DO NOT BUY: 10 Cities where Renting is Cheaper

By Nick Gerli | Posted on February 2, 2023(THE LINK WORKS NOW)

Should you Buy a House in 2023? Or should you wait for the crash to get worse?

These are the questions swirling in the minds of Homebuyers and Real Estate Investors right now. And one of the best ways to answer this question is by considering an often overlooked data point: RENT.

More specifically - by comparing the Cost of Renting to the Cost of Owning a Home. If Renting is cheaper than Owning, then it becomes a much easier decision to wait out the Housing Crash.

In this post we will cover the 10 Cities where Renting is much cheaper than Buying. These are cities where prices will need to decline substantially before homebuyers have a financial incentive to return to the market.

(Quick note before we start - the Cost of Owning is based on the combination of Mortgage Payments, Property Taxes, and Insurance Costs required to buy a home in each Metro in early 2023. The Cost of Renting is based on Zillow's Typical Rent Index.)

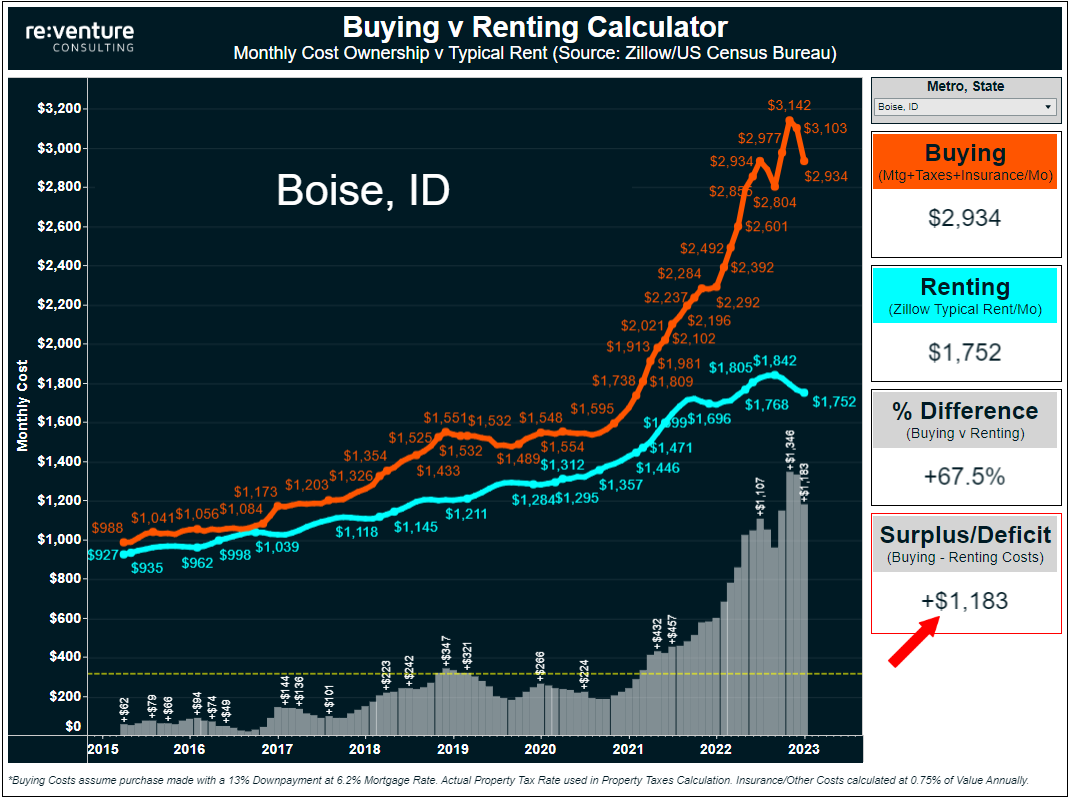

10. Boise, ID

Boise, ID will go down as the 1st market to Crash. Prices started going down here in late 2021 when they were still going up everywhere else. However, these initial price declines have not been close to enough to restore affordability to the market, and the result has been a massive collapse in buyer demand.

Why are buyers fleeing the Boise Housing Market? Because the cost to buy right now is $2,934/Month. That's a massive 68% higher than the $1,752/Month cost to Rent. No wonder home sales have fallen off a cliff. It simply makes zero financial sense to buy in Boise right now.

Home Prices in Boise will likely need to fall by a lot more before affordability is restored and buyers return. I'm projecting 30% declines.

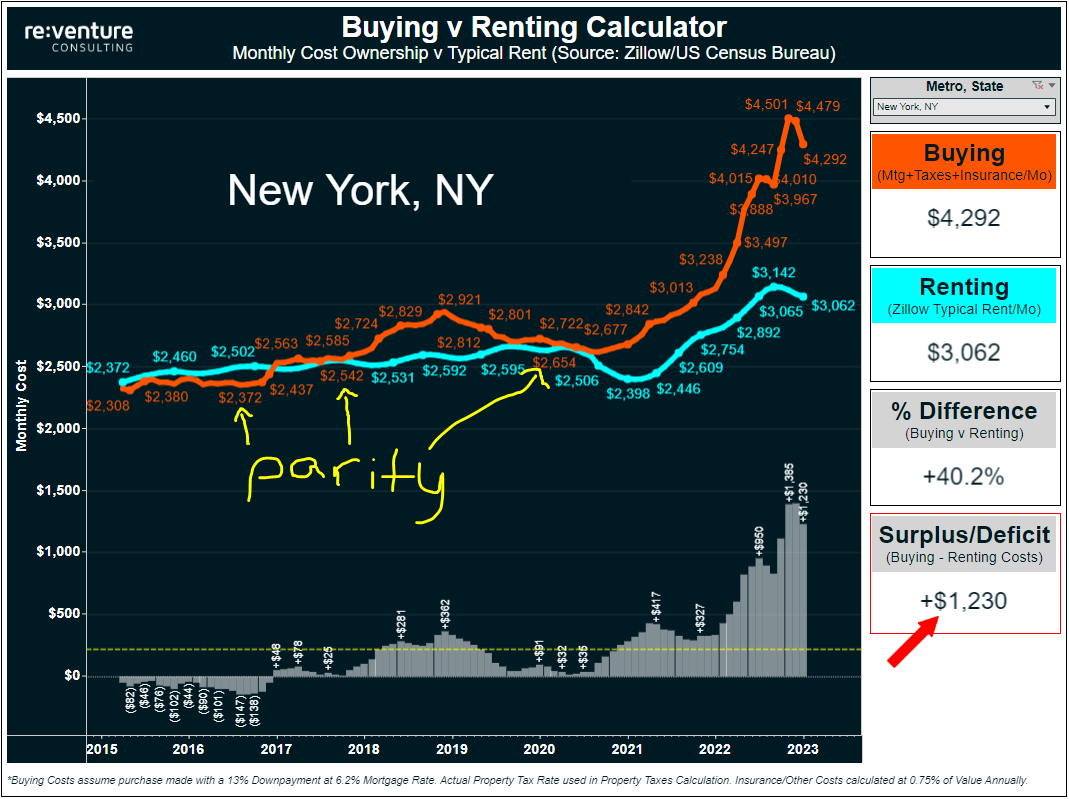

9. New York, NY

New York is a great example of a metro where there was "parity" between Buying and Renting prior to the pandemic. Meaning that from 2015 to 2020 they cost roughly the same.

But that started to change in 2021. Declines in Rent during the pandemic, coupled with higher Home Prices, resulted in buying costing more. Layer on rapidly rising Mortgage Rates in 2022 and now the Cost to Own in the New York Metro is $4,292/Mo.

That's a hefty $1,230 higher than the cost to Rent. Meaning that there is an increasing incentive for New Yorkers to wait out the Housing Crash and rent. Don't be surprised if home prices in New York decline by 10-15% over the next several years.

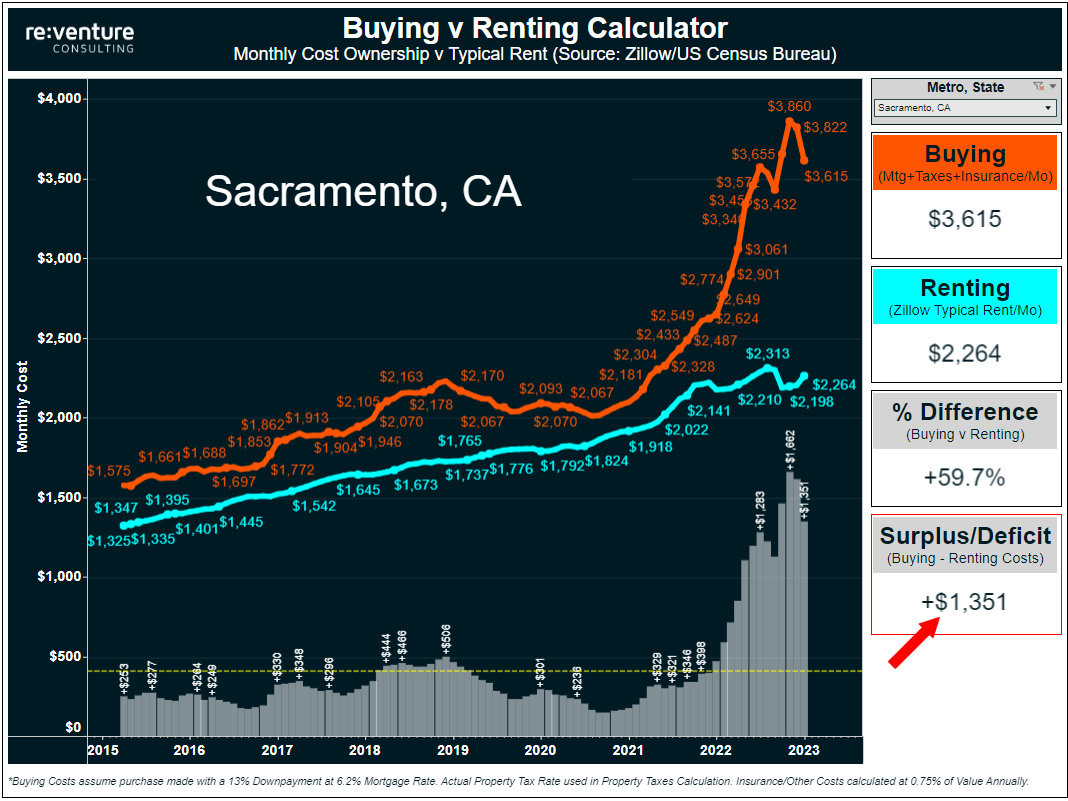

8. Sacramento, CA

Sacramento was one of the hardest hit areas in the 2008 Housing Crash. Prices went down an astronomical 50%. I think another hefty decline in prices could be coming this time around.

That's because home buyers in Sacramento have been completely priced out of the market. High-earning Bay Area transplants moved in during the pandemic and pushed up the prices. Then Mortgage Rates went up. The result is that the cost of buying is now north $3,600/mo. in a metro where the average worker earns $57,000 per year.

That's not sustainable. Especially when renting is a much more affordable option. Don't expect homebuyers to return in earnest to Sacramento's Housing Market any time soon.

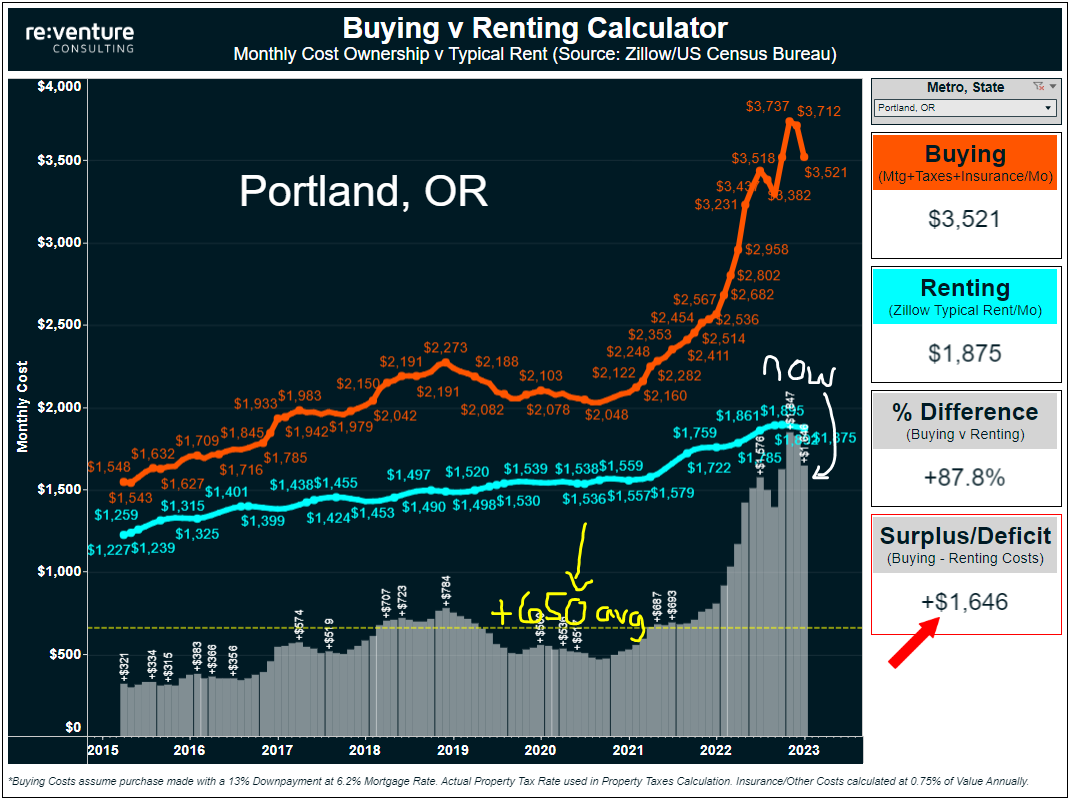

7. Portland, OR

Portland is a good example of a market where it is always more expensive to buy than to rent. Looking back the last 7 years the average buyer spent $650/mo. more than the average renter.

So Portland homebuyers are used to having to stretch their budget to own a home. But there's a problem in 2023. And it's the fact that the buyer cost surplus has surged all the way up to +$1,650. An insane 88% more expensive than thetypical monthly rent.

This tremendous lack of affordability is likely why Home Sales have crashed in Portland. And why prices are already down 5%. But clearly, they need to go down by more.

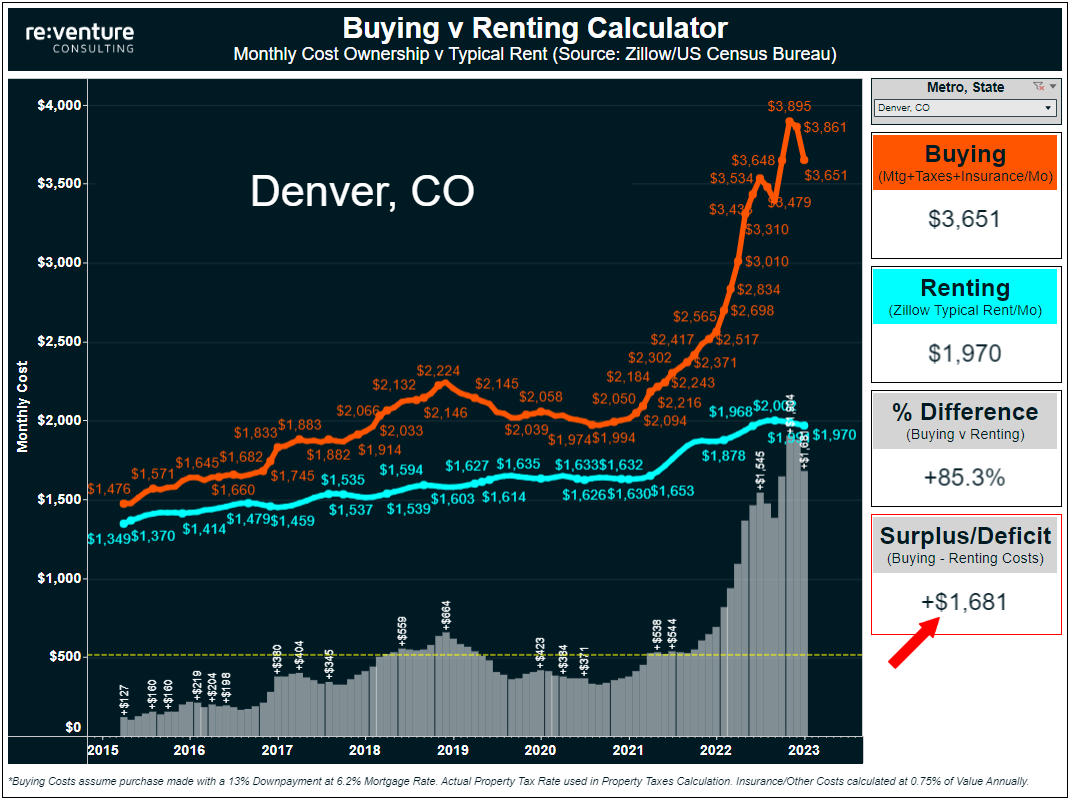

6. Denver, CO

Imagine being a homebuyer in Denver back in 2015. The cost to buy was $1,476/mo. The cost to rent $1,349. You only needed to stretch your budget a little bit to make the jump to ownership.

Now fast forward to 2023 and it's a whole different ball game in the Mile High City. These days a first-time homebuyer in Denver needs to shell out $3,650/mo. for Mortgage Payments, Taxes, and Insurance. Meanwhile, the cost of rent is still south of $2,000.

This cavernous gap between buying and renting indicates that Denver's Housing Market is in for a long, hard road in future years. It will likely require a 20% decline in prices, combined with Mortgage Rates below 5%, before homebuyer demand returns in earnest.

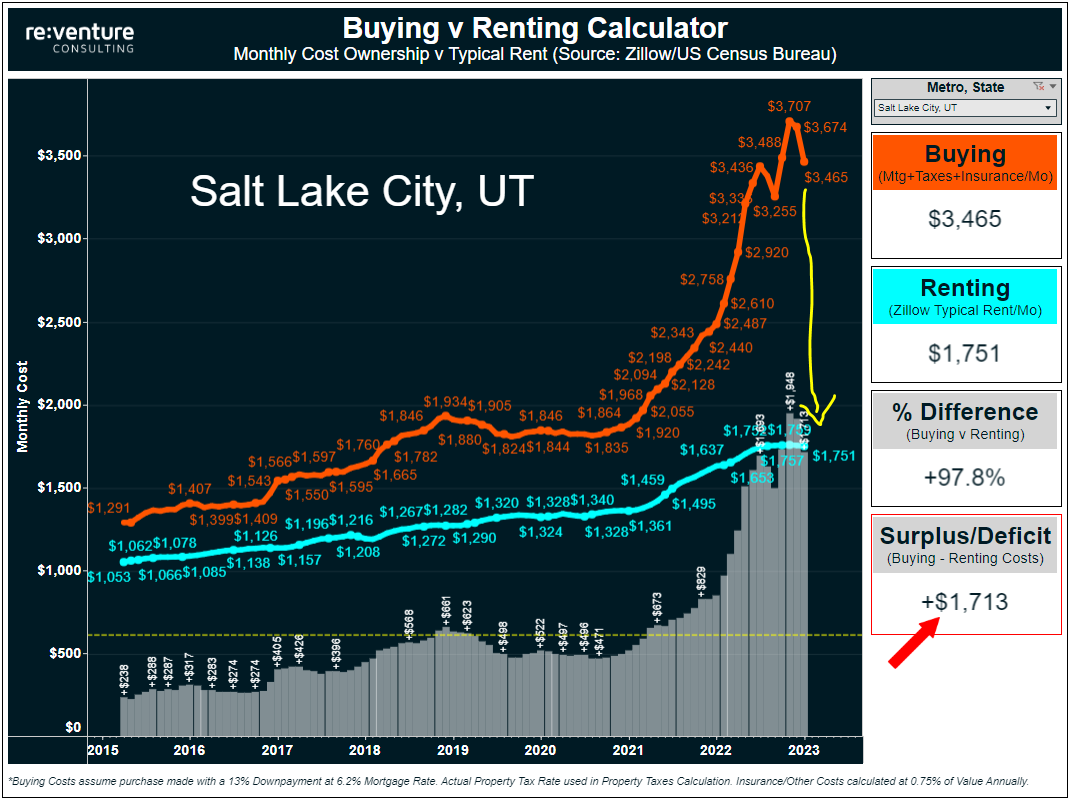

5. Salt Lake City, UT

Are you noticing a trend here? Mountain West markets like Boise, Denver, and Salt Lake City are tremendously unaffordable. It's no mistake that the Housing Crash is starting here.

But Salt Lake City ramps up the lack of affordability to another level. The cost to buy is nearly DOUBLE the cost to rent (98% higher, to be exact). Meaning that a homebuyer in SLC will need to spend $1,700/mo. more if they want to take the plunge into ownership.

So Renting is cheaper. A lot cheaper. Which is one of the reasons why inventory in Salt Lake City, and Utah more broadly (Provo/Ogden would have also made this list), has tripled in the last year.

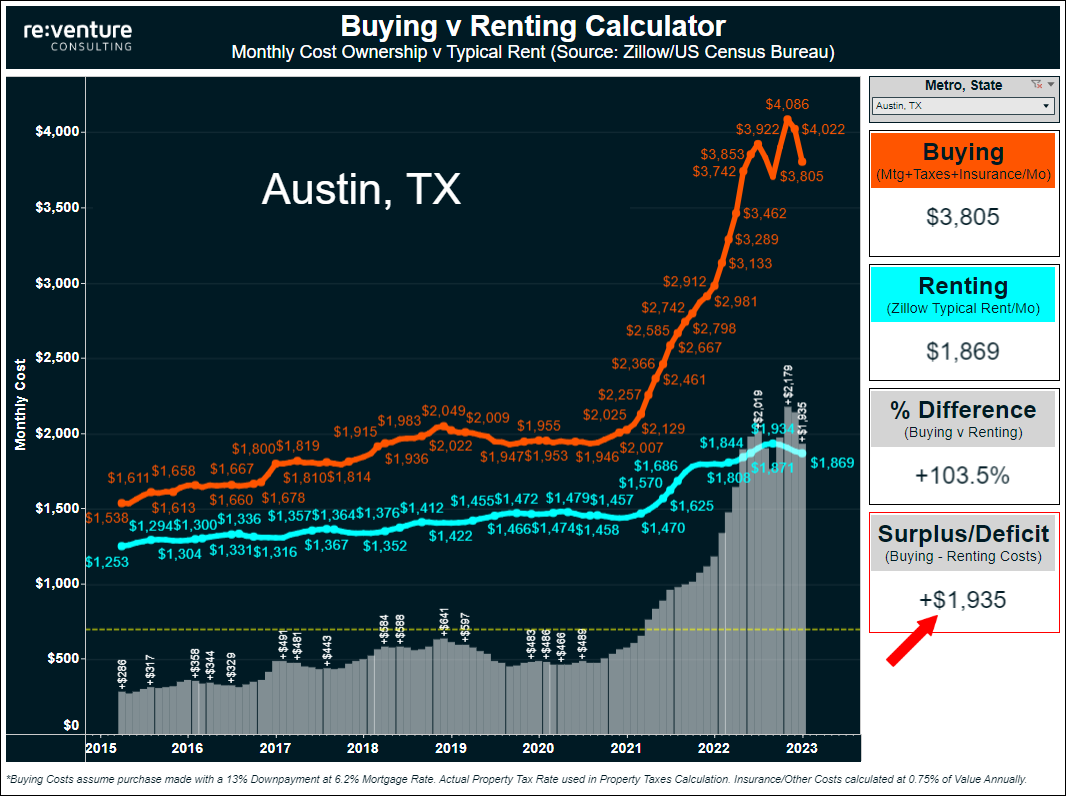

4. Austin, TX

Do you remember, like 9 months ago, when people still thought Austin's Housing Market was legit? Well those days have passed. Austin is in a full scale crash right now. Redfin say prices have already declined by -15% (Zillow's estimates are more conservative around -8%).

But more declines are coming. Because the Buy v Rent dynamic in Austin is still completely out of whack. Due to high prices, to go along with high property taxes, the average Austin home buyer will need to shell out $3,800/mo. to buy in early 2023.

That's more than double the cost to rent, which is at $1,869/mo. (and declining). I think prices still need to go down another 20-25% before buyers start coming back.

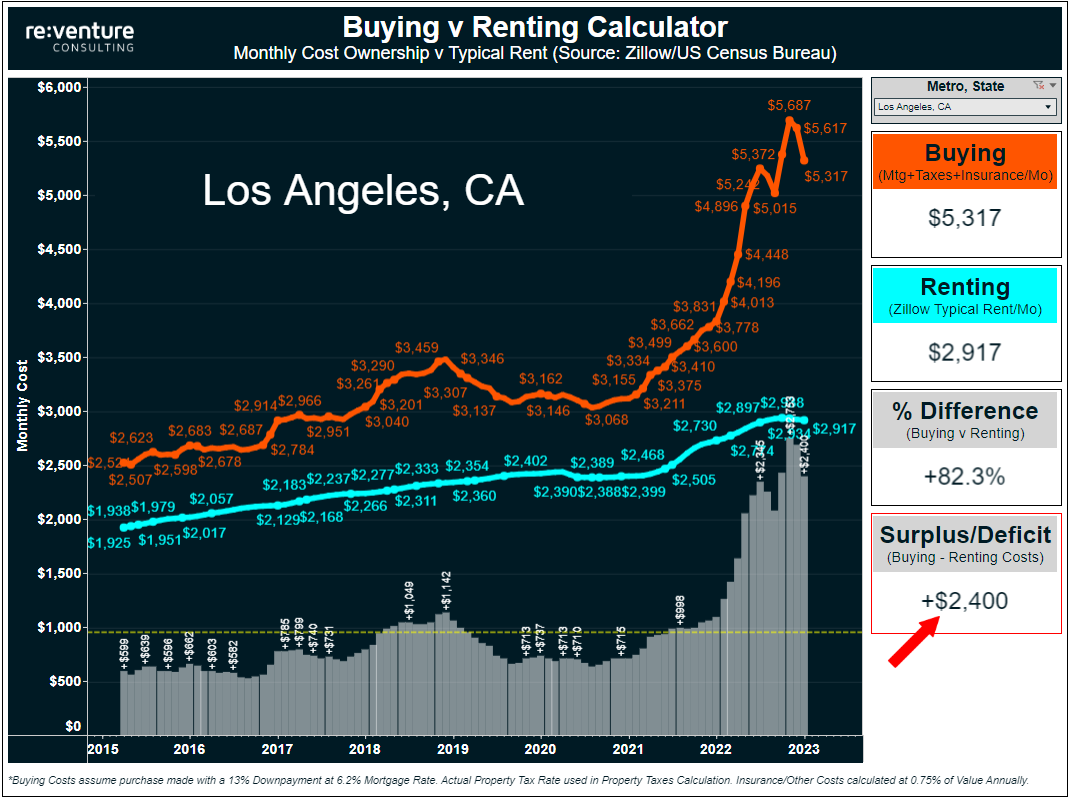

3. Los Angeles / San Diego, CA

People are going to get mad that I lumped Los Angeles and San Diego together. But for the interest of keeping this list to 10 I had to. And ultimately, the data on these Housing Markets looks remarkably similar.

In Los Angeles the cost to buy the typical home is a difficult to fathom $5,300/mo. (that's $64,000/yr. folks). Meanwhile, the cost to rent is $2,917/mo. Meaning that if someone wants to transition from renting to owning in LA they will need to expand their budget by a massive +$2,400/mo. Ouch.

San Diego looks pretty similar. Cost to Buy is $5,200. Cost to rent is $3,000. +2,218 differential. Make no mistake - California's Housing Crash is just in its beginning stages. Especially in SoCal.

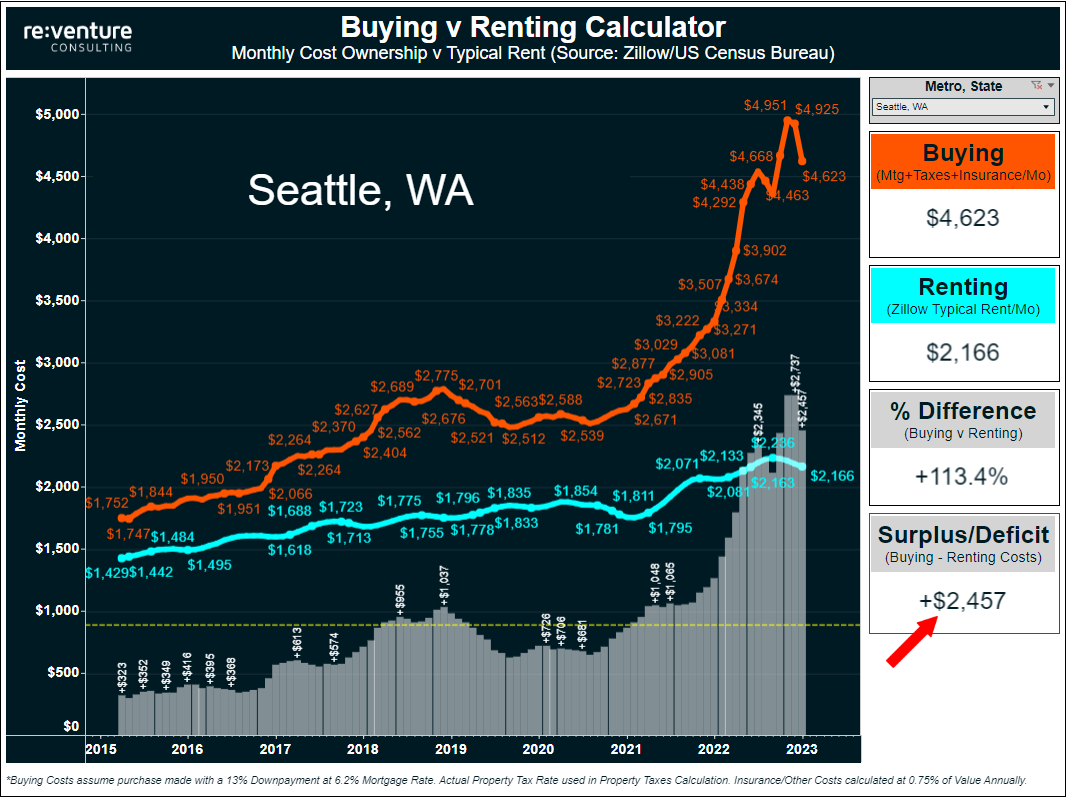

2. Seattle, WA

Seattle is a scary Housing Market. Even though prices have gone down by 10% in the last 6 months, the market is still way overvalued.

How overvalued? Well, the cost to buy is an astronomical 113% higher than the cost to rent ($4,623 v $2,166). Indicating that we'll need to see affordability improve by massive amounts before buyers comeback to Seattle.

I'm projecting that prices decline by 30% in Seattle when all is said and done. That's what's needed to get back to "baseline". Of course - a Housing Crash and Recession could cause price declines to go below baseline.

Add on economic exposure to a declining tech industry along with lots of home building and Seattle is a market I would not touch with a 10-foot pole in 2023.

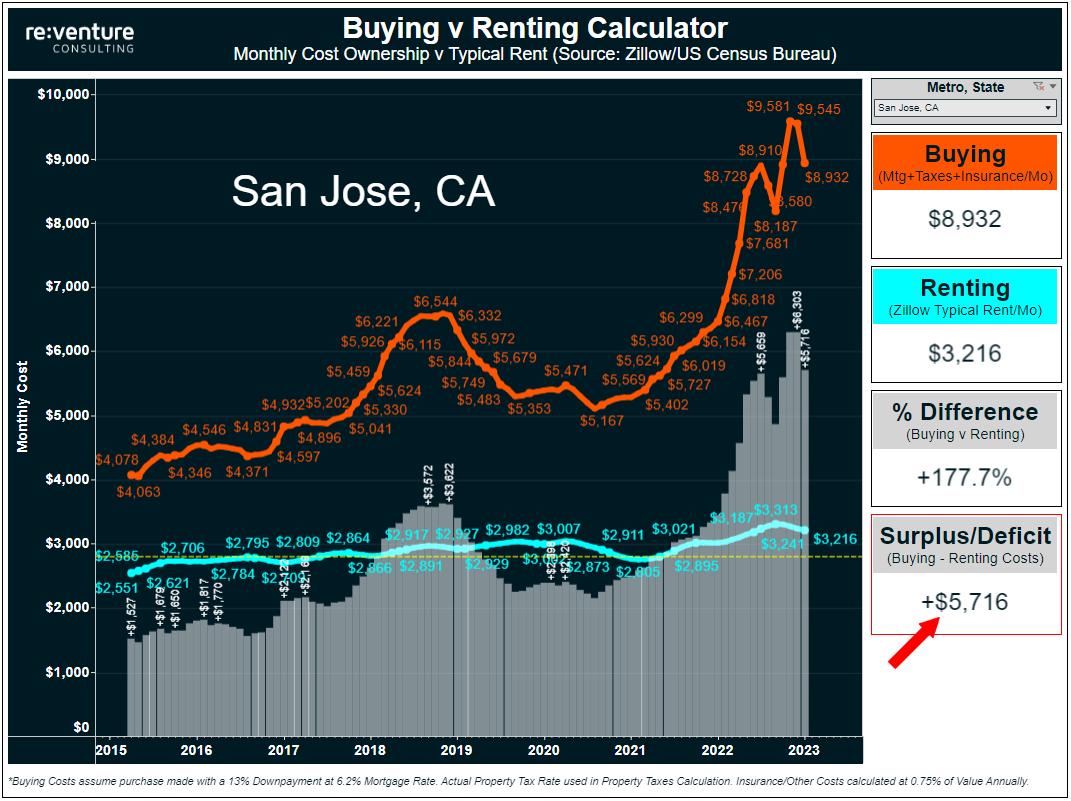

1. San Jose / San Francisco, CA

And here we arrive at #1. Looking at the metrics for the Bay Area make the rest of this list seem like child's play.

For instance: in San Jose the cost to buy, and I swear I'm not making this up, is nearly $9,000/mo. when you factor in Mortgage, Taxes, and Insurance. That's over $100,000 per year.

Meanwhile, the cost to rent is a much more manageable $3,200/month. Meaning that renting is $5,700 cheaper than owning.

Couple this insane lack of affordability with a crashing local economy due to tech layoffs and San Jose/San Francisco look poised to see home prices decline for a long time.

A couple notes here before signing off:

1) The Ownership Cost calculation assumes someone buys the typical home in a metro with a 13% downpayment (the US average). The most recent month's Mortgage Rate I'm using is 6.2%.

2) The Renter Cost is based on Zillow's typical rent index for each Metro. Note that this rent factors in the entire rental mix of the metro. So it includes both apartments and houses. However, since the apartment stock comprises a higher share of total rental units, the Zillow rent index is more representative of the rent you'd pay for an apartment.

3) My Channel Members on YouTube have already been looking at this data for the last several weeks. If you want access to it for your metro, and on a recurring basis each month as prices decline and the ratios change, sign-up on YouTube as a Channel Member. Here's the sign-up link. I release updates and provide links to the graphs once per month.

LASTLY: I want to hear your feedback.

-Will you be considering the Cost of Buying v Renting when making your purchase decision in 2023?

-Do these numbers align with what you're seeing in your city?

-Nick