Builders report surprise surge in Home Sales (is the crash over?)

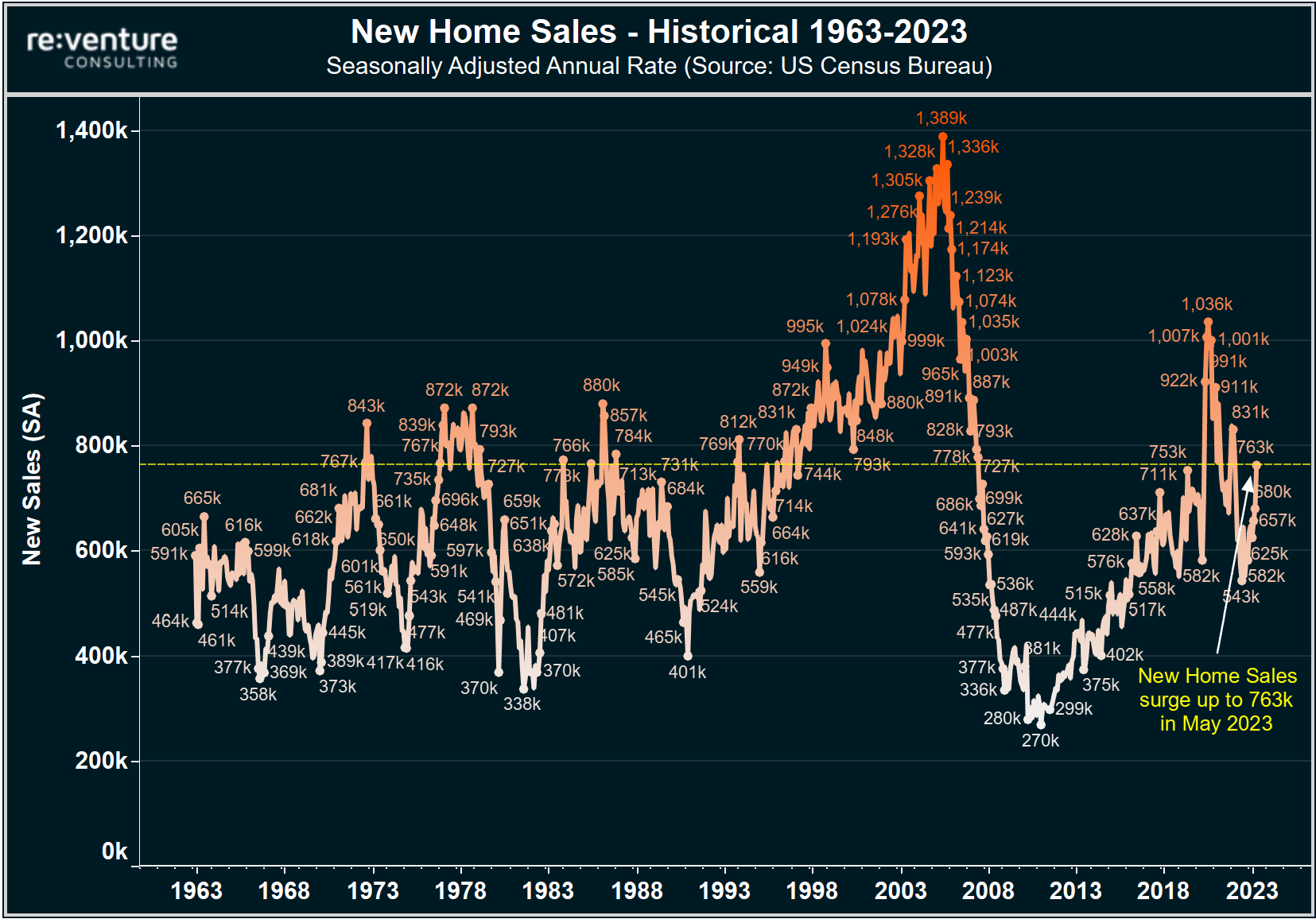

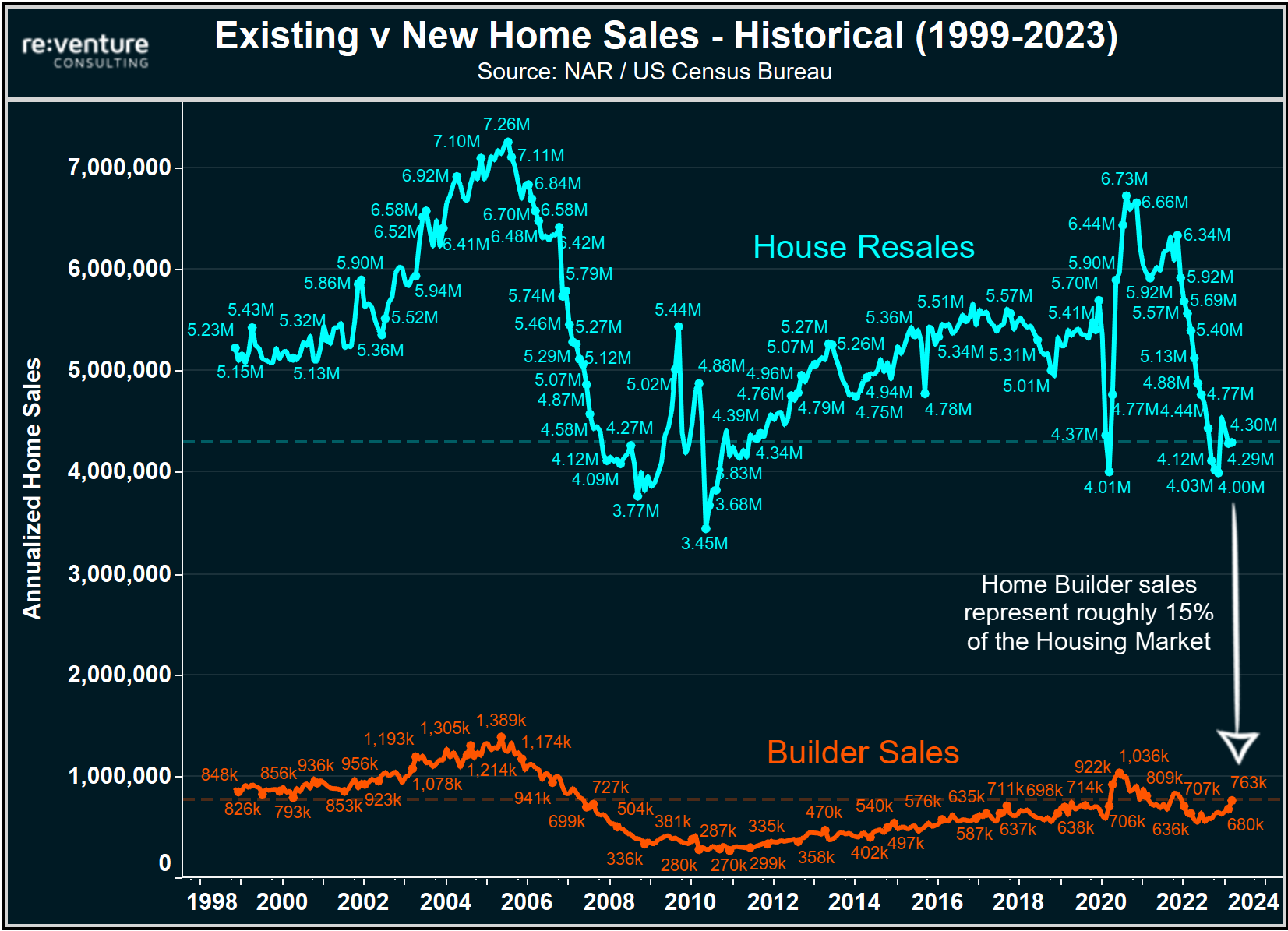

By Nick Gerli | Posted on June 28, 2023The saga of the home builders gets more interesting by the day. After last week's surprise surge in home construction, we learned this week that builders had a blowout sales month in May, booking orders for 763,000 new homes on an annualized basis.

Those sales figures were up 10% month-over-month, and nearly 20% from where they were last year, impressive growth rates that have stoked bullish sentiment in the housing market and sent builder stocks soaring.

But what's important to remember is that recent success of builders is not a sign that the housing market is improving. Rather, it's a signal that builders are taking a bigger share of the housing market pie by capitalizing on low re-sale inventory and offering big price cuts to homebuyers.

The result is that while home builder sales are increasing, the housing market as a whole is struggling, with re-sale activity still languishing at 2008-crash levels. A situation that will continue to persist until sellers take a cue from builders and cut the price.

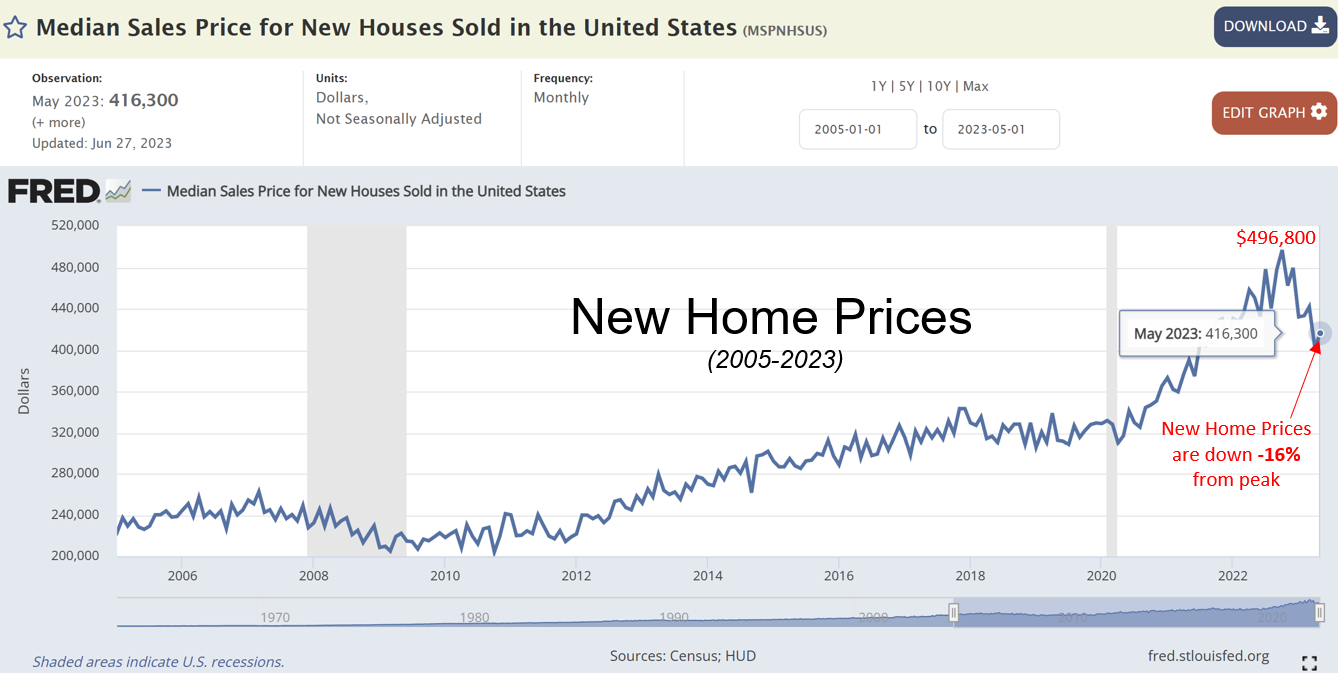

New Home Prices down 16% since late-2022

Data from the US Census Bureau shows that builders have been very aggressive in cutting the price over the last year, with the median sale price of new homes falling by -16% since October 2022.

That's a fairly substantial drop for only an eight-month period, much larger than what occurred in the initial stages of the 2008 housing crash, when the builders were much slower to cut the price.

And ultimately, it's these price reductions which are luring homebuyers back into the market. The 763,000 in annualized builder sales in May was a hefty figure, so hefty that if one were to exclude the 2020-21 pandemic boom, it ranked as the best sales month going all the way back to 2007.

Now a warning: the US Census Bureau comes up with these new home sale figures each month. And they are notoriously volatile and subject to revisions. So I wouldn't be surprised if in one or two months we find that the 763,000 sales figure was revised down.

But for now, it's a sign that builders are winning the 2023 housing market. At the expense of existing homeowners.

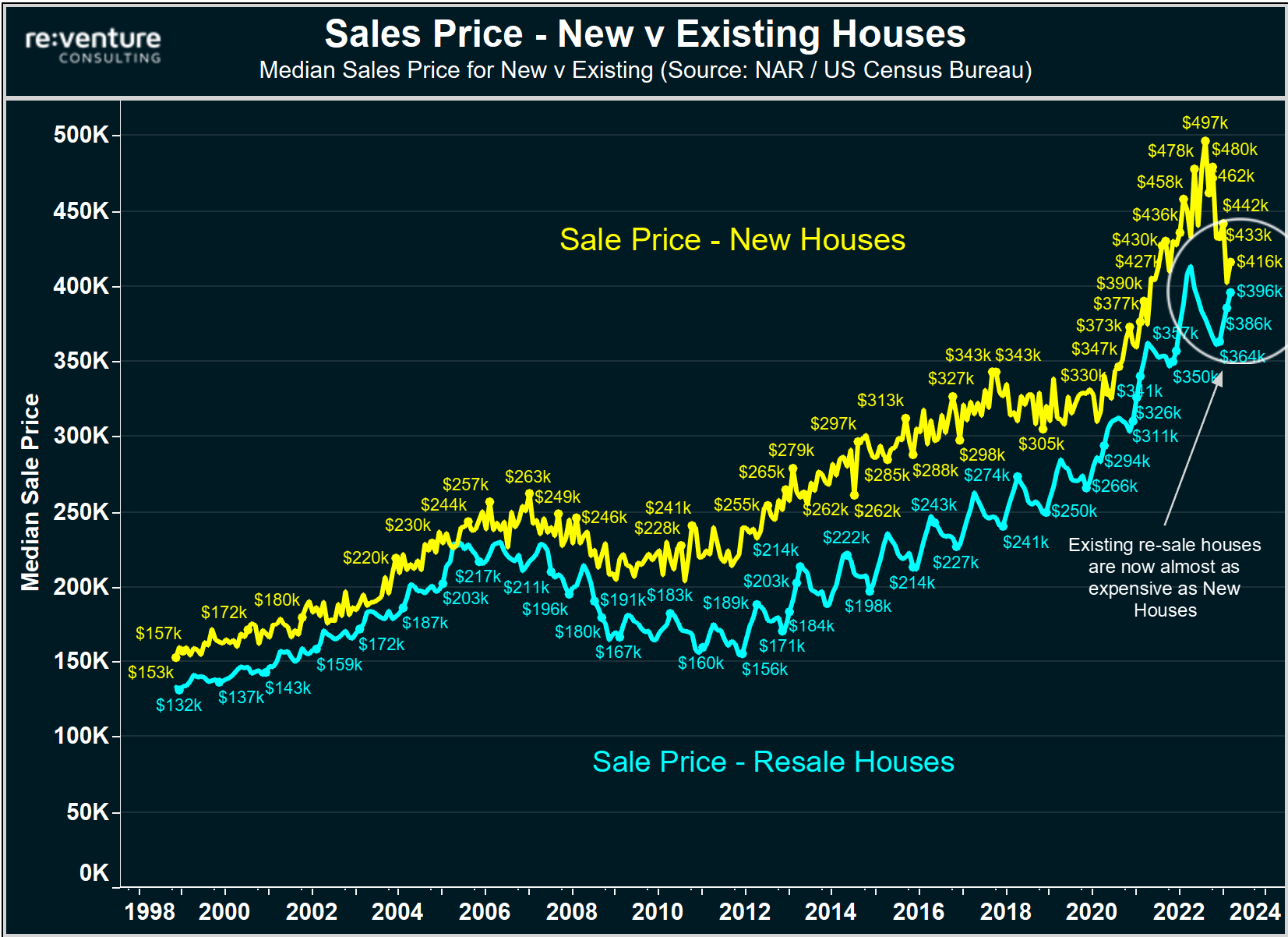

It's now cheaper to buy a New House than an Existing House

The builder price cuts, in conjunction with aggressive mortgage rate buydowns, now means that it's cheaper for a homebuyer to purchase a new house in 2023 compared to an existing house.

To see how this works, let's break out the numbers. The median sale price of a new house registered $416k in May 2023, which was still 5% higher than the $396k for an existing home. However, the gap has closed considerably in recent months.

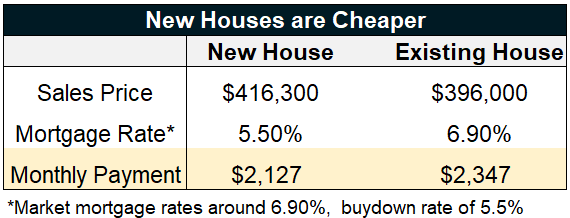

Those lower home prices for new builders are now being combined with mortgage rate buydowns to make the new homes even cheaper. For instance, DR Horton, America's largest builder, is offering homebuyers discounted mortgage rates as low as 5.50% when the prevailing market mortgage rate is close to 7.0%.

In many cases, these mortgage rate buydowns are full-term. Meaning they last for the entirety of the 30-year mortgage rather than just being for the first two years. The result is that despite new homes costing slightly more than existing homes, the monthly payment for buyers able to secure a buydown can be as much as 10% cheaper.

On top of that, buyers of new homes typically get a one-year workmanship warranty and have lower odds of needing to fund repairs in the first several years of ownership. Not to mention there is actually new home inventory available and buyers don't have to trip over themselves competing in multiple offer situations.

Yeah - no wonder builders are having some success this year.

But here's the problem: Builders are only 15% of the Market

But here's the issue: home builders only represent 15% of the housing market in America. The other 85% is comprised of the re-sale market, which is still in the tank in terms of homebuyer activity.

For instance, existing house sales registered 4.3 million annualized in May 2023 according to the NAR. A figure which is down -35% from the pandemic peak, -20% from normal levels, and roughly equivalent to what was experienced in the beginning stages of the 2008 crash.

These mammoth declines in in the re-sale market dwarf the increased sales that builders are reporting over the last several months.

Which highlights how disingenuous it is for someone to claim, as many housing market pundits are, that the increase in builder sales is a signal that the housing market as a whole is recovering.

Very clearly, the market as a whole is still in the tank. And it will likely remain in the tank until existing home sellers begin adopting some of the strategies that builders have implemented over the last year, like bigger price cuts and paying for full-term mortgage rate buydowns.

When will the "Builder Model" spread to the rest of the Housing Market?

The builders created their own market, with lower prices and mortgage rates, and found the clearing price necessary to attract buyers back in. This is something the housing market as a whole will need to do before it can truly recover.

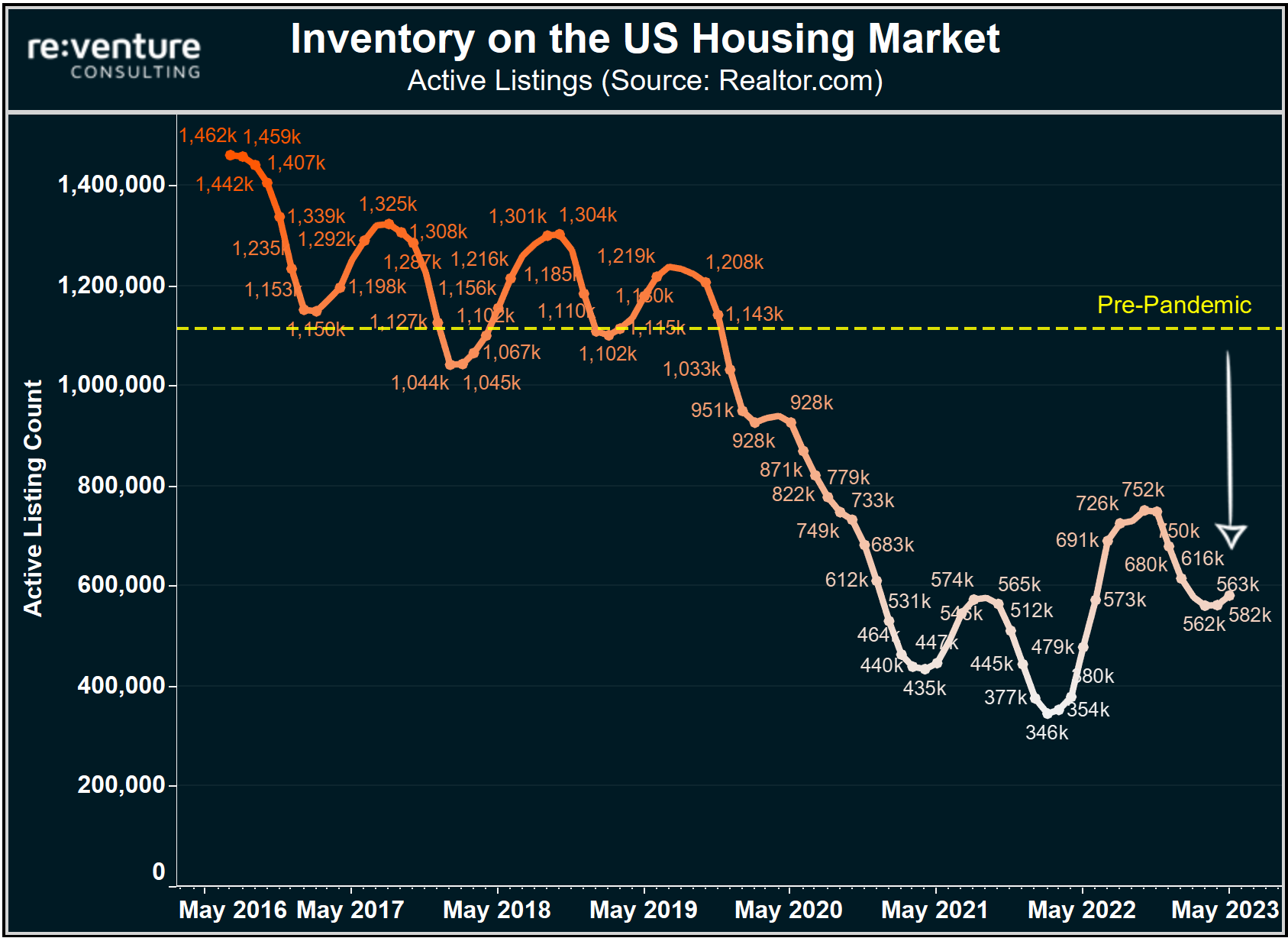

Unfortunately, what's preventing this recovery from happening is artificially low inventory levels on the re-sale market. According to Realtor.com, there were only 570k active listings in May 2023, down by almost 50% from pre-pandemic levels.

Due to this low inventory, created by years of government intervention in the housing market, existing home sellers are being tricked into thinking that their market is recovering.

However, as we discussed a moment ago, it isn't, with homebuyer demand in the re-sale market remaining at 20-year lows. A reality which will start to become apparent as inventory levels inevitably increase over the next year due to backlogged foreclosures, Airbnb distress, and increased unemployment causing a broader increase in forced selling.

As forced selling increases, existing homeowners will need to cut the price to attract buyers, similar to how home builders were forced to cut the price. At the same time, mortgage rates in this environment could decline due to long-term bond yields going down in a recessionary environment.

And voila - you have the 2023 Builder Model spreading to the rest of the housing market.

Should you buy a New House?

The data in this post begs an interesting question for homebuyers and investors: if you do want to buy right now, is it better to purchase a newly built house?

In some ways the answer is yes. There's more inventory. There's lower prices. And you could snag yourself a nice mortgage rate buydown.

However, there are also issues with buying new houses, particularly related to construction quality. I'm not naming names, but some builders have been accused of cutting corners over the last couple years, with buyers finding a litany of defects several months after moving in. If you do buy a new house, it's probably wise to get a home inspection from someone you trust before closing and moving in.

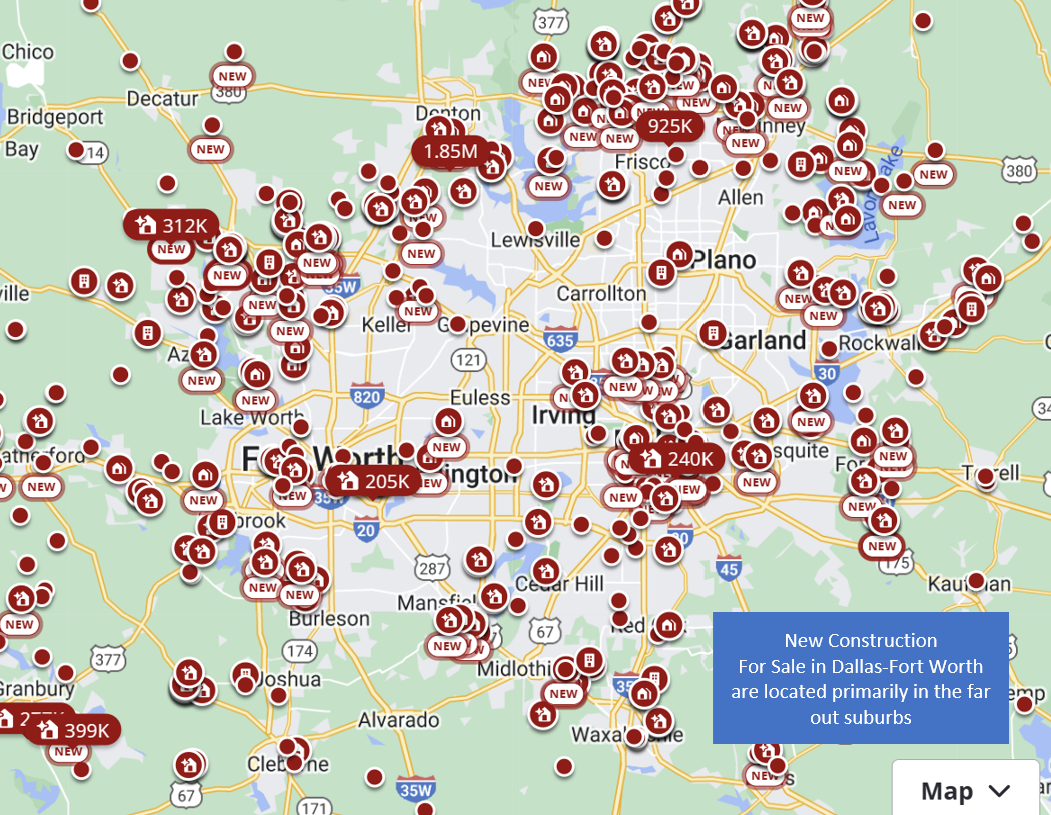

Additionally - newly built homes are often in not so desirable locations, often located on the suburban/rural fringe of a metro area, 25-30mi outside of downtown. The map below of the new construction homes available for sale in Dallas-Fort Worth proves this out.

Some people might like being in a far out suburb, others might not. I personally wouldn't want that since I prefer being closer to lifestyle amenities like restaurants.

Another thing to consider about builders: they can nuke the value of your house months after you buy it by discounting the prices on their new inventory. This happened to a friend of mine in Austin, TX. He purchased his house for around $500,000 in late 2022, and several months later the same model was selling for $450,000.