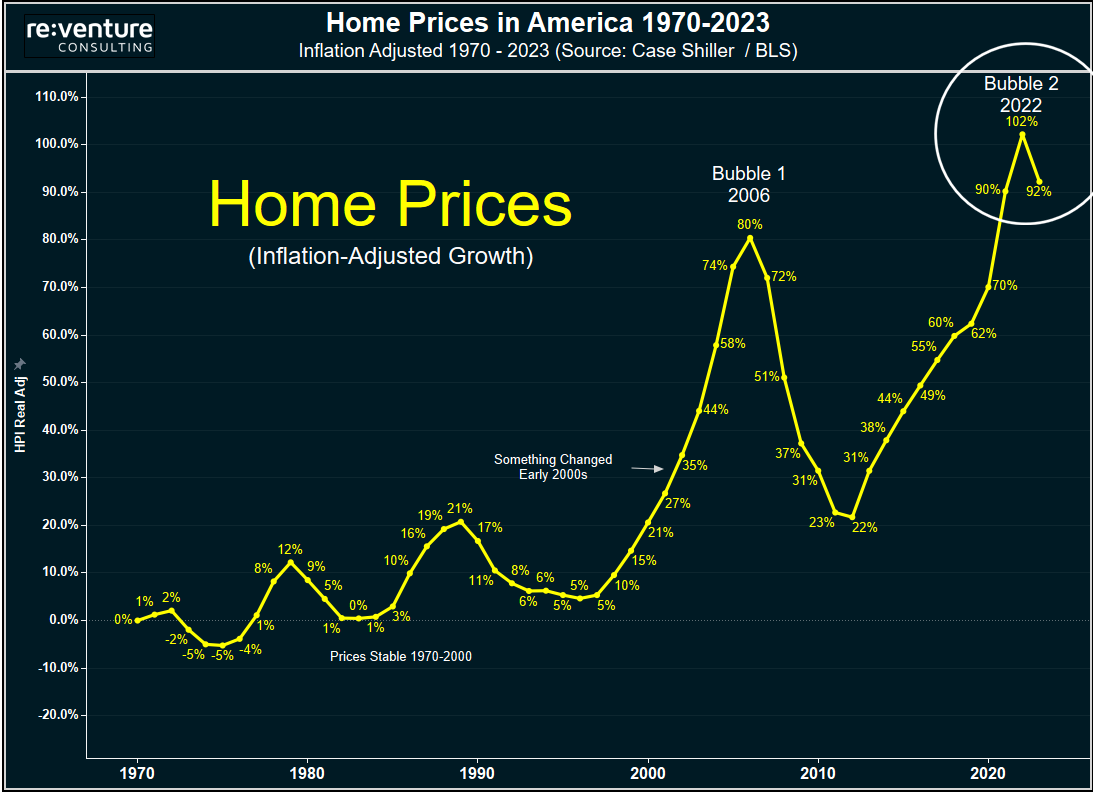

1) Home Prices still ridiculously high.

The first point to understand is that home prices are still ridiculously high. Way higher than the fundamentals support. You can see this outlined on the graph below which tracks the growth rate in inflation-adjusted home prices the last 50 years.

Home prices were very stable from 1970 to 2000. But something changed in the early 2000s. All of a sudden home prices began increasing at a much faster rate than inflation.

Home prices peaked in 2006 in the first bubble at 80% growth from 1970. Then they corrected a bit in 2007. And by 2008 the full-scale crash was on.

Fast forward to 2022 and the Housing Market peaked in an even bigger bubble. Inflation-adjusted prices were up 102% from their 1970 levels. And while the recent correction has brought them down, prices today are still higher than the peak of Bubble 1 in 2006.

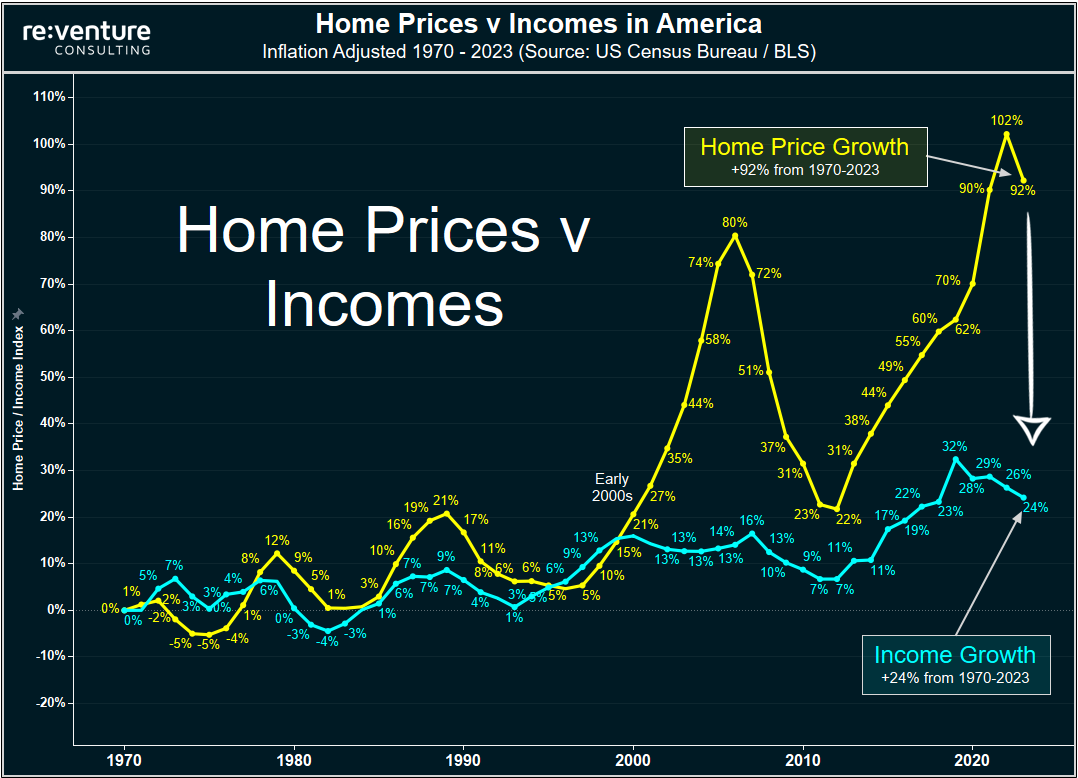

2) Incomes are not keeping pace.

In one second I'm going to tell you what changed in the early 2000s to usher in this new era of home price volatility.

But first I need to point out why this growth in home prices is not sustainable. And will inevitably come crashing down. And that's because income growth - the single most important fundamental for the housing market - is not even close to keeping up.

The Median Family Income in America has only grown by 24% in inflation-adjusted terms since 1970. And it's barely grown at all since the late 1990s. This means that American families are really no better off financially now than they were in decades past due to the damaging effects of inflation.

Meanwhile, inflation-adjusted home prices have increased by 92% over the same period. At a rate nearly 4x faster than income growth. Which theoretically shouldn't be able to happen since its incomes which support homeowner's ability to make mortgage payments.

Once again - you can see the divergence that occurred in the early 2000s. Prior to that, home prices and incomes tracked each other nearly 1-for-1. But since then home prices have been in two bubbles and grown increasingly volatile.

So, what changed in the early 2000s...?

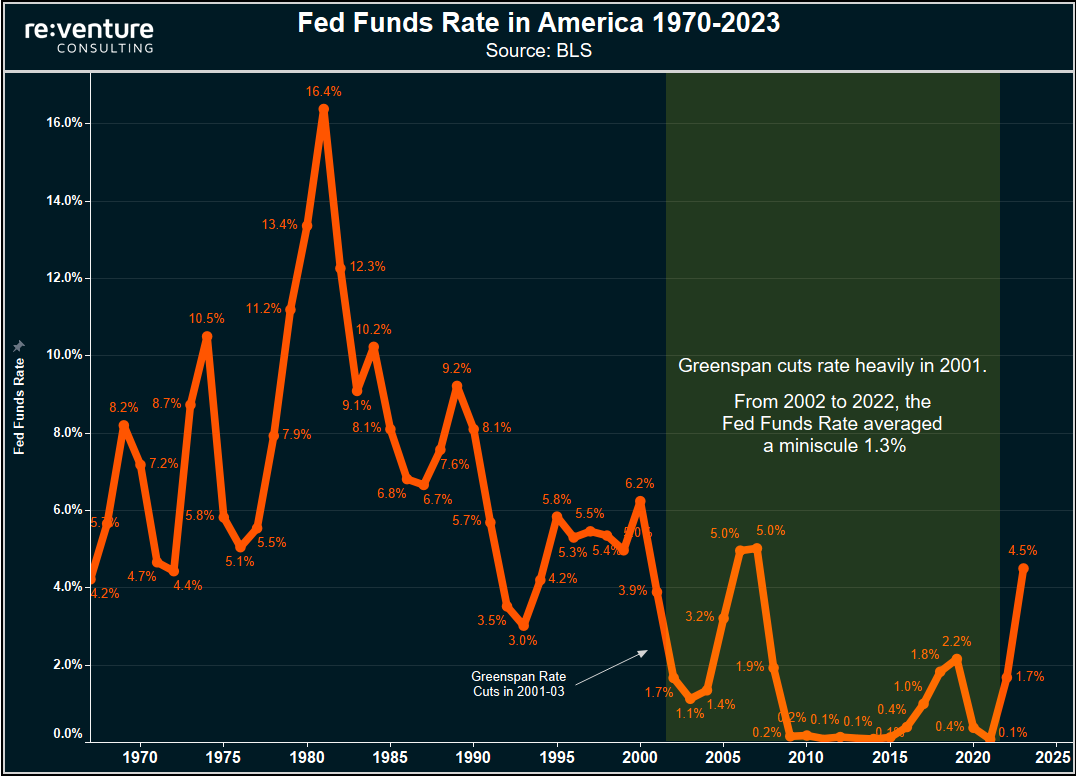

3) It's Alan Greenspan's fault. What he did in 2001 changed everything.

If you're not familiar with Alan Greenspan, you should be.

He was the 13th chair of the Federal Reserve, serving from 1987 to 2006. He was the longest serving Fed Chair in US History at 19 years. Spanning four different presidents.

He was known for his easy-money policies that inflated several different asset bubbles. Most notably the Dotcom Bubble in the late 1990s and then the first Housing Bubble in the mid-2000s.

Greenspan created these bubbles by slashing interest rates. Particularly in 2001, when he started reducing the Fed Funds Rate from 6.0% all the way down to 1.0% several years later. A historic level of monetary easing that America had never seen before.

The immediate result was that Mortgage Rates went down. And home prices went up. But more importantly - Greenspan sent a clear message to all the risk takers in the economy that the Fed would be there to bail them out if things ever went south (aka, the "Fed Put").

A message that subsequent fed chairs like Bernanke and Powell reinforced over the last 20 years as our economy became more and more hooked on the drip feed of low interest rates. If there was ever any economic instability, or even the prospect of instability, rates would get cut.

This perpetual Fed Put over the last 20 years led to the Fed Funds Rate averaging a mere 1.3% from 2002 to 2022.

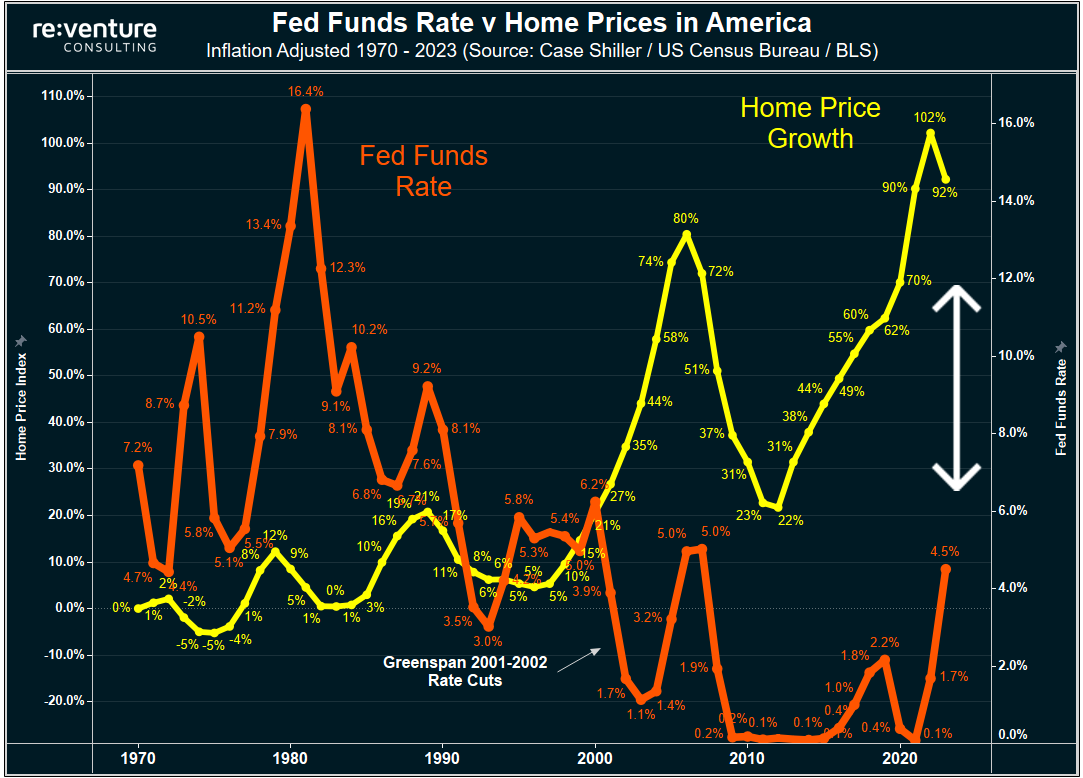

4) Cheap Rates cause Home Prices to go up faster than Incomes.

And ultimately it was these cheap interest rates that perpetuated the dueling Housing Bubbles that occurred in 2006 and 2022. And allowed home prices to detach from fundamentals and increase way faster than incomes.

The graph below makes this point very clear. Home price growth became detached from its long-term norms precisely when Greenspan did his unprecedented rate cuts in 2001-2002.

And it was off to the races after that.

When interest rates are cheap, it allows homeowners to borrow money at cheaper mortgage rates, lowering their monthly payment. And thus making up for the fact that income growth hasn't kept pace with the growth in prices.

Moreover, low rates encourage a huge amount of speculative investor activity in the housing market. Both on the part of flippers as well as landlords who rent properties out. This investor activity makes the Housing Market more volatile and prone to bubbles.

5) The Fed is hiking interest rates again. When will Home Prices crash?

Jerome Powell, in his effort to combat inflation and restore normalcy to monetary policy, has aggressively hiked interest rates in 2022 and 2023. And home prices have started to come down as a result.

But they're still ridiculously high. And in some cities home prices are going back up this spring.

So what gives? If interest rates are the driver of prices, why haven't prices crashed by 30% already?

It's because Greenspan's easy monetary policy juiced the economy and housing market for 20 years. Market participants - both regular homebuyers and investors alike - got used to the "good times". With many still acting as if the good times are here.

They're stubborn. Some still want to buy a house at a payment they can't afford. Others still think the can make a career out of real estate investing even though they'll lose money on their rental after paying their lender. There's a suspension of disbelief going on right now that everything is fine.

As a result: it's going to take more than one year of rate hikes and economic instability to convince homeowners and investors to give up and sell off.

6) Home Builders are "rejecting" the Fed's rate hikes.

The clearest example you can use to understand this suspension of disbelief is to look at what Home Builders are doing. Builders like DR Horton are offering their homebuyers 5.25% mortgage rates right now when the prevailing market rate is 6.66%.

How is DR Horton doing that? They're paying for expensive mortgage rate buydowns that cost them anywhere from $10-15k per home sold. These buydowns resulted in DR Horton's profits crashing by 35% in their latest earnings report.

What DR Horton is essentially doing here is rejecting the Fed's rate hikes.

The mortgage rate they need to keep their sales velocity and top line revenue humming is 5.3%. So that's how they're doing business. Of course - that's coming at a huge cost with the expensive buydowns.

But DR Horton doesn't mind so long as they can keep up the appearance of "high demand". And show their shareholders and investors top line revenue which is holding firm.

I've talked to home flippers and landlords who are employing a similar business strategy right now in 2023. Their profitability is going down. They're not making much money on new transactions. But that's okay.

Their current mindset is to keep the sales volume moving and all the staff on payroll until the Fed pivots and cuts rates. Thereby restoring profitability and saving the economy from a bad recession.

7) But what if the Fed doesn't pivot? And what if the Recession gets worse?

I was in the Fed Pivot camp for a long-time. In my 2023 Predictions I predicted a pivot by April 2023.

But clearly that's not happening.

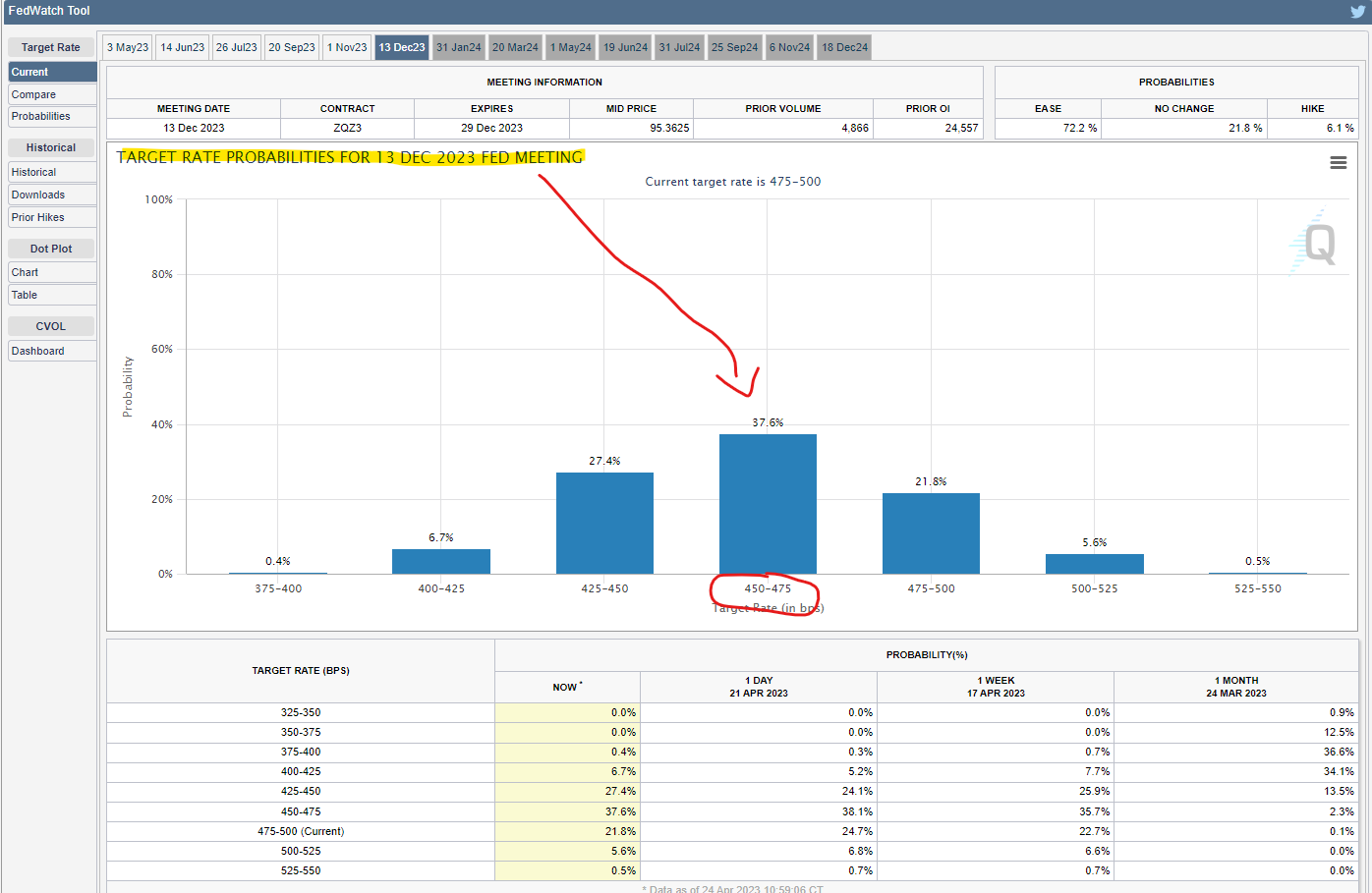

In fact - the betting markets think that by the end 2023, the Federal Funds Rate will be sitting between 4.50% to 4.75%.

That would reflect a 25bps cut from today's rates. And be aligned with a 30-year mortgage rate around 6.3%. Which would be a big problem for investors and builders.

Because if mortgage rates are still above 6% at the end of 2023, there will start to be real capitulation. The money backing these investors will get frustrated and begin asking tough questions.

"When will we start seeing betters returns?"

"The market isn't turning around. I want some of my principal back. When will you begin selling off the portfolio to pay me back?"

In essence, the 20-years of delusion that started from the Greenspan put will begin to fade. And reality will begin to set in. Capital could exit the housing market at a ferocious pace. Especially if the economy tips further into recession.

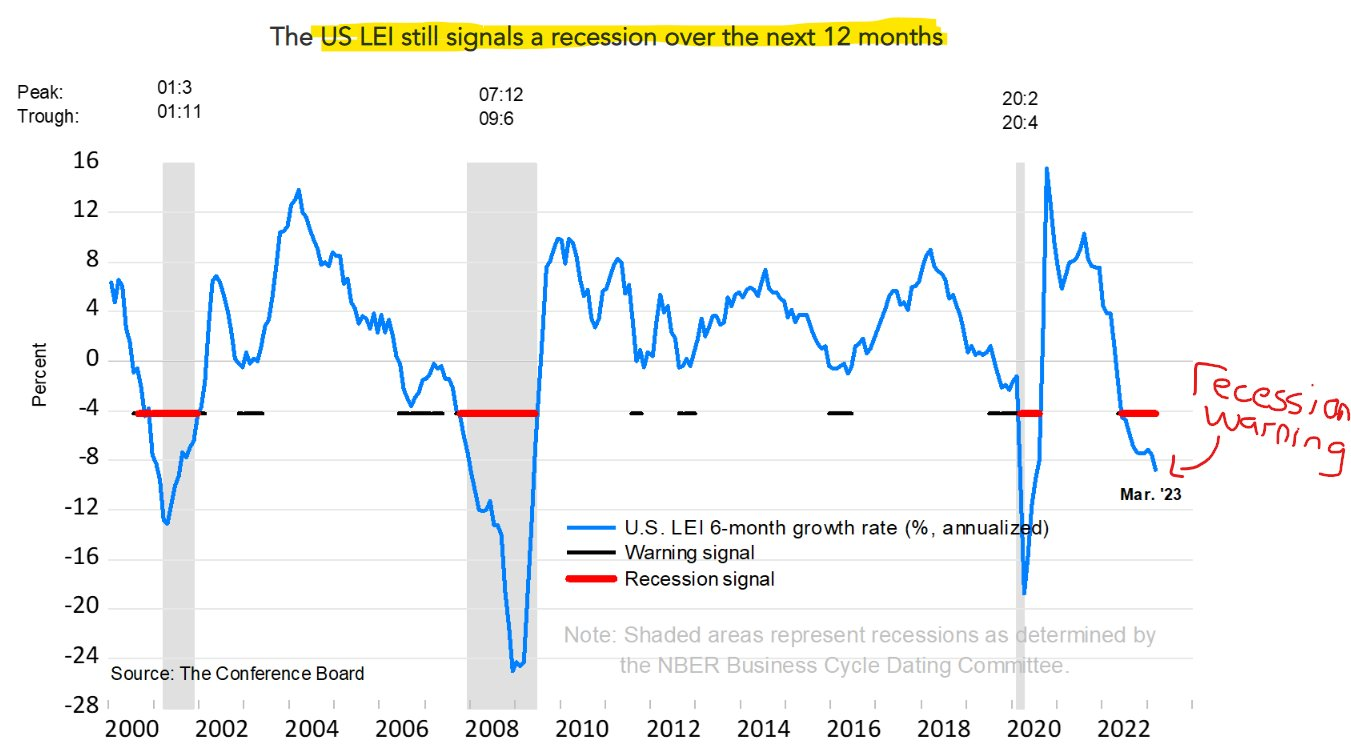

Right now the unemployment rate is still at a record low 3.5%. But the leading indicators for the future suggest the job losses will spike soon. In particular, the Conference Board's Leading Economic Indicator ("LEI") metric dipped further into recession territory in March 2023.

This LEI index uses a combination of inputs such as hours worked, credit conditions, building permits, manufacturing orders, and stock market indices to forecast turning points in the business cycle. It has predicted every recession since 1970 by about 6-12 months. The current timing of the LEI contraction suggests job losses will begin to mount by Summer 2023.

And if the unemployment rate goes up substantially, there will be real problems in the Housing Market. Mortgage defaults and evictions will surge. Rent growth will stagnate more, and potentially go negative again. Overall homebuyer sentiment will worsen. This is a reality that few participants in the housing market are taking seriously right now.

8) A reminder from 2008: s*** didn't hit the fan until job losses spiked.

An important lesson to learn from the last Housing Crash is timing.

1) First home sales collapse (2006).

2) Then prices start dipping (2007).

3) Then job losses mount and home prices really start going down (2008).

4) Then the foreclosures hit hard (2009-2010). Making the crash worse.

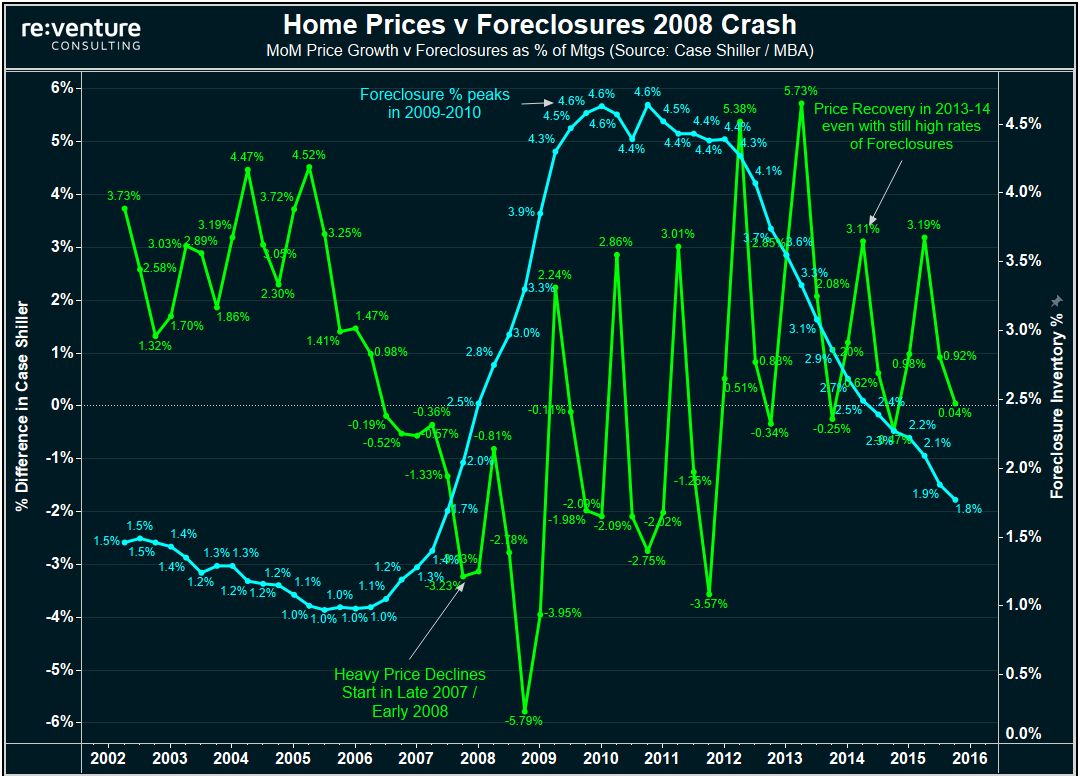

I find that many people have their recollection of this order of events reversed. They think foreclosures came first and caused the last Housing Crash. But that's not true. Prices were dropping before the number of foreclosures on the market spiked.

The initial price drops started in late 2006 and early 2007. While Foreclosures were near a record low 1.0%. Similar to the current environment.

Prices then really started tanking in late 2007 / early 2008, as unemployment claims began to rise and forced selling situations occurred. Foreclosures were increasing at this point, but hadn't reached catastrophic levels yet.

Those catastrophic foreclosure levels came in 2009 and 2010, when nearly 5% of all mortgages in America were in foreclosure. Interestingly - that's about the time period when the price declines abated.

All this is to say - job losses are hugely important to putting sustained downward pressure on home prices. They create the panic and liquidity needs necessary to override two decades of conditioning from the Fed that "everything will be okay".

And to this point we haven't seen the type of job losses needed to necessitate the forced selling that will cause big, 2008-style price drops (outside of markets like Austin/Boise, which are in freefall with 20% declines in a year).

But that doesn't mean the job losses won't come.

9) The Fed made a mess of the Housing Market. It will take time to clean it up.

I know that there's a lot of you who have been following me for a long time. It was two years ago that I first called the Housing Bubble in America and predicted the crash. Some of my predictions came true fairly quickly after that. Others haven't materialized yet.

Over the last year I have been continually surprised by the resilience (stubbornness?) of investors and sellers in the Housing Market. Even though all the fundamental data suggests it's time to sell and get out of the market, people have resisted doing it. The result is that new listings are down 21% YoY in April with inventory remaining low as a result.

The central question at hand now in 2023 is if sellers in the Housing Market will be able to keep being stubborn. And holding inventory from the market. Or if at some point their hand will be forced to sell.

I believe they will as fatigue from higher interest rates sets in and a job loss recession causes forced selling.

Remember - it took 20 years for the Fed to make a mess of this Housing Market. It will likely take more than one year for them to clean it up.

I hope you all enjoyed this post. Next week I will be diving into a topic I'm sure some of you already thinking about after reading this post:

the myth of the "Housing Shortage" in America.

This supposed housing shortage is one argument that realtors and investors hammer over and over in their effort to explain why "this time will be different".

Trouble is - there is no structural shortage of houses. In fact, America has the most houses it ever has relative to its population and employment. Instead, the perceived shortage today is the result of years of government manipulation of the market, particularly foreclosures.

Stay tuned a post and video coming out next week on that topic.

-Nick