Home Builders shock everyone with a 21% SURGE in Housing Starts

By Nick Gerli | Posted on June 21, 2023Home Builders just shocked everyone in the housing market by registering a record increase in home building last month, with annualized housing starts surging to 1.63 million in May 2023, a massive 21% increase from the previous month.

Such a dramatic increase in housing starts suggests that home builders and apartment developers are feeling more optimistic about a recovery in the US Housing Market in 2023. Bullish sentiment that is shared by the stock market, with investors piling into home builder stocks and pushing their prices up to the highest level on record.

But is this a false optimism? Builders are deciding to ramp up production at a time when traffic at their homebuilding sites is still down 35% from pre-pandemic levels. Moreover, economic indicators are still forecasting a worsening recession in 2023 just as Jerome Powell and the Federal Reserve are increasing their resolve to keep interest and mortgage rates elevated.

Ultimately this move increase housing starts could end up badly for builders, and good for homebuyers and renters. In this post I will breakdown the data on the recent surge in housing starts, its impact on home builder stock prices, and where I think the market will go for the rest of 2023 and into 2024.

Single-Family Home Construction spikes 19%

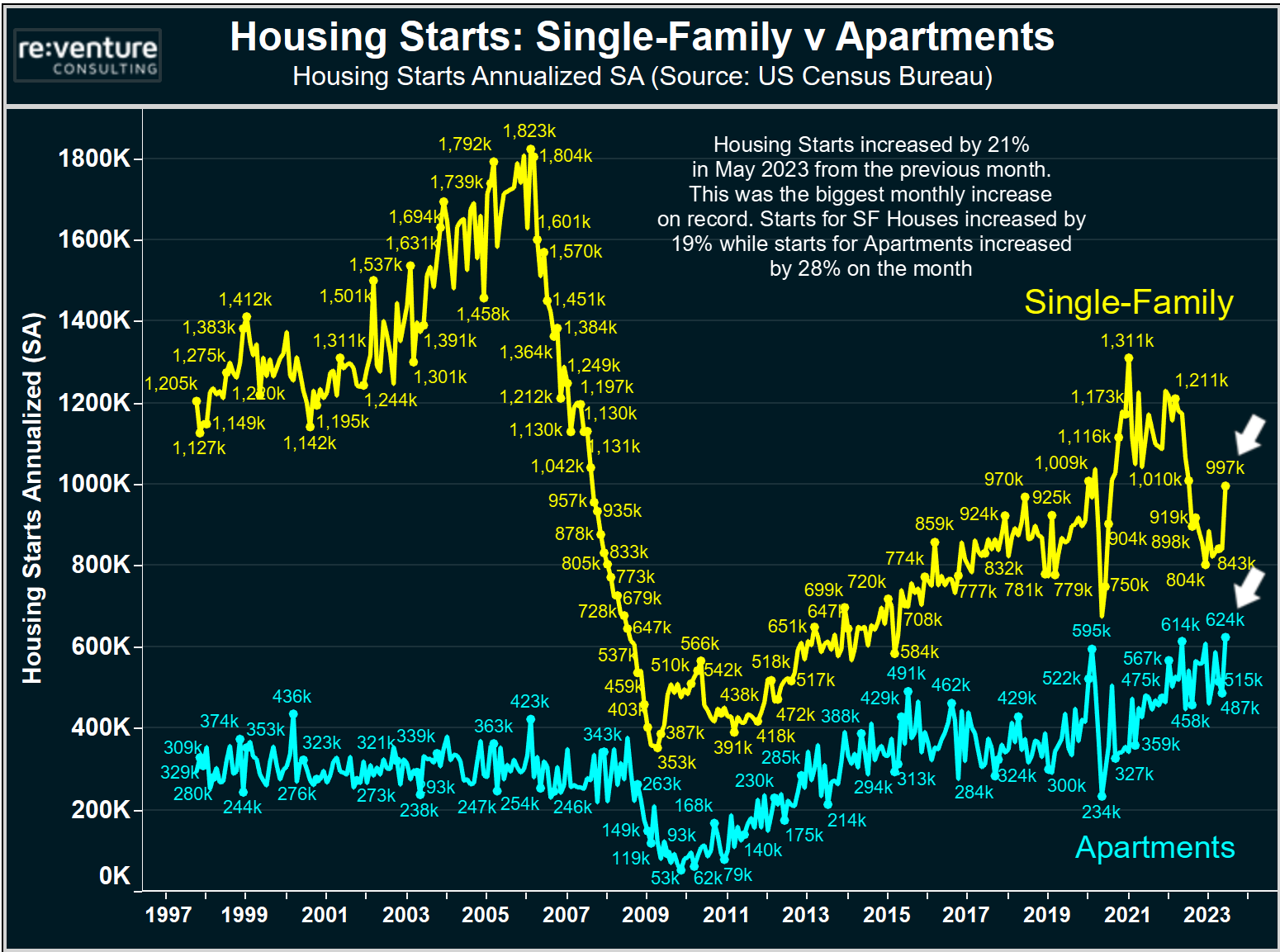

The big surprise in the May 2023 Housing Starts report from the US Census Bureau came from single-family home builders, who broke ground on 997,000 houses on an annualized basis.

These 997,000 starts for single-family homes were up 19% from the last month, reversing a steady downward trend in building that occurred over the last year since the Fed began their interest rate hike regime. This increase in starts is welcome news for single-family homebuyers, who will likely see more new homes offered for sale from builders in future months.

The other surprise in the report is that apartment developers also got very aggressive in May 2023, breaking ground on 624k multifamily and condo units, a level of building that was up 28% from the previous month. The level of new apartment construction May was so great that it actually set a record going back to 1997.

Suggesting that the slow-motion rental crash in America is will likely continue, with data from Apartment List already showing that the apartment vacancy rate has skyrocketed to 7% over the last year. Those rental vacancy rates will likely continue to increase over the next year with all the new construction, putting more downward pressure on rents (which should eventually filter through to home prices).

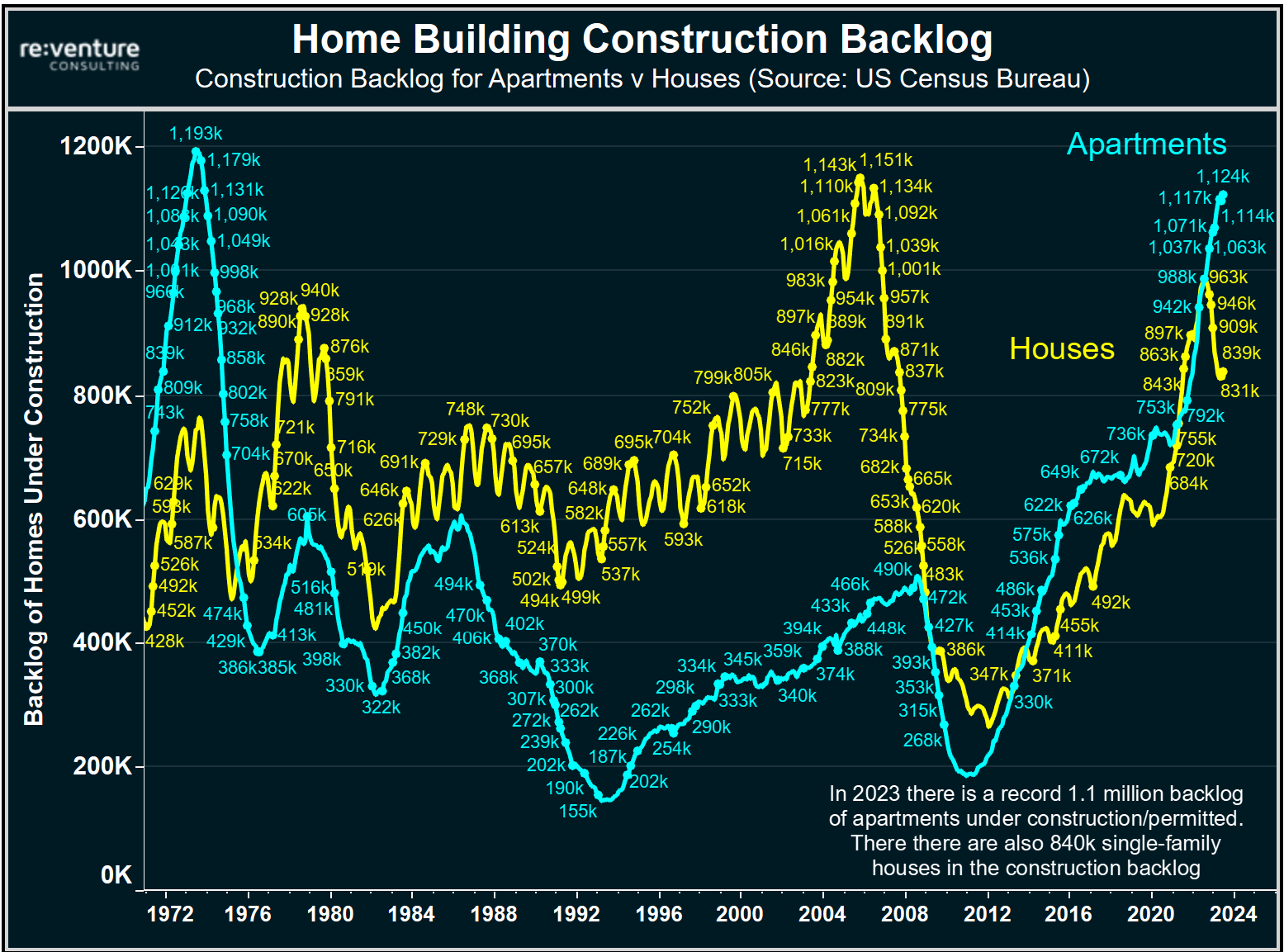

In aggregate, these new starts will add to the pile-up of building that is already ongoing, with 1.1 million apartment units currently in the construction backlog to go along with 840k single-family homes. These combined 2.0 million units currently in construction or permitting is the highest level of all-time.

Home Builder stocks are ripping. Is it a Bubble?

In response to the increase in housing starts, as well as several months of increasing new home sales, home builder stocks continue to rip higher.

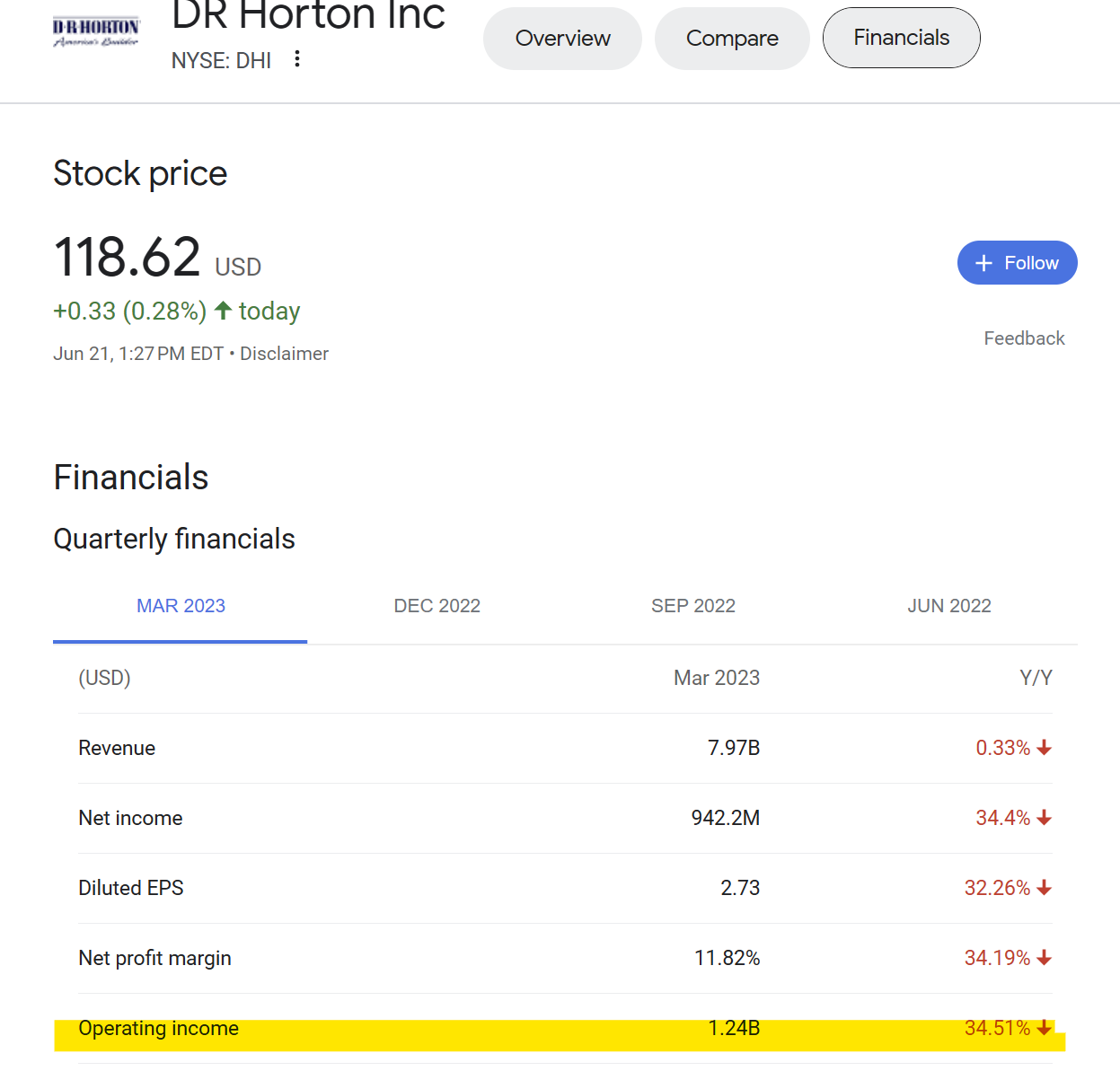

For instance, DR Horton, the largest builder in America, has seen their stock price vault by 93% over the last year and 191% over the last five years. Their stock is now trading at its highest level of all-time, even higher than the pandemic peak that occurred in late 2021.

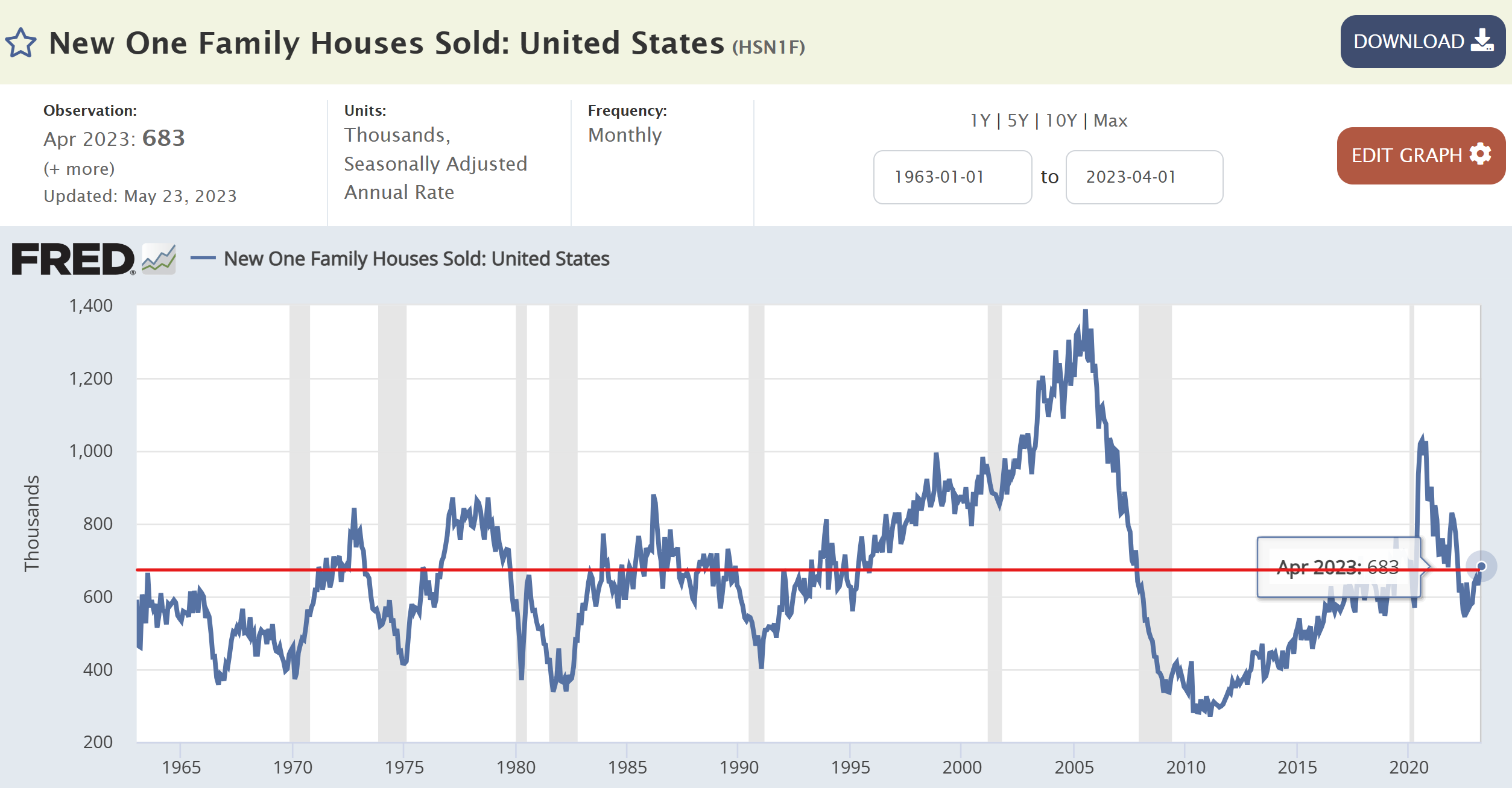

As I've covered numerous times, here and on YouTube, I believe this rally in home builder stock prices is a potential bubble driven by unfounded optimistic sentiment. Most notably, investors and builders alike are getting jazzed about the fact that over the last several months new home sales have increased to an annualized rate of 683,000.

This figure is about 15% higher than the lows experienced in late 2022, however it is still about 35% below the pandemic peak that occurred in 2021. And roughly on par with the levels that we saw directly prior to the pandemic in 2018-19.

Indicating that for the run-up in home builder stock prices to be legitimate, there needs to be continued growth in new home sales for the rest of 2023 and into 2024.

But will sales actually continue to increase? Or will these builders get left holding a boatload of inventory again like they did last year?

The allure of 5% Mortgage Rates and steep price Cuts

One thing that home builders have proved, and deserve credit for, is flexibility during this housing downturn. They saw it happening in 2022 and acted accordingly by slashing prices of their homes and aggressively pushing full-term mortgage rate buydowns to their customers.

For instance, the median sale price of newly built houses is down 15% from its peak in 2022. At the same, builders like DR Horton are offering buyers 5.5% fixed-rate mortgages in an environment where market rates are closer to 7.0%. These are appealing incentives to homebuyers in 2023, especially with inventory on the re-sale market still at historical lows, helping to explain why builder sales have rebounded.

However, these incentives come at a cost to builders, and that cost is lower profit margins, with DR Horton reporting a massive 35% YoY crash in operating income in the first three months of 2023.

One has to wonder - how much room do these builders have to continue slashing prices and offering below market mortgage rates? The longer they do it, the more their profits will erode, and eventually stock investors might start caring. Especially if homebuyer traffic at building sites continues to remain poor.

Homebuyer Traffic for Builders tells a mixed Story

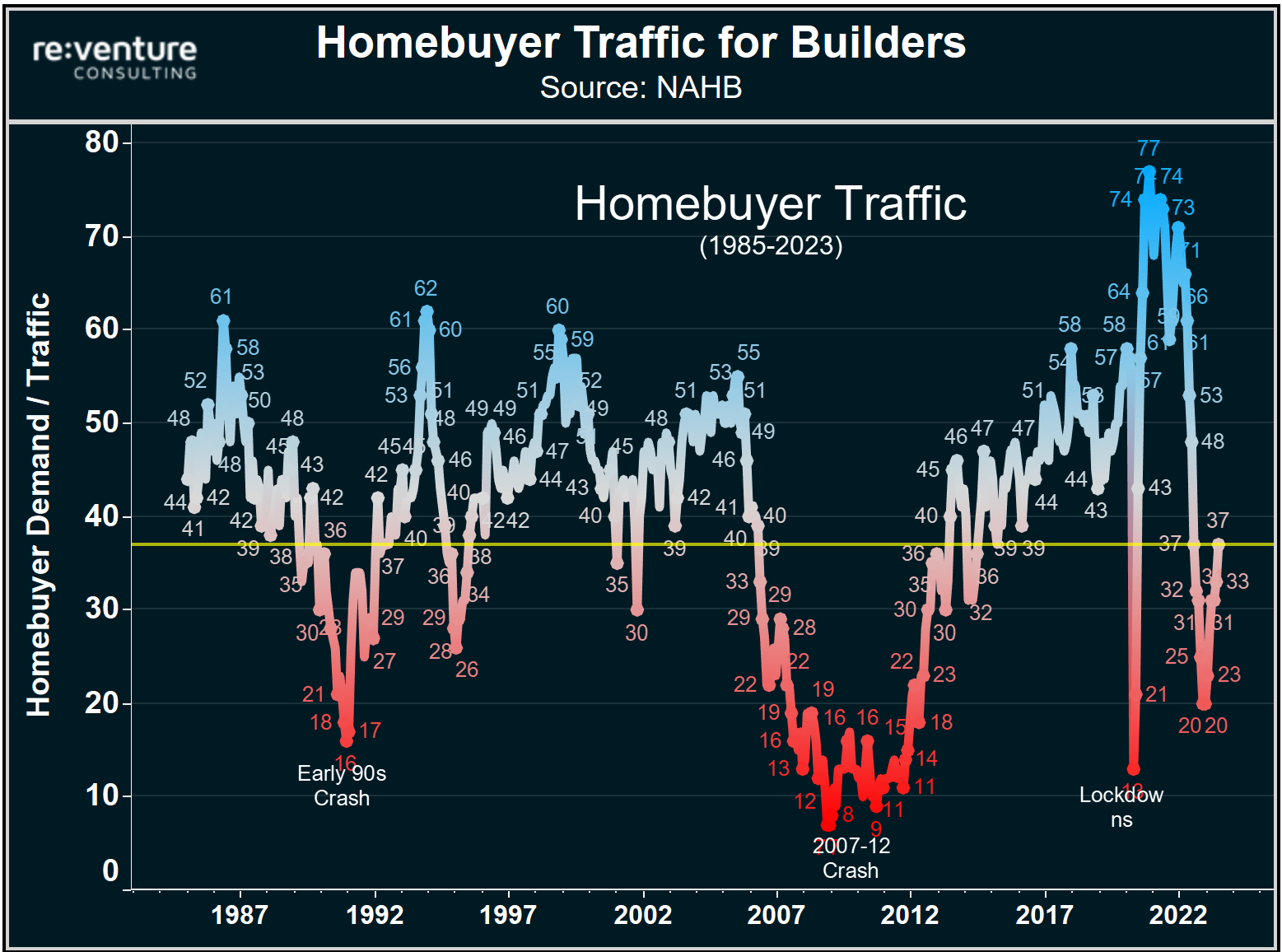

The one metric I'm watching closely to tell me about the future health of the builders, and the housing market more broadly, is Homebuyer Traffic reported at builder sites. This index is reported by the National Association of Home Builders each month and it shows a solid rebound from the lows that were experienced in late 2022.

However, the overall level of buyer traffic at builder sites is still historically low at an index level of 37. That's down by more than 50% from the pandemic peak and by about 35% from the "normal times" of 2018-19 before the pandemic.

As you can, see there's a bit of a disconnect between 1) the buyer traffic figures and 2) home builder stock prices and housing starts. The latter indicators are showing a massive recovery, while the former is saying there is a recovery, but things are still not so good.

Which is the better representation of reality? Well, it's hard to say, because there has been such optimistic sentiment around builders over the last several months that it's tempting to discount the buyer traffic survey as an outlier. However, it isn't an outlier when looking at the broader picture of the housing market.

Homebuyer Demand still at a 25-Year Low

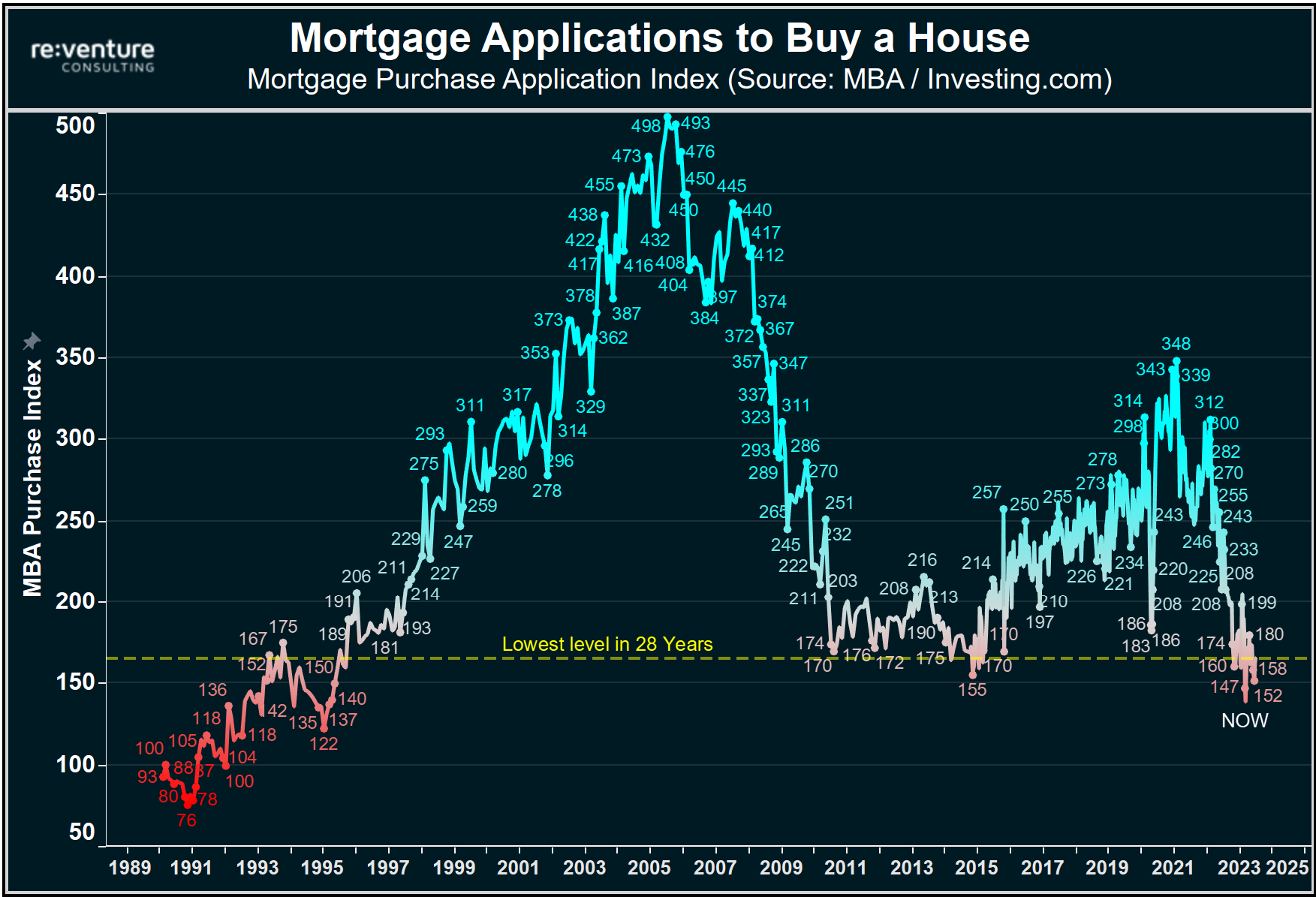

The broader housing market is still in the tank, represented by historically low rates of mortgage applications to buy a house.

In the most recent week, mortgage applications registered an index level of 165, which is down 31% YoY and by more than 50% from their pandemic peak. Indicating that there is no recovery in the housing market occurring.

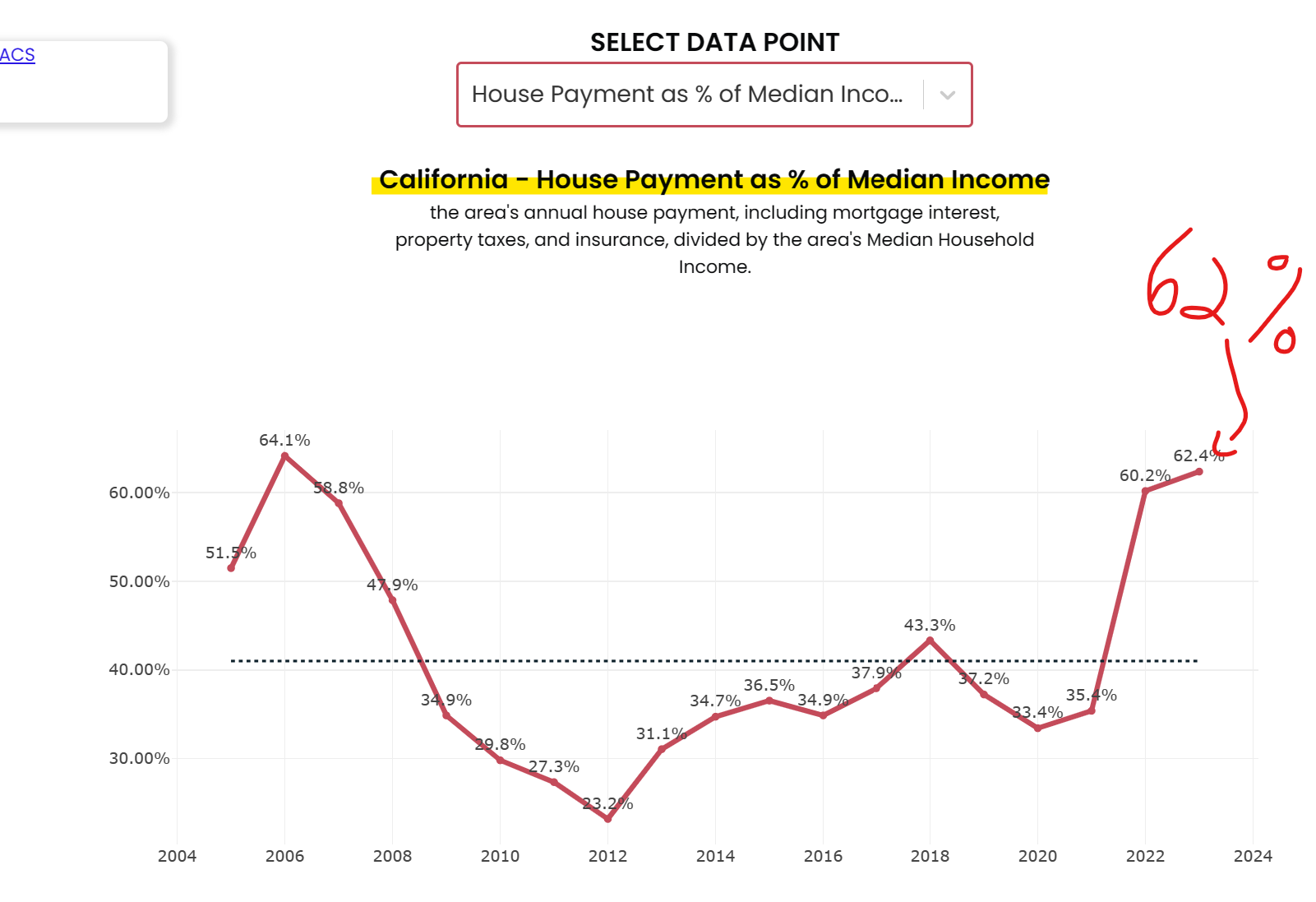

These figures are still at a 25 to 30-year low and align closer to what we're seeing reported in the Homebuilder Traffic survey. With the bottom line being that homebuyer affordability is still at the worst levels on record when comparing home prices to incomes in America. And at the worst level in nearly 40 years when comparing mortgage payments to income.

For example, in a state like California, the typical household needs to spend 62% of their gross income on mortgage payments, taxes, and insurance in order to buy a house in the 2023 housing market. That's near the highest level in the last two decades, matching the peak that occurred in the 2005-06 bubble according to data from Reventure App.

So long as the affordability metrics remain so poor, we are unlikely to see a true, sustained recovery in homebuyer demand.

Where do the Builders go from Here?

Thus far, Home Builders have been able to "win" in this housing downturn by aggressively slashing prices and offering discounted mortgage rates. Their success in doing so has prompted them to begin building more houses, which many are now interpreting as a clear sign of housing market recovery.

However, the underlying data suggests that true recovery is a long way off, with buyer traffic, mortgage applications, and housing affordability metrics all suggesting that the current rally is unfounded.

Of course, we'll have to track the incoming data on starts and new home sales in coming months to see where the market heads. Make sure you're signed up for the Reventure App Newsletter to receive the updates.

-Nick